Ryder System (NYSE:R) is a Miami, Florida-based multinational transportation and logistics company. The firm offers fleet management, supply chain management, transportation management, leasing, commercial fulfillment, etc. products and services.

Ryder Q1’23 Conference Call

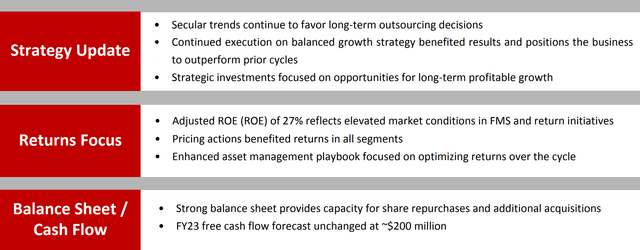

To adequately address the stressors of the current macro environment and Ryder’s present financial situation – its compounding adjusted ROE, for example – the logistics firm has updated its micro strategy to continue to favor outsourcing processes, ensure effective pricing strategy, and sustain a strong and continuously deleveraging balance sheet.

Introduction

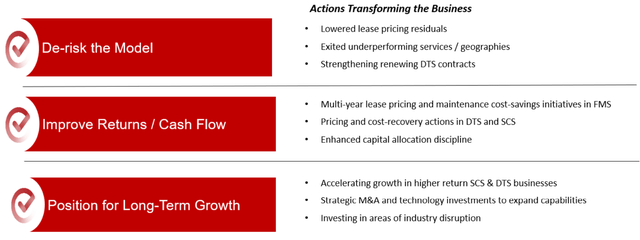

In the long run, however, Ryder maintains a threefold strategic model, centered around de-risking on operational and financial fronts, perpetual improvements to shareholder return capabilities, and positioning for long-term growth through opportunistic M&A, constant reinvestment and growth across the integrated supply chain and dedicated transportation solutions.

Ryder Q1’23 Conference Call

The combined effects of operational integration and margin-expanding products, investor return capabilities through repurchases and a steady dividend, and long-term megatrends favoring Ryder, alongside a general undervaluation, leads me to rate the stock a ‘buy’.

The firm only misses out on a ‘strong buy’ due to high debt levels and potential competitive intensity.

Valuation & Financials

General Overview

In the TTM period, Ryder – up 16.59% – has experienced superior growth to both the Supply Chain & Logistics Index ETF (SUPL) – up 6.16% – and the broad market, represented by the S&P500 (SPY) – up 14.59%.

Ryder (Dark Blue) vs Industry & Market (TradingView)

This reflects Ryder’s scaled revenue growth and cash flow growth across the past few quarters alongside the firm’s ability to adapt to macro volatility. That said, I believe the market continues to underprice Ryder’s operational strength and ability to generate quality returns with its capital.

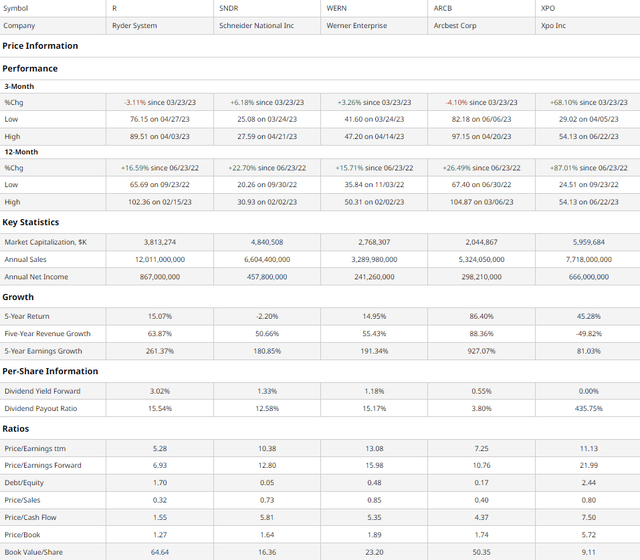

Comparable Companies

The ground logistics industry is one where activities are largely similar between peer firms, only differentiated through capital allocation and operational priorities. As such, the ground logistics industry maintains high competitive intensity, with the constant threat of backward integration from firms – i.e., Amazon (AMZN) – and downward price pressure. Therefore, Ryder is most comparable to similarly sized trucking-oriented firms, such as Green Bay-based Schneider National (SNDR), Werner Enterprises (WERN), trucker and less-than-truck provider ArcBest (ARCB), and small-freight shipper XPO (XPO).

