Merlin Properties (OTCPK:MRPRF) has a solid portfolio of assets, despite the exposure to office. The story here is that the locations have some downside protection in the worst case scenario for offices, but it seems that Europe is going to be less resistant to the return to the office than the US, thanks in part to a worse economic situation. New office openings have excellent occupancy rates, and existing leases are substantially very long-term. There isn’t much risk in this vehicle which trades well below other REITs.

Salient Points

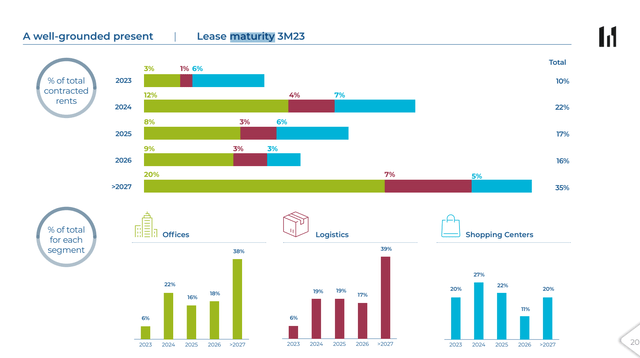

Let’s start with the lease duration profile since that’s a helpful baseline. the majority of the leases are going to roll-over later on. A good proportion 2027 or after.

Lease Maturities (H1 2023 Pres)

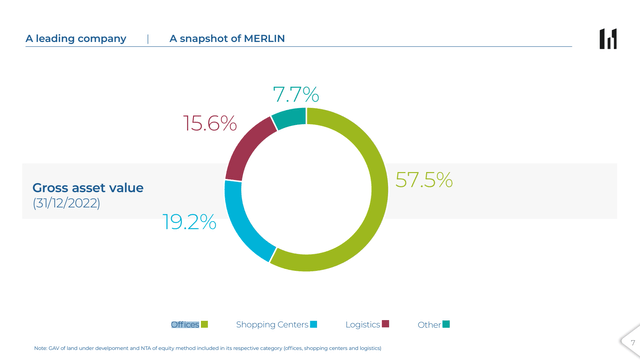

The majority of their portfolio is ultimately in office properties. Investors are right to be concerned with that. However, rates of remote work were lower in Europe once the deep lockdowns were over, and they’ve come down quite meaningfully on a sequential basis all the way from 2021. In 2020, 17% of the population employed were regularly working remotely. Now it’s down to less than 7%. The tougher economic climate: more severe inflation and being on the receiving end of inflation reduction initiatives in the US in terms of US wallet share, are all helping to reduce bargaining power against working in the office. Anecdotally, there was less enthusiasm for remote work in Europe to begin with. People in cities in Europe don’t deal with commuting issues or expenses like they do in the US.

GAV Distribution (Investor Presentation 2023)

The performance of new openings is important, which in 2023 had around 85% occupancy rate, which is good for a first year. In comparison major Manhattan office real estate has a little higher than that at around 90% occupancy rates, but as leases renew that figure is ticking down sequentially. With growing optimism about the US economy, it is conceivable that remote working will be even more resistant to back to the office mandates, which have been mounting in pressure. Merlin will be more insulated from that, being primarily an Iberian player. Also its current occupancy rates are above 90%.

Bottom Line

Merlin is interesting on a valuation basis. Compared to the general REIT, Merlin trades at almost half the multiple, 7x P/FFO vs. 12.85x. This has to do with the office exposure. Merlin trades in line with other US office REITs. We think this provides an opportunity. Firstly, Merlin’s real estate is less dependent on the performance of other office properties and of office occupancy in general because they are not located in cities like Manhattan, or equivalent commuter/high octane office cities in Europe. They are in Iberian capitals that have large tourism and other service industries that support them. A large proportion of the buildings are in urban areas, and even in quite historical buildings that could have easily been residential. It cannot be compared to an office dependent market like Manhattan. Moreover, there are other features around private debt and interest rates that make valuations more robust in these geographies, where concerns around commercial real estate, specifically office real estate in the US, could tank high density commercial zones in the US in a deleveraging event, which is something that markets are concerned enough about where REITs like Alexander’s (ALX) aren’t far from 2008 levels. The planning of cities in Europe is just too different for these concerns to be major for companies with central and urban real estate in Europe. Moreover, the other half of the real estate is in retail and logistics, where there isn’t any real concern. Gross rents are growing at 7% YoY, and they are getting into colocation centers to further diversify their exposures, which gets them in a position to provide IX services which benefit from network effects, with plans for 30% market share in Spain. Considering the economics of Equinix (EQIX) and their valuation, this makes Merlin pretty interesting. Equinix still hasn’t scaled up yet in the Spanish market. All debt is fixed, nothing matures until 2025, really not many risks on the horizon in the current market and only 10% above lows. A really decent proposition.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Read the full article here