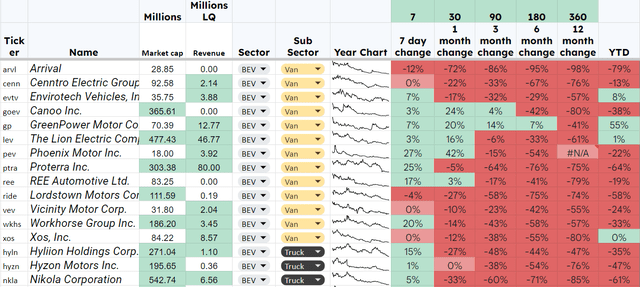

The Battery Electric Vehicle, Van, and Truck sector I track has made some exciting progress lately; five companies have shown improved share prices in the last month and even more have increased in the previous week. I am beginning to think another investment is due. The whole sector has been hit hard in the last 12 months. Still, the falling Lithium price is likely making their products more competitive, and various government incentives offer heavy discounts for buying electric buses, vans, and trucks. The fundamentals of the market have improved.

BEV Van and Truck Price Changes (Author Database)

GreenPower Motor Company (GP) continues to lead my BEV Van sector, up 55% YTD. My 2022 investment in GP ended when the stock doubled in price. GP still looks like excellent value (I have written about them twice here and here), and they had a barnstorming quarter, so I may decide to rebuy. First, I will look at other companies showing signs of life. I like to buy companies at the bottom when price action implies a move higher has begun, and fundamentals provide solid backup to the thesis. The price action of Canoo Inc (GOEV), Lion Electric (NYSE:LEV), Phoenix Motor Inc (PEV), Proterra Inc (PTRA), and REE Automotive Ltd (REE) has piqued my interest. REE and GOEV are discounted as they do not have sufficient revenue to prove their concept (I look for $1 million in the last quarter). I also ignore PEV as they do not have the market capital to provide a liquid market. That leaves LEV and PTRA as the two candidates to replace GP as my chosen company in this sector. In this article, I will look at LEV, and if I don’t like the look of it, consider PTRA next.

LEV Make School Buses

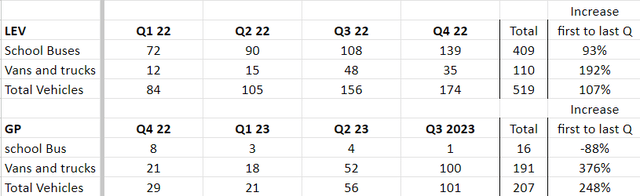

Comparing sales of LEV and GP is informative; 80% of units sold by LEV are School Buses, and 20% are Vans. For GP, the figures are 8% School Buses and 91% vans. Although they are direct competitors, they have progressed in opposite directions.

LEV v GP Unit sales (Author Database)

Electric Buses

LEV bus sales are up 93% in the last year and account for most of its income. It is not unreasonable to suggest LEV Bus sales are the key to its success and should drive its profits.

Blue Bird (BLBD) is probably the market leader in this area; in their Q4 2022 earnings call, they said they had more than 850 electric school buses on the road, with orders being up 84% year over year. The CEO said

Now, the EV school bus revolution is just getting warmed up. The EPA recently announced the lottery winners for the first $1 billion in funding from the Clean School Bus program, which provides $5 billion over 5 years for clean and cleaner emission school buses. Blue Bird is poised to generate over $200 million in revenue from just this first round of this fantastic program. And this wasn’t by chance.

(BLBD: 2022 – Earnings call Q4 2022 Transcript, 2022-12-13)

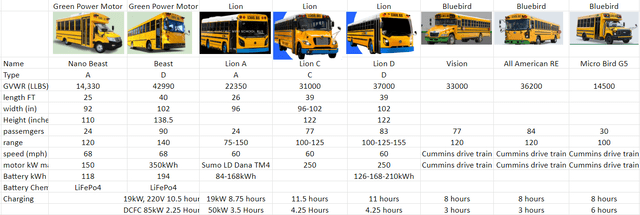

LEV will face stiff competition from Blue Bird, Thomas Built Buses, and IC Bus as well as GP. Looking at the vehicles produced by these companies is often informative. However, the buses seem generic, and there is little to choose between them

Bus Specifications (Author Database)

LEV has a bus lineup similar to BLBD and more extensive than GP.

At present, only the Lion C is available. The Lion A and Lion D are due for release later this year.

LEV is keeping pace with the market leader, it has delivered over 800 school buses (slide 19 Earnings presentation), putting it on par with BLBD and a long way above GP, who are still in double figures. Those figures could mean that the Lion C is America’s best-selling electric school bus.

