Investment thesis

Microchip Technology (NASDAQ:MCHP) looks like a very attractive investment opportunity. The company’s financial performance and profitability metrics look super strong even in a harsh environment. MCHP’s valuation looks very attractive, especially considering the decent forward dividend yield and rich history of dividend hikes. I assign the stock a “Strong Buy” rating with no doubts.

Company information

Microchip develops, manufactures, and sells embedded control solutions used by customers of various end markets. MCHP has more than 2,800 microcontrollers in its product catalog. The company’s products are used in end products in the automotive, communications, computing, consumer, and industrial control markets. According to the latest 10-K report, the company has manufacturing and R&D facilities worldwide.

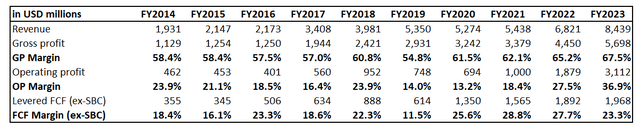

MCHP’s fiscal year ends on March 31. Microcontrollers represent about 56% of the company’s total sales. The Analog product line includes analog, interface, mixed-signal, and timing products.

Microchip’s latest 10-K report

The company generates about a quarter of its sales in the Americas and Asia, representing more than half of the total.

Financials

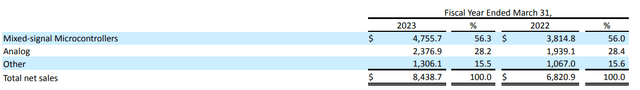

The company has a stellar “A+” profitability grade from Seeking Alpha Quant. Just look at the profitability ratios below, especially how they compare to the sector median and the company’s five-year averages. Impressive.

Seeking Alpha

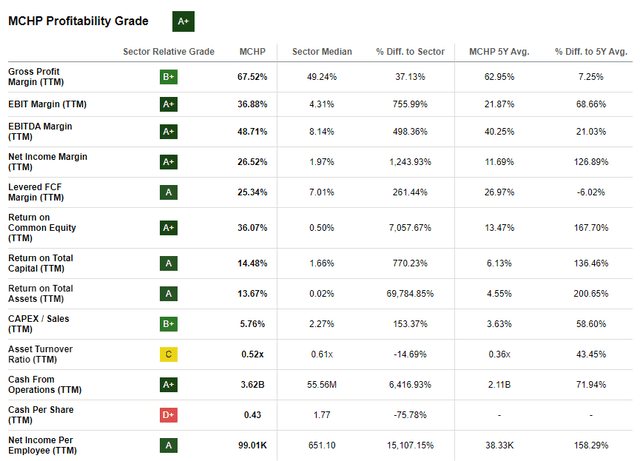

To ensure it was not a one-off performance, let me discuss the company’s long-term financial performance to see whether it was consistently successful. And it was, indeed. The revenue compounded at an impressive 16% over the decade. As the business scaled up, profitability metrics expanded significantly. For me, it is one of the most important signs that the management is strong in absorbing secular tailwinds. I like the free cash flow [FCF] margin, which is substantially above 20% even when I deduct stock-based compensation [SBC].

Seeking Alpha

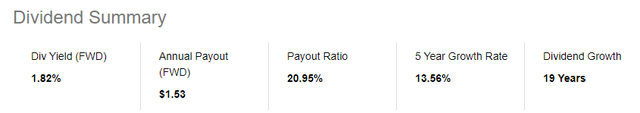

The company’s capital allocation has been consistently shareholder-friendly, with notable share buybacks and ever-growing dividends. MCHP has a very solid dividend scoreboard, mainly thanks to stellar consistency in dividend growth. The yield is not very high, but 1.8% looks decent.

Seeking Alpha

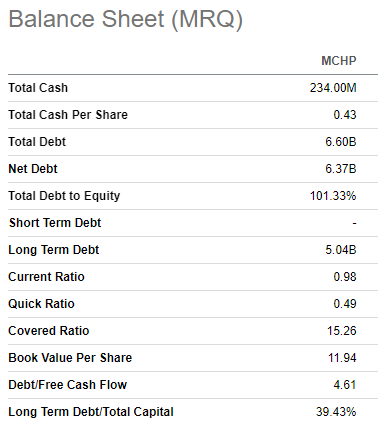

Microchip’s balance sheet might look not so weak due to its relatively low cash balance and substantial leverage ratio. But it aligns with the company’s capital allocation practices over the long term, especially during the low Federal Funds rates era. As the rates climbed, the company started allocating a significant part of available cash to the improvement of the balance sheet. Over the past four quarters, MCHP trimmed its net debt by about a billion. Also, the company’s high operating profitability ensures that the coverage ratio is very comfortable.