barchart.com

As demonstrated above, Ryder has experienced the second-poorest quarterly and yearly price action, despite impressive long-run growth metrics, strong capital return capabilities, and value-centric multiples relative to peers.

For instance, Ryder maintains the lowest trailing and forward P/E multiples alongside the lowest P/S ratio, lowest P/CF, and lowest P/B among peers. Although this comes at the price of a relatively high debt/equity of 1.70, the company remains financially secure with a best-in-class book value per share of $64.64.

And despite strong trailing 5Y earnings growth of 261.37%, Ryder’s underperformance has been chronic, only growing 15.07% in terms of the share price.

Ryder’s value proposition is further buoyed by its quality 3.02% dividend, on the back of a relatively low payout ratio of 15.54%.

Valuation

According to my discounted cash flow valuation, at its base case, the fair value of Ryder is $104.28, meaning at its current price of $82.02, the firm is undervalued by 21%.

My model, calculated over 5 years without perpetual growth, assumes a discount rate of 9%, incorporating a lower equity risk premium but a debt-heavier cap structure. Additionally, on a more conservative level, I calculated a revenue growth rate of 6%, despite a trailing 5Y ~10.96% average CAGR, to address potential recessionary effects and downward price pressure.

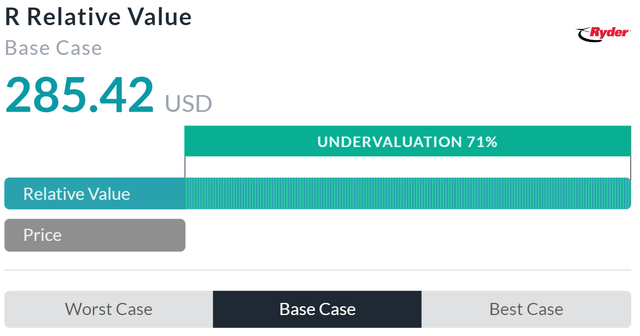

Alpha Spread

Alpha Spread’s multiples-based relative valuation tool, in my opinion, actually overvalues Ryder, calculating an undervaluation of 71%, meaning the stock should be worth $285.42.

However, as I’ve previously mentioned, I believe Alpha Spread overvalues the stock since its model is unable to incorporate Ryder’s relatively high debt levels, potential recessionary pressures, and dividend returns.

Strategic Investment’s Position the Company to Capture Macro Growth

Although Ryder faces significant headwinds from a potential reversion from offshoring – thus lower usage of ports and related company infrastructure, the firm has positioned itself for potential onshoring and nearshoring trends, with significant increases in cross-border revenues. On a more granular level, Ryder sustains an advantage in border-related trade activity through pre-existing relationships and integrated North American activities, Ryder has proven capable of dealing with large-order clients, from automakers to agrifood and beyond.

Ryder Q1’23 Conference Call

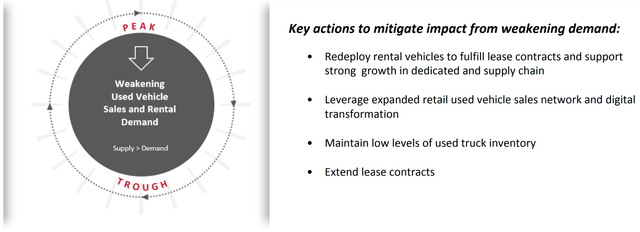

To further augment the firm’s promise of stability, Ryder has maintained a prudent asset management strategy, centered around the deployment of rental vehicle products across geographies, the expansion of retail used vehicle sales – which proved a positive development through the supply chain crisis of the past few years- and reductions in used truck inventory levels, thus reducing depreciation across the balance sheet.

