Investment thesis

Our current investment thesis is:

- Leidos is positioned to achieve healthy long-term growth, owing to its focus on government contracts in sectors of resilience and ones that are benefiting from tailwinds. Underpinning this is deep expertise and a competitive pricing/margin structure.

- The company does not look overly competitive relative to its peers, given the inherent restrictions of public vs. private markets and their respective budget growth rates. This said, investors should appreciate the lower downside risk with Leidos.

- Quality aside, we struggle to see upside at its current valuation. Leidos is expensive relative to its historical average on an FCF basis, with sufficient justification.

Company description

Leidos Holdings Inc. (NYSE:LDOS) is a prominent technology and engineering solutions company specializing in defense, intelligence, civil, and health markets. With a legacy spanning decades, Leidos is renowned for providing advanced technology solutions, scientific research, and systems integration services to governmental and commercial clients globally.

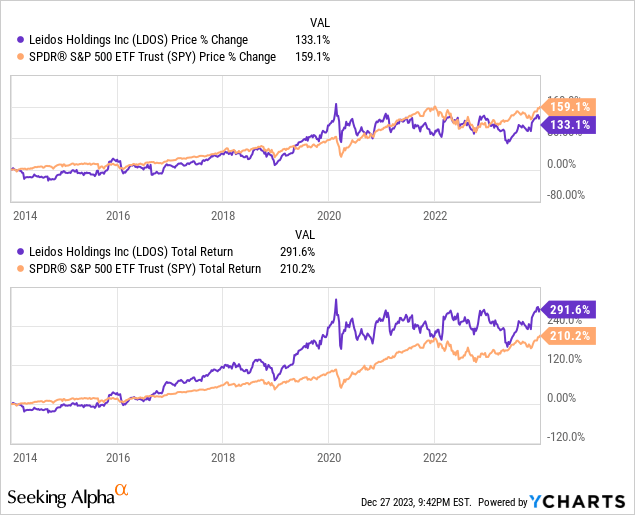

Share price

Leidos’ share price performance has been respectable, with total returns that have exceeded the wider market during the last decade. This is a reflection of its positive financial development and improving investor sentiment.

Financial analysis

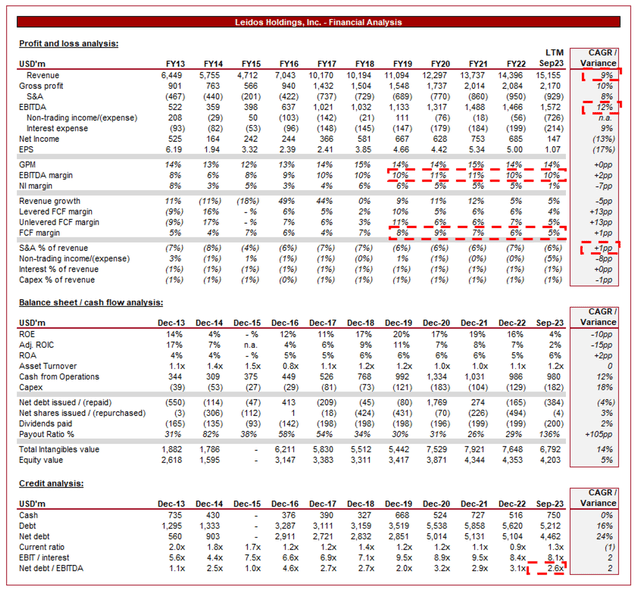

Leidos financials (Capital IQ)

Presented above are Leidos’ financial results.

Revenue & Commercial Factors

Leidos’ revenue has grown at a CAGR of +9% during the last decade, with broadly consistent gains post-FY15. This has been accelerated by periodic M&A.

Business Model

Leidos primarily operates as a government contractor, providing a wide array of services and solutions to various government agencies, including defense, intelligence, homeland security, healthcare, and energy. Their contracts range from technology development and integration to logistics and mission support.

The focus on government contracts has allowed Leidos to develop a strong backlog and greater revenue certainty, as contracts are usually longer term and have wider scopes. This said, the offsetting impact is a lack of significant growth due to budget constraints, as well as restrictive regulatory requirements and tighter margins.

