Louisiana-Pacific Corporation (NYSE:LPX) reported better-than-expected quarterly net sales and EPS, and management continues to show new corporate transformation initiatives. Already with a significant amount of cash in the balance sheet and a decent current ratio, I believe that the recent acquisition, sale of assets, and closure of certain businesses indicate that LPX is making meaningful corporate changes. With this information, dividend distribution, and repurchase programs, I think that we may see demand for the stock.

Louisiana-Pacific: Better Than Expected Earnings, And A Significant Amount Of Corporate Transformations

Louisiana-Pacific Corporation is a leading provider of high-performance construction solutions, serving builders, and homeowners globally. Its reputation is based on innovation, quality, and sustainability. In 2022, its main business segments included siding, oriented strand board or OSB, South America, and others.

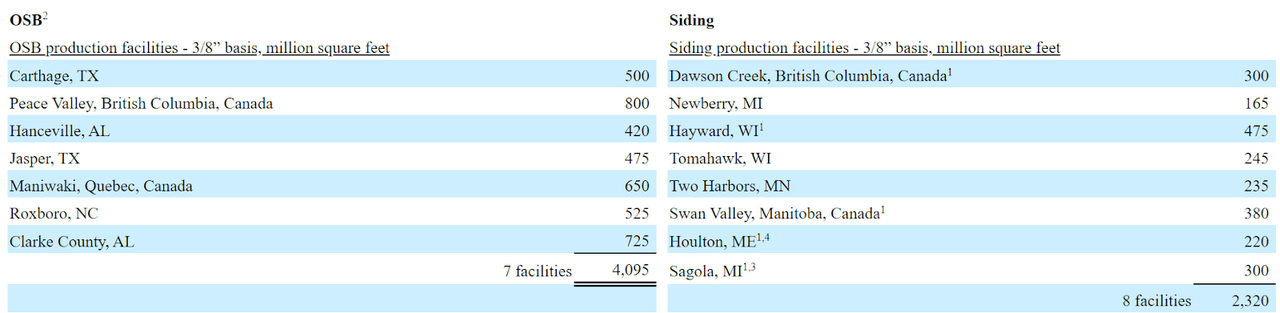

The company demonstrates an ongoing commitment to sustainable and durable construction, and its presence extends across multiple locations in North and South America. The following is a list of facilities offered in the last annual report. The most relevant assets are property and equipment.

Source: 10-k

Source: 10-k

The company focuses on sales and marketing strategies directed primarily toward traditional distribution and various wholesale and retail channels. Its wholesale focus is on specialist distributors and dealers supplying construction professionals and contractors.

Additionally, the company seeks to reach homeowners through large retail chains, which span the DIY and repair/remodeling market, as well as smaller independent retailers. This strategy allows for a broad and diversified reach in the market, serving a variety of clients and segments, thus consolidating its presence in the construction industry.

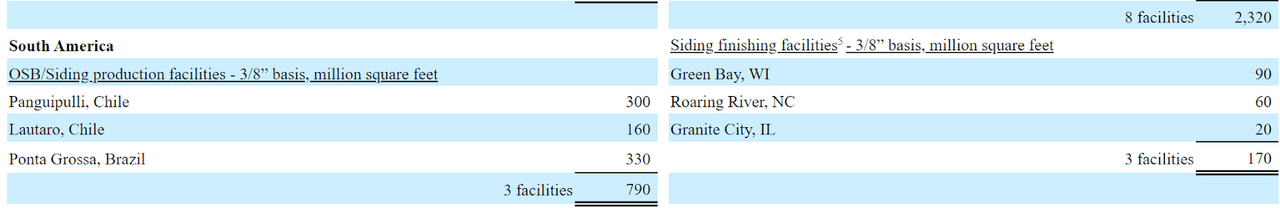

With that about the business model, I believe that it is worth having a look at the company because both EPS and quarterly net sales were better than expected in November 2023. In addition, in the last two years, the company sold, acquired, and transformed certain business segments, which may bring FCF growth in the coming years.

