The harsh cruelty of the stock market is that there is no floor and what has fallen can keep on falling. To be clear, Medical Properties Trust (NYSE:MPW) is down 33% since the start of 2023, down 57% over the last 12 months, and at 4.91x now trades 60% lower than its peer group median price to forward FFO multiple. MPW’s dividend yield has been driven to its highest level since the REIT went public on the NYSE in the summer of 2005. The yield is up 142% over the last year with MPW recently declaring a quarterly cash dividend of $0.29 per share, in line with its prior payout, and a 15.1% forward yield. The objective here for investors is not to pointlessly chase a high yield but to gain exposure to what seems to be a market seemingly too bearish on the simple business model of owning property on a leveraged basis.

Seeking Alpha

Seeking Alpha

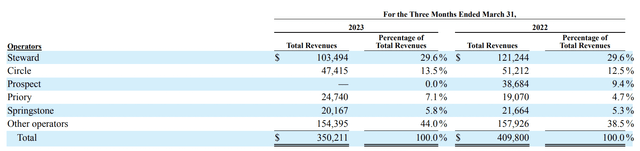

What is the controversy? The market has entirely lost confidence in the credit quality of MPW’s largest tenants; Steward Health Care and Prospect Medical Holdings. Indeed, both of these are currently amidst a level of pandemic-induced financial distress. Prospect, which previously accounted for nearly 10% of MPW’s rental revenue, is currently not paying any rent and has hired a refinancing specialist to help advise on refinancing debts. The hospital operator stopped paying rent at the end of December last year and is only set to resume payments in September.

How Steward, Prospect, And The Pandemic Disrupted The Future

Steward, which is set to account for 20% of MPW’s rental revenue, is also looking to refinance some of its debts coming due. This is not inherently groundbreaking as companies refinance their debts all the time before maturities come due. However, the use of third-party advisors for this has been flagged by bears as abnormal. The news of this third-party led refinancing effort was enough to send MPW’s commons down by double digits. Whilst I used the drop as a springboard to add to my position, the continued risks posed by Prospect and Steward should form a reason for risk-averse investors to avoid the stock.

Medical Properties Trust 10-Q

The current market zeitgeist for MPW is absolutely dire with a Fed funds rate that has been hiked to highs not seen since 2008 and with a rate of inflation that still sits far above its historical average. The March regional banking crisis, which has thrown up fears about the broader health of commercial real estate, still has no definitive ending. Further, large healthcare bankruptcies in 2022 were up by 84% over the prior year. However, most of these Chapter 11 healthcare filings were not by acute care providers but by senior care and pharmaceuticals. At the core of the issue facing MPW’s two largest US tenants is the pandemic, which saw more profitable elective surgeries get swapped out for COVID patients. This sparked an exodus of hospital staff, and the resulting wage inflation has wreaked havoc on the incomes of hospital operators and their operating room capacity. Hence, as more time passes, we should see wage inflation moderate and capacity normalize to ease financial pressure on hospital operators.

The Dividend Yield And The 2023 Outlook

MPW reported fiscal 2023 first-quarter revenue of $350.2 million, down 14.5% over the year-ago comp and a miss by $2.57 million on consensus estimates. This decline was led by Prospect not paying any rent during the quarter. The REIT did not acquire any new hospital property during the first quarter but $150 million in aggregate acquisitions, comprised of five UK behavioral hospitals and three German post-acute facilities, should be closed by the end of June.

Medical Properties Trust 10-Q

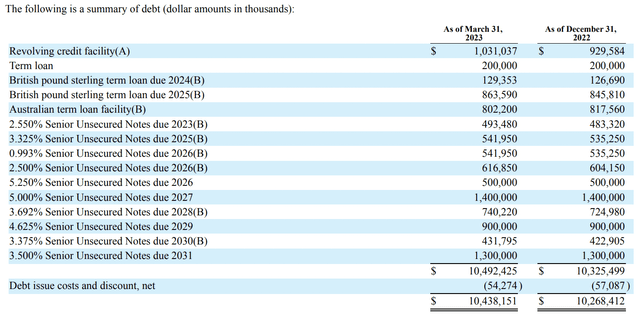

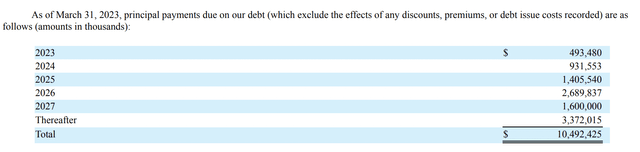

The ladder of debt maturities against the current interest rate environment forms the core headwind for MPW’s bulls. The REIT paid $97.7 million in interest expenses for its first quarter, up by around $6.5 million over its year-ago comp. MPW expects to make $493 million in principal payments this year, rising to $931.5 million next year.

Medical Properties Trust 10-Q

This is against cash and equivalents of $302 million as of the end of the first quarter with the REIT disposing of its Australian Healthscope property portfolio for AUD$ 1.2 billion. The proceeds of this will be used to fully pay off its Australian term facility. FFO for the first quarter came in at $0.37 per share, a miss of around $0.01 on consensus estimates and down from $0.47 in the year-ago quarter. Hence, whilst the current dividend yield forms a well-covered 78.4% payout ratio, FFO is under pressure. The REIT is guiding for FFO to be in the range of $1.50 to $1.61 per share for its full fiscal 2023. MPW’s payout ratio would be 77% against the lower end of this range, dropping to 72% at the higher end. Hence, I do not anticipate a dividend cut this year as existing tenants work through their issues. I’m still buying.

Read the full article here