Investment Thesis

Mama’s Creations (NASDAQ:MAMA) has risen over 200% in the last year, so I wanted to take a look at the company’s financials to see if even after such a rally, it is still worth investing in. Even after what I believe to be rather very conservative assumptions for the company’s growth, MAMA is still a buy at these levels and can easily double in the next couple of years if everything goes according to plan.

Briefly on the Company

Mama’s Creations is a company that specializes in deli meals, which include many different styles of deli dishes like teriyaki wraps, chicken paninis, and many other non-sandwich dishes that are also fresh, healthy, and easy to prepare at home. The company’s operations are sold in the US, with signature MamaMancini’s Italian beef and turkey meatballs and risotto, and most recently the company added Olive Branch and T&L to its portfolio, which helped the company double its sales in one year. The company also sells its products to the largest direct-to-consumer marketer, QVC, which is owned by Qurate Retail (QRTEA).

Financials

As of Q2 ’24, MAMA had $5.5m in cash and equivalents, against around $7m in long-term debt. This is a decent position to be in, in my opinion even for a small cap like MAMA. Small companies like this are encouraged to use leverage to expand their operations and further the growth of the company. Is there a reason to be worried about the debt on books? No, I don’t think because it seems to be very manageable. As of 6 months ended July 31 ’23, MAMA’s interest coverage ratio stood at around 12x, which means that EBIT can cover interest expenses on debt 12 times over. For reference, many analysts believe that a coverage ratio of 2x is sufficient, however, I think it is a bit too close for comfort as there may be years where EBIT will underperform and, in those years, it would be hard to cover the expenses. I prefer to see an interest coverage ratio of at least 10 as that gives a bit of leeway for bad years. So, it is safe to say MAMA’s coverage ratio is more than sufficient and the company is at no risk of insolvency.

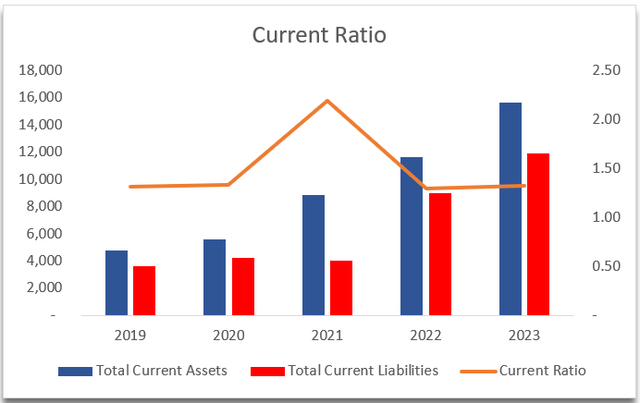

The company’s current ratio has been decent over the years and quite stable at around 1.3, which is good enough. It can cover its short-term liabilities and still has some capital left over for future expansion of the company as that is very much in play for a company with a market cap of around 130m.

Current Ratio (Author)

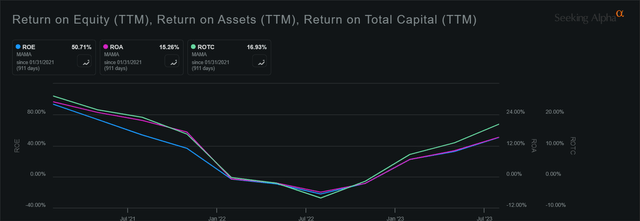

In terms of efficiency and profitability, we can see that the company’s ROA and ROE have improved massively from the lows in July of last year and are exhibiting an uptrend. The company’s bottom line improvements from FY22 to FY23 played a huge role in improving these metrics as sales almost doubled, which can be attributed to strong organic growth and also inorganic growth through the acquisition of T&L and Olive Branch. As sales doubled, so did COGS, however, where it worked out in the end was operating expenses increased by only 40% y/y, which attributed to the positive bottom line in the end. The company’s ROTC has also experienced the same recent uptrend, which suggests the company’s some pricing power and a competitive advantage in the industry.

Profitability and Efficiency (Seeking Alpha)

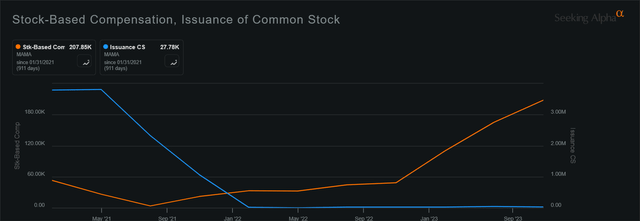

I was also very surprised that the company did not rely heavily on stock-based compensation as many other similar-sized companies do, however, it has been on the rise yet again. For a company that is still very small, I don’t mind the use of SBC, as long as the share price rises much quicker than the dilution, which seems the case here for MAMA, as it is up over 220% in 1 year.

