Investment action

Based on my outlook and analysis of Mister Car Wash’s (NYSE:MCW) 2Q23 results, I recommend a buy rating. I believe the competitive threat mentioned by Driven Brands Holdings (DRVN) is not as bad as one imagined for MCW, especially with MCW gaining market share and printing positive comps. My simple DCF model also suggests the stock is undervalued using conservative assumptions. As such, I see the drop in share price as a buying opportunity.

Review

Both MCW’s 2Q23 revenue of $236.9m and adjusted EBITDA of $73.9mn were slightly below consensus estimates. Although results fell short, I do not believe the stock should have dropped as much as it did. Investors likely got cold feet because DRVN, one of MCW’s competitors, pointed out that the market’s intensified competition over the past few years has hurt business at DRVN’s older facilities.

As Jonathan mentioned previously, we’ve seen some weakness in our retail customer demand, continued unfavorable weather conditions and we’re also seeing an increase in competitive intensity. DRVN 2Q23 earnings call

Naturally, the comments spilled over and impacted MCW, given that both of them operated in the same industry. The concern here is how much it impacts the long-term profitability of the business, as DRVN management specifically called out the weakness of over-indexing older stores.

One, we talked about sort of three contributing factors to this year and our revised guidance for this year. Competitive intrusion is definitely one, and I mentioned that that is over indexed towards some of our older stores, and some of those older stores had I would say suboptimal real estate because they were built 10, 12, 15 years ago. DRVN 2Q23 earnings call

What further spook investors was that MCW’s management noted that more than 50% of their stores have a competitor that is operating within three miles. While all of these have merit, I have another view on the matter. I believe competition is not a new thing in business or industry at all. This is a rather commoditized business that has always had a lot of competition. I encourage investors to focus on MCW’s positive comp during the quarter as an indication that MCW is operating much better. Specifically, MCW is still gaining share and has built up a loyal base of customers.

So we’ve been duking it out on the street and delivering exceptional customer experience and I think at the end of the day, our numbers speak for themselves, right? We’re performing in a highly competitive market and we’re winning share and we’re maintaining customers and what we’ve built is a very loyal customer base. 2Q23 MCW earnings call

In my opinion, this is a promising opening for MCW. Because of the difficulties its competitors are having recently, I believe MCW will continue to expand its market share. As a result of rising capital costs, higher interest rates, and stricter lending standards, MCW’s management anticipates a slowdown in greenfield expansion by competitors beginning in 2H24. I believe this is good for the industry and MCW, as it means a lower supply glut in the future. Also, I believe that MCW will be able to acquire assets at a lower valuation thanks to the high rate environment forcing a resetting of valuation.

Valuation

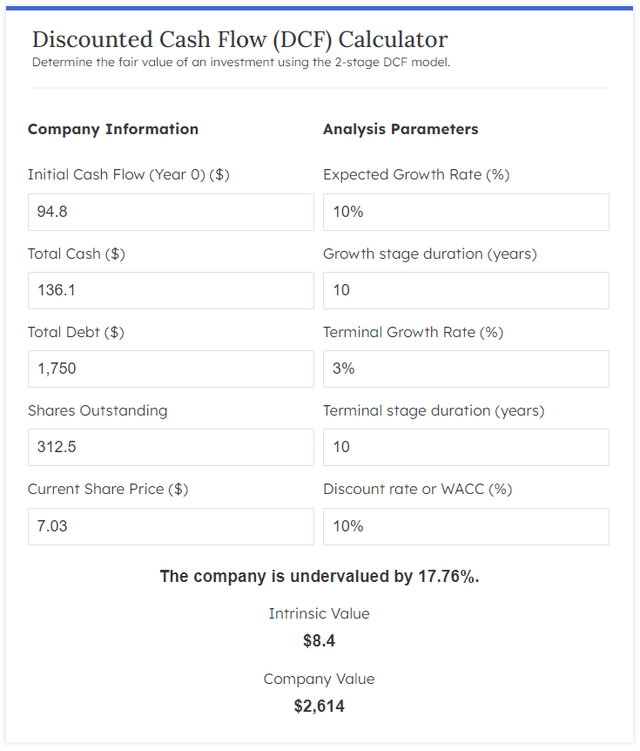

Finmasters

Using MCW EPS as a proxy for its FCF in this DCF model, the stock is undervalued by 18%. My DCF model assumes MCW can continue to grow earnings by 10% in the growth stage duration, which is easily achievable in my opinion. Historically, MCW has grown revenue by more than 10%, with expectations of mid- to high-single digits over the next 2 years. As MCW scales, there are a lot of fixed costs in the business that can be leveraged, driving margin improvement (the EBIT margin has expanded from 9% to 20% LTM). However, I think it is a fact that this is a commoditized business that will always face competition. As such, I am assuming a 10% discount rate to account for this risk.

Risk and final thoughts

The risk here is that we start to see MCW getting impacted by competition, despite management comments that they are fending it off well. One look at DRVN’s share price would suggest the potential downside that MCW stock could see. In conclusion, my analysis suggests a favorable investment outlook for MCW. Despite a slight dip in 2Q23 results and concerns over increased competition expressed by DRVN, I believe MCW’s market share gains, positive comps, and resilient customer base position it well. The stock’s drop appears overblown, creating a buying opportunity. While competition is inherent in the industry, MCW’s ability to maintain customers and expand during challenging times signifies strength. The anticipated slowdown in greenfield expansion among competitors and potential for lower asset valuations support MCW’s growth trajectory.

Read the full article here