After previously covering Lincoln Electric (NASDAQ:LECO) with a hold rating, the stock has seen great price action, soaring to new highs. However, after examining the firm’s fundamentals and future expectations, I still believe that Lincoln Electric is currently overvalued, resulting in a hold.

Business Overview

Lincoln Electric Holdings, Inc. and its affiliates are involved in the worldwide creation, innovation, production, and marketing of goods related to brazing, cutting, and welding. The Harris Products Group, International Welding, and Americas Welding are the three separate business sectors that make up the organization. Filler metals for brazing and soldering, arc welding equipment, wire feeding systems, plasma and oxyfuel cutting systems, fume control equipment, welding accessories, and specialty gas regulators are just a few of the wide range of products it offers. Furthermore, Lincoln Electric is involved in the retail industry in the US.

Additionally, the firm produces parts for the HVAC industry in Mexico and the United States, including distributor assemblies, manifolds, and headers made of copper and aluminum. Lincoln Electric serves a wide range of sectors, including shipbuilding, heavy fabrication, energy and process, automotive and transportation, construction and infrastructure, and general fabrication. The firm sells its goods directly to consumers of welding supplies as well as industrial distributors, dealers, and agents.

Lincoln Electric

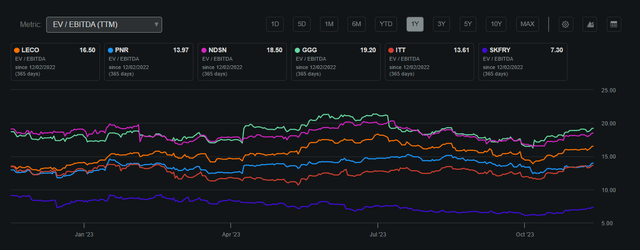

With a market valuation of $11.33 billion, Lincoln Electric has achieved an impressive 22% Return on Invested Capital despite the current high-rate environment. Over the past 52 weeks, the stock has experienced a trading range from $210.86 to $139.92. Currently priced at $201.77, the company holds an EV/EBITDA ratio of 16.5, approaching its peak. Notably, Lincoln Electric’s EV/EBITDA ratio stands relatively high compared to industry peers, indicating the potential for overvaluation.

Lincoln Electric EV/EBITDA Compared to Peers (Seeking Alpha)

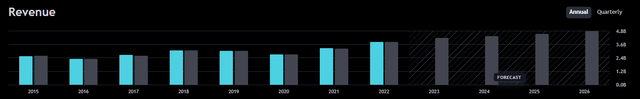

Lincoln Electric also pays a dividend of 1.41% representing a payout ratio of 30%. I believe this dividend provides investors with a small portion of income while allowing Lincoln to utilize the bulk of its FCF to capitalize on growth, as exemplified by its 22% ROIC. I believe that as the firm’s growth begins to slow, Lincoln Electric will begin to use its stable FCF to pay a greater dividend or repurchase more shares to create shareholder value. But, with revenues and EPS expected to continue growing into the future, I believe that investing in the core business model would be best until this growth seems less likely.

Revenue Estimates (Trading View) EPS Estimates (Trading View) Share Performance (Seeking Alpha)

Performance Compared to the Broader Market

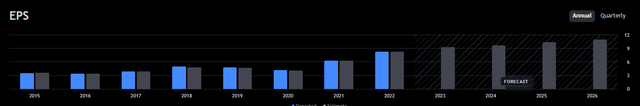

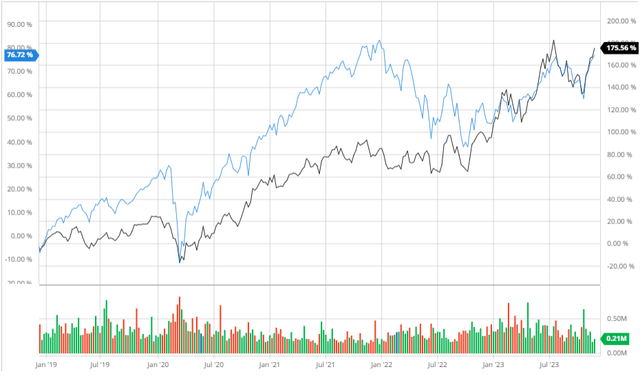

Over the last 5 years, Lincoln Electric has significantly outperformed the S&P 500 when adjusting for dividends with a 175.56% return compared to 76.72%. I believe that this outperformance highlights management’s ability to create value over the long term for shareholders through core business growth. In the future, it is speculative if Lincoln Electric will continue to outperform due to its expensive price tag, which will make expected growth already priced in.