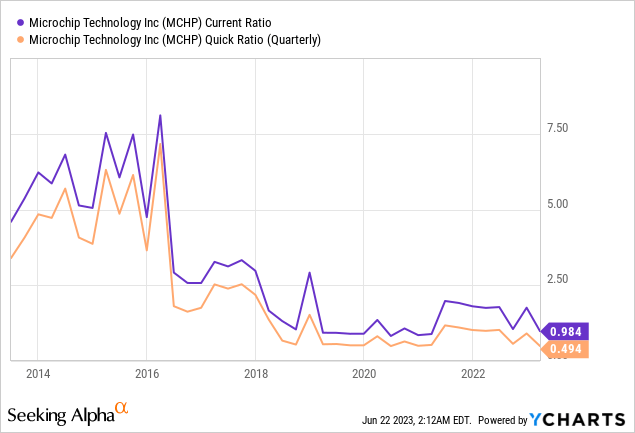

Seeking Alpha

Liquidity ratios might also look warning, but if we refer to history, we can see that the current ratio has been consistently dancing around one for the past several years. Half a point for the quick ratio also aligns with prior years. These “low” liquidity ratios were not a big problem for the company, as we have seen in the P&L dynamics of recent years.

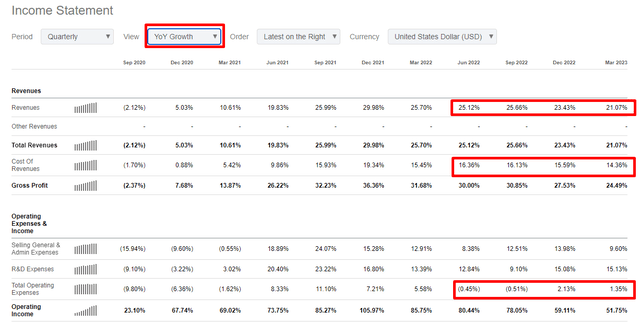

Now let’s move to the quarterly analysis to assess how the company navigates the challenging environment. Revenue growth momentum is robust at confident double digits. But what I like much more is that the topline increases much faster than expenses. I think that not so many companies in the world are expanding profitability metrics amid the current harsh environment.

Seeking Alpha

Overall, the company’s financial performance is nothing but stellar. I like that MCHP continues to improve profitability even under challenging circumstances. Some potential investors might not like the balance sheet, but my analysis suggests that it aligns with the company’s capital allocation history.

Valuation

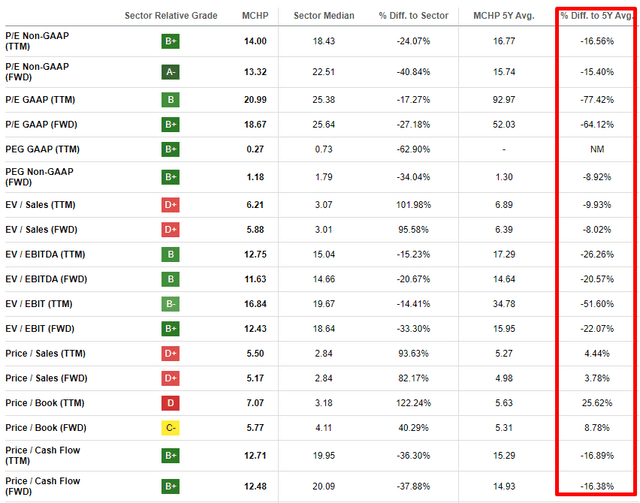

Microchip demonstrated a 20% year-to-date rally, which outperformed the broad market. On the other hand, the stock significantly underperformed the flagship iShares Semiconductor ETF (SOXX), which delivered a 42% price appreciation year-to-date. The company has a low “D+” valuation grade for the Seeking Alpha Quant, suggesting the stock might be overvalued. This is mainly due to the high price-to-sales and EV-to-sales ratios. At the same time, other metrics look relatively attractive, and most of the multiples are lower than the company’s 5-year averages.

