LuxUrban Hotels (NASDAQ:LUXH) (NASDAQ:LUXHP)has not been public for long but has notched 200% year-to-date returns in a year that’s seen its real estate peers shed material value from their market caps as the Fed ramped up its fight against inflation. The real estate operating company has somewhat of a unique business built around its rapidly expanding portfolio of urban hotels acquired through long-term leases. For example, the company signed a 25-year master lease agreement earlier this year in May to operate Hotel 57 in midtown Manhattan, a 204-unit property with a four-star rating. This asset-light model sees LuxUrban avoid direct ownership of hotel assets and instead take on the leases of these distressed properties that have faced material headwinds from the pandemic and then the subsequent ramp of the Fed funds rate to a 22-year high of 5.25% to 5.50%.

LuxUrban Hotels November 2023 Investor Presentation

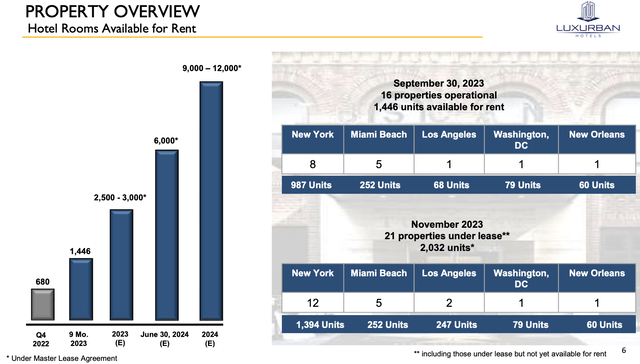

The company was operating 16 properties with 1,446 units available for rent at the end of its fiscal 2023 third quarter. This has expanded to 21 properties and 2032 total units post-period end. New York forms 68.6% of its total units with Miami Beach and Los Angeles forming the second and third largest at 12.4% and 12.16% respectively. What’s intriguing is the company’s guidance for its units available for rent ramp. LuxUrban wants to have between 9,000 to 12,000 rooms available for rent by the end of 2024, representing year-over-year growth of at least 280% at the midpoint of both ranges.

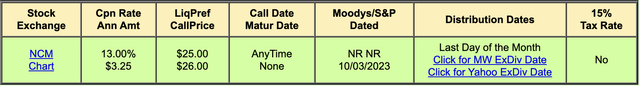

The 13.6% Yielding Monthly Paying Preferreds

LuxUrban’s 13% Series A cumulative preferreds (LUXHP) were issued a few months ago in September. The company offered 280,000 shares, raising $6.44 million in proceeds after underwriting fees and other expenses. As these were issued at the peak of the rate hiking cycle and on the back of the Fed’s 25 basis points hike in July, their coupon rate at 13% is quite steep. This is not a sleep well at night income security with the $3.25 annual coupon distributed in $0.27083 monthly installments for what’s currently a 13.6% yield on cost. The preferreds are currently trading hands for $23.91 per share, a roughly 4.4% discount to their $25 par value.

QuantumOnline

It’s rare to find preferreds that are monthly paying, a feature concentrated on preferreds of CLO closed-end funds and a handful of other companies. It’s attractive, not a primary need, but helps to attract retail investors. The commons would of course have more upside on the realization of the growth ramp. Preferreds offer distinctive benefits to a company’s capital stack over debt but that LuxUrban is offering such a high coupon and has had to use a monthly distribution teaser to attract investors highlights the extent of risk here. The company is building its portfolio on distressed hotel properties in urban locations where hospitality demand is yet to recover to its pre-pandemic averages due to work-from-home trends. The focus on cities with healthy domestic and international tourism figures does help to counter this though.

Operating Performance, Balance Sheet, Unit Economics, And Financial Guidance

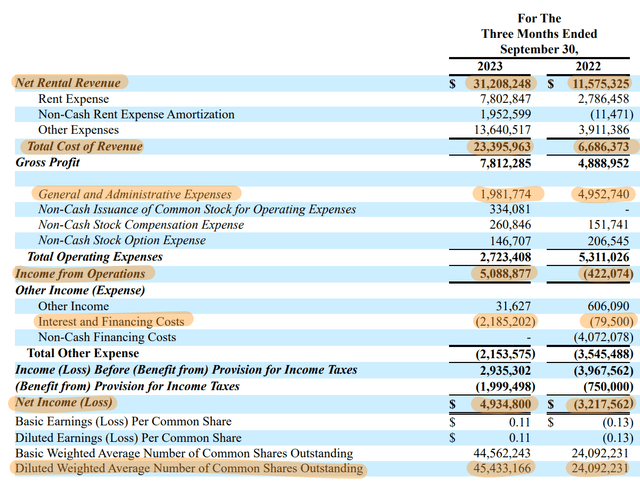

LuxUrban Hotels Fiscal 2023 Third Quarter Form 10-Q

The company recorded net rental revenue of $31.21 million during its third quarter, up 170% over its year-ago comp but a miss of around $1.32 million on analyst consensus. Cost of revenue at $23.4 million was up 250% year-over-year for a gross profit of $7.8 million. This meant gross profit margins of 25%, a compression from 42% in the year-ago period and below the low end of LuxUrban’s gross profit target range. However, using these figures as a basis point for an investment decision is hard as LuxUrban is expanding so quickly and guiding for material ramp over the next year. Growth is the key here.

