Introduction

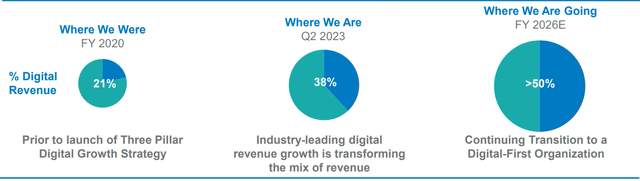

I like to write about undercovered micro-cap stocks on SA, and today I’m taking a look at Lee Enterprises (NASDAQ:LEE). It’s a media company that is currently shifting its business from print-centric to digital-centric in a bid to return to growth and get back in the black. At the moment, close to 40% of its revenues come from digital solutions, and the objective is for this share to increase to over 50% by FY26. Yet, the balance sheet is in a rough shape, and I think that there could be significant stock dilution on the horizon as the pivot to digital isn’t happening fast enough. My rating on Lee Enterprises is neutral. Let’s review.

Overview of the Business and Financials

Lee Enterprises was founded in 1890 and is among the largest newspaper publishers in the USA with a portfolio of 77 daily newspapers across 26 states as well as over 350 weekly, classified, and specialty publications. Its newspapers have an average daily circulation of around a million copies, and the company also has more than 38 million digital unique visitors monthly. Most of the daily and weekly publications of Lee Enterprises are focused on small cities in the USA, which makes the demand for them more resilient compared to national newspapers. Lee Enterprises also owns a full-service digital agency named Amplified Digital, which is focused on strategic marketing, creative services, planning, and consulting solutions. It has more than 4,500 customers in 49 states. The company also operates BLOX Digital, a provider of web hosting, content management services, and video management services.

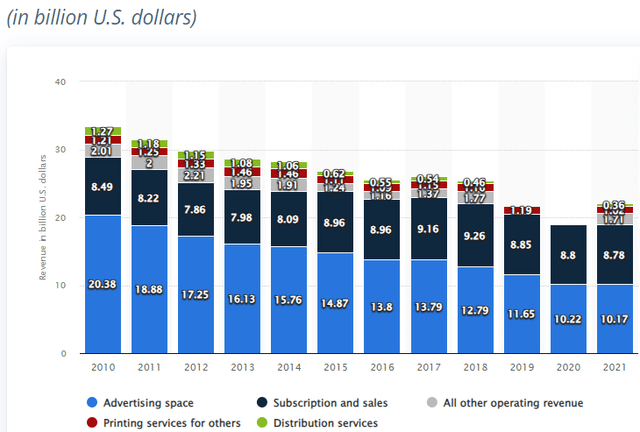

Overall, the newspaper publishing business in the USA has been in a secular decline for many years and Lee Enterprises is pivoting to digital products just like many of its competitors. Here is the estimated revenue of newspaper publishers in the USA from 2010 to 2021 according to data from Statista:

Statista

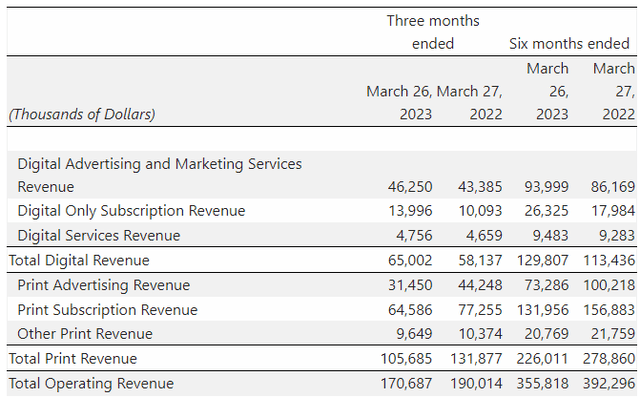

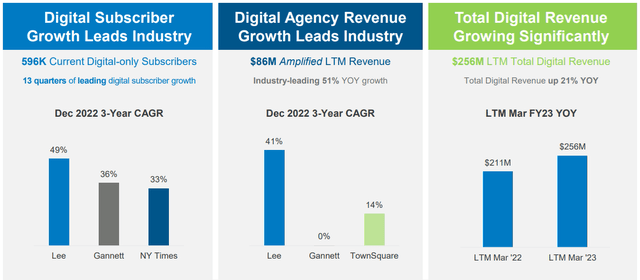

Lee Enterprises finished Q2 FY23 with a total of 596,000 digital-only subscribers, which is 21% more compared to the same period of FY22. In addition, digital-only subscription revenue increased by 39% while total digital revenue was $65 million, up 12% year-on-year. Overall, digital revenue accounted for about 38.1% of the total revenues of Lee Enterprises in Q2 FY23, which is a significant step forward compared to 2020 when their share was only about 21%. The company aims to boost the share of digital revenues to over 50% of total revenues by FY26, and I think it has a good chance to achieve this based on the growth rate of this segment.

