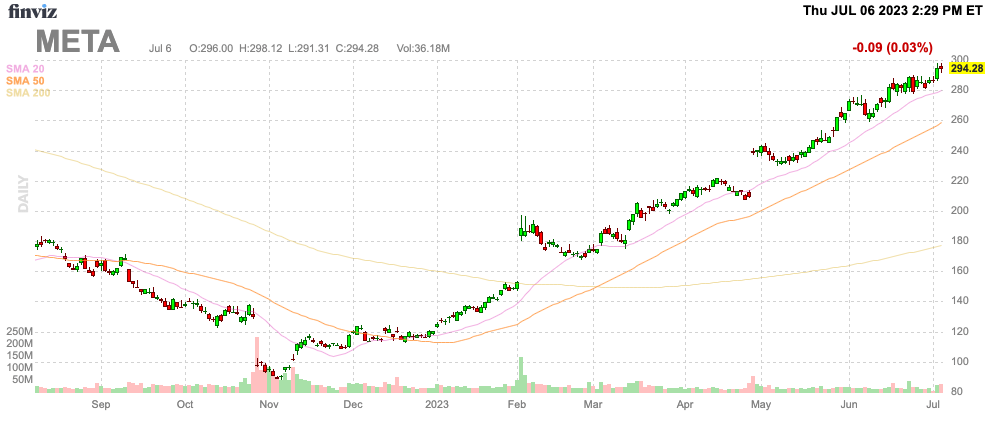

While I am a big fan of the stock, Meta Platforms, Inc. (NASDAQ:META) constantly launches new apps that don’t lead to much. The latest addition is likely the touted Twitter-killer app called “Threads” just launched by Instagram. My investment thesis remains Bullish on the stock, but the preference is for the social media platform to focus on all of the existing untapped assets.

Source: Finviz

Waste Of Money

Meta has constantly launched apps copying competitors to no success. The company has routinely launched new features to existing apps, like Reels for Instagram, to huge success.

Threads was officially launched on Wednesday night on Apple’s App Store and Google Play for Android. The app is labeled as a short-posting text app similar to Twitter, which is run by Elon Musk, whom CEO Mark Zuckerberg plans to battle in a cage fight.

Source: Instagram/Threads

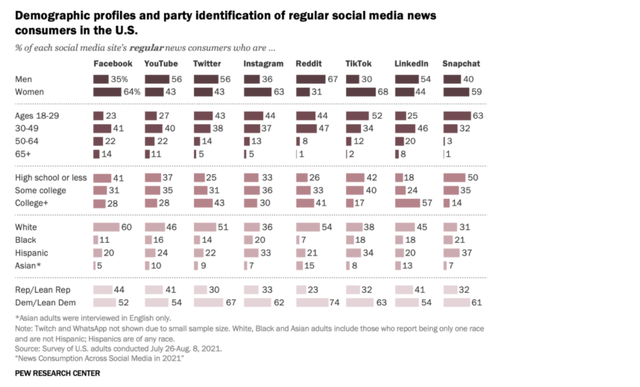

The major problem here is that Twitter and Instagram have vastly different user bases. Twitter is a social app for influential users in the media, political, and finance spaces focused on the news of the day while Instagram is an app for influential social media users focused on sharing photos and videos of themselves.

Twitter is tilted towards young males with a college education, while Instagram is focused on female users in the 18 to 49 crowd, with a higher portion of people without a High School education.

Source: Smart Insights

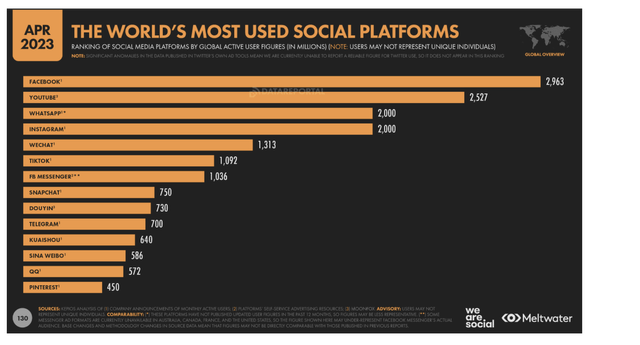

Outside of the logical platform disconnect, Meta Platforms already has 3 of the top 4 social platforms in the world. The company already has the highly successful WhatsApp with 2 billion global users that isn’t currently monetized, along with Facebook and Instagram.

Source: Smart Insights

Meta is still burning $17 billion a year in losses trying to build AR/VR devices and the Metaverse. The company already has its hands too full with the above massively popular apps and the Metaverse to spend time and money on a new app where the demographics of existing users doesn’t follow the profile of the typical Twitter user.

Immaterial Opportunity

The stock has rallied to nearly $300 on the news of the Threads launch. The site has apparently already had 30 million downloads in less than 24 hours in a good start, but one has to question how sticky a Twitter replacement will be after the initial surge of early adopters checking out the platform.

The problem is that Threads just won’t move the needle much either way. Meta is already a $125 billion business, and a user base 50% the size of Twitter only moves the needle by 1% to 5% per KeyBanc Capital analyst Justin Patterson, an estimated $800 million to $6.7 billion.

Also remember, Threads has a huge potential of only shifting usage between the platforms already owned by Meta: Facebook and Instagram. A lot of hard core Twitter users are highly unlikely to end up being top users of Threads due to the large audiences already on the social site.

Wells Fargo analyst Ken Gawrelski only forecast a 1% to 3% annualized EPS boost at maturity. Meta still has too much upside potential in WhatsApp and the Metaverse to chase such a small opportunity.

These market opportunities provide large business expansions beyond existing opportunities in the ad market. The company focused on efficiency would appear to have a better use of investment dollars than starting a new app with a dominant player already in existence with over 300 million DAUs.

As discussed in prior research, META stock remains cheap with a normalized 2025 EPS target of $20 based on eliminating up to $5 in losses related to Reality Labs. The division is focused on developing the crucial Metaverse and AR/VR assets for the future of the business, and the management team being sidetracked with a Twitter-like app doesn’t appear the ideal way to reach this EPS target.

At $300, Meta is still cheap now trading near 15x normalized earnings for 2025. The initial download success of Threads is likely a negative by encouraging management to double down on investments in Threads, while Reality Labs and WhatsApp deserves any additional focus on the executive team that it can muster.

Takeaway

The key investor takeaway is that Meta Platforms, Inc. stock is still cheap here after the massive rally, but Threads appears a huge distraction. The social media company has too much upside from existing assets to get sidetracked on a new app.

Meta would be best served by ending Threads, but either way the stock is still cheap below $300.

Source: Smart Insights

Read the full article here