In the first round of EPA finances, LEV received 201 purchase orders out of 990 that named an OEM (slide 12 Earnings presentation) BLBD secured 300 (earnings call), leaving 480 going to other OEMs and 1405 direct applications from schools that have not yet chosen their supplier. BLBD stated they expect to secure 500 of these (earnings call), implying that LEV could receive a further 350 (if the market share remains consistent) for a total of 551 orders; this is the first of 5 rounds of bidding, giving a likely total of 2,755 bus sales for LEV.

The LEV order book stands at 301 trucks and 2,167 buses, and 317 charging stations.

Revenue Calculations

Solving simultaneous equations for LEV sales in Q4 and Q3 gives us an approximate revenue per bus of $210,000, implying additional income from the EPA program of nearly $1 billion. This figure agrees with information from BLBD.

BLBD said the program will deliver $1 billion in additional revenue 2023-2027 (earnings call 13 Dec 2022).

Can LEV Build this Many Buses?

Short answer yes, they can. Their US manufacturing site based in Joliet is now operational. It will have a maximum capacity of 2,500 school buses annually by the end of 2023. The total cost of this facility will be $105 million (slide 10 Earnings presentation).

Lion has built a Canada-based battery manufacturing facility in Mirabel, Quebec, with a 1.7 GWh production capacity. This facility will cost $123 million (CND). I estimate that the battery factory will be able to provide batteries for 5,000 LEV vehicles per year. (derived by dividing 1.7Gwh by the battery size given in the table of bus features).

Lion Vans and Trucks

The Bus business looks excellent, with high demand, solid market share, a growing product line, and in-house battery production. It is a proven revenue-generating operation; this can not be said of the Lion van and truck operation.

Where GP has managed to turbocharge its sales of Vans and trucks, LEV has run into problems. LEV wants to sell Class 5, 6, and 8 vehicles. The class 6 and one of the two class 8’s are available, the class 5 is due in 2023, but the Class 8 Tractor unit is stuck in a legal dispute with Nikola. The legal issue with Nikola relates to the Romeo battery company acquired by Nikola in 2022. LEV designed the Class 8 Tractor to work on the Romeo battery and has run into supply issues.

Apart from the Romeo issue, Nikola is a salutary lesson regarding Class 8 BEV; they were the first to launch a commercial product, the Nikola Tre, but sales have been languid. I wrote about Nikola and expected the Tre BEV to be a big seller with the revenue generated transformative for Nikola. That has just not happened. I now have significant doubts about Class 8 BEVs being big sellers. I think Class 8 trucks will remain diesel/Natural gas powered until the Hydrogen fueled trucks become available. I discussed this idea in this article focused on Hyliion.

LEV vans and trucks will be built at the Montreal site; the capacity here is 1,000 buses and 1,500 trucks (earnings call answer to question from M.Shlisky and K.Chiang). Although they have the equipment to build 1,500 trucks, they do not have the people with an order book of 300 trucks. They are not planning any further investment in this area.

LEV Financials

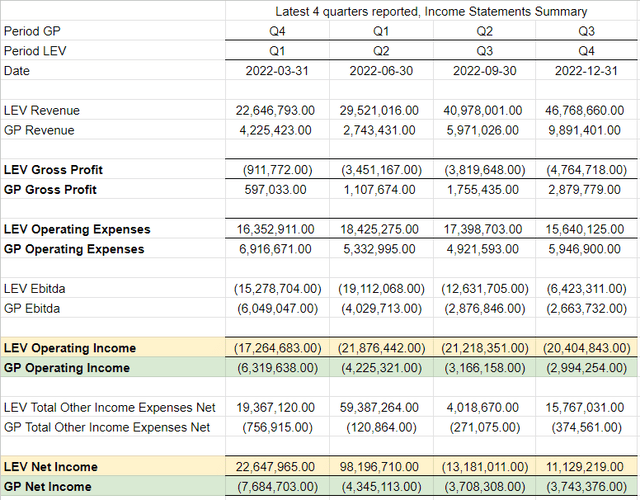

When comparing LEV and GP, I put the following table together, summarizing the two income statements.

LEV v GP Financials (Author Database)

A few things stand out

- LEV revenue is significantly higher than GP revenue; however, LEV gross profit is negative and worsens as volume increases. GP has a positive gross profit that is growing with volume.

- In 3 quarters, LEV had a negative operating income and a positive net income.

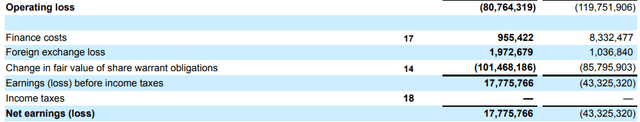

The additional income for LEV beyond its operations is a non-cash line item. The annual report for 2022 shows the detail.

From page 149 the statement of earnings gives

Earnings statement (LEV financial statements)

The line item ‘Change in fair value of Warrant obligations adds $101 million of income.

