Luxfer Holdings PLC (NYSE:LXFR) recently released their Q2 2023 results and surprised the market when they lowered FY2023 adjusted EPS guidance by about 25%. Since this happened, Luxfer’s stock is down 10% but is down 25% since early June. I believe this drop provides an attractive entry point for investors as the stock has been de-risked due to the lowered guidance, and that developments that led to lowered 2023 guidance don’t necessarily hurt the chances of Luxfer achieving their longer term 2025 earnings guidance.

Guidance was lowered due to both an upcoming reduced demand environment in the second half of the year, and continuing supply chain issues that will keep costs high. The main supply chain issue is the ongoing force majeure issued by U.S. Magnesium in late 2021 that is hindering Luxfer’s ability to manufacture and deliver products. The likely end of U.S. Magnesium’s force majeure in Q3 or Q4 should benefit Luxfer as it should lead to both an uptick in revenue and lower costs.

2023 adjusted EPS guidance was lowered from the range of $1.15-$1.35 to $0.88-$1.00. At the low point of the current guidance range, Luxfer’s stock is trading about 14 times 2023 EPS which is reasonable based on where the stock has traded in the past relative to adjusted EPS. Given the reasonable valuation based on already lowered guidance and expectations, I rate Luxfer a buy. I believe adjusted EPS will come in at the higher end of the guided range due to an improving demand environment, the upcoming reduction of supply chain headwinds, and the safe 4%+ dividend yield.

In this article I will provide an overview of the business and its past financial performance, its current valuation and my expectations for the stock given my estimates of future earnings.

Business Overview

Luxfer is a United Kingdom based company that, in 2017, converted all of its American Depository Shares into ordinary shares on the NYSE. Luxfer breaks its business down into two segments: the Elektron Segment and the Gas Cylinder Segment. The Elektron segment manufactures Magnesium and Zirconium based products for military, emergency relief, oil and gas, pharmaceutical, and packaging end markets.

The Gas Cylinder segment manufacturers a variety of gas cylinders for specialized use by firefighters, emergency responders, scuba divers, alternative fuel vehicles, and healthcare professionals.

Luxfer’s primary end markets are transportation, defense & first response & healthcare, and general industrials. In 2022, transportation accounted for 32% of sales, defense & first response & healthcare accounted for 32% of sales, and general industrials accounted for 36% of sales. This is a very even split and this even split has been consistent over the past few years. In 2018 the split was 31%, 34%, and 36% respectively.

Going forward, the drivers of end market demand will be a mix of increased spending in secular growth categories and general cyclical trends. The secular growth categories include global clean energy initiatives, defense investments, healthcare investments, and increased global awareness for emergency relief. The cyclical end markets are the industrial ones. This includes oil and gas customers, and packaging customers.

Past Financial Results

Due to its ties to the industrial sector, Luxfer has delivered cyclical results over the past 10-15 years and the stock has followed these results. The following is a breakdown of Luxfer’s revenue and adjusted EPS since 2012:

|

Year |

Revenue |

Adjusted EPS |

|

2012 |

$511 |

$2.05 |

|

2013 |

$481 |

$1.42 |

|

2014 |

$489 |

$1.11 |

|

2015 |

$460 |

$1.08 |

|

2016 |

$414 |

$0.92 |

|

2017 |

$441 |

$1.02 |

|

2018 |

$488 |

$1.69 |

|

2019 |

$444 |

$1.43 |

|

2020 |

$324 |

$1.03 |

|

2021 |

$374 |

$1.29 |

|

2022 |

$423 |

$1.36 |

The stock has generally traded between 10 and 15 times adjusted earnings per share. In the years of high earnings, investor excitement and momentum led to multiple expansion and the stock traded at the higher end of that range. In years of low earnings, the multiple compressed to the lower part of that range. Since 2012, the business has not changed much in terms of capital intensity, capital structure and operating segments so I expect this range of multiples to apply to the stock going forward.

It’s difficult to predict future revenue and earnings because of the variety of products that Luxfer manufactures. One end market may have a period of high demand while another has a lull. This leads me to take a simplified approach to valuing Luxfer. I believe that investors should primarily look at current and longer term adjusted EPS guidance and use past multiples to create a range of potential scenarios for the stock.

