MamaMancini’s Holdings (NASDAQ:MMMB) manufactures prepared refrigerated foods. They provide beef and turkey meatballs, chicken, pasta entrees, salad bars, and cold deli. They sell their products to supermarkets, mass-market retailers, and through websites. MMMB recently announced its Q1 FY24 results. I will do its financial, fundamental, and technical analysis in this report. I think it is the best time to invest in MMMB. Hence I assign a buy rating on MMMB.

Financial Analysis

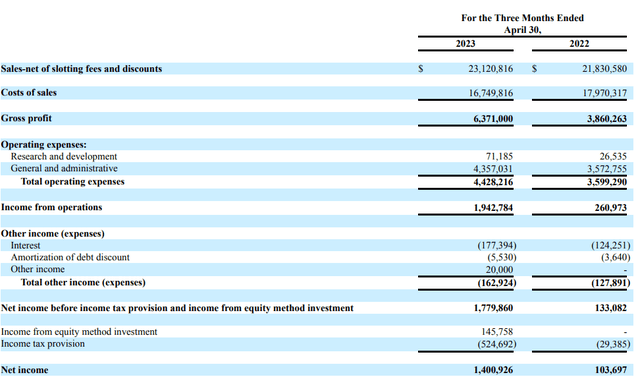

MMMB recently announced its Q1 FY24 results. The sales for Q1 FY24 were $23.1 million, a rise of 5.9% compared to Q1 FY23. I believe successful cross-selling efforts were the major reason behind the revenue growth. The gross profit also saw a significant rise of 65% in Q1 FY24 compared to Q1 FY23. The gross margin for Q1 FY24 was 27.5% which was 17.6% in Q1 FY23. I believe the major reasons behind the improvement in gross margins were the lowering of commodity costs and advancements in efficiency creation throughout the company.

Seeking Alpha

The net income for Q1 FY24 was $1.4 million compared to a net income of $103.6 thousand. Now talking about its balance sheet, by the end of Q1 FY24, it had Cash and cash equivalents of $5.2 million, a rise of 20.1% compared to Q4 FY23, which is quite impressive. In addition, with a market capitalization of $116.7 million, they have a long-term debt of $8.8 million which is quite less, in my opinion, considering MMMB is still small and growing and that expanding businesses generally have significant debt that they employ for growth purposes. But in the case of MMMB, they have minimal debt, and their Cash is increasing with each quarter which is a positive sign. In my opinion, MMMB is looking financially and fundamentally solid, and their financial performance in Q1 FY24 was solid, with a significant increase in the margins and net income.

Technical Analysis

Trading View

MMMB is trading at the $3.4 level. The chart of MMMB looks amazing; since April, the stock has increased by 65%, and looking at the size of the candlesticks, I think there is still strength left in the stock. The stock has broken out of an important resistance zone of $3.14, and I think it has the potential to reach the high of $4.2, which it made in July 2021. One thing that I like about the price action made in the last three months is that in the 65% up move, the candles weren’t only green. If we look at the chart after every green candle was made, the stock consolidated for a week or two, and after that, the stock continued its upward trajectory, which is a positive sign. Now talking about the future scenario, recently, the stock made a huge green candle, so looking at the price action of the previous three months, I think the stock might consolidate for a week or two, and after that, it might continue its upward trajectory, and I believe there is a high possibility that it might reach $4.2 in the coming times. Hence I think fresh buying positions can be made in the company.

Should One Invest In MMMB?

First, look at MMMB’s valuation. MMMB has a P/E [FWD] ratio of 20.13x compared to the sector ratio of 18.41x. This might show that it is overvalued, but I have a different view. It has a five-year revenue [CAGR] of 25.85% which is quite impressive. It is a high-growth company with its revenue growing every year and quarter, so its trading above the sector ratio is justified by its high growth. In addition, its five-year average P/E ratio is 21.87x, so it is still trading below the historical average. Hence I think it is still undervalued and has a lot of growth potential.

They are financially sound, with their revenues and margins continuing to improve, they are fundamentally strong with low debt and high cash, and technically they look promising. Hence I don’t think there is any reason not to invest in MMMB. So, after considering everything, I give MMMB a buy rating.

Risk

Two clients accounted for about 37% of its gross revenues in the fiscal year that ended January 31, 2023, while three customers accounted for about 58% of its gross revenues in the fiscal year that ended January 31, 2022. The loss of its biggest clients would cause a considerable revenue decline, negatively impacting its operational results. There is no guarantee that these clients will keep making purchases in the future. Thus, the heavy reliance on a few clients becomes a matter of concern.

Bottom Line

MMMB is financially, fundamentally, and technically strong. I believe it is still undervalued, with a lot of upside left. Hence considering all the factors, I think it is the best time to invest in MMMB. Hence I assign a buy rating on MMMB.

Read the full article here