Leidos invests heavily in R&D, focusing on cutting-edge technologies and solutions to justify its ongoing relationships with clients, allowing for upselling. Its innovation drives the development of advanced systems, cybersecurity measures, data analytics, and artificial intelligence, allowing its clients to keep track of the wider market developments.

Leidos has a strategic approach to acquisitions. By acquiring companies with specialized expertise, it diversifies and bolsters its offerings and expands its client base. This diversification reduces risk and allows Leidos to participate in various sectors within the government market.

We believe Leidos’ focus on specific industries will position it perfectly for long-term growth:

- Healthcare – Leidos provides a range of solutions, leveraging technology to improve patient care, manage healthcare data, and enhance operational efficiency. The demand for improvement will remain strong due to the non-cyclical nature of the provision of healthcare. An aging population and a widening wealth gap will ensure growth in this segment.

- Cybersecurity Services – Leidos is a significant player in the cybersecurity domain, offering services to safeguard critical infrastructure, government networks, and sensitive data. Naturally, this is incredibly important for government agencies and with growing technological capabilities, the risk of a breath is growing rapidly (as is the cost).

- Focus on National Security – In conjunction with the above point, Leidos plays a crucial role in national security, providing intelligence, surveillance, and reconnaissance (ISR) solutions. This supports the defense industry and is similarly robust.

- Data Analytics and AI – Governments are famously the last to incorporate technological advancements into their capabilities. There has been a push to become more agile, noting the potential budgetary savings associated with operating in a lean fashion. This is contributing to growing demand for modernization services and ongoing support to upskill and implement new technologies. We consider AI and Cloud computing to be key opportunities.

Margins

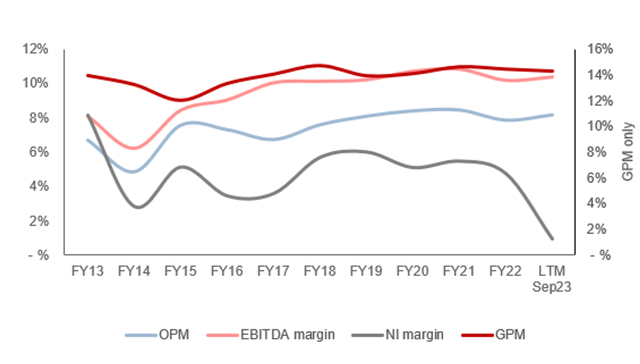

Margins (Capital IQ)

Leidos’s margins have broadly improved over the last decade, with a ~2% improvement in EBITDA. This has been almost wholly due to operating cost leverage, with S&A spending declining as a % of revenue (~2ppts).

The labor-intensive nature of the industry means achieving significant margin improvement is limited, as employees will seek to partake proportionately in rate card increases and broader profitability initiatives.

This said, the company operates at a moderate level in our view when considered in conjunction with its growth, which acts as a qualitative proxy for its competitive value proposition in the market, reflecting strong interest in its service.

Quarterly results

Leidos’ recent performance has been modest despite the wider macroeconomic environment, with top-line revenue growth of +5.9%, +5.9%, +6.7%, and +8.7%. In conjunction with this, margins have remained stable, with minimal variability.

The company’s financial strength is a reflection of a combination of factors. Firstly, it has developed a strong backlog, allowing for revenue to unwind through the delivery of existing contracts. Secondly, Leidos specializes in robust segments, including Defense and Health, where spending continues regardless of funding uncertainty.

Looking ahead, we expect macroeconomic conditions to remain difficult in the coming quarters, with the potential to step further down depending on the timing of inflation subsiding. We expect Leidos to remain robust, although its growth rate will likely land in the LSD/MSD range.

