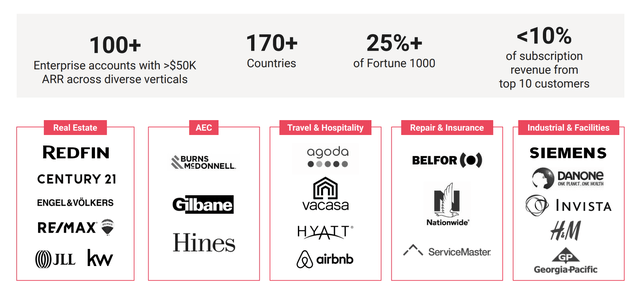

Matterport, Inc.’s (NASDAQ:MTTR) headwinds have been multifaceted this year but 2024 offers an opportunity for a reset of macroeconomic conditions that have led to led to poor returns for the firm whose 3D capture technology is extensively used by realtors, vacation rental companies, and facilities management firms for digitizing their buildings. The prize here is ramping high-margin subscription revenue on the back of the growth of spaces under management which reached 11.1 million at the end of the third quarter. This was 28% year-over-year growth. MTTR realized third-quarter subscription revenue of $22.9 million, a growth of 20% over its year-ago comp with annualized recurring revenue (“ARR”) exiting the quarter at $91.4 million. The impact of ARR growth will be a gradual increase in gross margins for an enhanced scope for profitability and positive free cash flow.

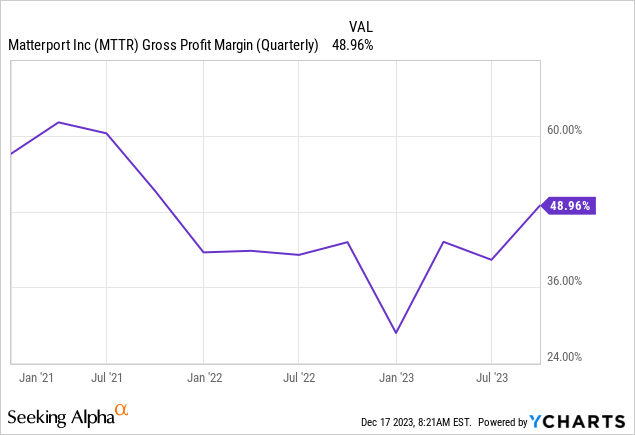

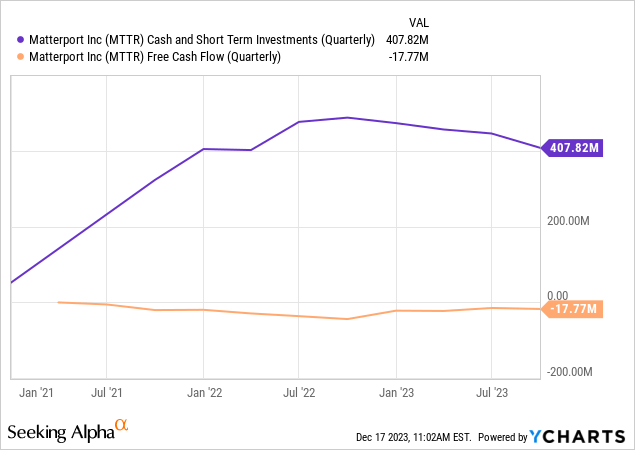

To an extent, we’re seeing this gradual increase already. MTTR’s gross profit margin for the third quarter at roughly 49% was an 800 basis points sequential increase and up from 43% in the year-ago comp. To be clear, the outlook for ARR growth forms the core bullish factor for MTTR whose currently underway with efforts to reduce operating expenses as it targets profitability next year. MTTR’s current market cap of $806 million means a price-to-sales multiple of 5x against trailing 12-month revenue of $160 million at the end of the third quarter. Is this cheap? Not really. But adjusting the market cap for cash and short-term investments of $407 million at the end of the third quarter and no real debt means the multiple gets cut in half to 2.5x on an enterprise value basis. Subscription revenue should also fetch a higher multiple but is currently aggregated with hardware revenues.