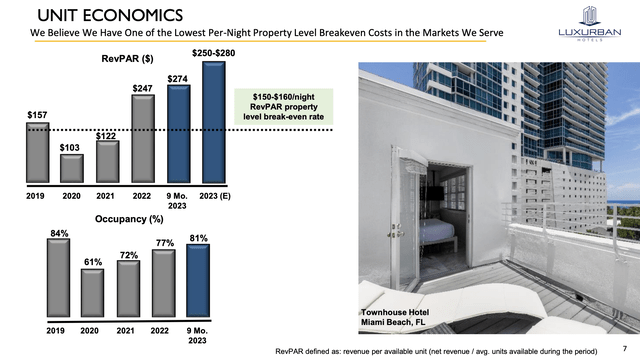

LuxUrban Hotels November 2023 Investor Presentation

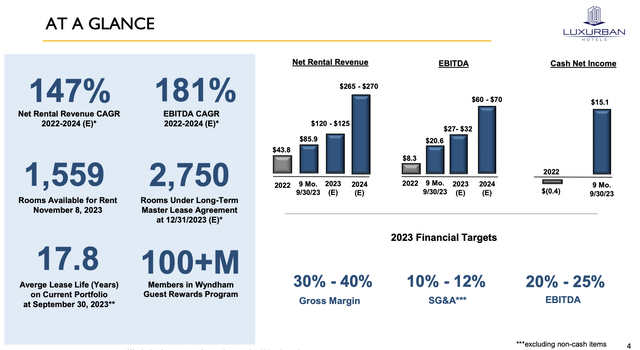

LuxUrban has ambitious growth plans and expects to deliver an 181% EBITDA compound annual growth rate from 2022 to 2024. The company is also guiding for full-year 2023 revenue of $120 million to $125 million, rising roughly 121% to $265 million to $270 million in 2024. EBITDA will at minimum come in at $27 million in 2023, growing 2x to at least $60 million next year.

LuxUrban Hotels November 2023 Investor Presentation

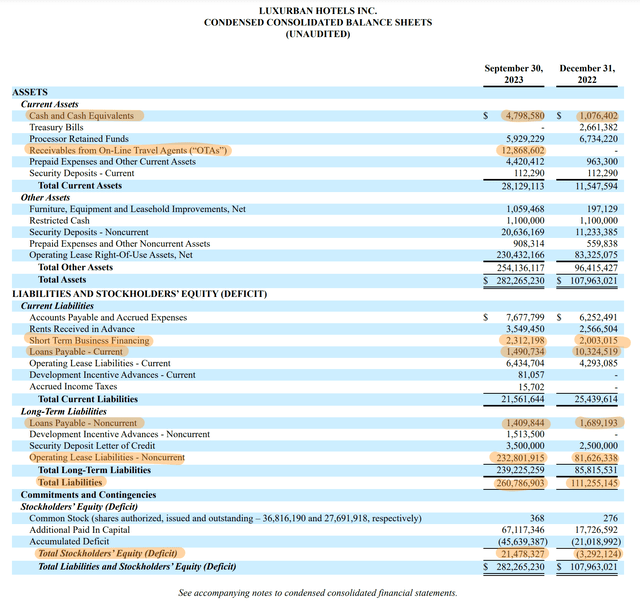

Guidance should not be taken as fact, but these figures are for next year and historical growth has been strong. Growth has been partially funded by dilution though with the company expanding its outstanding share count by an astounding 90% year-over-year to 45,433,166. Its cash and equivalents balance at the end of the third quarter stood at $4.8 million, up from $1 million at the end of 2022.

LuxUrban Hotels Fiscal 2023 Third Quarter Form 10-Q

LuxUrban had around $232.8 million in long-term lease liabilities at the end of its third quarter, up from $81.6 million at the end of 2022. Bears, who form the 13% short interest, would flag this as a developing risk and a similar conundrum as WeWork. Taking on long-term lease liabilities without ownership of the underlying properties embeds higher growth but comes with more material operational risk. The company does have very little debt with $1.5 million of current loans payable and another $2.3 million in short-term business financing coming due in less than 12 months. Critically, net cash used in operating activities was negative at $7 million for the 9 months from the end of the third quarter, an improvement from an operating cash burn of $13.6 million in the year-ago comp. Hence, the preferreds would be an incredibly speculative play even as shareholders’ equity improved to $21.5 million from negative $3.3 million at the end of December. The common would offer more upside from a speculation perspective and I’ll rate it as a hold. Dilution will be material though and a recession would crash the business.

Read the full article here