Investment Thesis: Marriott International could see further growth going forward, on the basis of strong earnings growth, an attractive P/E ratio, and continued RevPAR growth across its luxury brands.

In a previous article back in April, I made the argument that Marriott International (NASDAQ:MAR) could see significant growth going forward, on the basis of significant expansion of its Ritz-Carlton and W Hotels brands in China this year, as well as looking attractively priced from an earnings standpoint.

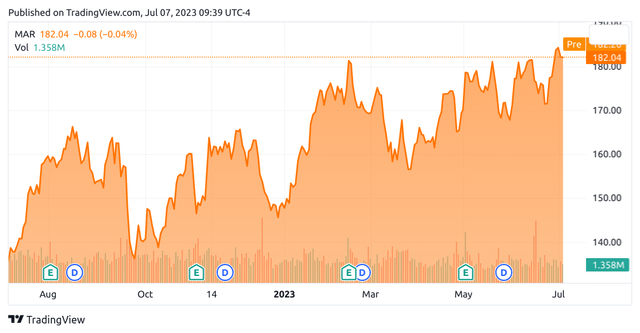

Since then, the stock has ascended to a price of $182.04 at the time of writing:

TradingView.com

The purpose of this article is to assess whether Marriott International has the ability to see continued growth from here taking recent performance into consideration.

Performance

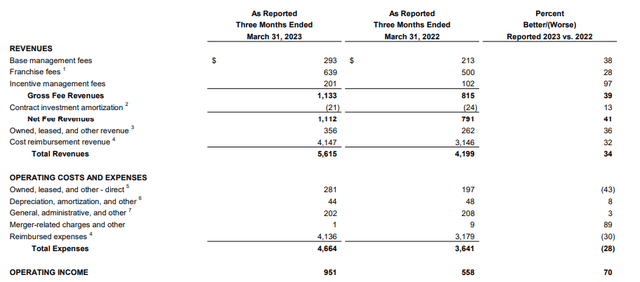

When looking at first quarter 2023 results for Marriott International, we can see that operating income saw substantial growth of 70% as compared to the same quarter in 2022, on the basis of strong growth in total revenues and operating income:

Marriott International: First Quarter 2023 Results

Over the same period, earnings per share (diluted) was up by 113% from $1.14 in Q1 2022 to $2.43 in Q1 2023.

In my view, this strong growth in earnings demonstrates that Marriott International has shown resilience in the face of inflationary pressures – revenues have continued to rise in spite of higher prices and this has been more than sufficient to absorb the effect of higher operating costs. The luxury end of the market has continued to perform strongly, and I am optimistic that this trend can continue as we head into Q2.

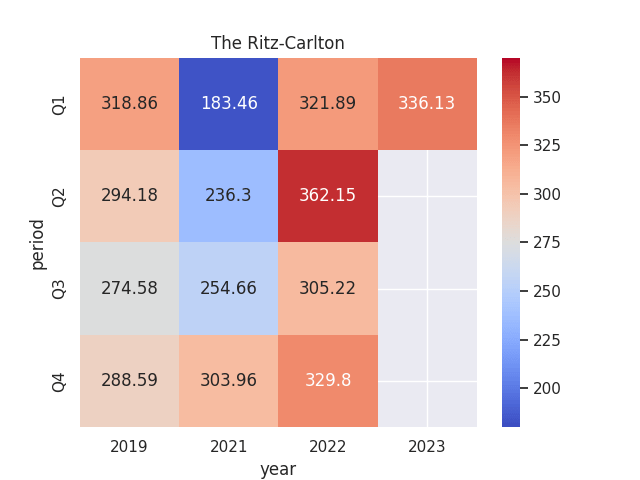

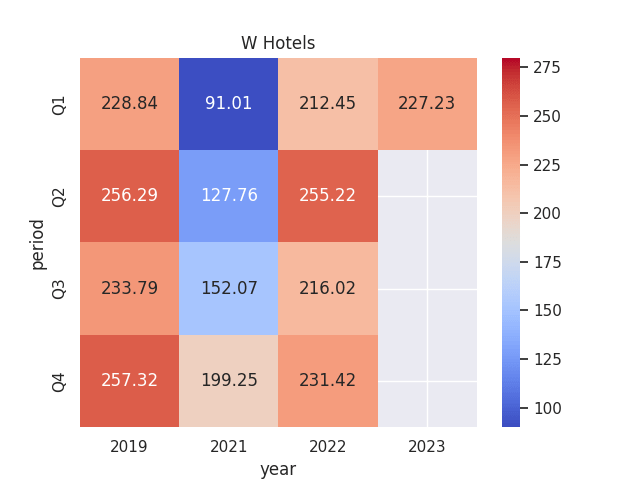

Given my previous argument that the expansion of The Ritz-Carlton and W Hotels brands in China could help to propel overall growth for Marriott International – I would like to analyse performance across these brands in more detail.

We can see that RevPAR for Q1 2023 is up for both The Ritz-Carlton and W Hotels on that of Q1 2022 (for comparable company-operated US & Canada properties):

The Ritz-Carlton

Heatmap generated by author using Python’s seaborn library. RevPAR figures sourced from historical Marriott International Quarterly Reports (Q1 2019 to Q1 2023).

W Hotels

Heatmap generated by author using Python’s seaborn library. RevPAR figures sourced from historical Marriott International Quarterly Reports (Q1 2019 to Q1 2023).

We have seen that Q2 was the strongest performing quarter for these brands last year.