Source: SA

Balance Sheet, Cost Of Debt, And Cost Of Capital

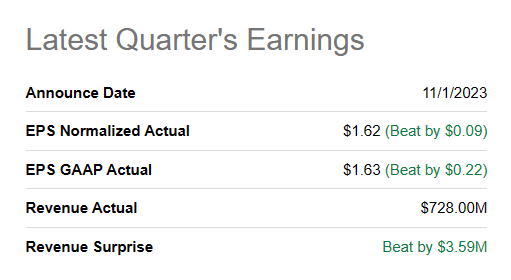

As of September 30, 2023, the company reported cash and cash equivalents worth $160 million, receivables close to $181 million, inventories worth $379 million, and prepaid expenses and other current assets of about $25 million. Total current assets are equal to $745 million, and the current ratio is larger than 2x. In sum, given the total amount of cash in hand, I believe that liquidity does not seem an issue right now.

With property, plant, and equipment of close to $1.512 billion, operating lease assets close to $34 million, and goodwill and other intangible assets worth $27 million, total assets stand at $2.380 billion. The asset/liability ratio is larger than 2x, so I would say that the balance sheet is quite healthy.

Source: 10-Q

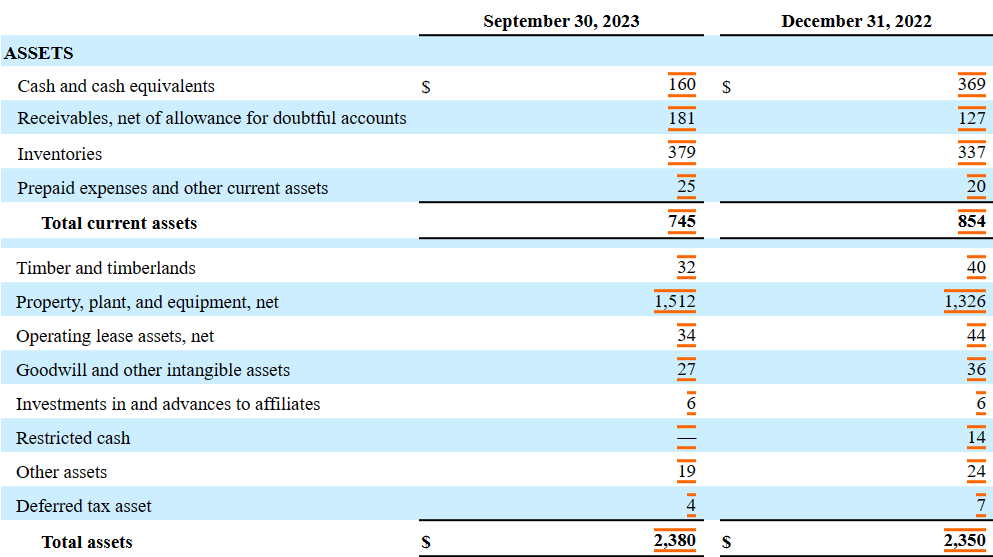

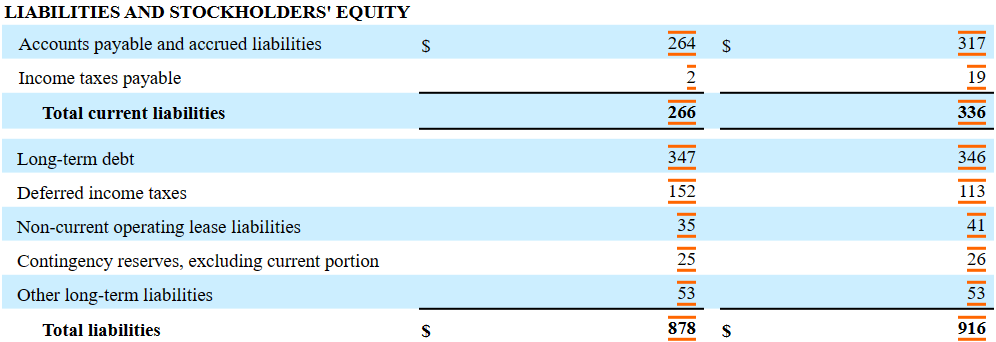

The list of liabilities is not worrying. However, investors may need to study carefully the total amount of debt. With accounts payable and accrued liabilities worth $264 million, long-term debt stands at $347 million, with deferred income taxes of $152 million and total liabilities of $878 million.

Source: 10-Q

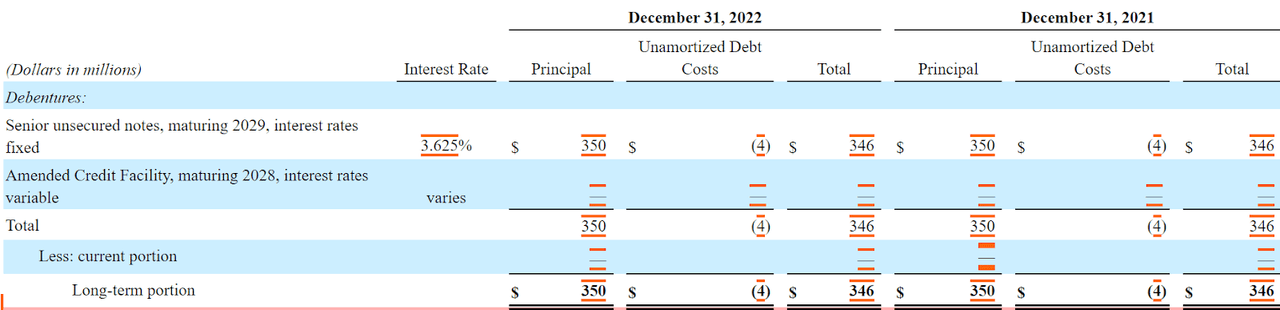

The company issued $350 million in Senior Notes due 2029 in March 2021, with options to redeem on or after March 15, 2024. The contract imposes restrictions, such as limitations on liens and mergers. In case of change of control, buyback is required. The contract also includes customary events of default. In September 2016, the company issued $350 million in Senior Notes due 2024, which were redeemed in March 2021 at a redemption price of 102.438%, generating an early debt termination charge of $11 million. The following is information from the last annual report.

Source: 10-k

According to the last 10-Q, the company pays interest close to 3.62%, so I believe that assuming a cost of capital close to 4% and 6.5% appears reasonable.

The net carrying value of the 3.625% Senior Notes due in 2029 (2029 Senior Notes) was $347 million and $346 million as of September 30, 2023 and December 31, 2022, respectively. The fair value of the 2029 Senior Notes was estimated to be $295 million and $306 million as of September 30, 2023 and December 31, 2022, respectively, based on market quotations. Source: 10-Q

Further Investments In Cladding Solutions, Expansion Of Facilities, And Ongoing Customer Programs Will Most Likely Bring Capacity Increases And Net Sales Growth

The company’s strategic focus includes converting factories from OSB to cladding solutions, with projects that will add capacity and optimize resources. The expansion of facilities reflects the commitment to innovation and customer service. Operational efficiency, cost reduction, and adaptation to market conditions are priorities.

In the last quarterly report, the company also noted that customer programs and competitive pricing strategies are also ongoing, which I believe could enhance future net sales.

