My latest article on Medical Properties Trust (NYSE:MPW) was issued back in October 2023 before the Company circulated its Q3, 2023 results and provided some interesting insights to the market.

In this article, I outlined several fundamental aspects, which have made MPW an attractive investment:

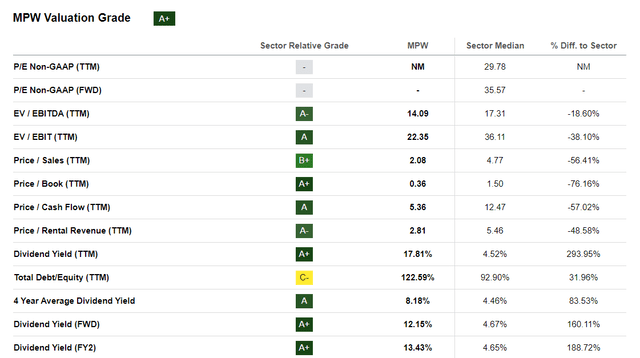

- Multiples trading at a deep value territory warrants a favorable ground for experiencing a huge bounce back provided that positive data points emerge.

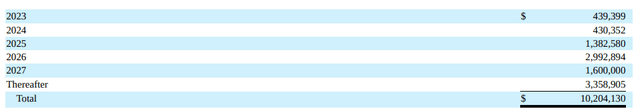

- Solid debt management due to a combination of dividend cuts and asset sales, MPW has largely neutralized major refinancing risk by year 2026.

- Well-structured lease expiration profile puts away pressure on lease rollovers that could potentially impose an additional layer of risk during times of balance sheet optimization, when cash flow stability is critical.

With that being said, the entire investment case should be caveated by two tenants – Prospect Medical Holdings and Steward Health Care – which together account for ca. 25% of the Q3 2023 leases. As many of you know, MPW has been forced to step in here to avoid filing Chapter 11, provide its own financing, and defer lease collections (on a cash basis). While financial prospects seem to be improving for both of these tenants, they both are still operating in speculative territory with a notable probability of further distress. In the case of such a scenario, the impact on MPW’s cash generation and additional risk premiums on the Company’s capital would be dramatic.

Now, since the publication of my article, the total returns have landed at 3.9%, while the S&P 500 is up by 9.1%, and, most importantly, the broader REIT index advancing by 15.1%.

In the meantime, MPW has published fresh quarterly results and the assumptions of monetary policy have changed in favour of such entities as MPW, which will have to refinance and embark on notable asset monetization transactions.

Synthesis of the existing situation after Q3

Let’s now take a quick look at the underlying financials and the state of MPW’s balance sheet.

In my opinion, the most concerning issue is associated with MPW’s ability to successfully refinance and do so in a manner, which does not destroy the FFO generation.

In Q3, 2023, we could finally notice how a part of the immediate debt maturities has been successfully retired – mainly due to the sale of Australian facilities.

Form 10-Q for Medical Properties Trust

Currently, MPW has to refinance only ~$440 million by the end of this year and not worry about additional debt rollover until 2025. The outstanding amount in 2024 which is reflected in the table above, has been already paid down right after the publication of the Q3 report (by using the proceeds from prior transactions of Australian properties).

Considering the quarterly cash retention after dividend distribution of ~$135 million (based on Q3, 2023 data), obtaining short-term financing for 2023 maturities or tapping into some of the existing revolver capacity should not be a problem for MPW.

Plus, we should not expect a major impact on the interest cost component even though this 2023 maturity is based on a relatively low fixed rate. The positive effects from a full neutralization of the 2024 amount should provide an offsetting boost in terms of the interest cost position.

All in all, these improvements should not be that surprising since that was already communicated before. A positive element in this context is that we can see a practical realization of the communicated strategy that a notable de-leveraging focus will take place.

In the recent earnings call, Edward Aldag, CEO of MPW, also confirmed that getting balance sheet in check remains the key priority for the management:

Our current primary focus is on executing a capital allocation strategy that will provide the liquidity to satisfy our debt maturities even debt that doesn’t mature for several years.

On top of this, Steven Hamner, CFO of MPW, stated that there is a plan to attract ~$ 2 billion of capital over the course of 2024:

I can say that we are targeting approximately $2 billion of liquidity transactions over the next three to four quarters.

This means that MPW will be able to refinance 2025 debt well in advance of its official maturity and to some extent further optimize the underlying risk profile by bringing down some of the high yielding debt. Here we have to note that we do not know how much of these proceeds will stem from debt financing (i.e., mortgages) and how much will come from equity such as monetization of JVs or direct asset sales.

