MGIC Investment Corporation (NYSE:MTG) is a Milwaukee, Wisconsin-based private mortgage insurer, with a presence across auxiliary services such as underwriting services for retail mortgage lending and financing.

MGIC Annual Report 2022

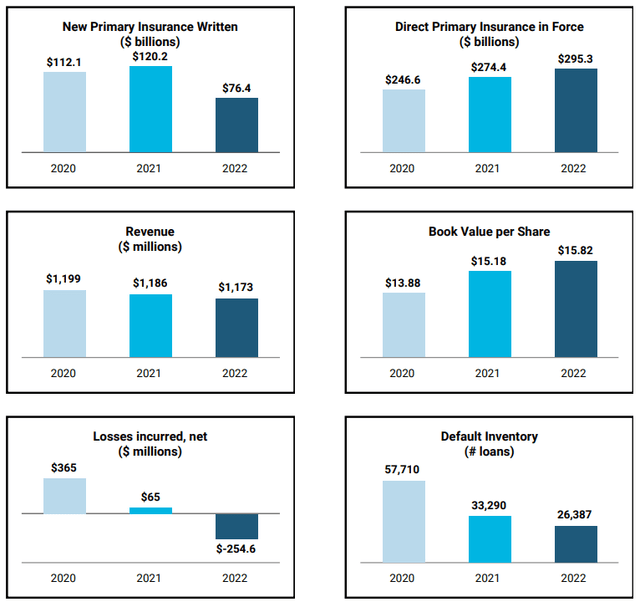

Through its suite of services, MGIC has achieved Q1’23 revenues of $283.96mn, a YoY decline of 3.62%, a net income of $154.55mn, declining 11.69%, and a free cash flow of $211.92mn, a 6.69% decline.

Introduction

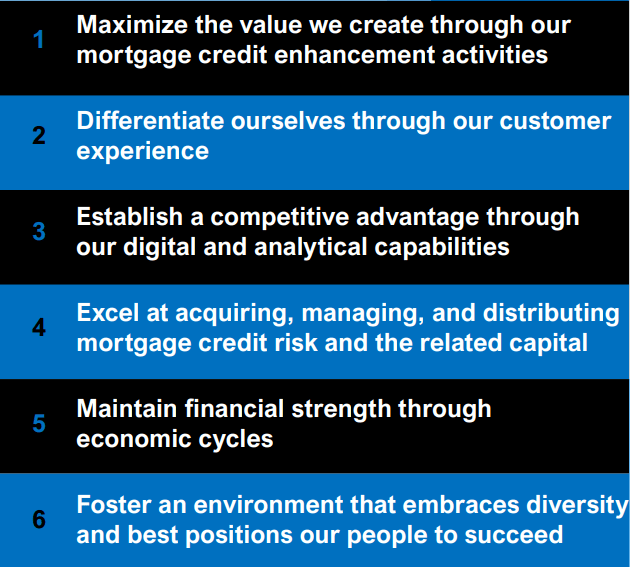

At the core of MGIC’s value creation strategy are six tenets: the company aims to position itself as a mortgage credit enhancement firm, providing services beyond insurance, in addition to differentiation through positive consumer interaction, efficiency advantages through digital and analytical capabilities, support for an effective capital allocation strategy, a constructive risk management strategy, and the creation of a talent retaining and inducing environment.

MGIC Barclays Global Financial Services Conference Presentation

Although the past quarter has seen MGIC grow by ~22.94%, reducing the overall upside of the firm, I believe the market is still hesitant to price in the firm’s superior risk management capabilities, interest rate hedging strategy, and disciplined and accretive capital allocation strategy, therefore rating MGIC a ‘buy’ for now.

Valuation & Financials

General Overview

In the TTM period, MTG- up 22.57%- has experienced similar price action to the Mortgage Finance Equities Index- up 22.63%- while outperforming the broader market, represented by the S&P 500 (SPY) – up 14.91%.

MGIC (Dark Blue) vs Industry & Market (TradingView)

I believe this reflects the ability of mortgage finance companies, alongside MGIC, to adapt to the higher cost of capital environment. Still, my opinion is that MGIC deserves to be priced higher than the industry it operates within due to relative value and superior capital deployment.