Our businesses routinely incur customer program costs to obtain favorable product placement, promote sales of products, and maintain competitive pricing. Customer program costs and incentives, including rebates and promotion and volume allowances, are accounted for as deductions from Net sales at the time the program is initiated. Source: 10-Q

Sustainable Business Model That May Bring The Interest Of Investors Focused On ESG Investments

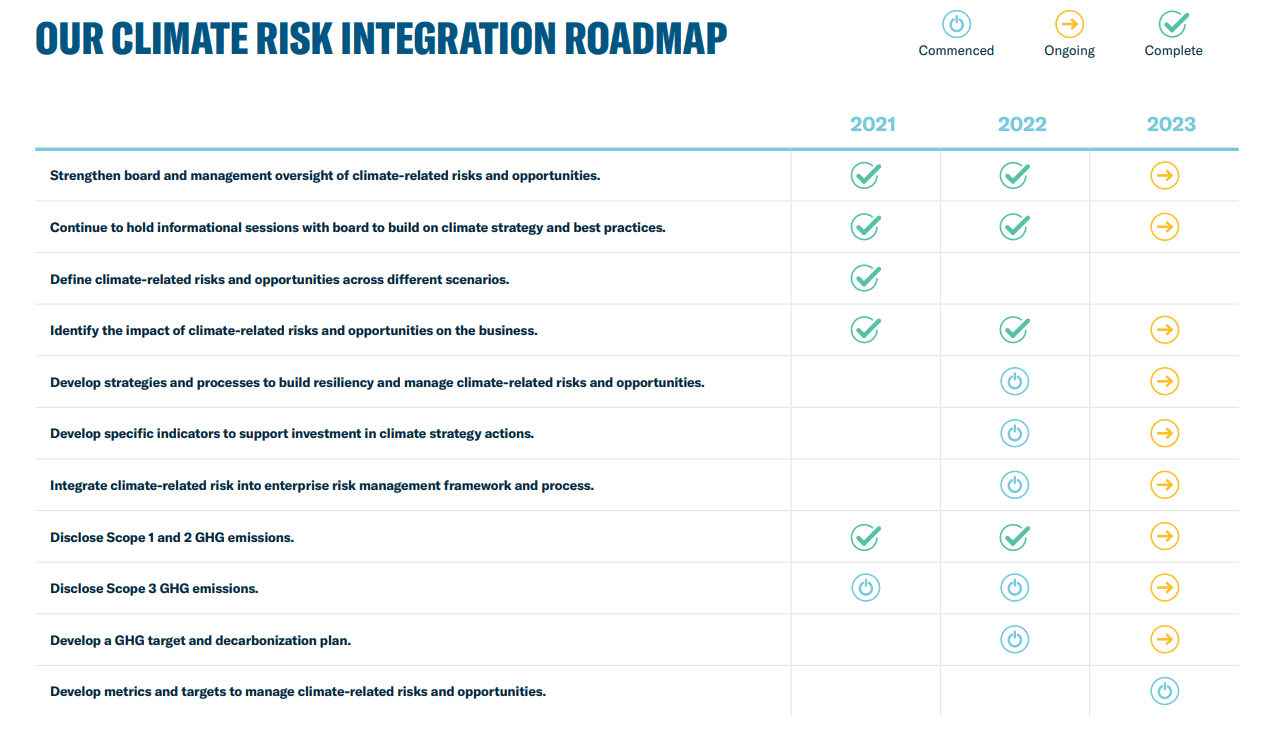

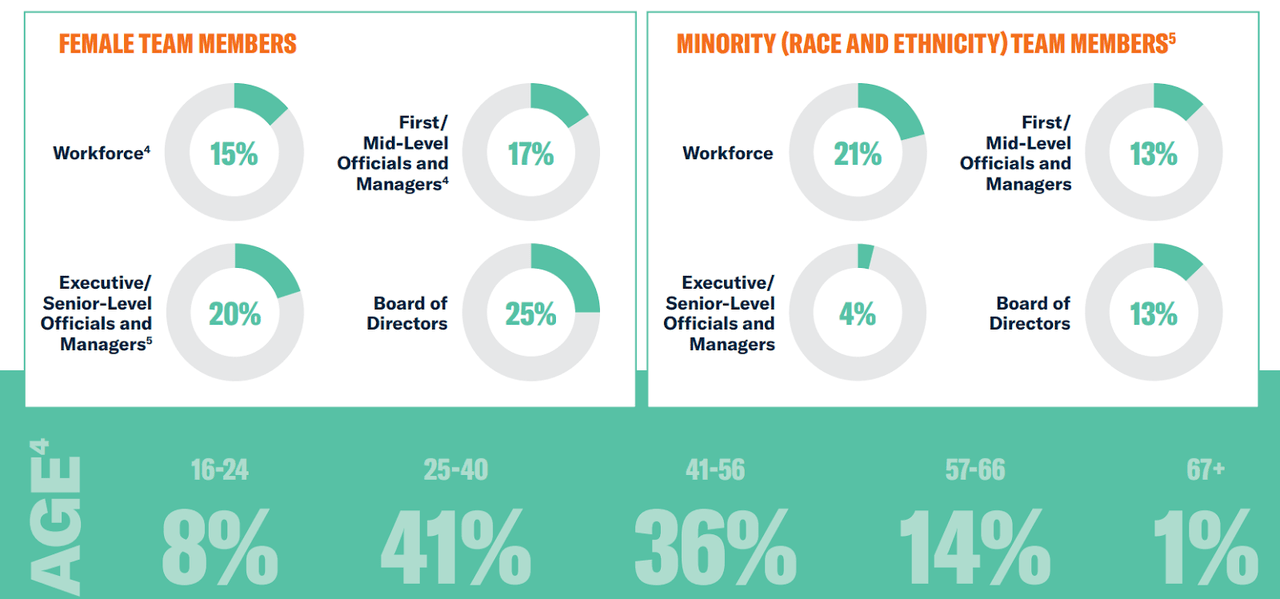

The company seeks to capitalize on the continued growth in demand for sustainable solutions. In 2023, the company delivered an extensive sustainability report, which included significant intentions with regards to climate risks, information about minorities, age groups, and jobs for young employees.

Source: 2023 Sustainability Report

Source: 2023 Sustainability Report

Considering the recent growth in the number of funds investing in ESG opportunities, we may see certain new demand for the stock of the company.

Transformation Is Ongoing: Sale Of Assets, And Acquisitions

Management sold a stake in joint ventures and completed the asset sale of the Engineered Wood Products segment. Besides, the company noted the acquisition of Wawa OSB, Inc.

In my view, the transactions indicate that management is willing to offer an improved balance sheet and further FCF growth potential. Interest from investors would most likely grow as soon as the company makes meaningful communications about these efforts.

We sold our 50% equity interest in two joint ventures that produce I-joists, and we sold the remaining assets related to the Engineered Wood Product segment. Source: 10-QWe acquired a manufacturing facility in Wawa, Ontario, Canada from Wawa OSB, Inc. a subsidiary of Forex Inc., for $80 million, financed by a combination of cash on hand and availability under the Amended Credit Facility (defined below). The manufacturing facility is expected to be converted into an LP® SmartSide® Trim & Siding mill. We are evaluating project schedules and market demand to determine when construction will begin. The facility will remain shut down until such construction is completed. Source: 10-Q

It is also worth noting that in the second quarter of 2023, Entekra Holdings, LLC ceased its operations. In sum, the company appears to be executing significant transformation inside operations, closing business segments that may not be as profitable as expected.

