MAIA Biotechnology (NYSE:MAIA) is developing 6-thio-2′-deoxyguanosine (6-thio-dG), a telomere targeting agent, for a variety of cancers. A recent update on the company’s clinical trial and fundraising by the company are positives that have made the name worth writing about.

MAIA’s THIO-101 trial

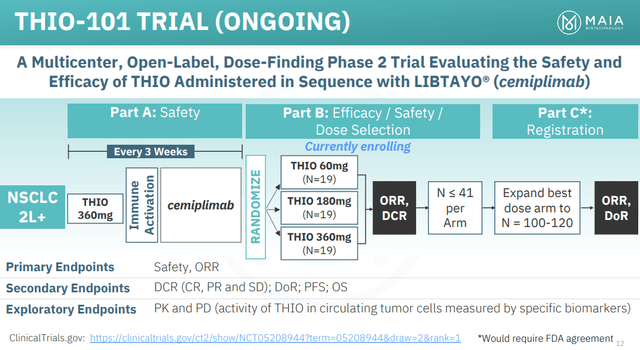

MAIA’s THIO-101 trial recruits stage III or IV non-small cell lung cancer (NSCLC) patients, who have relapsed or progressed following treatment with an immune checkpoint inhibitor, and treats them with 6-thio-dG in combination with the immune checkpoint inhibitor cemiplimab (Libtayo). Libtayo is currently marketed by Regeneron (REGN), who MAIA have a clinical supply agreement with.

Figure 1: Schematic of THIO-101 trial of 6-thio-dG (or simply THIO). ORR refers to overall response rate, DCR to disease control rate, DoR to duration of response. (MAIA Corporate Presentation, June 2023.)

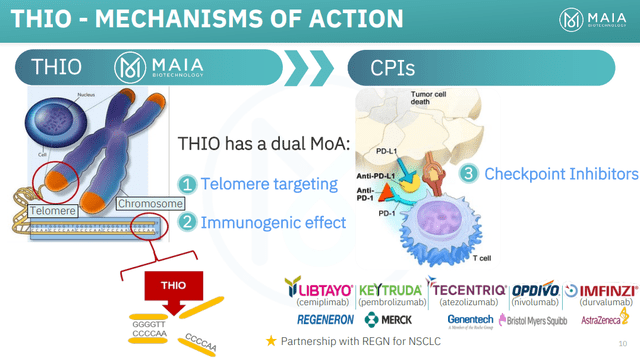

Although THIO-101 enrolls patients that have already relapsed or progressed following treatment with a checkpoint inhibitor, MAIA’s 6-thio-dG has an immunogenic effect that might work in concert with checkpoint inhibitors (that have a similar but complementary action) to help a patients immune system recognize and direct an attack against tumor cells.

Figure 2: Mechanism of anti-cancer activity for MAIA’s 6-thio-dG. (MAIA Corporate Presentation, June 2023.)

Some progress in the THIO-101 trial

While MAIA began dosing patients in July 2022 in its THIO-101 trial in Australia, a June 20 press release from MAIA notes the opening of 13 trial sites in Europe in 2023. These new sites have allowed the company to more than double enrolment in a short amount of time, with 29 patients now enrolled.

“With rapid enrollment in the trial, we project a substantial number of patients completing 3-6 months of treatment by the fall which will allow us a preliminary evaluation of the treatment efficacy”

Mihail Obrocea, MD, MAIA’s Chief Medical Officer.

I’m upbeat about the rate of enrolment of the trial despite only enrolling 29 of the eventual 184 planned patients, since I would expect part A of the study, which is now complete, to move more slowly as MAIA took time to collect modern safety data (6-thio-dG was trialed at much higher doses in the 70’s, when checkpoint inhibitors didn’t exist) and generate interest in the trial. Further MAIA still plans to open two more sites in Europe.

Outside of Europe and Australia, MAIA plans to submit an Investigational New Drug (IND) application in 2023 to the US Food and Drug Administration (FDA) so it can begin running the THIO-101 study at sites in the US as well. MAIA held a pre-IND meeting with the FDA in 2022, and was planning at the time to submit an IND in H1’23 and begin enrolling in the US in H2’23. A 2023 Corporate Summary on MAIA’s website, updated in early June 2023, still lists a 2023 time line for enrolling patients in the US in THIO-101, so it doesn’t seem like there has been any slippage in the timeline since the pre-IND meeting in late 2022.