Lee Enterprises

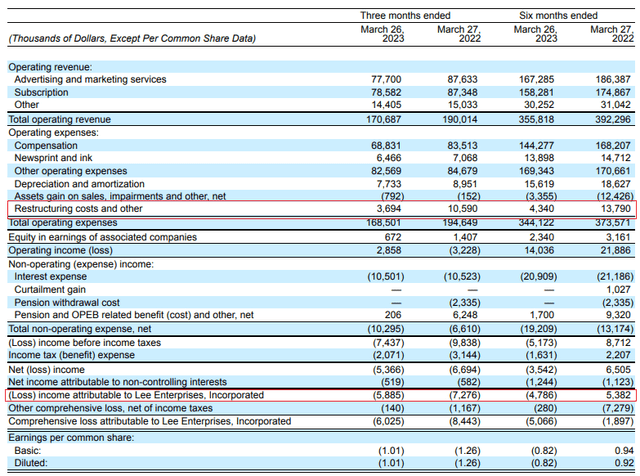

Yet, it’s worth noting that another major reason the share of digital revenue is growing rapidly is the fast decline of the print business. In Q2 FY23, the print revenue of Lee Enterprises slumped by 19.9% to $105.7 million, which offset the strong performance of the digital segment as total revenues went down by 10.2% to $170.7 million.

Lee Enterprises

The lower revenue was a major driver behind adjusted EBITDA dropping by 15.4% year-on-year to $14.3 million for the quarter. The net loss for the period declined by 19.1% to $5.9 million, but the main reason behind the improvement was $6.9 million in restructuring costs.

Lee Enterprises

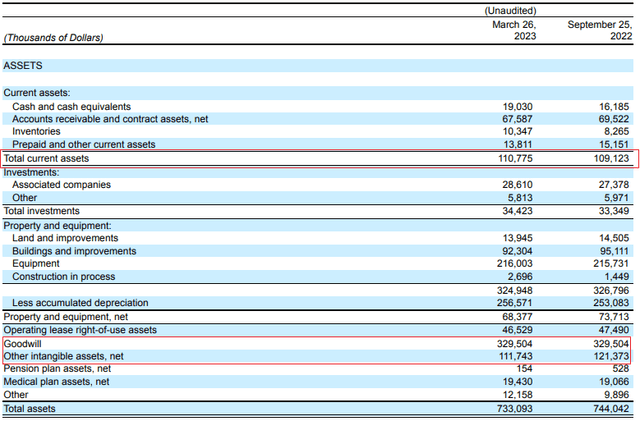

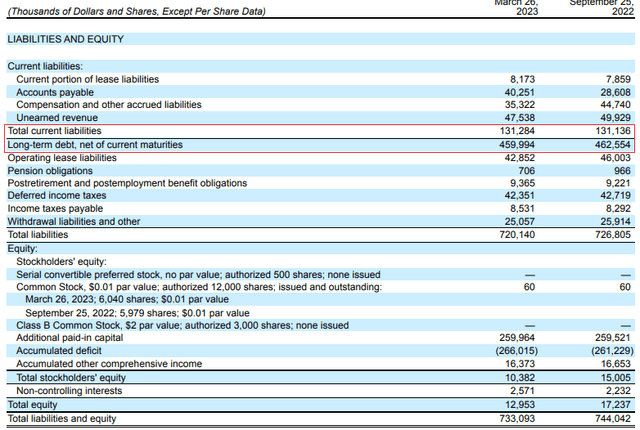

Turning our attention to the balance sheet, I think that the situation looks dire as Lee Enterprises had a working capital deficit of $20.5 million as of March 26 and the tangible book value was deep in the red as intangible assets stood at $441.2 million. In addition, the company has $460 million of debt outstanding under a credit facility with BH Finance that has a fixed annual interest rate of 9%. At the moment, interest expenses are over $10 million per quarter.

Lee Enterprises Lee Enterprises

Considering the financial performance of Lee Enterprises has been deteriorating as the growth of the digital business hasn’t been able to compensate for the decline in the print business, I think that there is a high chance that the company could tap the equity market in the coming months which is likely to lead to significant stock dilution considering the market capitalization is down to just $78.8 million as of the time of writing.

Looking at what to expect for the future, the FY23 guidance includes total digital revenue of between $270 million and $285 million and adjusted EBITDA of between $94 million and $100 million. Considering that Amplified is growing rapidly and that the LTM total digital revenue stands at $256 million, I think that Lee Enterprises is likely to meet its digital revenue guidance for the fiscal year. Yet, I’m concerned that the company could fall short of its EBITDA goal as it has a lot of ground to make up in the second half of FY23. Adjusted EBITDA for the first half of the fiscal year was just $31.9 million, down 25.7% year-on-year.

Overall, I think that there is significant value in the digital business of Lee Enterprises as the LTM revenue of Amplified reached $86 million in Q2 FY23, which represents an annual growth of 51%. In addition, the three-year compound annual growth rate of the number of digital-only subscribers stood at 49% in 2022 which is much higher than many competitors.

Lee Enterprises

Yet, there is no indication that Lee Enterprises plans to sell or spin off its digital business and its financial results are being dragged down by the weak performance of its print business. The company has a high debt load and I think that investing in this stock is too risky at the moment as the stock dilution risk seems high due to declining the EBITDA and accumulating losses.

Investor Takeaway

In my view, Lee Enterprises has a rapidly growing digital business, and the pace of growth of Amplified is particularly impressive. Yet, I think that the Q2 FY23 financial results were underwhelming as the decline in the print business managed to offset the strong performance of the digital business. In my view, Lee Enterprises is unlikely to meet its FY23 adjusted EBITDA guidance, and with working capital in the red and interest expenses above $10 million per quarter, significant stock dilution in the near future seems likely. Overall, I think that Lee Enterprises is an interesting stock that is worth keeping on my watchlist, but the risk is too high for me to consider opening a position at this time. In my view, risk-averse investors should avoid this stock.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here