During the second quarter of 2023, we ceased the manufacturing operations of Entekra Holdings, LLC (Entekra), an off-site framing operation previously reported within our “Other” category, which comprises other products that are not individually significant. Business exit charges were $1 million and $35 million for the three and nine months ended September 30, 2023, respectively. Source: 10-Q

Stock Repurchase Agreements, And Impressive Stock Performance

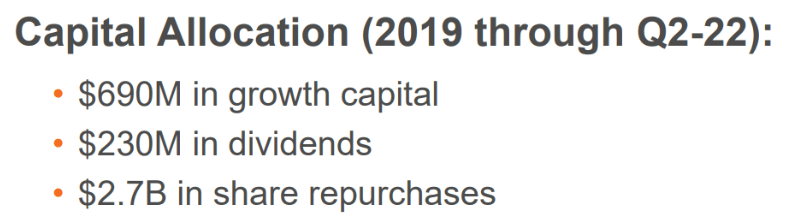

If we also mention the amount of funds delivered in the form of dividends and stock repurchases, LPX could appear more appealing for some investors.

Source: Investors Deck

Finally, I believe that the stock performance in the last 20 years is another indication of good allocation of capital. Since 2002, the company has grown from about $7 to around $70-$59 per share.

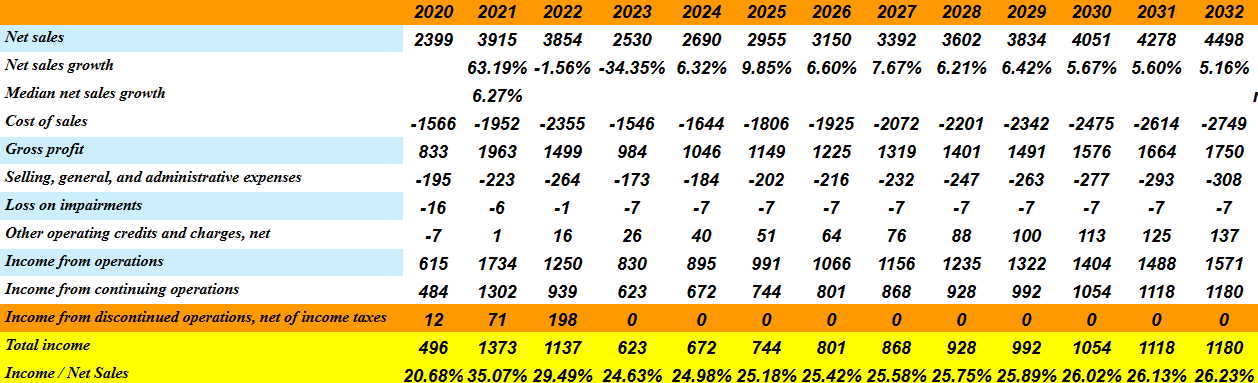

Given Previous Assumptions And Previous Net Income Growth, I Ran My Own Income Statement Expectations

