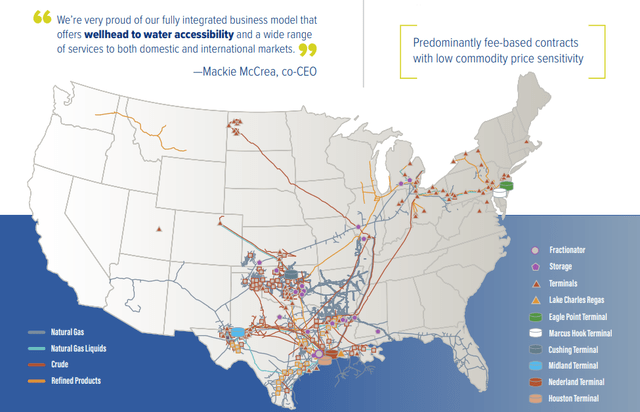

Energy Transfer (NYSE:ET) is a $41-billion market cap firm that operates an extensive pipeline network across 41 US states and plays a vital role in transporting 30% of US natural gas, 35% of US crude oil, and 20% of global natural gas liquids exports.

ET’s factsheet

The company is divided into 5 segments and has investments in subsidiaries involved in various energy-related activities. These include compression services, natural gas marketing, and resource management. They also hold interests in other companies engaged in compression services and manage coal and natural resource properties, generating revenue from royalties and land management activities.

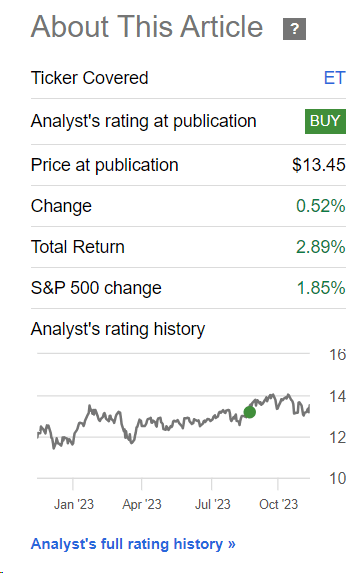

The only time I’ve written about Energy Transfer was in August 2023, and since then the stock’s total return has outperformed the overall market by ~100 basis points, which I think is a pretty good result for such a short period:

Seeking Alpha

In early November, the company reported its Q3 FY2023 results – let’s take a look at them to understand whether my bullish thesis is still valid.

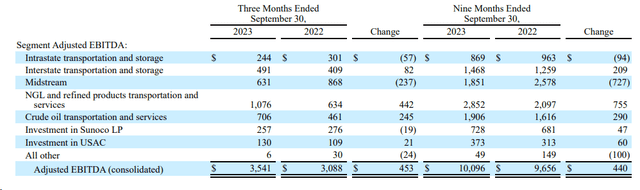

Energy Transfer’s Q3 2023 financial and operational results demonstrated strong performance across its various segments. The company reported growth in gathered gas volumes in the midstream segment, reaching 19.8 million MMBtus per day, a 4% increase from Q3 FY2022. However, lower natural gas and NGL prices offset the volume growth, resulting in an adjusted EBITDA of $631 million, down from $868 million in Q3 2022.

NGL and refined products saw adjusted EBITDA of $1.1 billion, a significant increase from $634 million in Q3 2022. This growth was attributed to strong performances in transportation, storage, terminals, and fractionation operations. The crude oil segment reported adjusted EBITDA of $706 million, up from $461 million, driven by higher volumes on pipelines and the acquisition of Lotus assets.

In the interstate segment, adjusted EBITDA increased to $491 million, compared to $409 million in Q3 2022, primarily due to placing the Gulf Run Pipeline into service and higher contracted volumes. Intrastate segment adjusted EBITDA was $244 million, compared to $301 million in Q3 2022, affected by lower spreads across the intrastate pipeline network and lower natural gas pricing.

As a result, the total adjusted EBITDA for the quarter was $3.5 billion, compared to $3.1 billion in Q3 FY2022:

ET’s 10-Q

Distributable cash flow [DCF] attributable to Energy Transfer partners was $2 billion, reflecting an increase from $1.6 billion in Q3 FY2022, resulting in excess cash flow after distributions of $1 billion.