ARR Ramp And Subscribers

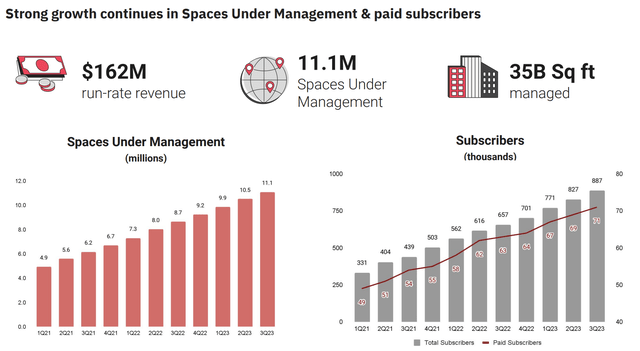

Matterport Fiscal 2023 Third Quarter Presentation

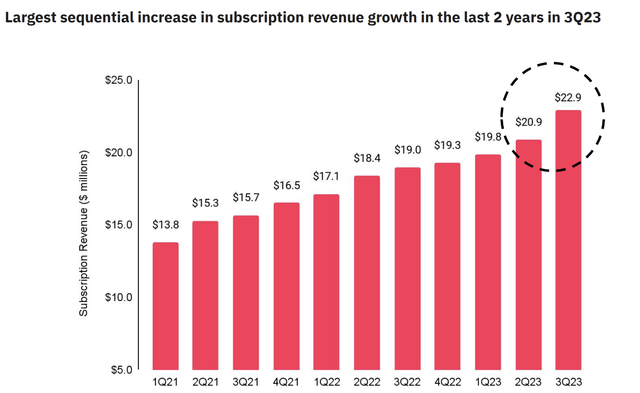

MTTR recently signed a multi-year partnership with Vacasa, Inc. (VCSA) that will see the vacation rentals company use MTTR’s digital twin platform for its onboarding and guest service experience. This partnership highlights the value add of MTTR as each digital twin immerses prospective renters in a virtual tour of the property. This not only increases the likelihood of a booking, but reduces any downstream complaints. Subscription revenue formed 56% of total third-quarter revenue of $40.64 million with total revenue growing by 7% over its year-ago comp to beat consensus estimates by $1.52 million. Critically, subscription revenue as a percent of total revenue was up roughly 600 basis points year-over-year with total subscribers increasing to 887,000 at the end of the third quarter, up 35% year-over-year.

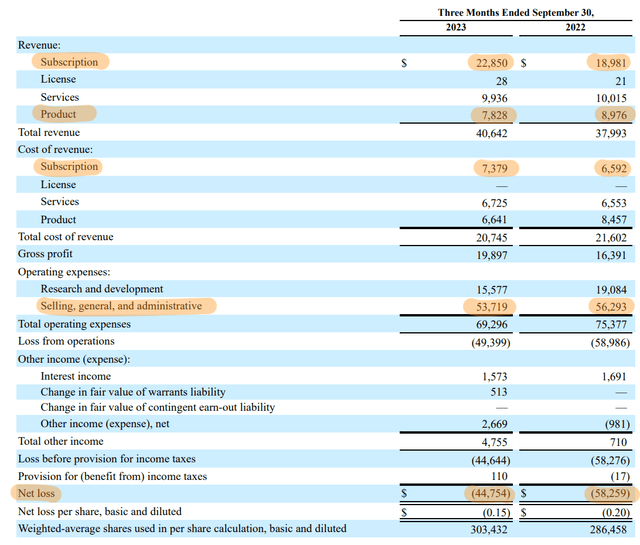

Matterport Fiscal 2023 Third Quarter Form 10-Q

Subscription-only gross profit margins at 68% at the end of the third quarter highlights just how much MTTR stands to ride the growth of ARR to greater profitability as product-only gross profit was lower at 15%. Subscription revenue growth was driven by both an uptick of new subscribers and price increases brought in during the quarter that helped push MTTR to realize its largest sequential increase in revenue growth during the third quarter. This is well on track for $25 million per quarter for a $100 million ARR, a future milestone that could also act as a catalyst for the commons.

Matterport Fiscal 2023 Third Quarter Presentation

Balance Sheet, Fed Pivot, And 2024 Outlook

Another of MTTR’s bullish points is its balance sheet health with what’s essentially zero debt and a short-term liquidity position that amounts to half of its market cap. The company earned $1.57 million in interest income during the third quarter albeit with its cash position dipping by $38 million sequentially with its cash burn from operations improving by 62% year-over-year to $15.5 million.

MTTR’s diversification across several sectors is also key for introducing earnings stability and reducing volatility. Whilst real estate will continue to form the source of most of its subscribers, the continued growth of other verticals including industrial and facilities, insurance, and hospitality will help derisk MTTR. The core risk continues to come from elevated interest rates which has dampened activity in its key real estate vertical. However, 2024 is set to see three interest rate cuts of at least 75 basis points as per the December Fed dot plot. The CME FedWatch Tool, which visualizes 30-Day Fed Funds futures pricing data, is expecting 2x this amount through 2024 with the Fed funds rate likely set to be 3.75% to 4.00% at the end of 2024.

Matterport Fiscal 2023 Third Quarter Presentation

Hence, I think the commons have a greater probability to perform strongly in 2024 after relatively flat trading year-to-date. The market will be looking for ARR surpassing $100 million, the continued growth of subscribers, and a clear pathway to profitability to reprice the shares higher. MTTR forms a speculative buy on this scenario playing out next year.

Read the full article here