Seeking Alpha

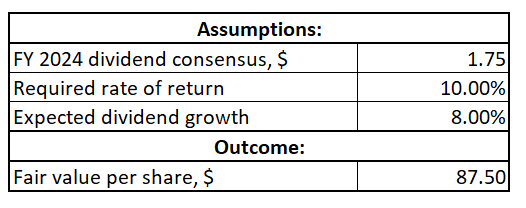

MCHP pays dividends to its shareholders, and the company has been consistent with nineteen consecutive years of dividend hikes. Therefore, I want to continue my valuation analysis with the dividend discount model [DDM[ approach. I think a 10% discount rate I use for all semiconductor companies would be conservative enough. Consensus dividend estimates suggest a $1.75 in FY 2024, which I use for my analysis. Since the company has a solid dividend growth history, I believe an 8% dividend growth rate would be a fairly conservative assumption for my DDM analysis.

Author’s calculations

As you can see above, the stock’s fair price is about $88 per share, meaning slight undervaluation compared to current levels. Now let me move on to the discounted cash flow [DCF] approach to get more conviction.

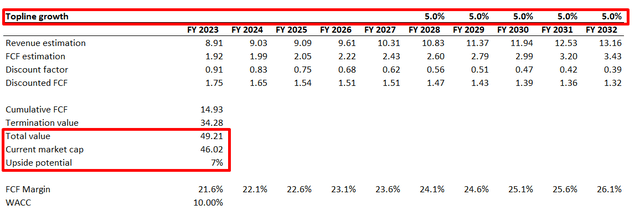

I use the same 10% discount rate for my DCF analysis. Consensus estimates for revenue growth are available up to FY 2027, and for a base case scenario, I use a very conservative 5% CAGR. For the FCF margin, I use 21.6% for FY 2023, the past decade’s average ex-SBC. I expect it to expand by 50 basis points yearly and peak at 26.1% in FY 2032. This might look too optimistic, but I want to add context here. The company delivered above 25% FCF margin in 2020-2022, meaning it is doable.

Author’s calculations

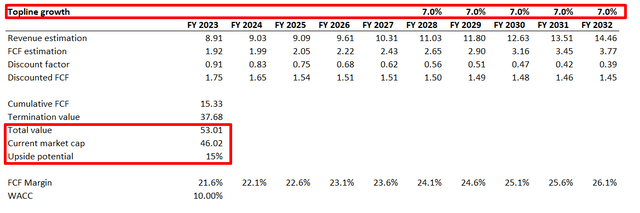

As you can see above, the stock looks about 7% undervalued. Such an upside might look unattractive to some investors, but let me remind you that just a 5% revenue CAGR is incorporated. Let me simulate a slightly higher topline CAGR at 7%, which is twice lower than the past decade’s revenue growth pace. With other assumptions untouched, the DCF now suggests the stock is about 15% undervalued.

Author’s calculations

Overall, MCHP stock is attractively valued at current levels. Based on my analysis, the upside potential might not look so high, but readers should remember those conservative growth assumptions incorporated into DDM and DCF.

Risks to consider

As a global company, MCHP faces significant risks inherent to generating revenues worldwide. About 75% of the company’s sales are generated outside the U.S., meaning it is vulnerable to several factors outside its control. The most apparent for me is foreign exchange risk, meaning the company’s earnings are at risk if unfavorable exchange rate fluctuations occur. A vast part of sales generated outside the U.S. also means high dependence on international trade regulations and tariffs. The company has no power to control it as well.

The company’s recent performance suggests that it has been resilient to headwinds businesses started facing in 2022. It is good, but global economic conditions are unlikely to ease in the nearest quarters meaning that the weakness in the end markets will eventually affect MCHP’s financials. In these circumstances, MCHP’s capital allocation of maintaining low cash and liquidity levels might be risky. On the other hand, the company generates a substantial FCF margin, meaning it is highly likely to find financing, if necessary, rapidly.

Bottom line

Overall, I believe the potential benefits of investing in MCHP stock far outweigh the risks. The company has a solid track record of success, and recent quarters’ performance suggests it is resilient to weather storms. I like the upside potential, especially with the dividend yield and growth consistency. The stock is an apparent “Strong Buy” for me.

Read the full article here