Most exchange traded funds or ETFs do not have a fixed amount of distribution. It varies based primarily on the current net income, with some focus on net asset value preservation. At the same time, most websites quote the trailing yield of a fund, that is, the sum of the distributions divided by the current price. While this enlightens all concerned parties about what came to pass, it would be inconceivable to utilize it as what to expect in the coming months. But most of the commenters of our last piece on PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (NYSEARCA:MINT) were having none of it. They seemed to be exercising the last bit of their patience in explaining to us exactly how wrong we were in thinking that.

So this one time, last August, the trailing yield was 0.82%, the yield based on the most recent distribution at the time was 1.69%, while we extrapolated that investors buying it at that point would earn more than double that yield.

Based on the last distribution amount and the price of $99.28 at the time of writing this article, MINT yields 1.69%. Most websites quote the trailing yield, which is the cumulation of the last 12 months (0.82%).

However, in the current environment of rising rates, both figures will actually be on the lower side of reality, and we should comfortably do well in excess of 4.0%. With the increasing earning potential and market volatility, investors are showing higher support for this ETF and looks like in 2022 it will spend a smaller amount of time trading at a discount.

Source: MINT: Cash Parking Pays Over 4% Now

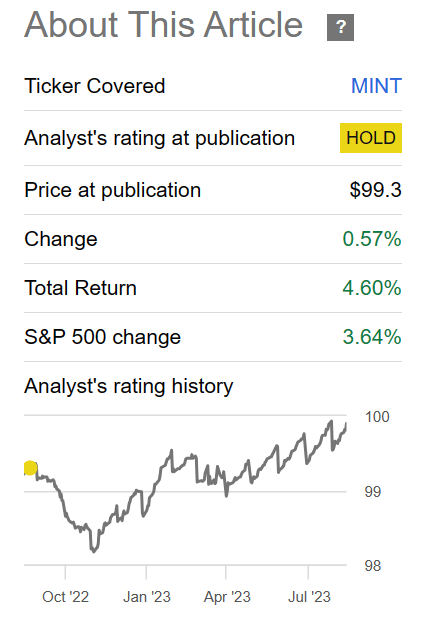

Check out the total returns, most of which came from distributions since then.

Seeking Alpha

Let us review this ETF again and see if we can rile up the crowd with our distribution predictions once more.

The Now

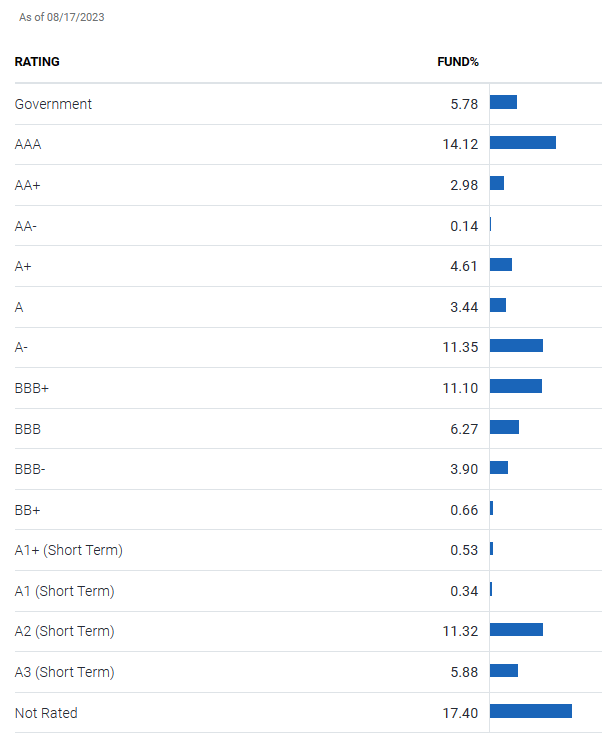

MINT’s objective is to maximize current income, preserve capital and meet the liquidity needs of its investors. It aims to beat “traditional cash investments, in exchange for a modest increase in risk”. With the risk-free rate actually providing a bang for your buck, MINT has improved its risk profile since last August. About 39% of the ETF’s holdings were unrated then, and that number is less than half that now, with virtually everything else being investment grade.