Past Valuations

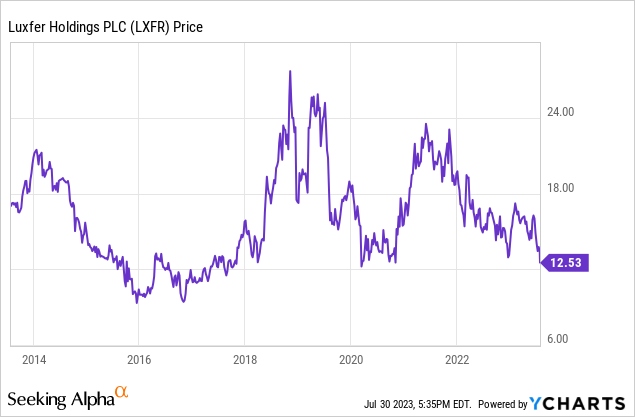

The recently lowered 2023 guidance calls for $0.88-$1.00 of adjusted EPS and a 1%-4% year over year decline in revenue, for a range of $406m-$418m. Compared to past results, this 2023 adjusted EPS guidance would come in at the lowest range of past EPS as it only compares to the 2016-2017 period. In that period the stock traded at around $11-12 per share, or about 11-12 times EPS, but briefly reached a low in October 2017 of $9.30, or about 9.5 times EPS.

This period of low earnings in 2016 was primarily caused by weak military demand for Magnesium products. In the Q4 2016 call, Luxfer’s CEO at the time spoke about this:

As in the third quarter, the principle headwind came from sales of our North American magnesium products and in particular defense-related products. We occupy a very strong position in supplying the U.S. Military with all its requirements from military powders, flameless heaters and personal chemical agents, detection and decontamination products. It is a great place to be when demand is strong. But it has been problematic during this period of tight budgets and de-stocking.

However in 2017 and 2018, demand in the military powder business bounced back while high demand in other markets such as the oil and gas market, the disaster relief market and the alternative fuel end market continued to benefit Luxfer. This led to the 60% growth in EPS in 2018 to which the stock responded by rising over 100% due to both the earnings growth and multiple expansion.

Current Valuation and Future Valuation Estimate

Currently Luxfer is trading at about 13.3 times the midpoint of 2023 adjusted EPS guidance. This puts it at the middle of the range of past earnings multiples. Going forward, I expect Luxfer to achieve adjusted EPS at the upper end of the guidance. I think this will be the case as most of the underperformance this year has been caused by weakness in the general industrial end markets, and higher costs associated with Magnesium sourcing specifically. Current evidence is pointing to both of these issues easing throughout the remainder of 2023 and through 2024.

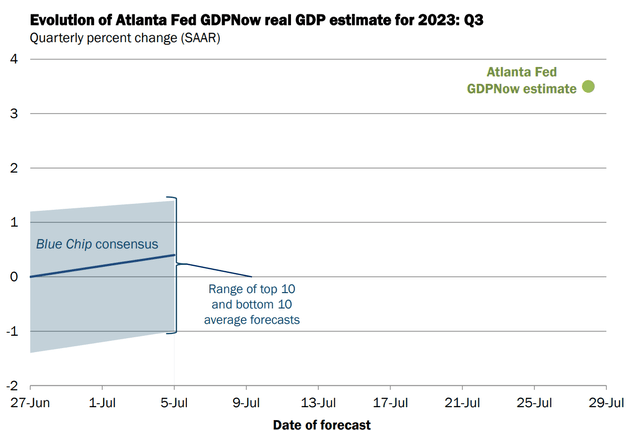

Regarding the potential for improvement in general economic weakness, the Atlanta Fed’s most recent real GDP estimate for Q3 came in at a surprising 3.5%.

Atlanta Fed Real GDP Estimate (Atlanta Fed)

If this estimate proves to be true, the weakness Luxfer noted in H1 2023 for the general industrial end markets should reverse.

Additionally, U.S. Magnesium, Luxfer’s main source of Magnesium, may end its force majeure and return to production in Q3 2023. A June 2023 update from the U.S. Geological Survey commented on this:

US Magnesium LLC might restart production from some capacity at its primary magnesium smelter in Rowley, UT. The smelter declared force majeure on deliveries to contracted customers in September 2021 citing an equipment failure. The magnitude of shutdown at the 63,500-metric-tonper-year smelter was not announced by company. (See Magnesium in the Third Quarter 2022.) Company officials stated in March 2023 that equipment was being delivered and the repairs were expected to be completed by early summer, with production expected to resume by early in the third quarter of 2023.

I expect Luxfer’s 2023 adjusted EPS to come in at $0.98 which puts the stock at around 13 times 2023 EPS. Going forward, in my max downside scenario I assume adjusted EPS drops to $.90 in 2025 and the stock trades at 10 times EPS, or $9.00 per share. This would leave Luxfer investors down 28% in 2025 compared to the stock price today.