Lincoln Electric Compared to the S&P 500 5Y (Created by author using Bar Charts)

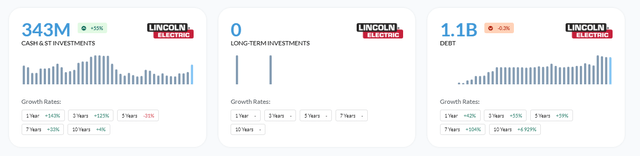

Balance Sheet

Lincoln Electric also holds a solid balance sheet in which operating income has more than doubled since 2020 and debt has only grown 55% in that same time. This means that the firm is well leveraged for the current macroeconomic headwinds and would have a competitive cost of debt if needed to expand and outpace competitors. With a Current Ratio of 1.83 and an Altman-Z-Score of 6.43, Lincoln Electric can remain solvent for many years to come.

Financial Position (Alpha Spread) Solvency Ratios (Alpha Spread)

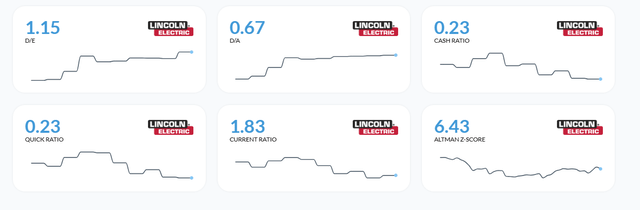

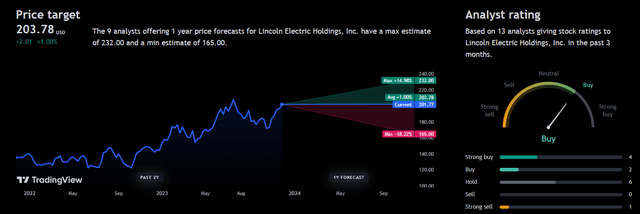

Earnings

Lincoln Electric reported fairly strong Q3 2023 earnings with EPS beating expectations by $0.15 at $2.40 and revenues missing by only $7.45 million at $1.03 billion showing a 10.48% YoY growth. I believe that these earnings demonstrate Lincoln Electric’s ability to grow cash flows even in tough times, exemplifying its ability to utilize cash flows to create long-term resiliency. With solid earnings projected for the upcoming years, I believe that Lincoln Electric can achieve these goals as the firm continues to have solid FCF to foster growth, thus removing the need to take on expensive debt.

Earnings Estimates (Seeking Alpha)

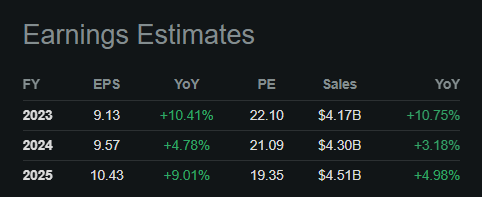

Analyst Consensus

Analysts currently rate Lincoln Electric as a “buy” with a 1-year price target of $203.78 presenting a potential 1% upside. I believe that analysts also notice that although Lincoln Electric has a solid business model and growth plan, the firm’s expensive price does not support current fundamentals and growth estimates.