As a result, particular attention will be paid to RevPAR performance in Q2 2023 – as underperformance in this regard could give investors concern that growth is slowing.

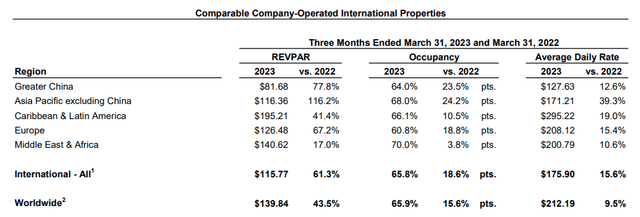

Looking at RevPAR performance holistically, we can see that while RevPAR for Greater China still remains significantly below that of other regions – in spite of growth of 77.8% in Q1 2023 as compared to Q1 2022.

Marriott International: First Quarter 2023 Results

In addition, it is notable that growth in the average daily rate for this region was 12.6% over the same period (which is significantly below that of Asia Pacific excluding China, and below that of Europe and Caribbean & Latin America). In addition, ADR itself was also lower than other regions.

This might suggest that customers are more price-sensitive in the Greater China region than others – whereby an increase in price could lead to a greater drop in booking demand as compared to other regions.

With Marriott International having celebrated the opening of its 500th hotel across Greater China in June, the hotel chain could be in a good position to bolster overall revenue through volume growth. However, this will need to be accompanied by RevPAR growth over time to justify the increased cost of operating in the region. As such, the upcoming quarter will be a significant telling point as to whether overall RevPAR across Greater China can recover after the lifting of COVID restrictions.

Risks and Looking Forward

Going forward, I take the view that Marriott International is in a good place overall to continue seeing growth from here.

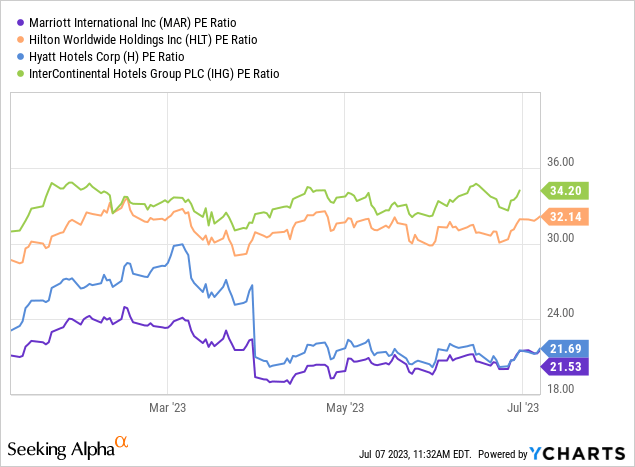

As we have seen, earnings per share is up significantly on that of the same quarter for the previous year. In addition, we can see that among competitors Hilton Worldwide Holdings (HLT), Hyatt Hotels (H), InterContinental Hotels Group (IHG) – Marriott International currently shows the lowest P/E ratio among its competitors below in spite of strong earnings growth. This could indicate that the stock is attractively valued relative to others in the industry:

ycharts.com

To investigate this further, let us compare Price/RevPAR as a ratio across these four hotel chains. Given that revenue per available room is a key measure of profitability for the hotel industry – a company that is trading at a low price relative to the RevPAR that the hotel generates in a particular period can be argued to be more attractively valued on this basis.

| Marriott International | Hilton Worldwide Holdings | Hyatt Hotels | InterContinental Hotels Group | |

| Price on 31st March 2023 | 166.04 | 140.87 | 111.79 | 66.6 |

| Worldwide (system-wide) RevPAR | 139.84 | 103.72 | 130.54 | 74.77 |

| Price to RevPAR ratio | 1.19 | 1.36 | 0.86 | 0.89 |

Source: Closing stock price on 31st March 2023 sourced from nasdaq.com. Worldwide (system-wide) RevPAR figures sourced from Q1 2023 reports for Marriott International, Hilton Worldwide Holdings, Hyatt Hotels, and InterContinental Hotels Group.

We can see that Marriott International trades lower than Hilton Worldwide Holdings on this basis – but higher than that of Hyatt Hotels and InterContinental Hotels Group. With that being said, the fact that the company showed the highest worldwide RevPAR for Q1 2023 gives me more confidence that investors would be prepared to pay a premium for the stock as a result.

In terms of the potential risks to Marriott International at this time, I see the main one as being that RevPAR in the next quarter comes in lower than that seen for Q2 2022. Should this happen, then investors might take this as an indication that growth in booking demand is stalling due to macroeconomic factors, and we could see the stock consolidate as a result. In addition, if RevPAR across Greater China also remains significantly below that of other regions, then this could also be seen as a sign that the post-COVID recovery is stalling.

With that being said, RevPAR for the Ritz-Carlton and W Hotels continues to see growth across the US & Canada – which is a bigger market for Marriott International as compared to Greater China. Should we continue to see RevPAR growth in the next quarter across these brands – then I take the view that the stock could continue to see further upside.

Additionally, with COVID-19 now in the rear-view mirror – we could be in a good position to see a strong rebound of international travel by Chinese customers to the United States – which is expected to lift overall revenues across the company’s luxury brands further.

Conclusion

To conclude, Marriott International has continued to see strong earnings growth, and RevPAR across its luxury brands has continued to rise.

While risks to growth remain, I take the view that the company’s strong earnings growth, attractive P/E ratio, and continued growth in RevPAR across its luxury brands could still allow the company to see further upside going forward.

Read the full article here