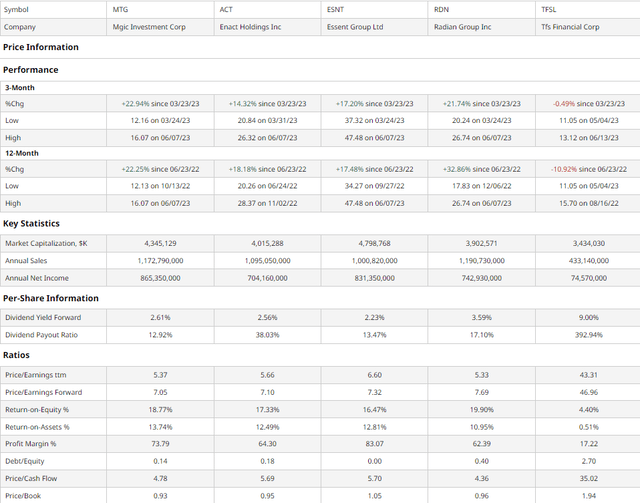

Comparable Companies

With the private mortgage insurance market is fragmented between vertically integrated lenders, regional competitors, and broker-offered services. As such, MGIC is most comparable to similarly sized mortgage finance companies, which experience similar macro environment convexity and sensitivities. Enact (ACT), for instance, is a holding company which provides mortgage insurance to lenders and investors or TFS Financial (TFSL), which offers mortgage lending and deposit gathering services. Operating under the same verticals alongside additional reinsurance products is the Essent Group (ESNT), while the Radian Group (RDN) offers all those plus title insurance.

barchart.com

As demonstrated above, MGIC has experienced the second-best annual price action, largely driven by its peerless quarterly growth of 22.94%. Despite that rally, I believe MGIC’s multiples and growth capabilities tell a story of residual growth.

This theme is best exemplified by the firm’s second-best trailing P/E, best forward P/E, second-best P/CF, best P/B, and overall strong multiples. Furthermore, MGIC is committed to fiscal discipline, with a debt/equity of 0.14 alongside exemplary profitability, and adherence to growth, with the second-best ROE and best-in-class ROA.

Therefore, with a solid dividend on the back of a low payout ratio in addition to low debt and compelling value, MGIC is positioned for reinvestment and shareholder returns.

Valuation

According to my discounted cash flow valuation, at its base case, MGIC’s fair value is $21.04, meaning at its current price of $15.22, the stock is undervalued by 28%.

My model, calculated over 5 years without perpetual growth, assumes a discount rate of 8%, a benchmark rate which incorporates MGIC’s low equity risk premium and debt-light cap structure. To account for recessionary pressures and potential refinancing and interest-related concerns, I project a real revenue growth rate of 2%, lower than the company’s 10Y smoothed-out CAGR.

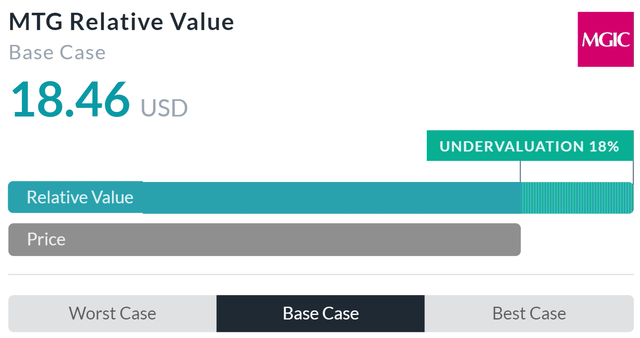

Alpha Spread

Alpha Spread’s multiples-based relative valuation tool corroborates my theory on the stock’s undervaluation, estimating a base case fair price of $18.46, meaning MGIC is currently undervalued by 18%.

Thus, taking an average of my DCF and Alpha Spread’s relative valuation, the true value of MGIC is $19.75, with the company undervalued by 23%.

MGIC’s Mortgage & Ancillary Services Drive Integrated Resilience & Growth

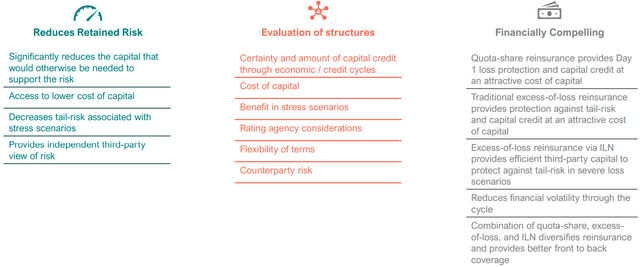

Of the strengths undergirding MGIC’s success is its risk management capabilities, driven by three core values; the reduction of retained risk, the constant evaluation of its capital and corporate structures, and more than sufficient risk mitigation products. In practice, this is demonstrated by MGIC’s fortress balance sheet, with a focus on low debt and quality assets. Moreover, the firm is dedicated to cost-effective reinsurance with flexible terms and adequate counter-party risk coverage.