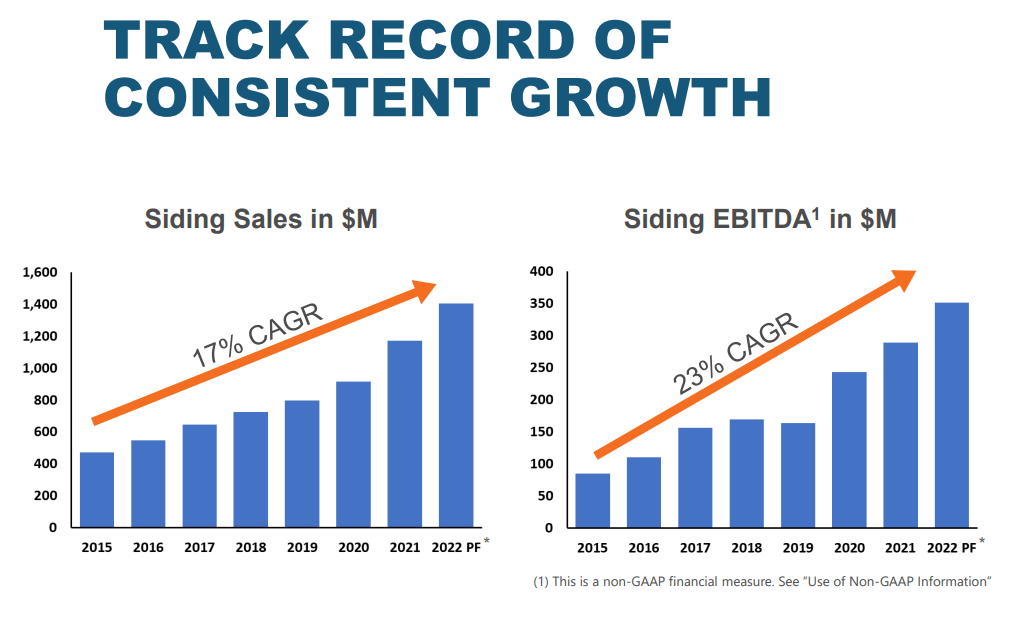

My expectations include net sales close to $4.498 billion, 2032 net sales growth close to 5.1%, and a median net sales growth of about 6.27%, which I believe is quite conservative. I believe that my figures are more conservative than what the company reported in the past.

Source: Investors Deck

I also included 2032 cost of sales of about -$2.749 billion, with gross profit of about $1.749 billion, selling, general, and administrative expenses of close to -$309 million, and 2032 loss on impairments close to $7 million. Finally, income from continuing operations and net income would stand at about $1.237 billion.

Source: DCF Model

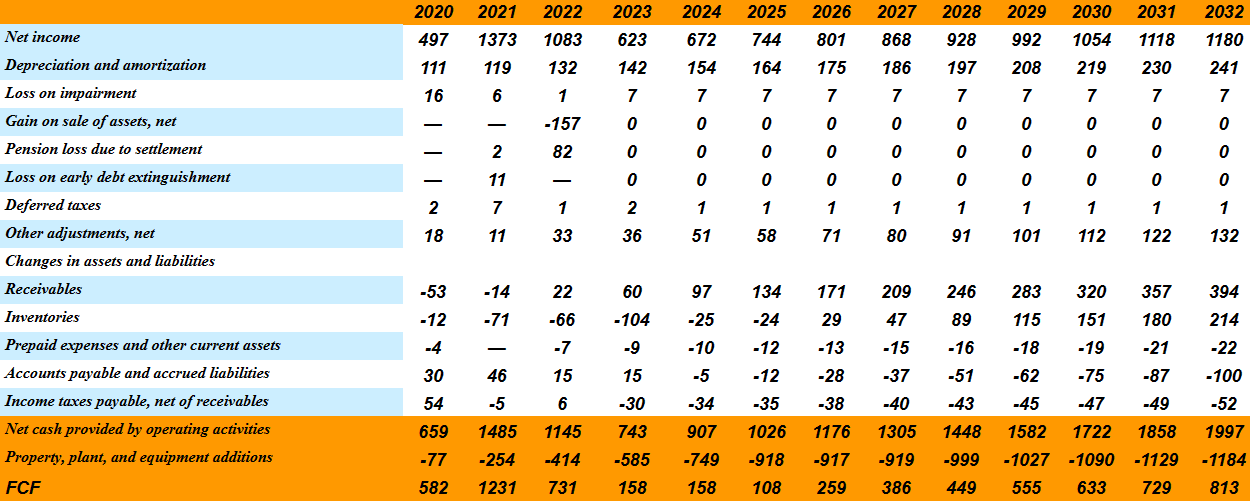

Given Previous Assumptions, I Run My Own DCF Model

My cash flow expectations include 2032 net income of about $1.179 billion, 2032 depreciation and amortization of $241 million, and loss on impairment of $7 million, but no gain on sale of assets, pension loss due to settlement, or loss on early debt extinguishment.

Besides, with changes in receivables of close to $394 million, changes in inventories close to $214 million, and changes in prepaid expenses and other current assets of -$22 million, I also included changes in accounts payable and accrued liabilities of about -$100 million.

If we also include changes in net of receivables of -$52 million, net cash provided by operating activities would stand at $1.996 billion, and with property, plant, and equipment additions close to -$1185 million, 2032 FCF would be $813 million.

