2023 is looking to be a solid year for Chocoladefabriken Lindt & Sprüngli AG (OTCPK:CHLSY) (OTCPK:LDSVF). However, near-term prospects are challenging due to rising cocoa costs and Switzerland’s minimum taxation. The company could overcome these challenges medium term through packaging innovations, pricing actions supported by continued brand building, and a possible moderation of materials costs. Although valuation is pricey, the stock could be viewed as a hold considering their good fundamentals including a global presence (which gives scale advantages and positions them well to capitalize on growth opportunities in fast-growing markets such as Asia), strong brand, and leading position in a market with moderate barriers to entry.

Company Overview

Chocoladefabriken Lindt & Sprüngli AG is a Swiss chocolate company, among the leading players in the premium chocolate space. The company has a presence in over 120 countries worldwide, and owns a portfolio of chocolate brands including Russell Stover, Ghirardelli, Caffarel, Lindor and their flagship Lindt brand.

2023 Financials

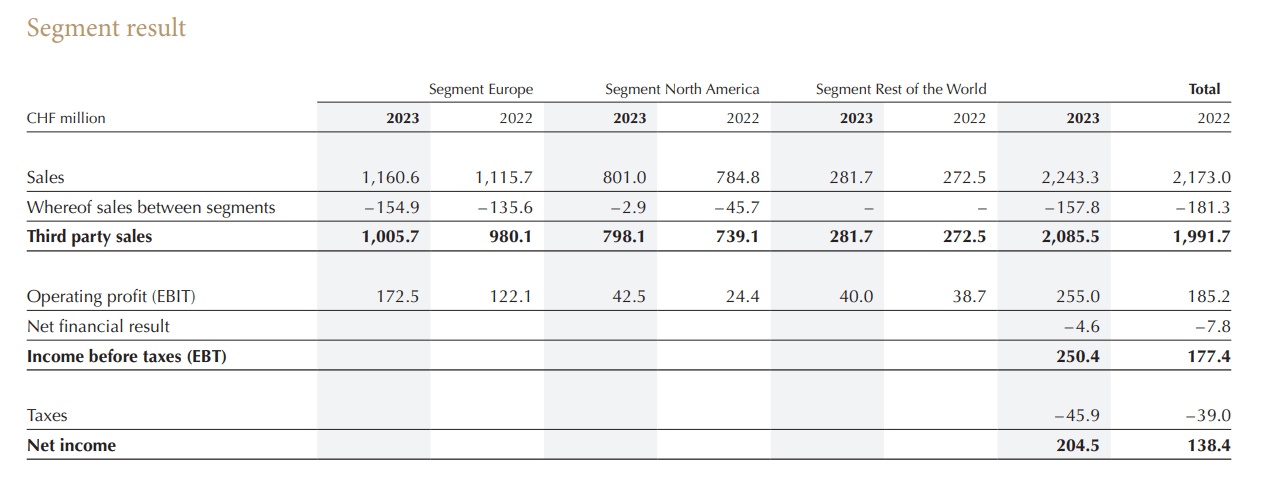

For 1H 2023, Lindt reported revenues of CHF 2.09 billion, with organic revenue growth of 10% YoY, driven by robust market share gains and organic growth performance across all geographic segments despite inflationary conditions dampening consumer spend; in Europe, their biggest market, revenues amounted to CHF 1 billion, registering an organic growth rate of 8.9% YoY driven by Germany and France. In North America, their second-biggest market, revenues rose to CHF 798.1 million, at an organic growth rate of 11.2% YoY supported by double digit growth for their top two brands Lindt and Ghirardelli, helping Lindt maintain their position as the leading premium chocolate player in the U.S. Rest of the World delivered revenues of CHF 281.7 million, with organic growth of 11.1% supported by double digit growth in Japan and Brazil.