Analyst Consensus (Trading View)

Valuation

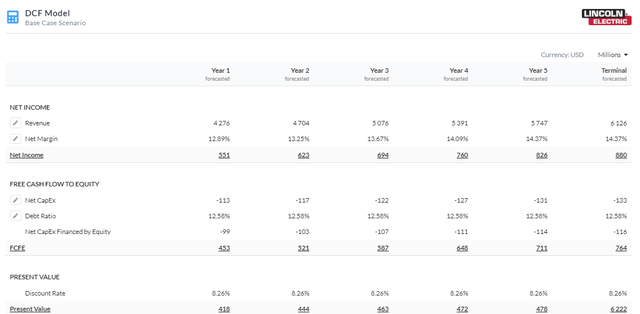

Before creating my DCF for Lincoln Electric, I decided to find a fair discount rate by finding the Cost of Equity using the Capital Asset Pricing Model. With a Beta of 0.9, and a risk-free rate of 4.21% based on the current 10-year treasury yield, Lincoln Electric has a Cost of Equity of 8.26%. This demonstrates the return investors demand to compensate for the risk of holding Lincoln Electric Shares.

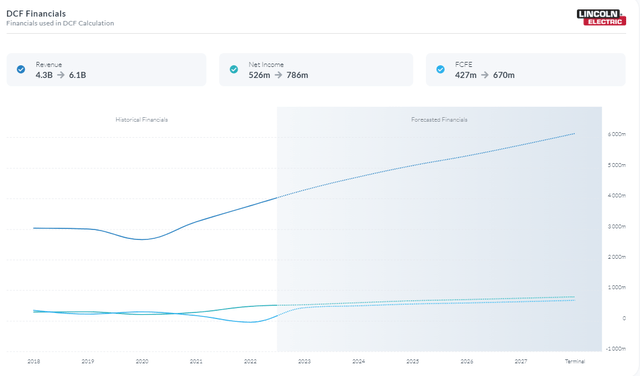

After calculating an appropriate discount rate, I decided to calculate the fair value of Lincoln Electric by using a 5-year Equity Model DCF based on FCFE. I used the firm’s Cost of Equity of 8.26% as the discount rate with no risk premium as the firm’s balance sheet and core business are rather safe, and I also do not expect macroeconomic headwinds to worsen in regards to interest rates and inflation as inflation begins to cool and rates have remained stagnant. I also estimated revenues and margins to continue growing with expectations, which resulted in a fair value of $148.56 representing a 26% overvaluation.

5Y Equity Model DCF Using FCFE (Created by author using Alpha Spread) Capital Structure (Created by author using Alpha Spread) DCF Financials (Created by author using Alpha Spread)

Constant Innovation Resulting in Improved Cash Flows

Lincoln Electric’s dedication to creating innovative welding and cutting solutions that meet changing industry demands is the foundation of its product innovation strategy. The company’s adoption of improved welding technology is a prime example of this approach in action. The introduction of the Power Wave platform, for example, demonstrates Lincoln Electric’s commitment to innovation. With the help of the advanced waveform control technology included in the Power Wave systems, welders may achieve exceptional arc performance and welding precision.

This innovation improves the look of the bead, decreases spatter, and increases control over the welding process. Lincoln Electric places a strong focus on ongoing research and development to make sure that its products match the wide range and progressively more complicated needs of its clients, while being at the forefront of industry standards. Lincoln Electric continually sets itself apart in the market and solidifies its position as an industry leader dedicated to pushing the limits of welding technology by delivering novel and cutting-edge solutions. This product innovation approach is in line with the company’s overarching objective of offering its worldwide clientele top-notch, effective, and cutting-edge solutions.

I believe that this innovative strategy will allow Lincoln Electric to outperform competitors, giving them greater pricing power, thus improving margins and allowing the firm to have greater cash flows to capitalize on growth. This strategy will also allow the firm to expand rapidly in great macro environments and allow Lincoln Electric to avoid debt in economic downturns, which will protect long-term cash flows as well.

Risks

Raw Material Costs: Price fluctuations for essential raw materials, such as energy and metals, can affect profit margins and manufacturing costs.

Technological Changes: To remain competitive, rapid technological improvements can necessitate continuing expenditures in research and development. A lack of technical adaptation may impact a company’s standing in the market.

Conclusion

To summarize, I believe that Lincoln Electric is currently a hold because even though the firm has a solid balance sheet and innovative culture, they are currently overvalued given current fundamentals and future projections.

Read the full article here