The fair value adjustment relates to warrants issued to Amazon ($28 million adjustment) and those issued at the time of the SPAC business combination. Adjusting the bottom line for this item would give a net income of -$78 million, not +$23 million. I have said in several articles how warrants with Amazon are generally a bad idea. Amazon seems very good at using its size and prestige to make an excellent deals with newer companies and extract warrants. The practice caused a real issue for Plug Power (PLUG) when it had to record negative revenue due to Amazon.

LEV Balance Sheet

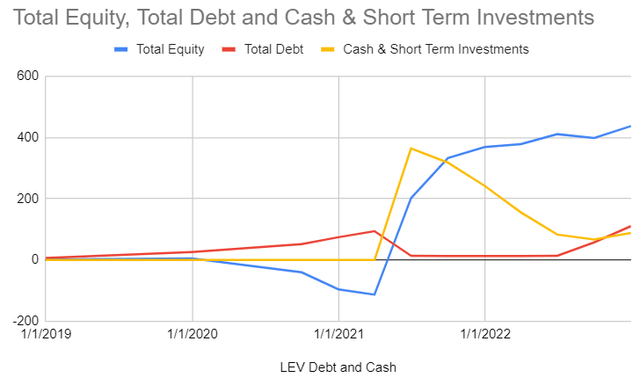

LEV cash v debt overtime (Author Database)

Cash generated by the SPAC combination has dropped, and debts are beginning to rise. Debt is now higher than cash, and with the significantly negative income identified, interest payments will not be well covered.

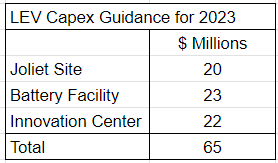

Debt is rising, gross profit is negative, and capex will continue to be high in 2023 (earnings call statement Nicolas Brunet CFO).

Capex guidance (2022 earnings call)

Brunet also said $25 million of the $45 million due to be spent at the Battery and Innovation facilities would come from federal and provincial loans.

LEV closed the year with $88 million of cash. They raised $21 million by selling and leasing back the Mirabel facility, raised an additional $7.5 million through selling shares, and could raise another $94 million through their existing ATM program.

With $88 million in cash, $65 million planned capex spend, and perhaps another $78 million in losses, LEV might need an additional $55 million this year. $25 million is expected from the government capex loans, but that still leaves them short of $30 million. Another year of significant shareholder dilution looks like a possibility.

Earnings Reports, What I will be Watching

- Gross Profit and Margins

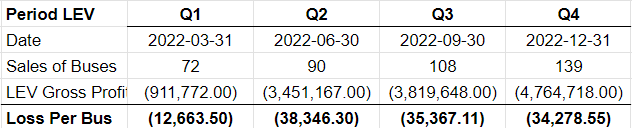

I need to see an improvement in this area. Bringing together the information already presented in this article, we get

Loos per unit calculation (Author generated, data from SeekingAlpha)

It is not entirely accurate as it does not consider van and truck production, but that is a small part of the business. We must see improvement here if the company will ever profit. This figure has to alter; so far, the omens are unfavorable as deliveries have improved and loss per bus has remained stubbornly high. It looks like Tesla (TSLA) circa 2015, and we all know how that went.

2. EPA sales.

How many of the 1,405 buses that have not named their OEM are going to LEV? I would like to see around 300-400 units to keep them on track with BLBD and prove that they have become one of the leading players in this growing industry. If LEV can secure these orders, deliver them, and profit from them, they will be my next medium investment and probably make it into my pension fund.

3. CAPEX Spend

What are the ongoing requirements of the manufacturing build-out? Two obvious things we need to see. Is the Juliet US manufacturing site still on track? And what about the battery factory? Will its products be ready when needed?

3. The Cash

Finally, the cash situation looks like they may issue significant additional share capital. They mentioned $90 million in the last earnings call, which would be another 20% dilution,, a percentage similar to last year. Some guidance here would be helpful; I would rather buy after the issuance than before.

Conclusion

LEV has made outstanding progress as an electric bus seller. They have competed effectively with established market leaders in this industry, building an enviable market share in a growing industry.

None of the other electric van and truck companies I track have managed to do this in any sector.

The problem is that LEV loses money on every bus they sell and spends large amounts of capex as they build its manufacturing capability.

I remember Tesla being in a similar situation around five or six years ago. I regret that I didn’t think Tesla would make it and didn’t invest at less than $100 per share. Will LEV make it? Before my Tesla experience, I would have said no, but now I am unsure. If they can keep growing the bus sales to a sufficient volume where economies of scale begin to kick in and can fund themselves to that date, they will likely make a significant profit.

Will I invest? Not yet, but I will watch every quarterly report looking for improvement in the gross profit figure. If that begins to trend in the right direction, I will be a buyer.

I will update you in the comments as the story progresses.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here