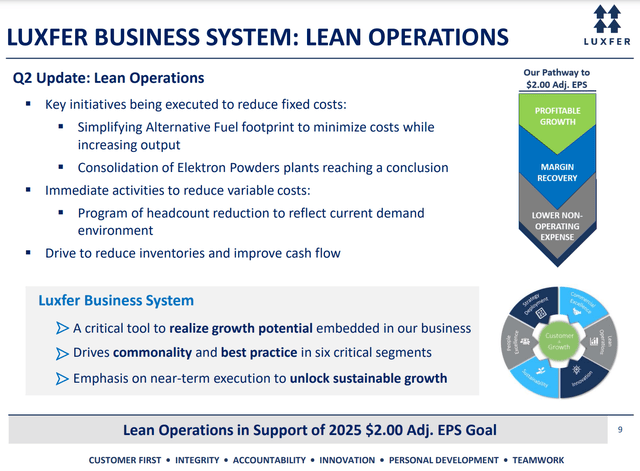

In my upside scenario, I assume Luxfer achieves its 2025 goal of $2.00 of adjusted EPS and trades at 15 times this figure which would put the stock at $30 per share by the end of 2025.

Luxfer’s 2025 Adjusted EPS Guidance (Luxfer Q2 2023 Earnings Presentation)

Assuming an equal chance of either EPS scenario occurring, I rate the stock a buy and estimate that the stock will trade at $19.5 per share by the end of 2025. This would provide an return of 18% for the next few years.

As a bonus, Luxfer has consistently paid out a stable and recently growing dividend over that time to smooth out investor returns that fluctuate with economic cycles. The current yield is 4.15% and I believe it is safe as the company has been consistently profitable and cash flow positive over time.

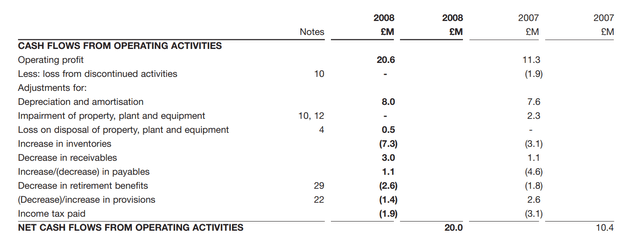

This has been the case because of Luxfer’s commitment to lean operations and its even split of sales across segments and end markets, provides diversification and downside protection when there is a weak economy. Even in 2007 and 2008, the company reported solid operating profits and positive cash flow despite the global economic issues at the time.

2007-2008 Cash Flow Statement (Luxfer 2008 Annual Report)

This stable dividend will work to both offset losses in the downside scenario and improve returns in the upside scenario.

Risks

The biggest risk is general economic risk which would lead to a higher probability of my bear case playing out. The Atlanta Fed real GDP estimate is not a forecast and is subject to changes with upcoming economic data. If the economy weakens into 2024, I would adjust the weights of the different scenarios for my price target.

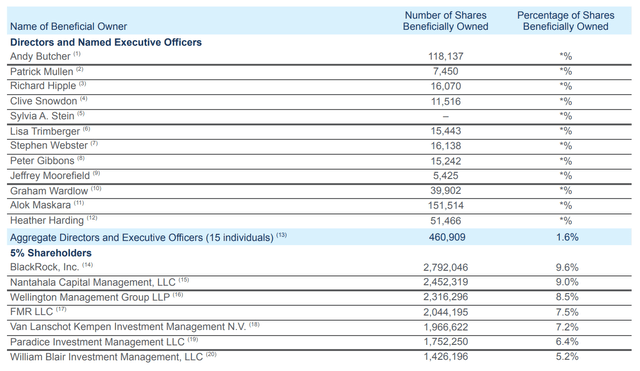

Additionally, there is little insider ownership of the stock as the board and executive team own only 1.6% of the shares outstanding, and there has been only one open market purchase in the past 12 months. This does not inspire confidence in management’s longer term guidance and is something that investors should be aware of.

Luxfer Insider Ownership (2023 Proxy Statement)

Luxfer is also a micro-cap stock and is subject to large swings as, on average, only about $1.7 million in shares are traded per day. This could cause the stock to move quite a bit if a large seller needs to sell or if a buyer wants to buy quickly. Investors that are averse to volatility should either not invest in Luxfer or only hold a small position in the stock.

Final Thoughts

I believe Luxfer’s stock is de-risked after recently lowering 2023 adjusted EPS guidance. I estimate that Luxfer is now trading at 13 times 2023 adjusted EPS and an investment today provides a favorable risk/return going forward. Based on my bear case scenario of the stock trading at 10 times adjusted EPS of $0.90 in 2025 and my bull case of the stock trading at 15 times adjusted EPS of $2.00, my expected value for the stock is the equally weighted average of these scenarios, or $19.5 per share in 2025.

Additionally, the current dividend is providing a 4.15% yield and I believe it is quite safe given the consistent profitability of the business, even in extremely poor economic conditions. This dividend will help to offset losses if economic conditions worsen in my view.

Read the full article here