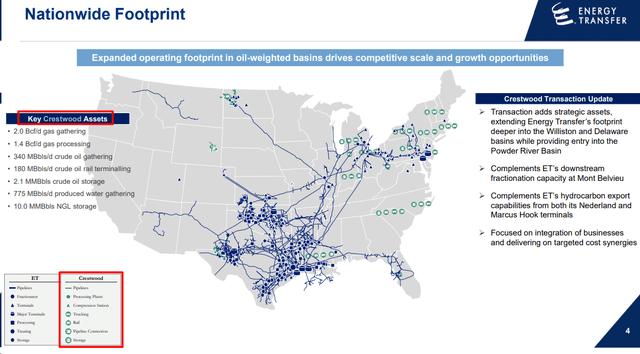

Energy Transfer’s acquisition of Crestwood Equity Partners (which was expected to close on November 3, 2023) should be immediately accretive to DCF per unit, deepening Energy Transfer’s position in the Williston and Delaware basins and providing entry into the Powder River Basin.

ET’s IR materials, author’s notes

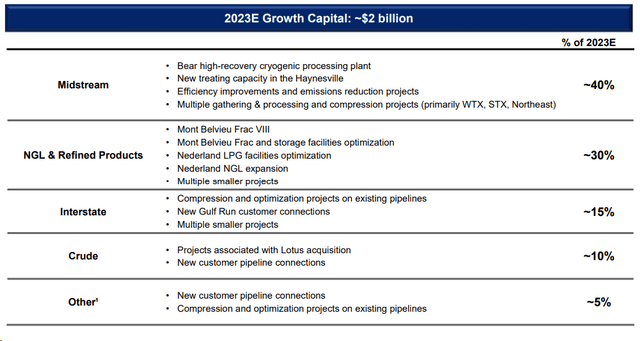

Looking ahead, Energy Transfer plans to expand its NGL export capacity at Nederland, with construction underway and expected to be in service by mid-2025. The company continues to evaluate and pursue growth projects, with a focus on maintaining a long-term annual growth capital run rate of approximately $2 billion to $3 billion, the CEO noted during the latest earnings call.

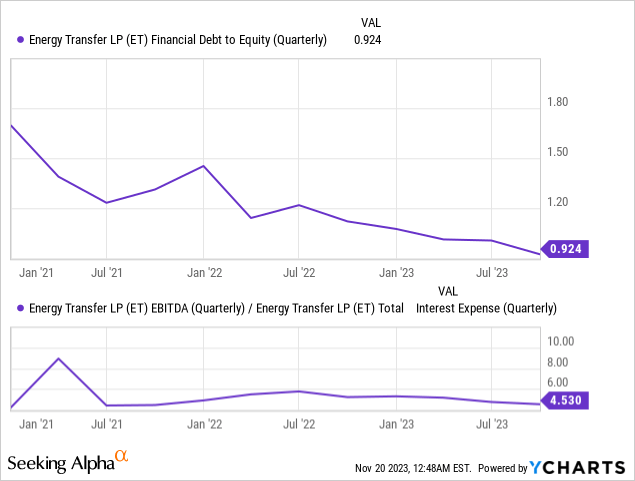

During the Q&A session, the company emphasized its focus on the balance sheet and stated that unitholder buybacks remain an option, especially as leverage approaches the low end of the target range. If we look at the dynamics of the last few quarters, we can see how ET’s leverage profile is getting better and better, which means that the company’s cash flows are increasingly in favor of the equity shareholders.

Without the high level of debt on the balance sheet and the company’s ambitious plans to diversify its operations by spending $2 billion annually on organic projects and mergers, ET’s DCF and the resulting dividend yield seem quite stable to me.

