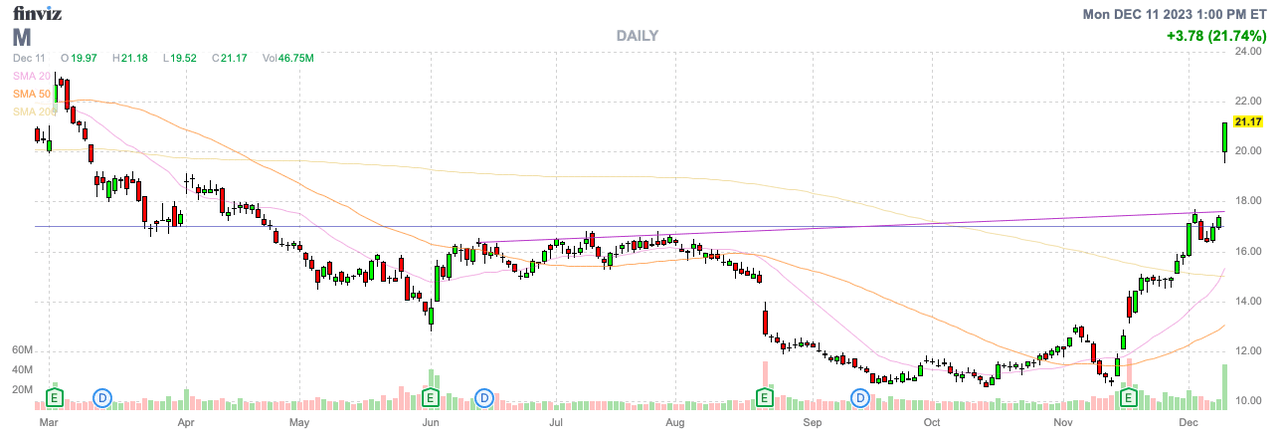

Over the weekend, news came out that beaten-down department store retailer Macy’s, Inc. (NYSE:M) was offered $21 per share to take the chain private. The stock has doubled off the lows in only a month, but Macy’s doesn’t even trade at 52-week highs after the bid. My investment thesis remains ultra Bullish on the department store stock loaded with valuable real estate, warranting a far higher valuation.

Source: Finviz

Lowball Bid

According to the WSJ, Arkhouse Management, a real-estate focused investing firm, and Brigade Capital Management, a global asset manager, on December 1 submitted a proposal to acquire the Macy’s stock they don’t already own for $21 a share. Macy’s has quickly soared above $21 now on signs the bid could easily rise after due diligence.

The inclusion of a real-estate investing firm isn’t surprising considering Cowen estimated the company’s real estate alone was worth anywhere from $6 to $8 billion. The current bid for the whole company at below $6 billion is apparently below the value of the real estate alone.

Evercore ISI assigned a potential $50 value to the stock back in early 2022 when profits were higher. At the time, the analyst suggested Macy’s had far higher earnings upside and the stock should trade at a 10x P/E.

At a similar time, Macellum Capital Management proposed a valuation of $100 for Kohl’s (KSS) based on a similar theory to Macy’s of selling valuable real estate, repurchasing shares and operating a leaner department store business. Macellum forecast Kohl’s could boost EPS by over 50% via selling real estate at a higher EBITDA multiple while using the cash to repurchase shares a far lower EBITDA multiple.

At the time, the investment firm predicted the $100 price target via a historically low P/E multiple of ~7x to 8x. In essence, the current bid for Macy’s should be seen as a low P/E multiple on the top of earnings already being under pressure.

Normalized Profits

The really odd part of the deal is that Macy’s forecast an ~$3 EPS target for the year after a tough apparel segment hit profits hard in 2023. The department store was earning ~$3 pre-Covid and the company saw EPS soar to $5+ in FY22.

While the deal offers a premium from where Macy’s traded, the stock should’ve never traded in the current range. Macy’s traded below 4x EPS targets at the lows and only trades at 7x EPS estimates based on the current offer.

The biggest mistake investors make is looking at the deal premium, instead of the realistic valuation. Macy’s trading at simply 10x EPS targets gets the stock up to $30 and 2023 has been a rough year for the sector.

The biggest question is the normalized EPS following the Covid shakeout and inventory reductions in the sector. The company has no reason to sell the stock on a lowball offer when Macy’s has spent limited time over the last decade trading below the $21 offer level.

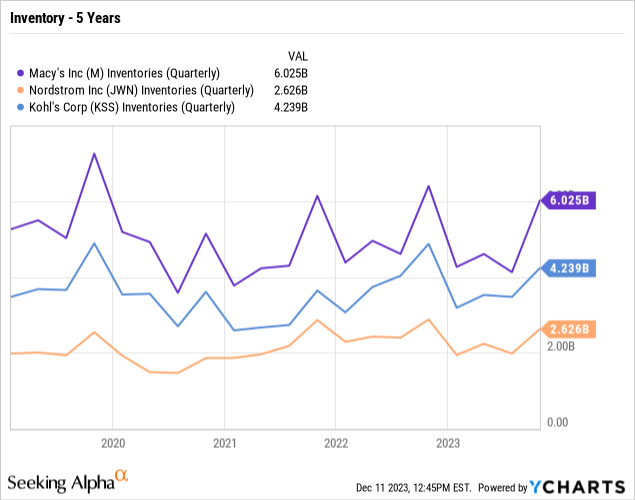

Macy’s ended FQ3 with inventory down 19% from the FY19 levels. The department store is in a great inventory position for when the overall sector resolves the over ordering due to Covid supply chain issues.

The company has nearly $3 billion in net debt, but the large inventory balance of $6 billion along with another nearly $6 billion in listed property and equipment sets the business in a great financial position.

Macy’s has reset the business model since FY20 when EPS was in the $3 range. The market appears to think the business model is weaker, but the Macy’s Backstage and Blue Mercury units are bright spots suggesting the business has EPS potential in between the current level and the $5 Covid levels.

Takeaway

The key investor takeaway is that Macy’s has no reason to accept an offer below the estimated value of the real estate alone. Not to mention, the current earnings potential of the department store warrants a far higher multiple on a premium bid. The company should provide a hard pass to this lowball offer from Arkhouse Management and Brigade Capital Management and see where a sweetened bid values the stock.

Read the full article here