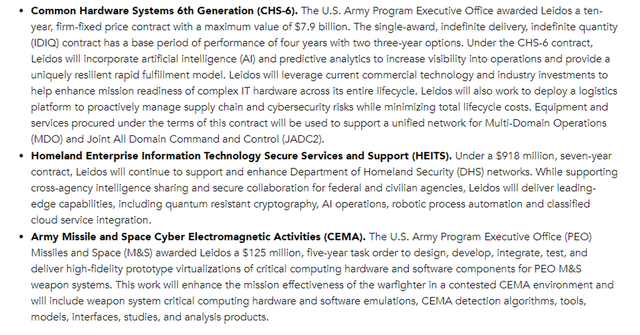

Key takeaways from its most recent quarter are:

- Revenue growth was driven by digital modernization, hypersonics, and medical examination solutions.

- The company’s net bookings of $7.9b represent a book-to-bill ratio of 2.0, which is significantly above 0.8 in Q2.

- Interestingly, backlog declined from $34.7b to $34.1b Q2, while only increasing well in Q3 by 8.6%, reflecting an uncertain future outlook.

- Notable contract wins include:

Leidos

Balance sheet & Cash Flows

Similar to other firms within the industry, Leidos’ balance sheet is fairly uneventful. The company has an ND/EBITDA ratio of 3.1x, which is at the top-end of our range but primarily relates to capital leases and fixed debt and so interest payments are only ~1% of revenue despite the current environment.

Its strong and consistent FCF conversion has allowed the company to distribute regularly to shareholders, with periodically large buybacks to accompany dividends. We suspect this approach will continue in the medium term given its ability to defend margins.

In conjunction with distributions, the company has allocated capital to acquisitions, spending over $4b in the last decade. This has been margin neutral as we have observed and importantly, also ROE neutral. This essentially means capital has been allocated at the minimum level investors buying into the company would pay.

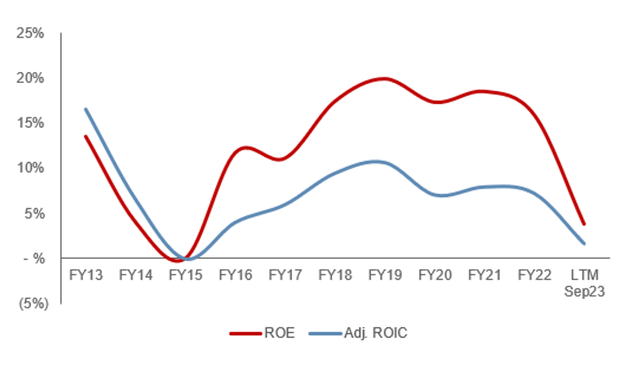

Returns (Capital IQ)

Outlook

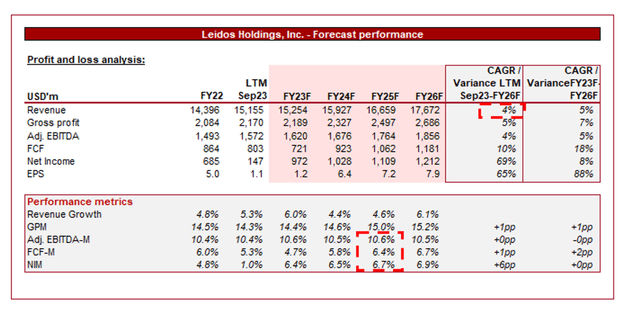

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming years.

Analysts are forecasting a step down in the company’s growth, with a CAGR of 4% into FY26F. in conjunction with this, margins are expected to remain flat.

We consider these assumptions to be conservative. The company will likely continue its M&A strategy and has shown a track record of delivering solid integration and non-dilutive scale. When considering this in conjunction with its organic trajectory, suspect the company can achieve closer to 6-8%.

Industry analysis

Seeking Alpha

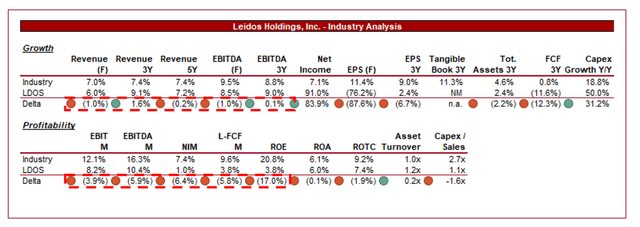

Presented above is a comparison of Leidos’ growth and profitability to the average of its industry, as defined by Seeking Alpha (30 companies).

