In my initial write-up on Magellan Midstream (NYSE:MMP) in March, I wrote that the stock should give investors a nice high-yield bond-like return. I followed that up in May, saying it was a defensive stock that pays a nice dividend, while keeping a “Hold” rating on the stock.

A few days later, the company announced it would be acquired by ONEOK (NYSE:OKE). Let’s take a look at the deal, and why I think MMP unitholders should vote against the deal.

Company Profile

As a reminder, MMP is a midstream company focused on the transport, storage, and distribution of refined petroleum products, such as gasoline and diesel fuel. In fact, it has the longest refined petroleum products pipeline system in the U.S. with the ability to access nearly 50% of the refining capacity in the U.S. Approximately 71% of its business in refined products, while 29% is crude oil.

MMP’s contracts are primarily fee based, with volume throughput and tariffs the biggest drivers of its profits. Tariffs are generally tied to PPI or other market factors. Overall, about 85% of its operating income comes for fee-based activities.

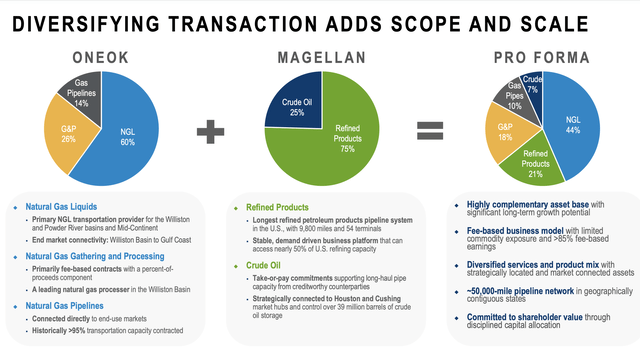

By comparison, OKE operates in three segments. Its natural gas gathering segment provides gathering and processing service to E&Ps in the Bakken, Powder River Basin, and Mid-Continent. Its NGL segment, meanwhile, owns and operates facilities that gather, fractionate, treat and distribute NGLs. Its Natural Gas Pipeline segment operates both intrastate and interstate pipelines that transport natural gas.

Company Presentation

Merger

In mid-May, OKE agreed to acquire MMP is a deal valued at $18.8 billion at the time. If approved, OKE plans to pay MMP unitholders 0.667 OKE shares and $25 per share in cash. The deal valued MMP at $67.50 at the time it was announced, and represented a 22% premium to both MMP’s closing price and 20-day VWAP. The deal is expected to close in Q3. OKE unitholders will own 77% of the pro forma company, with MMP unitholders the other 23%.

Based on OKE’s current price around $60.90, the deal currently values MMP at around $65.62. With MMP’s stock trading at $60.39, it’s trading around at an over 8% discount to the takeover price.

OKE touts the deal as being beneficial to OKE unitholders as it diversifies its product mix to include natural gas and NGL-focused businesses. It also notes OKE’s strong project backlog, something that MMP has been lacking.

On the merger call, CEO Pierce Norton said:

“There are four key points to highlight for the rationale of this transaction. First off, this deal will combine two premier and diversified energy infrastructure businesses with top-tier in industry-leading returns on invested capital that generates significant and diverse free cash flow. Adding Magellan’s stable, primarily demand-driven, fee-based business to ONEOK will create an even more resilient energy infrastructure company designed to generate stable cash flows through various commodity cycles. Number two, this transaction will provide immediate financial benefits, including cost, operational and tax synergies and is expected to be financially accretive. … And three, we believe this is a compelling long-term value proposition to current and future investors, driven by consistent and disciplined capital allocation philosophy. The combined company is expected to generate significant average annual free cash flow after dividends and growth capital, and we will remain committed to growing EPS and the dividend by reinvesting available cash into high-return organic growth projects. …

“Number four, on a combined basis, we’ll own nearly 50,000 miles of pipeline assets, primarily in the Central U.S., of which are 25,000 miles of liquids-oriented pipelines. As a result, we see value and significant potential for enhanced customer product offerings and export opportunities. Given ONEOK’s and Magellan’s assets and operational expertise, we have forecasted at least $200 million of base annual synergies and believe that the activities could result in a total annual synergies of exceeding $400 million within the next 2 to 4 years.”

Why Vote Against the Merger

The biggest reason to vote against the merger is the tax consequences. With MMP being an MLP and OKE a c-corp, this will be a taxable event for MMP unitholders.

And the longer investors have held MMP, the bigger the tax burden will be. A 22% premium, which has now been reduced to 18% based on the decline in OKE shares, isn’t really worth the huge tax hit.

A good percentage of distributions from MLPs are considered a return of capital and are thus tax deferred (often around 80-90%), reducing an owner’s cost basis. If you’ve held MMP for the past 10 years, your cost basis is probably close to zero. Note that the cost basis can’t fall below zero, and the distributions then are generally taxable right away.

In addition to taxes, the asset bases of MMP and OKE are quite different. For the most part, the two companies don’t transport the same products. Technically, OKE transports some refined products on its North System, but it is a tiny part of its business.

Companies like Energy Transfer (ET) and Enterprise Products (EPD) tend to make highly strategic deals where they can add a lot of value to some particular assets. I don’t see that with this deal. Yes, there may be some opportunities to get into the NGL or LPG export market and some other synergies, but for the most part the two companies don’t seem the most natural fit. For a nearly $20 billion combined company, $200 million in synergies is also not a lot.

Earlier this month, MMP’s 4th largest unitholder said it would come out and vote against the deal. The firm argued the deal was an enormous transfer of wealth to OKE shareholders and the IRS. It urged the company to feature tax consequences analysis in all future merger communications.

EIP CEO James Murchie concluded his letter writing:

“Finally, while the S-4 will likely describe the strategic benefits and costs of this transaction, it cannot address the issue of portfolio diversification for the unitholder who would lose the ability to hold ONEOK shares and Magellan units in the proportion of their choosing. If EIP wanted to own an investment that is 77% ONEOK and 23% Magellan, which we do not, we can do that by purchasing more ONEOK on the open market without incurring this enormous tax liability.”

Conclusion

If you’ve owned MMP for any long period of time, it is likely in your best interest to vote against the merger with OKE. The fit between the two companies is not great, but more importantly, the tax consequences are not worth the modest premium unitholders are getting.

While shareholders rejecting a merger generally isn’t easy, the fact that a large unitholder has already come out against the deal does help. There are no overwhelming institutional holders of the stock. Alps is listed as the top holder, owning around 7.7% of the company, but it most likely is holding the units in swap for some of its clients. That means individual investors getting out and rejecting the offer is important, because with apathy will come a potentially big tax bill.

Read the full article here