Ryder Q1’23 Conference Call

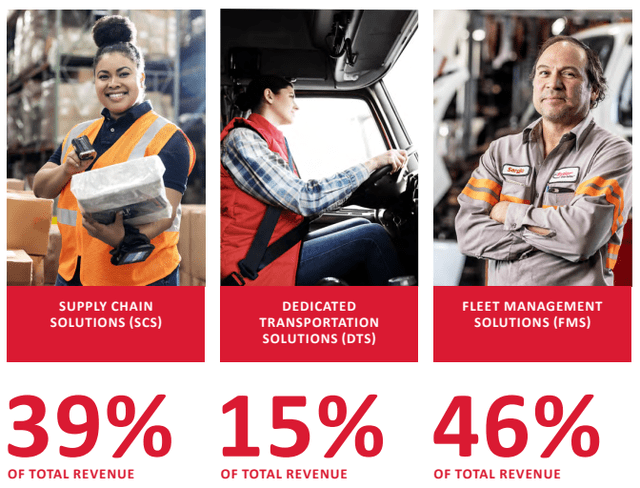

Further, emphasizing Ryder’s ability to support secular growth trends is its revenue diversification strategy, with revenues split between Supply Chain Solutions – offering end-to-end logistics solutions, Dedicated Transportation Solutions – which combines leasing and maintenance of Ryder products, and Fleet Management, Ryder’s original and still-largest business offering commercial truck rental and a range of tractor and trailer driven solutions. Furthermore, Ryder has seen significant end-market diversity, with the largest segments being Food & Beverage, accounting for 20% of revenues, Retail and Consumer Goods at 18% and Transportation & Logistics at 17%.

Ryder Annual Report 2022

Wall Street Consensus

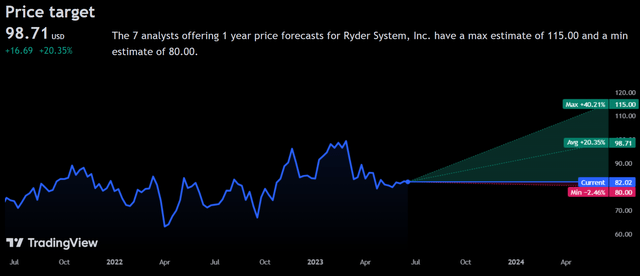

Analysts largely corroborate my positive view on the stock, projecting an average 1Y price increase of 20.35%, to a price of $98.71.

TradingView

Even at a minimum projected price decline of -2.46%, analysts predict a 1Y price of $80.00, which would still leave investors net positive when incorporating dividend returns.

This emphasizes Ryder’s resiliency and built-in growth regardless of broader headwinds.

Risks & Challenges

Demand Compression from Recessionary Pressures

Although Ryder has successfully navigated rising interest rate pressures of the past few years, sustained rate hikes may lead to reduced retail activity – already evidenced through poor consumer sentiment – and, through downstream effects, may reduce demand for Ryder’s products; this remains even more relevant for B2B, commercial activities.

Supply Chain Difficulty & Onshoring Concerns

Ryder, through its asset management strategy and nearshoring infrastructure, has effectively adapted to recent years’ supply chain concerns, generating significant earnings-based alpha through these steps. Increased industrial policy and regulatory pressures, though, may lead to reductions in multinational train activity and thus reductions in demand for Ryder’s highest margin segment, Supply Chain Solutions.

Conclusion

Going forward, Ryder seeks to leverage broad-based trends across logistics and trade, employing a nearshoring-centric, integrated offering which enables maximal shareholder returns in my view.

Read the full article here