Investment Thesis

Matterport, Inc. (NASDAQ:MTTR) share price has started to move higher in the last few weeks. This means that investors are more inclined to get involved and pay up for Matterport. However, as I analyze Matterport’s near-term prospects, I’m struggling to get behind its story and pay 6x sales for this unprofitable business.

Even though I recognize that there are some positive considerations too, such as the fact that its revenue growth rates are starting to stabilize. Also, the fact that Matterport carries no debt is clearly a positive.

Why Matterport? Why Now?

Matterport creates 3D digital twins of physical spaces. Matterport’s spatial data-driven and 3D capture technology digitalizes physical spaces.

Simply put, Matterport transforms how people, predominantly construction teams, engage with physical spaces through interactive digital experiences.

This resonates with Nvidia’s recent Keynote speech, where Jensen Huang, notes that in the future, before anything gets built in the physical world, the digital world is built first and users will rely on the digital world to maximize ROI and minimize time and errors.

In other words, Matterport has the right narrative at the right time. But does this small growth business have the right fundamentals to back its story? That’s something we will now discuss.

Revenue Growth Rates Are Stabilizing

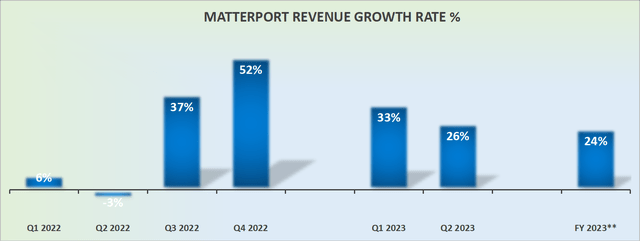

MTTR revenue growth rates

Before we go much further, it’s important to recall that Matterport acquired VHT back in Q3 2022. This led to a massive bump in revenue growth rates, starting in Q3.

However, after Q2 2023, the current quarter ending in a few days, Q3 will be lapping against that period with a significant amount of inorganic growth.

Now, this is where things get interesting. Could we make the case that on a go-forward basis, Matterport’s growth rates could stabilize around the mid-teens CAGR?

How do I reach this assumption? Because consider the following.

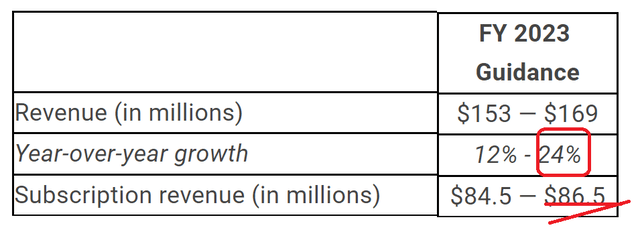

MTTR Q4 2022

Above we see Matterport’s guidance at the end of Q4 2022. The business at the time was guiding for about 24% top line growth for 2023. Next, consider its recently upwards revised guidance, provided together with its Q1 2023 results.

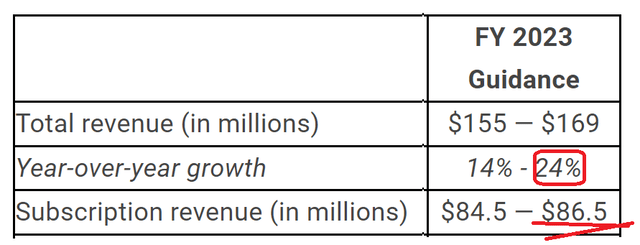

MTTR Q1 2023

The business is still guiding for around 24% CAGR on the top line. Given that H2 2023 is expected to grow by approximately 30% CAGR, naturally, this means that H2 2023, that’s comping against that higher revenue base should probably only see around 18% top line growth. Think of it as this, H1 2023 growing at 30% CAGR, and H2 2023 growing at 18% CAGR.

Consequently, however, we consider Masterpoint, this is a business that’s growing around 20% CAGR and no more.

In the next section, we’ll discuss what for many investors is the bull case facing Matterport.

A Debt-Free Business

Approximately half of Matterport’s market cap is made up of cash. More specifically, Matterport is debt free with approximately $450 million of cash. The problem here is that this is only considered to have a large margin of safety if the business is on a path towards cash breakeven.

This leads me to quote from Matterport’s management,

We have improved our free cash flow by more than 20% from the year ago period, and continue to believe we are more than fully funded to achieve our business plan.

If we take the quote above, from my rough calculations, Matterport is on a path to burn about $80 million of free cash flow in 2023. Needless to say that about half of this free cash flow (or slightly more than half), is non-cash stock-based compensation.

Meaning that its underlying profitability is still some way off. Management went on to say

On the margin front, gross margin front […] our outlook for gross margins in total is roughly consistent as well with what we reported in Q1.

This reinforces my overall perspective that in the best-case scenario, Matterport’s gross margins will be around 45%, and not higher. The problem for Matterport is that its hardware and service businesses are operated nearly as a breakeven.

So, only when the subscription side of the business grows to become the majority of its business, will Matterport’s consolidated gross margins significantly improve.

And even then, the subscription side of the business only carries gross profit margins in the mid-60s% range.

Overall, I’m not particularly bullish on Matterport, as I don’t believe that paying around 6x sales for a medium-growth business that’s unprofitable is all that exciting.

The Bottom Line

The recent share price appreciation points to increased investor interest, but I remain hesitant about the company’s near-term prospects and its high valuation of 6x sales for an unprofitable business.

Although there are some positive aspects, such as stabilizing revenue growth rates and the absence of debt, the fundamentals do not align with the company’s narrative.

Furthermore, even if its growth rates are projected to stabilize around the mid-teens CAGR, its profitability remains distant, with significant expected free cash flow burn and moderate gross margins. Given these factors, I find Matterport unattractive.

Read the full article here