Lamar Advertising (NASDAQ:LAMR) issued 2025 guidance on 2/20/25. It called for roughly 4% AFFO per share growth over 2024.

S&P Global Market Intelligence

That guidance had since been called into question as macro concerns threatened advertising spend. There were legitimate concerns that key advertisers would pull back on ad spend due to uncertainties of supply chains and consumer spending. Why spend money on advertising when you don’t even know if you will have a proper amount of inventory to sell?

In March, MAGNA cut its forecast for media advertising revenues:

“Factoring all drivers and inhibitors, media owners’ advertising revenues are projected to grow by +4.3% in 2025 (down from the previous forecast of +4.9%). When adjusting for cyclical spending in both years (political advertising and the Summer Olympics in 2024)”

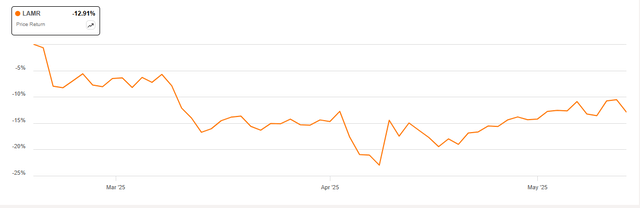

The market was understandably worried that Out of home advertising spend would also be impacted. LAMR stock has dropped considerably from its February highs.

SA

We sold LAMR from the 2nd Market Capital High Yield Portfolio on 2/11/25 at $126.84 and alerted Portfolio Income Solutions subscribers to the trade.

I think this drop sets up for a good opportunity to buy LAMR back if it can continue to grow through the somewhat challenging environment.

Well, recent data has come out suggesting that LAMR is in fact continuing to grow.

Fresh Data

The OAAA conference (Out of home Advertising Association of America) took place on May 5th-7th.

Lamar, as the industry leader, was of course in attendance and had some interesting takeaways. LAMR reported 1Q25 earnings on May 8th, a day after the conference, so the earnings report was informed with the latest data.

Sean Reiley, Lamar’s CEO, reaffirmed guidance on the earnings conference call

“We are still pacing to reach our previously provided guidance for full year AFFO per share. We are obviously keeping a close eye on the broader economy, but out of home has historically proven to be a resilient medium in times of uncertainty, and we are not seeing any cancellations or hearing anything from local or national customers that suggest we’re headed for trouble. To the contrary, I just returned from our industry conference in Boston, and our larger agency customers are telling us that it is steady as she goes.”

LAMR provided even more color on the environment at the J.P. Morgan Global Technology, Media and Communications Conference on Tuesday, May 13, 2025.

Sean Riley described 75% of ad space already signed:

“As we sit today, 75% of under contract with enough revenue that takes us to the midpoint of the range. So while we do have to sell that remaining 25%, it’s nice to have 75% in hand, and that’s fairly typical this time of year for us to have 75% book to goal.”

He went on to discuss that growth is set to accelerate throughout the year

“It is back-end loaded, as you’ve heard from a lot of media companies, it’s — the pacings are showing us sequential strength as we move through the year.”

It would appear that LAMR is still on track to grow AFFO/share by about 4% this year. That is substantially below the pace at which Lamar has been growing. Thus, it behooves us to determine if that is a negative inflection point or more one-time in nature.

I believe it is one-time as there are 2 significant headwinds that specifically affect the 2025 versus 2024 comp.

- 2024 Superbowl was in Vegas which is Lamar’s top market

- Political advertising spend was very high in 2024 due to the presidential election

There was of course a Superbowl in 2025 as well, but it was in New Orleans to which LAMR has much less exposure.

In 2025, LAMR will still get some political spend for local races, but it pales in comparison. Sean Riley commented on the tough comp:

“For us to hit our goals, we have to replace, give or take $15 million or so of back half political. Our pacings suggest we’re doing that, that we’re able to sell that space to other customers, but we still have to get there”

Given these 2 factors, I think the slowdown to 4% AFFO/share growth is just a difficult comp while the underlying growth rate remains closer to 6%+.

Out of home advertising as an industry

Billboards have had strong organic growth for a long time due to 2 key factors:

- Limited new supply

- Gaining market share in local

When organic growth rates get above a certain level, it economically incentivizes new competition. Certain real estate sectors such as manufactured housing, land, and billboards have substantial supply constraints which prevent this competition from coming in. It is quite difficult to obtain approval to put up a new billboard which creates a strong moat for existing billboards.

As such, the organic growth in these industries can remain above a standard level for an extended period of time.

The red tape largely handles the supply side of the equation while demand has been bolstered by billboards gaining market share in local advertising. Localized advertising has historically been done through linear TV and radio, both of which are losing share to OOH.

Sean Riley at the same J.P. Morgan conference discussed this concept:

“I’m beginning to see it in linear TV. Just it’s obvious from the comparative growth rates, right? As a matter of fact, we’re the only local mass medium that’s growing. So by definition, we’re taking share.”

Potential catalyst – guidance beat

When the tariff selloff happened LAMR stock fell well below $110, which the company noted as making buybacks highly accretive.

It had an outstanding authorization for $250 million of buybacks. 1.223 million shares were bought back in April per the earnings release:

“During April 2025, the Company repurchased 1,223,562 shares of its Class A common stock outstanding at a total purchase price of $131.6 million.”

At that price point, the buyback was highly accretive to AFFO per share and because it happened after guidance was released, the accretion is not factored into guidance.

LAMR is also engaging in accretive acquisitions which should add a few pennies to AFFO as well.

Risks to LAMR

One of the substrates Lamar uses for its posters is imported and subject to significant tariffs. The overall impact was described as immaterial, but it is still an increase to Opex and may minorly impact margins.

Advertising as an industry is constantly in flux. There is significant variance in both the magnitude of ad spending and the preferred medium. So far OOH has performed well in market share, but the efficacy of advertising can change with cultural or behavioral changes in society. As such, there is inherent risk to anyone in the advertising industry. Perhaps there are some people who can anticipate these things, but I find predicting social patterns to be nearly impossible which increases the margin of error in analysis.

I am able to find comfort in investing in LAMR despite this risk for 2 reasons:

- The risk is two-sided. Cultural shifts have just as much potential to help OOH as to hurt it.

- Volatility can be mitigated by LAMR being a significantly different kind of exposure to the rest of my portfolio. Its fundamentals are largely uncorrelated with other REITs.

Overall take

At its lower price, LAMR is trading at 13.7X AFFO which is quite opportunistic for a company that has a growth outlook of 4% to 8% for the next 5+ years. This growth, combined with a large 5.36% dividend, sets up for an above market total return. I like the company. I like management and its clean balance sheet.

Read the full article here