Source: DCF Model

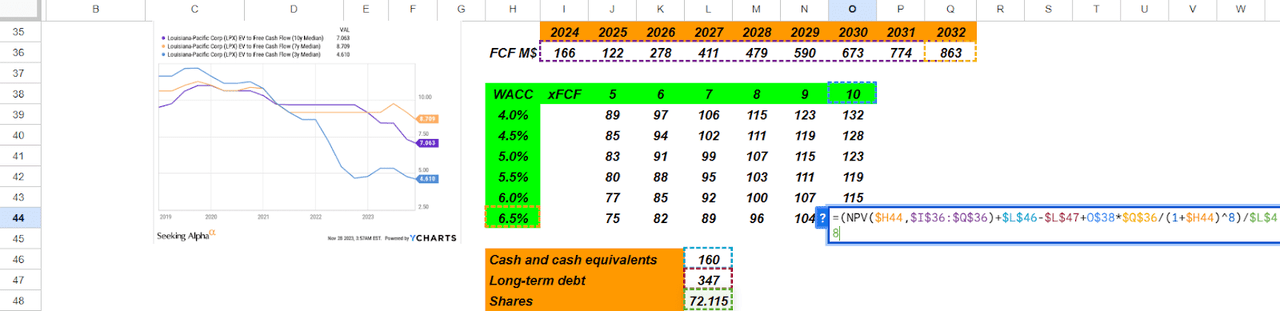

In the past, the company traded at close to 5x and 10x FCF, so my exit multiples are close to those figures. Also, with a WACC of 4%-6.5%, the implied forecast price would range between $75 and $132 per share. The implied valuation would not be far from $99 per share.

Source: DCF Model

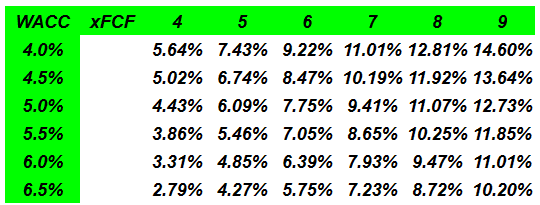

Now, the internal rate of return using the current share price would be between 2.7% and 14% with a median close to 7%-9.4%. Other analysts may obtain different results with different initial assumptions, however I believe that most investors would accept that the company appears undervalued.

Source: DCF Model

Competitors

In my opinion, the construction products industry is highly competitive, facing international competition with thousands of companies, from large integrated corporations to small manufacturers. The company also faces indirect competition from substitute products. Its specialized products, such as cladding and structural solutions, compete on the basis of features, quality, sustainability, and availability.

In contrast, entry-level OSB competes primarily on price, quality, and availability. Competition encourages innovation and continuous improvement, and to stand out in this environment, they focus on offering high-quality products and sustainable solutions that meet the needs of their customers.

Risks

The company faces risks related to the costs of customer programs, where incentives and reimbursements are estimated based on historical and projected experience. Although these estimates are believed to be reasonable, actual results may differ. Additionally, the termination of defined benefit pension plans in 2022 resulted in an accumulated comprehensive loss of $82 million, with an additional $6 million pending recognition. Completion of the plan is subject to regulatory requirements, and may require additional financing. These risks can affect the financial stability of the company, and require careful management of financial resources and commitments.

My Opinion

In my opinion, LPX shows a solid position in the construction industry, supported by its focus on high-quality and sustainable products. Its factory expansion and conversion strategy to meet growing demand for sustainable coatings are promising. I also believe that the recent transformation may bring an even more solid balance sheet and higher FCF/Sales margin. Besides, the company may receive more attention from funds investing in ESG opportunities or investors looking for stock repurchase programs or dividend distribution. LPX faces risks related to the estimation of program costs for clients, competition in the industry, or changes in the price of commodities. With that, I think that the company remains undervalued.

Read the full article here