Though the markets have rallied over the past few months, it’s difficult to recall sometimes that this year has been an especially tough climate for most businesses. We owe some due respect – and perhaps investment consideration – in the companies that have been able to make operational improvements amid this tough macroenvironment.

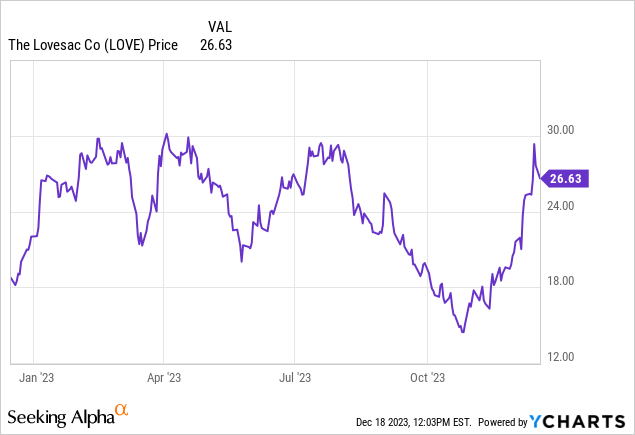

The Lovesac Company (NASDAQ:LOVE), surprisingly, is one of those names. The sectional furniture maker has seen its share price climb 20% this year (roughly in line with the S&P 500), with a late-year rally making up for earlier losses.

I last wrote a bearish article on Lovesac in February, when the stock was trading closer to ~$30. A lot has happened for Lovesac since then, including a delayed Q2 earnings release on the back of required accounting restatements. But in light of recently released Q3 results that I believe exhibit strength in the business, plus the lower share price since my last look at the stock, I am now more sanguine on the company’s prospects and am rating Lovesac at neutral.

I now see the company as a more balanced bag of positives and negatives. On the bright side for Lovesac:

- High gross margin products. Lovesac generates healthy >50% gross margins, which demonstrates both its positioning as an upper-middle tier home decor product plus operational excellence. At scale, these high gross margins can help Lovesac generate meaningful profitability.

- Modular product encourages cross-sell. Lovesac insists that its Sactionals product, which is roughly 90% of its revenue, is a “platform and not a product.” While a bombastic statement, the point is that customers can mix and match sectionals to create their desired furniture layout, which encourages repeat sales of multiple products.

- Omni-channel expert. Lovesac has a powerful network of both company-owned retail stores as well as pop-up locations, most notably in Best Buy (BBY) stores. Having these third-party placements can help the company reduce its opex footprint while still showcasing the brand to buyers who will eventually execute their purchases online.

At the same time, however, we have to watch out for the following:

- Home goods demand is down post-pandemic. The pandemic (and the move to the suburbs that it encouraged) pulled forward a lot of demand for home goods-related products into 2020 and 2021. Now, amid tougher macro conditions, consumers’ willingness to spend on home luxuries is dampened.

- Deep competition. Furniture is by no means an easy market to compete in, and Lovesac has much deeper-pocketed rivals including budget furniture giant IKEA and online marketplace Wayfair (W), with its collection of both lower and higher-end brands.

The bottom line here: I no longer necessarily believe there is tremendous downside to go in Lovesac shares; but neither do I think there are meaningful catalysts to get Lovesac to outperform in 2024. This stock is now back on my watch list, but it’s not yet a “rush to buy” name either. Keep monitoring this name and investing elsewhere for now: watch for either the stock to drop materially from here, or for quarterly results that materially accelerate, before buying back in.

Q3 recap

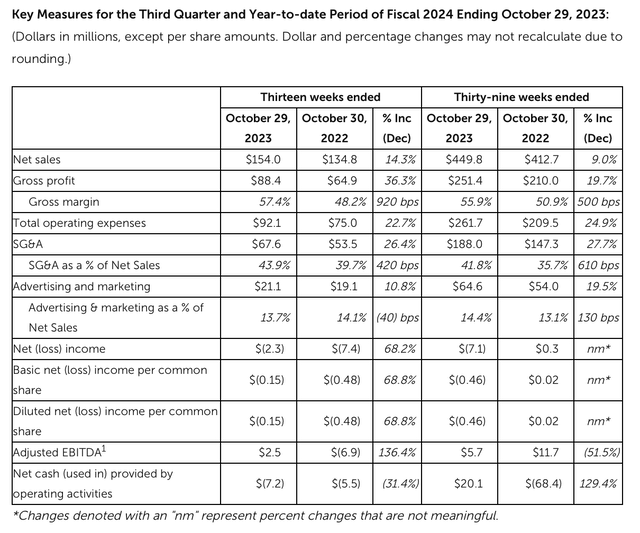

Let’s now go through Lovesac’s latest quarterly results in greater detail. The Q3 earnings summary is shown below:

Lovesac Q3 results (Lovesac Q3 earnings materials)

Lovesac’s revenue grew 14% y/y to $154.0 million in the quarter, ahead of Wall Street’s expectations of $153.8 million by a hair. Importantly, revenue growth accelerated relative to single-digit growth in Q1 (9% y/y) and Q2 (4% y/y).

It’s worth calling out as well that unlike other consumer products companies that rely heavily on shipments to channel partners who hold products on their own books, Lovesac does the bulk of its business through direct sales – meaning there is no inventory shipment distortion on its revenue results.

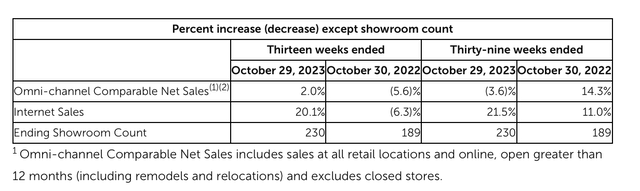

As shown in the chart below, the company’s Internet sales soared to 20% y/y growth in Q3. At the same time, the company has also expanded its showroom count to 230, up 22% y/y. On a comparable stores basis, excluding the contribution from newly opened locations, omni-channel sales were up 2% y/y:

Lovesac showroom fleet (Lovesac Q3 earnings materials)

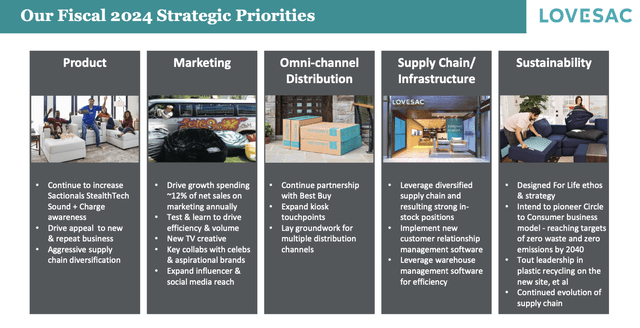

Expanding lower-touch storefronts has been a core priority for Lovesac this year, which has deepened its showroom partnership with Best Buy:

Lovesac strategic priorities (Lovesac Q3 earnings materials)

The company has also continued to expand its footprint at Costco (COST) locations as well. The long-term bull case for Lovesac will be to continue deepening and diversifying its retail partnerships with these large-format, big-box stores. In doing so, the company will minimize its capex spend to open new stores as well as limit its opex in operating those stores – overcoming its much smaller balance sheet in relation to its much larger rivals.

Management noted strong performance in the lead-up to the critical holiday sales period, which is a strong leading indicator for Q4 results. Per COO Mary Fox’s prepared remarks on the Q3 earnings call:

Category outperformance has continued this quarter with strength and demand versus last year during Cyber 5, from Black Friday through Cyber Monday. And we are very pleased with our early results. Some highlights from Cyber 5 include having our two largest sales days and the largest week in our history. We believe this peak in sales that is unique to our business within our category is due in part to our investment in building a brand that is unmatched in the furniture category, coupled with delivery to customers’ homes in just a few days. Our clear strategy for growth and the team’s consistent execution against our growth strategies allows us to continue to fuel our flywheel and drive operational excellence across the business.”

From a profitability perspective, Lovesac’s gross margins jumped 920bps to 57.4%, which as previously noted is incredibly high for a consumer products maker. This was partially offset by higher opex spending, but overall, adjusted EBITDA clocked in at $2.5 million for the quarter, or a 1.6% margin – seven points higher than -5.1% in the year-ago quarter.

Key takeaways

Trends are moving in the right direction for The Lovesac Company, with accelerating sales results and expanding gross margins. Add this stock back to your watch list, but don’t buy immediately.

Read the full article here