Finally, the performance of both struggling tenants seems to be getting better and showing first signs of recovery. For example, during Q3, 2023, MPW started to receive lease payments from Prospect Medical Holdings. It is projected that Prospect will initiate new lease payments of $3.5 million per month early next year (related to previous direct finance/support from MPW).

Steward has also managed to strengthen its profile as the reported EBITDARM rent coverage landed at 2.7x.

Granted, the situation for these two tenants still remains difficult and MPW has not yet materialized its investments and actual cash flows have not started to flow in a full/complete manner.

Way to play it

While from the aforementioned aspects, MPW’s equity story looks rather solid, there is still a high probability of experiencing further difficulties down the road.

In my view, there are four major considerations on why to avoid equity exposure:

- Looking at the recent history, we had several instances that are similar to this one, where the MPW’s fundamentals have looked very sound, but in the end (mostly due to tenant issues), the stock price has just continued to go south.

- Despite the recent news and a favourable recalibration of near-term interest rate outlook from high and uncertain to gradually declining and clear in terms of the peak level, MPW has responded poorly, especially if compared to the other REIT peers. This sends a clear signal that it will be rather difficult for MPW to get the stock price higher without significant improvements on the tenant side.

- We lack transparency of the underlying financial positions of Steward and Prospect to make justified conclusions pertaining to their ability to service their lease obligations, which in MPW’s case account for ~25% of the top-line.

- Based on the recent news, it seems that there could be additional tenant problems brewing in MPW’s portfolio. If this risk starts to materialize, I think it is for sure that more market cap will be wiped out.

At the same time, looking at the progress on balance sheet optimization as well as some initial signs of improving situation with Steward and Prospect going short would be also a risky idea.

Seeking Alpha

The risk of “short squeeze” is especially relevant when we see completely depressed valuations in conjunction with positive tailwinds in the monetary policy space.

As a result of this, in my humble opinion, a position in MPW’s bonds seems the most attractive way to capture returns from MPW.

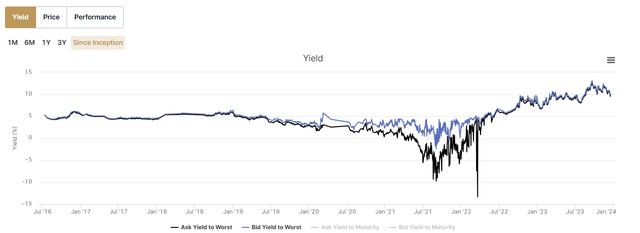

It depends on which bond we take, but sticking to USD currency and a maturity profile that would give investors time to collect coupons, MPW 5.250% 01Aug2026 Corp bond (US55342UAG94) could be considered optimal.

Bondsupermart Ltd

As we can see in the chart above, currently MPW’s bond yields are close to their peak levels, yielding ~10%. The YTM of the USD 2026 bond currently stands at 9.8%, which is just ~220 basis points below the prevailing dividend yield.

Considering the risk and reward ratio between MPW’s equity and bonds, it is clear that an additional 200 basis points do not justify the incremental risk, which is associated with equity exposure.

Adjusted for one-offs, MPW distributes ~60% of its AFFO, which leaves an ample amount of internal cash that could be put to work on either reducing debt or making accretive acquisitions. This implies also an ability for MPW to absorb new shocks without having to tap into debt financing sources. In the worst case, MPW carries also an optionality to make further dividend cuts to save $100 – 150 million per quarter.

Bonds are also more protected given that the Management has set goals to reduce leverage in the books and potentially retire portions of the currently outstanding debt even though their maturities are quite far in the future.

Finally, in the context of normalizing interest rates, exposure to duration factor (e.g., bonds) per definition should respond well. As opposed to MPW’s equity, which has not reacted to more dovish news, the bond positions have actually adjusted accordingly by increasing in value; so the YTM level has dropped by ~150 basis points in the past month.

The bottom line

While MPW’s equity seems to be rather attractive due to the depressed valuations and improving fundamentals, the key risks remain somewhat unclear, which in the case of materialization would most probably further destroy shareholder value.

Yet, given the strengthening of underlying fundamentals (e.g., no material debt maturities by 2025) and the relatively attractive yield that is offered by MPW’s bonds, taking a long position in the fixed-income component of MPW is far more optimal way to capture a double-digit yield.

Read the full article here