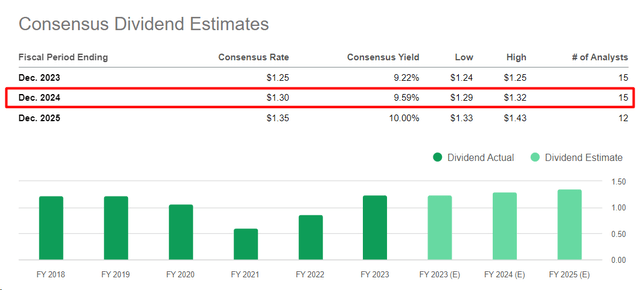

Calculations by 15 analysts have now produced a consensus yield of 9.59% for next year – that’s a lot if we take into account the assumption that the Fed leaves rates unchanged (or starts to cut them sometime in 2024). I think this is a more than achievable yield for ET.

Seeking Alpha, ET’s Dividends

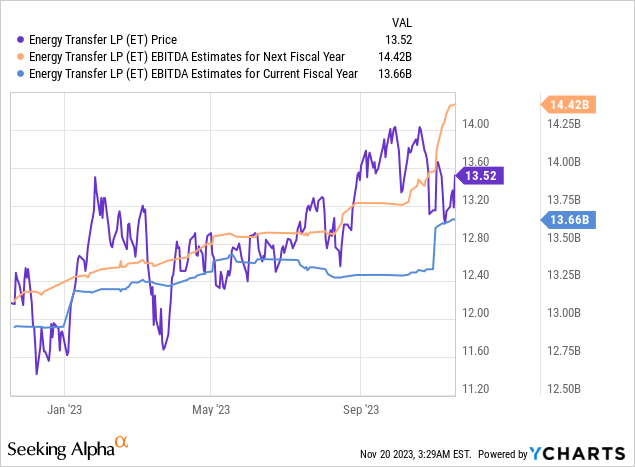

ET’s adjusted EBITDA guidance for FY2023 is between $13.5-13.6 billion (including 2 months of Crestwood). The company remains committed to its targeted annual distribution growth rate [3-5%] while balancing leverage reduction, increasing equity returns, and maintaining sufficient cash flow for growth opportunities.

ET’s IR materials

I think that the guidance set for FY2023 will also be positive next year thanks to the persistently high prices for key commodities. Bank of America projects Brent and WTI to average $90/bbl and $86/bbl respectively in 2024 [November 2023, proprietary source]. The global oil balance is expected to remain tight, as OPEC+ is holding back supply while demand is growing more slowly. Natural gas supply and demand in the US are expected to increase by 4.5 Bcf/d and 1.6 Bcf/d respectively in 2023, with inventories reaching 3.81 Tcf in October. Bank of America expects an average price of $2.70/MMBtu for US gas in 2023 and a recovery to $4/mmbtu in 2024.

BofA [November 8, 2023 – proprietary source], author’s notes![BofA [November 8, 2023 - proprietary source], author's notes](https://wealthbeatnews.com/wp-content/uploads/2023/11/49513514-1700464878762202.png)

It is the presence of a favorable backdrop in the commodity markets and a systematic reduction in leverage that makes me feel that Energy Transfer’s share price should remain sustainable given its current high yield. But how true is this assumption from a valuation perspective?

The Valuation

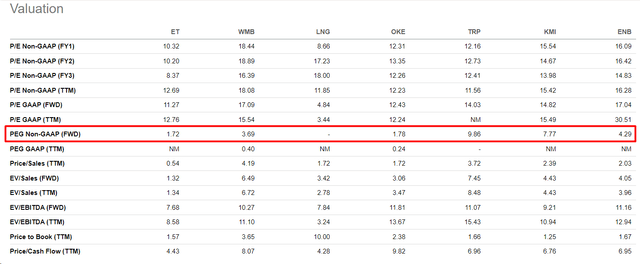

Energy Transfer stock trades at ~7.7x next year’s EV/EBITDA and only ~3.75x next year’s price-to-cash flow, which is relatively cheap. If we look at the PEG ratios (price-to-earnings with growth rates) for next year compared to other peers in the sample, we will see that ET compares very favorably to other companies as well.

Seeking Alpha, author’s notes

But ET, like the other companies in the sample, operates in a highly cyclical industry. Only the lazy don’t write about it, so I won’t make an exception either.