Fund Website

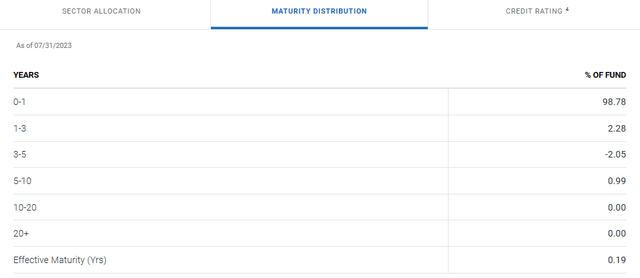

The high credit quality, coupled with most of the investments maturing in one year or less, gives the unitholders of this ETF very little to worry about in terms of credit and interest rate risk.

Fund Website

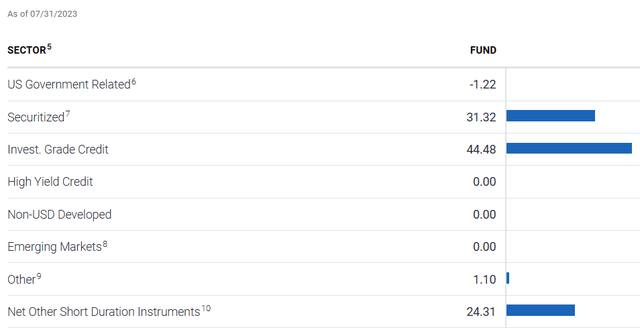

The negligible interest rate risk is even more apparent when we consider the 0.16 years effective duration of the portfolio. This more or less reflects how much the portfolio would decline in value with a 100 basis points increase in interest rates, and vice versa. With the short term nature of this ETF, it will be nimble enough to be relatively unscathed from the interest rate gyrations. Point to note, is that though still very low, the effective duration was 0.62 years during our last coverage of this ETF. A portfolio comprised 672 holdings makes MINT well diversified, with investment grade credit leading the charge, followed by securitized issues coming in second.

Fund Website

The MINT investor pays around 0.36% annually for all expenses associated with the fund operation. With the estimated yield to maturity at 6.12%, there is more than enough room for the investors to make modest returns on this holding.

Fund Website

Using the most recent distribution of 41 cents and the current price of $99.88, the current yield comes to around 4.93%.

Fund website

After accounting for expenses from the YTM, we expect the fund to yield closer to 5.80% in the coming months. This number is not as shocking as the jump we had predicted back in 2022, hence we suspect it will be easier to swallow.

Verdict

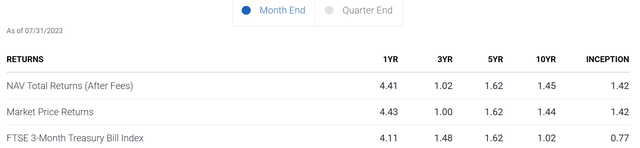

MINT’s performance versus its benchmark index, FTSE 3-Month Treasury Bill Index, has especially great considering that index does not have expenses, unlike the ETF.

Fund Website

MINT has beaten or kept up with the index in most time frames, as we can see above, only coming up short in the 3-year period. As we had said previously:

MINT will not be minting wealth for its investors anytime soon, that is not its purpose. Its purpose is to be a place where investors let their cash hang while they look for safe, higher-yielding investments or ride out the volatile times.

Source: MINT: Cash Parking Pays Over 4% Now

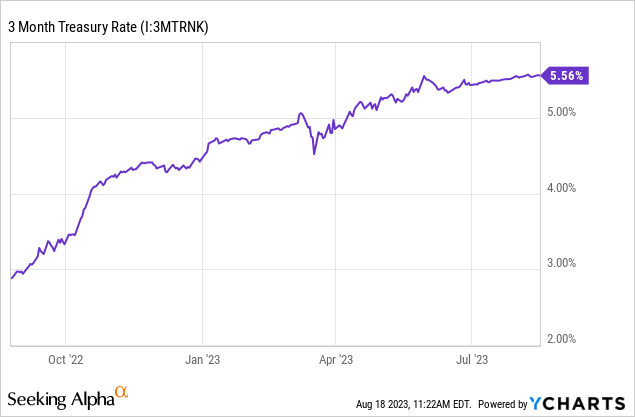

That was in August 2022, when we expected MINT to yield at least a 100 basis point more than the risk-free rate. Now the difference between the two is close to zero.

Is the small amount of risk that comes with owning MINT versus the short term treasuries worth the reward? That is a tough one to answer, and every investor must decide that for themselves. But our take is that worst case would be a total return (including low potential for losses) to be equal to the Treasury bill rate. So we think investors can park some cash here, although there are always more complex choices for even better returns.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here