Leidos is underwhelming relative to its peers. The company’s revenue growth is broadly comparable to the market, which is naturally distorted by noise in this industry following a period of consolidation. This suggests Leidos has a healthy competitive position.

The bigger concern is that its margins are subpar, and quite considerably so on an EBITDA basis. This implies the company’s ability to compete is materially influenced by its pricing aggressively relative to peers and also the lower margin nature of targeting Government contracts.

Based on this, we expect Leidos to trade at a discount to its peer group, sufficiently reflecting its weaker financial performance and likely subpar commercial standing. Margins are a fantastic proxy for competition when considered alongside growth, as we have discussed. Although on an absolute basis it is attractive, against its peers, we believe Leidos is weighted materially to the attractiveness of its pricing rather than on a like-for-like quality basis compared to its peers.

Valuation

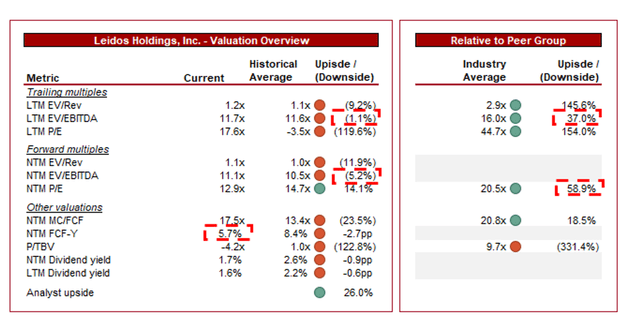

Valuation (Capital IQ)

Leidos is currently trading at 12x LTM EBITDA and 11x NTM EBITDA. This is broadly in line with its historical average.

We believe parity with its historical average is justifiable in our view. The company does now benefit from greater scale and slightly superior margins, however, its growth trajectory may be somewhat limited by its ability to take on debt for a transformational acquisition. This will restrict its ability to achieve the historical rate of ~9% and so offset the improvements to the business achieved.

Further, Leidos is trading at a ~37% discount to its peers on an LTM basis and ~59% on a NTM P/E basis. A discount is warranted for the reasons discussed, although we are hesitant to suggest the existing levels are appropriate (we see ~25% to be more realistic). Investors are punishing the company for its relative attractiveness in our view.

Although this analysis leans toward the company being undervalued, this is not a compelling argument, which is why the business remains at its existing level. Its NTM FCF yield is 5.7%, which although attractive, is below its historical average of 8.4%. Investors are not provided a sufficient reason to acquire this business at a discount in cash terms.

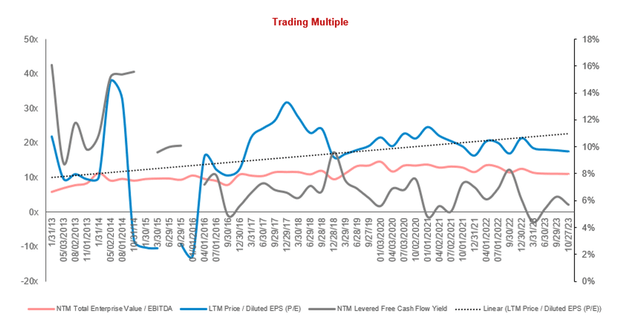

Valuation evolution (Capital IQ)

Key risks with our thesis

The risks to our current thesis are:

- Budget constraints due to macro conditions.

- Regulatory hurdles/changes.

- Negative technological disruptions.

Final thoughts

Leidos is a solid company in our view, representing a lower-risk investment. The company is positioned perfectly to grow consistently, owing to industry tailwinds and targeting non-cyclical/resilient sectors. We see little that can deviate this trajectory.

Leidos has a strong competitive position, although this likely relies on aggressive pricing due to competition, limiting its margins (and likely growth) relative to those that target corporates with more traditional consulting services. Investors must appreciate this trade-off.

Currently, we do not see sufficient upside based on this trade-off, with the company unjustifiably expensive relative to its historical level.

Read the full article here