Chocoladefabriken Lindt & Sprüngli AG 1H 2023 report

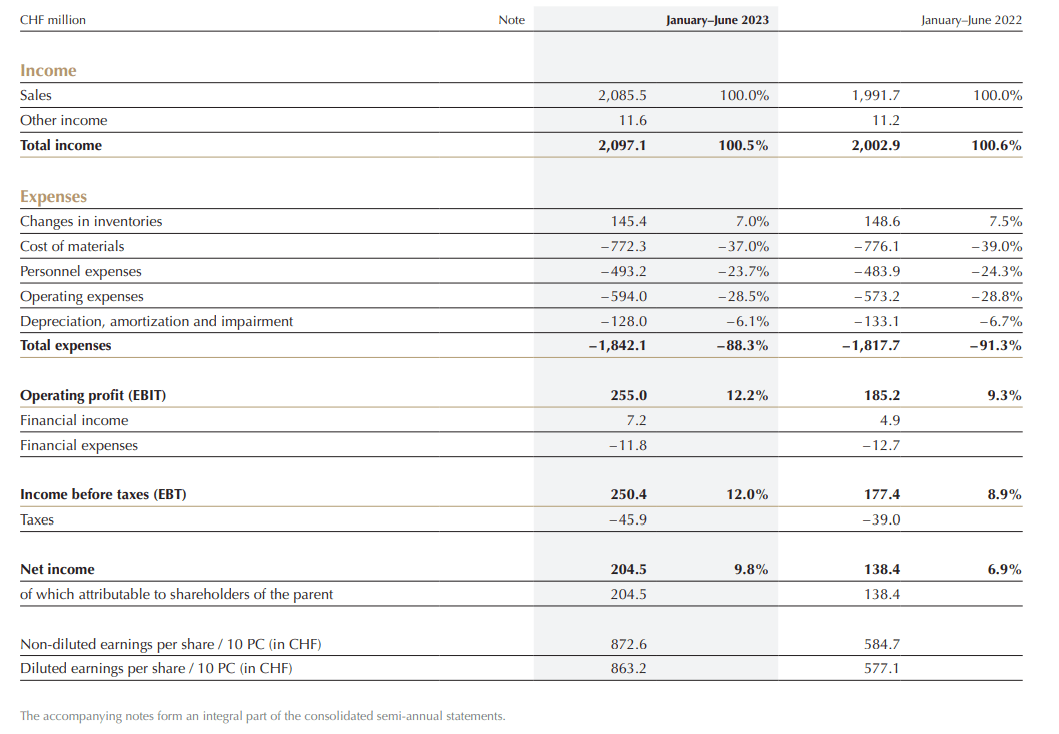

1H 2023 net income rose 47.8% YoY to CHF 204.5 million partly due to price hikes, moderating inflation for inputs like milk and packaging (materials costs amounted to 37% of revenues, down from 39% the same period last year) and lower logistics costs helped by efficiency improvements (operating expenses as a proportion of revenues dropped to 28.5% of revenues in 1H 2023 from 28.8% the same period last year, largely driven by lower logistics costs according to company management).

Chocoladefabriken Lindt & Sprüngli AG 1H 2023 report

With over 60% of revenues generated in 2H 2023 due to seasonality, Lindt is poised to generate at least 7% revenue growth for full-year 2023 assuming no major negative impact to 2023 seasonal sales which based on available information has so far held steady; Euromonitor estimates 2023 seasonal chocolate sales growth at under 0.2%. Lindt management upgraded their full-year 2023 outlook with revenue growth expected at 7%-9% (from 6%-8% previously) driven by growth in all segments (Europe is projected to grow 6%-8%, North America in the high single digits to 10%, and Rest of the World between 12%-14%), and profit margin increase expected at 30-50 basis points (from 20-40 previously).

2024 profitability however may take a hit due to materials costs as well as the impact of Switzerland’s minimum corporate tax (management expects their effective tax rate to increase to about 23%-25% medium term). Chocolate makers typically hedge cocoa for 6-12 months, and Lindt benefited from a roughly 300 basis point hedging benefit in 2023 and therefore while full-year 2023 raw materials costs may only be slightly higher than 2022, materials costs are expected to increase materially in 2024 with cocoa prices exceeding $4,000/metric ton in November 2023, reaching their highest levels in over 45 years (cocoa prices remain over $4,000/MT as at January 2024 over 50% higher from the $2,500-$2700 range in 2022).

Longer term, Lindt is positioned to exploit growth opportunities in the premium chocolate space. Lindt’s top two markets, Europe and North America are projected to see growth in the high single digits over the coming years while Asia is expected to see faster growth. Strategic growth initiatives in North America for Lindt and Ghirardelli brands may help the market leader defend (or even grow) market share. Lindt management is targeting revenue growth at 6–8% (roughly in line with the industry average based on research projections) and an improvement in operating profit margin of 20–40 basis points per annum in the mid-to-long term which is not unrealistic assuming a mid-single digit growth rate in Europe, high single digit growth rate in the U.S., and growth of around 10% in the Rest of the World. Meanwhile, packaging innovations, and possible moderation of materials costs as well as continued marketing investments could support management’s margin expansion targets.

Conclusion

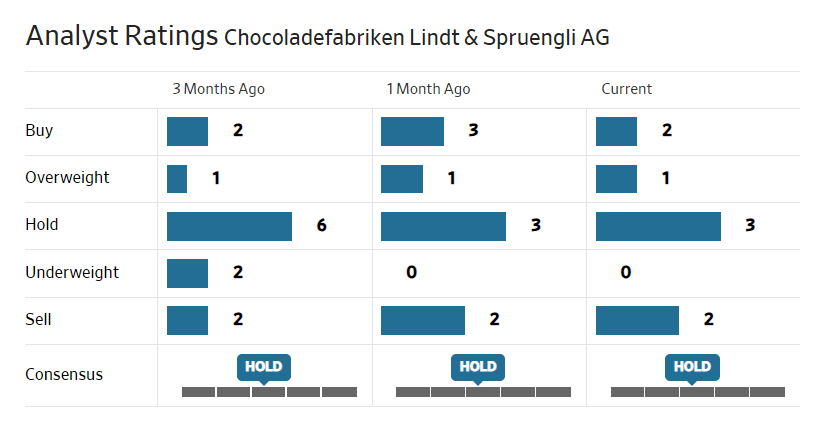

Lindt & Sprüngli has a hold analyst consensus rating.

WSJ

A DCF analysis with the following assumptions suggests Lindt’s fair value is under USD 13 billion (or roughly CHF 11 billion), considerably lower than their roughly CHF 28 billion market cap currently.

|

Revenue growth YoY% |

Around 7.4% annually for the next three years |

|

Terminal growth rate % |

2% |

|

Net margin % |

2023 = around 11.7% based on management’s guidance of 30-50 basis points (2022 net margin = 11.4%). 2024 = dropping to 10% and then gradually improving at 20 basis points annually for the next three years |

|

Depreciation |

5%-4.5% of revenues |

|

CAPEX |

Between CHF 250 – CHF300 medium term based on management guidance |

|

Discount rate % |

7% |

Lindt is pricey on a relative basis as well with their GAAP P/E of 40 being nearly double the sector median of 21. Nevertheless, the stock could be viewed as a hold considering decent growth prospects, a solid brand, and a market leading position in the global premium chocolate space which tends to have fairly high barriers to entry in terms of brand building and consumer acceptance.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here