MGIC Barclays Global Financial Services Conference Presentation

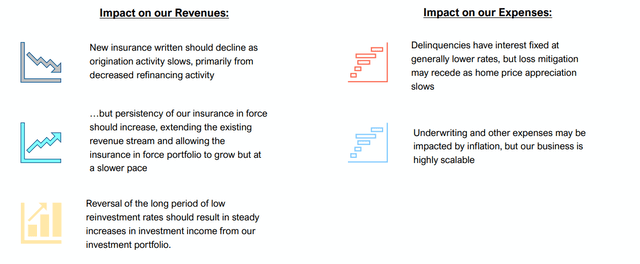

The firm’s risk-hedging success is best embodied by its assessment and adaptability to rising interest rates. Although the firm has seen reductions in income driven by new insurance written and increased expenses due to slowed house price appreciation, the company, over the past few years, has seen material net income increases through stable insurance fee growth, increases in investment income- with the firm’s AUM dominated by bonds, and cost-reduction through material scalability.

MGIC Barclays Global Financial Services Conference Presentation

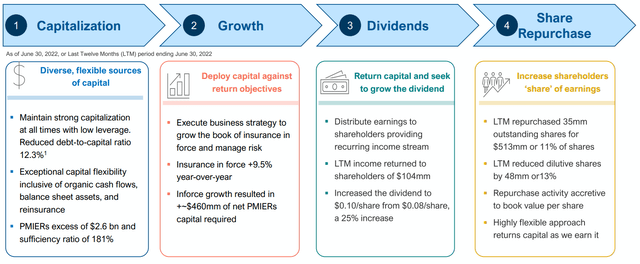

MGIC’s capital deployment strategy manifests the firm’s risk-mitigation-above-all-else strategy, with cash flow priority being the maintenance of low debt and capital flexibility, followed by organic growth, then shareholder returns and opportunistic repurchases. As such, investors can expect a stable company with gradual share price growth and income-based returns.

MGIC Barclays Global Financial Services Conference Presentation

Wall Street Consensus

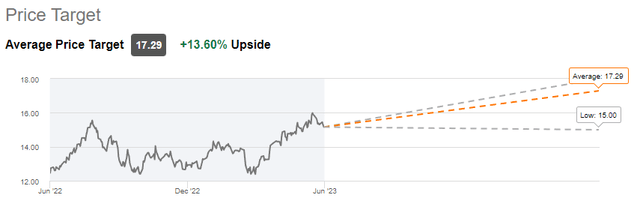

Analysts largely support my positive view of the stock, projecting an average 1Y price increase of 13.60% to a price of $17.29.

Seeking Alpha

Even at the minimum projected price of $15.00, investors can expect a positive return when incorporating dividends.

This positive view mirrors MGIC’s resilience in spite of macro headwinds as well as a level of undervaluation and growth prospects.

Risks & Challenges

Rising Interest Rates May Continue to Drive Downwards Demand Pressure

Although MGIC has adapted well to the temporary effects of interest rates, the long-run impacts may reduce demand for mortgages, and, by extension, mortgage insurance products. This would hamper MGIC’s cash flow generation and net income capabilities. If sustained, MGIC may acquire increased debt, reduce operational capacity, or reduce capital returns.

Continued Regulatory Shifts & Complexity

Both the mortgage industry and insurance industries are highly regulated, by federal and state entities alike. Given price regulation, MGIC may be forced to reduce prices and profitability. Even downstream, increased regulation for mortgage lenders may lead to reduced demand or escalating pass-through costs for MGIC, thus lowering free cash flow.

Conclusion

MGIC, in spite of macro headwinds, remains a resilient, steady growth-oriented firm with a debt-light capital structure, fortress balance sheet, and low implied volatility, enabling long-term stable growth and returns.

Read the full article here