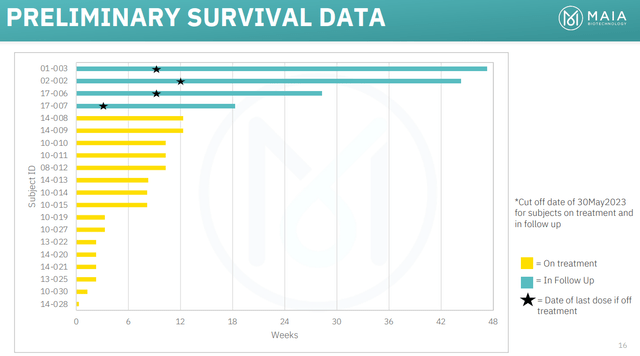

MAIA already notes that the first two patients in the THIO-101 study, that were recruited in Part A of the study, are still progression free six and seven months after stopping treatment, and still surviving at 10 and 11 months after beginning treatment.

Figure 3: Preliminary survival data from the THIO-101 trial of 6-thio-dG in NSCLC. (MAIA Corporate Presentation, June 2023.)

These two patients had stage IV NSCLC and are receiving third and fourth-line treatment. If we take MAIA’s word for it that these patients normally survive for just 3-4 months, then we could already say there are hints of efficacy for 6-thio-dG. I want to see some data from a larger number of patients before we try to draw very precise comparisons to historical data or specific survival numbers from other trials in refractory NSCLC patients. Just eyeballing that comparison right now however, I can see how if MAIA continues to see patients surviving that long, an update in a larger number of patients might get the market excited. That is, even if scientifically I remained skeptical about that comparison across trials, from a trading viewpoint, I think the stock could rally. I think many biotech investors might be tempted to look at 10 months or more of overall survival in refractory NSCLC patients and say that MAIA might have something promising. Similarly, if MAIA sees some partial responses and complete responses, I think that could excite the market.

Financial overview

MAIA had ~$7.6M in cash at the end of Q1’23. R&D expenses were $2.2M for Q1’23 and G&A expense was $2M in the same quarter. Net loss was $4.1M for Q1’23 and net cash used in operating activities was $3.4M.

In April, the company raised net proceeds of approximately $5.1M from the sale of 2,555,500 shares of common stock at $2.25 per share ($5.75M gross proceeds). MAIA’s June Corporate presentation (Slide 29) notes a cash balance of $9.57M as of June 7, 2023. I’d expect MAIA to make it to mid Q1’24 then, assuming cash burn of $3.4M per quarter, unless the company raises more cash. Assuming a higher rate of cash burn, as MAIA spends more on R&D by enrolling more patients and opening more trial sites, MAIA can at least make it to a fall update (Q3’23 to Q4’23) on data from the THIO-101 trial.

As of June 7, 2023, there were 13,625,925 shares of MAIA’s common stock outstanding, giving MAIA a market cap of $29.3M ($2.15 per share). That being said, there are another 7.7M shares worth of options outstanding, and 0.9M of shares worth of warrants outstanding, bringing the fully diluted count to nearly 23M shares. Further, the options are, on average, not that far out of the money at current trading levels, with a weighted average exercise price of $2.67.

On June 8, 2023, MAIA filed a Form S-1 with the SEC containing a preliminary prospectus for an offering of 2,083,333 shares of common stock noting an assumed public offering price of $2.40 (MAIA closed at $2.47 on June 8). There has been no update since regarding the offering, so shareholders should keep an eye on the SEC filings and releases from the company for a further update on whether or not MAIA goes ahead with this offering and any funds raised.

Conclusions

I consider MAIA a buy as I expect the upcoming catalyst that is another update on the THIO-101 trial in the fall (Q3’23 to Q4’23) to result in a rally. Even if there isn’t enough to say the drug is working, I think there will be enough promise to excite the market. I think the company’s recent fund raising activities and cash balance should provide the company with the cash to get to that fall update.

While the initial data is promising and safety is good, it is possible subsequent results trend back towards a 3-4 month survival as MAIA has suggested is typical. Further MAIA already trades above cash, despite barely having enough for a few more quarters of operation and having no other trials dosing patients currently. As such, the name isn’t a strong buy in my opinion, it isn’t ridiculously undervalued and while I do think further data may follow the current trend and excite the market a bit, there is no guarantee. Indeed MAIA trades with a positive enterprise value in a market where many biotechs trade below cash, so the market has assigned some value to 6-thio-dG it would seem (I’m assuming that is what the market likes about the company, since other projects are preclinical).

The risks of any long in MAIA are several fold, a few of which are discussed here. Firstly, subsequent data from THIO-101 could disappoint, secondly, MAIA could fail to raise additional funds leading to concerns over cash and thirdly, delays in enrolment could cause the stock to trade down.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here