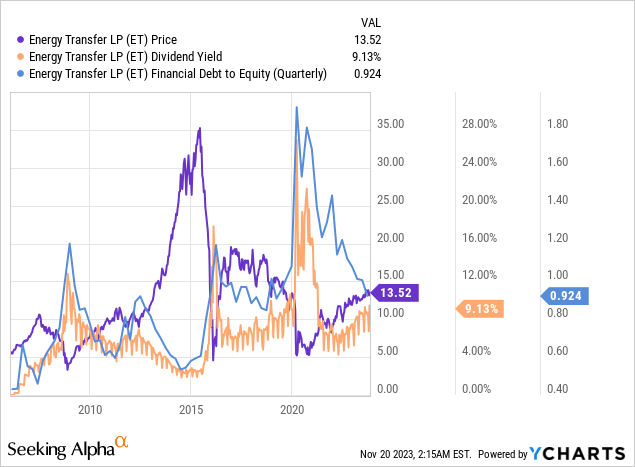

Let’s look at the historical share price performance and try to evaluate it from the point of view of the dynamics of the stock’s fundamentals. Value companies are usually particularly attractive when:

- we observe the upward cycle of their industry (if any);

- they pay dividends above the cost of equity;

- their debt is minimal or actively decreasing and ‘promises’ to become even lower in the foreseeable future.

There are dozens more such conditions, but I will focus only on this list so as not to overload the chart you see below:

What we see in the chart above: On a TTM basis, ET yields are already well above the historical median of recent decades (excluding times of crisis). At the same time, ET’s leverage is declining, as I have already written, which increases the attractiveness of the company in terms of future cash flow distributions. In previous periods when the D/E ratio has fallen as much as it has today, ET’s share price has actively risen and returned its ‘valuation discount’ back to the market – we are experiencing the same thing today. At the same time, the deleveraging process is still well underway, so I expect that the still existing discount to other peers (we have seen this above) should gradually become smaller and narrower. The process I have described should also be aided by the industry itself, which I believe is still in an upward cycle – otherwise, the major investment banks would not have predicted a commodity price run next year.

So what’s the fair value of ET given all that?

Let’s assume that ET will generate EBITDA of $14.42 billion in FY2024 – that’s what the consensus data tells us:

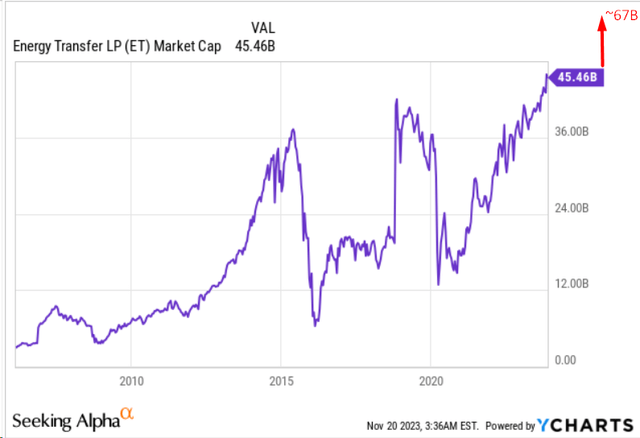

I think ET’s EV/EBITDA ratio should remain at ~8x if we assume further deleveraging on the balance sheet. Considering a net debt of ~$48.4 billion, ET’s implied market capitalization should increase to ~$67 billion by the end of FY2024. This results in an upside potential of 47.3%:

YCharts, author’s notes

The Bottom Line

Investing in Energy Transfer stock comes with certain risks that potential investors should be mindful of. These include susceptibility to market and commodity price fluctuations, uncertainties related to regulations, substantial debt levels, and operational challenges. The company’s financial performance is notably influenced by shifts in energy prices and potential regulatory hurdles. Economic changes, shifts in demand, and evolving climate-related regulations present additional challenges. The stability of ET’s distributions, a significant aspect for investors, relies on its financial performance, which may suffer greatly during a recession.

The demand side could really be affected by a possible recession next year – but in my opinion, this risk is largely priced in given the huge discount I have calculated above. So I assume that ET will continue to grow and at the same time pay dividend yields that more than cover the required rate of return.

Energy Transfer stock is a value ‘Buy’.

Thanks for reading!

Read the full article here