SBC (Seeking Alpha)

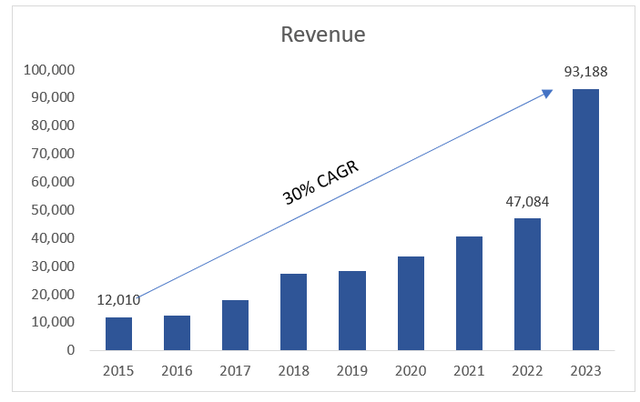

In terms of revenue growth, the company has been growing quite rapidly, which is expected from a company of that size. I would be worried if it was anywhere under 20% CAGR, which it almost was if we don’t include the latest year (23% CAGR without FY23, and 30% CAGR with FY23).

I would like to see this trend continue for more years because the company is still supposed to be in that growth phase and any slowdown will be a big red flag for me. So, I was quite surprised to see that analysts for FY24 are expecting around 9% and 13% for FY24 and FY25, respectively. Although, I’ll take these estimates with a grain of salt since there aren’t many that are covering the company on the street.

Revenue (Author)

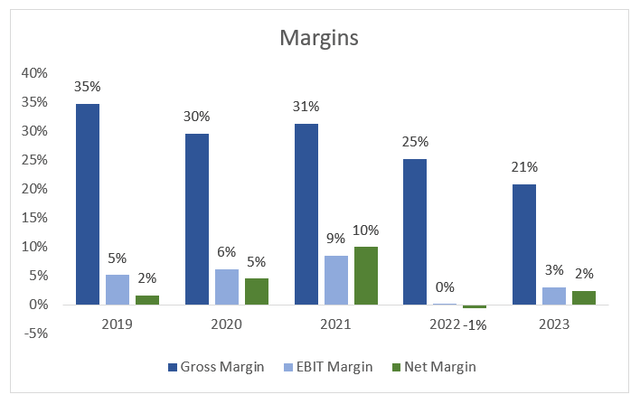

In terms of margins, we can see that these have deteriorated slightly in recent years, however, as of the latest quarter, gross margins have returned to the company’s long-term goal of over 30%. This increase can be attributed to “normalization of commodity costs, successful pricing actions, and improvements in operational efficiencies across the organization.”

Now that the inflation is much lower than it was before, I wouldn’t be surprised if the goal of 30%+ on gross margins is achieved going forward.

Margins (Author)

Overall, I can see a company that is going strong and improving efficiency and profitability. I don’t think the sub-10% revenue growth is an indication of future growth because I do believe that it will manage to achieve higher growth if it keeps continuing its strategy of acquisitions.

Valuation

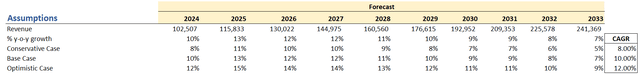

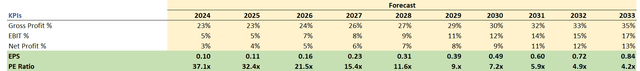

I decided to go quite aggressively conservative with my assumptions for this company, because it is so small still, which inherently comes with much higher volatility and fluctuations on the good and the bad end.

For the revenue growth, I went with quite low estimates for a company that should be growing much faster, however, this will give me much more margin of safety in the end. Below are my estimates for MAMA’s sales for the next decade.

Revenue Assumptions (Author)

In terms of margins and EPS, I went on the more conservative side too for that extra margin of safety. As you can see gross profit margins won’t reach 30% until FY30, which is very conservative.

Margins and EPS Assumptions (Author)

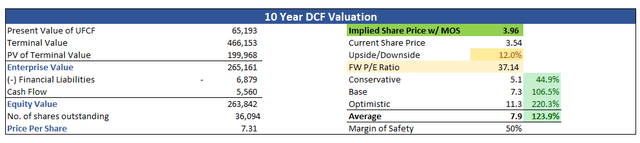

For my DCF model, I went with the company’s WACC of around 9% as my discount rate, while my terminal growth rate is set at 2.5%, as I would like the company to at least match the long-term US inflation goal.

And just to get that good night’s sleep, I added another massive 50% margin of safety to the final calculation. The reason I did this is because it is a small-cap company that has a lot of risks and will see a lot of fluctuations, so it is better to be safe than sorry. With that said, MAMA’s intrinsic value is $3.96 a share, which means that even with such conservative estimates, the company is trading at a discount to its fair value.

Intrinsic Value (Author)

Risks

As I mentioned multiple times, the company is small-cap. The daily volume isn’t very large, so there may be quite a bit of volatility in the share price over time. Be prepared to stomach large variances on seemingly no news if someone decides to unload their position or start a position.

Macroeconomic headwinds may rear their head again because inflation is still rather sticky, and the Fed may still raise interest rates further and keep them higher. This may lead to broad market volatility and small caps get hit the worst. Inflation may come back up, which would deteriorate the company’s margins once again, and that will not be good for its share price.

Future acquisitions may not synergize well and that would hurt the company’s bottom line. So far it seems like that strategy has been working though.

Closing Comments

I’ve beaten down this company considerably with my assumptions and the company still came out on top. I have no problem opening a position at this price level and letting it simmer over the next couple of years to see what becomes of it. The company can easily double in price if everything goes according to plan over the next year or two. It can even more than 2x, but only if the management plays its cards right. I will be looking to open a position before the year ends and will be holding on to the shares for a couple of years to see what happens.

Read the full article here