Investment Thesis

Company Overview

Modine Manufacturing (NYSE:MOD), founded in 1916 and headquartered in Racine, Wisconsin, is a manufacturer and technology provider of thermal management and cooling systems and solutions. Since Q1 of 2023, the company has transitioned to a two-segment structure: Performance Technologies and Climate Solutions. It has the following brands:

Modine: Brands (Company Presentation Nov 23)

Strength & Weakness/Risks

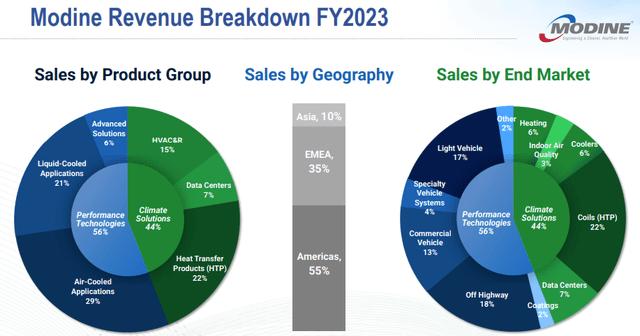

In an effort to refocus its business, Modine has been making the transition to the current two-segment business model for the past two years. The company regarded this effort to be critical to set it “on the path to success”. The two-segment business has taken shape with Performance Technologies [PT] of 56% of revenue and the rest is Climate Solutions [CS]. Not surprisingly, sub-segments of Air-Cooled Application and Liquid-Cooled Application accounted for 50% of revenue, while Heat Transfer Products (HTP) 22%. Thermal and cooling solutions are still the core, but segmenting out Data Center and HVAC&R sub-segments also has implications.

Modine: Revenue Breakdown FY 2023 (Company Presentation Nov 23)

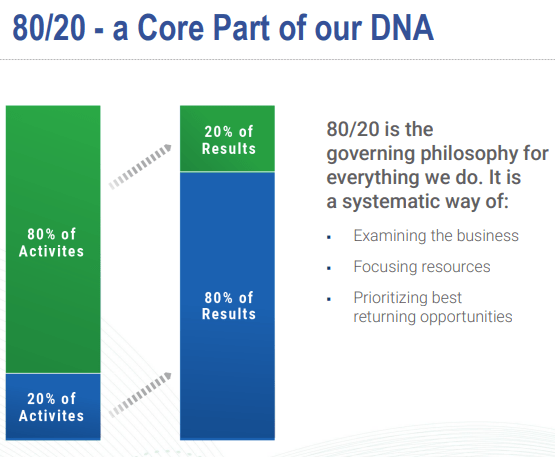

It uses a so-called 80/20 principle, through data analytics, to identify valuable inputs that can produce 80% output with 20% input. Simplifying and segmenting the business units help to identify which one is high-performance, so it can focus more resources and generate better return and margin. As a result, it identified data centers, electric vehicles, and HVAC&R as the best opportunities for profitable growth.

Modine: Refocus Resources to High Growth Markets (Company Presentation Nov 23)

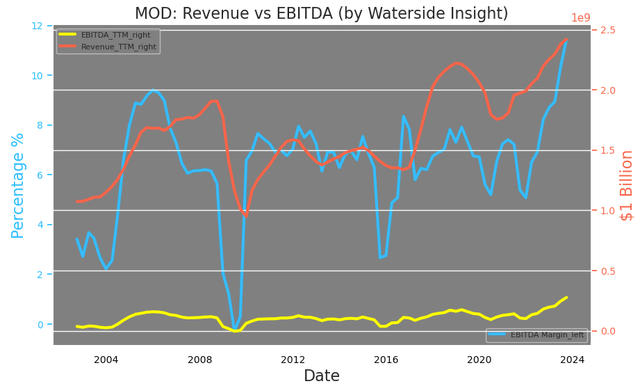

Modine has not only been increasing its revenue by about 40% since 2020 but also doubling its earnings during that time, resulting in its EBITDA margin surging to its highest level.

Modine: Revenue vs EBITDA (Calculated and Charted by Waterside Insight)

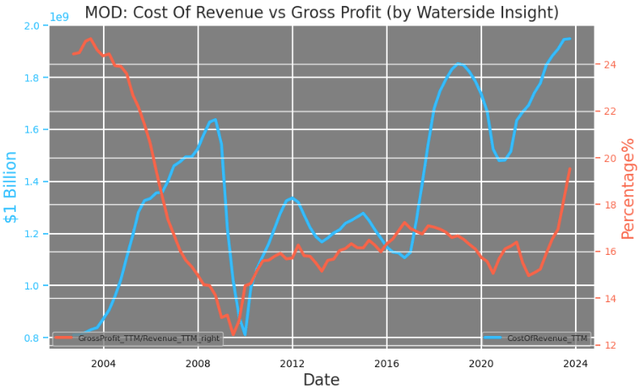

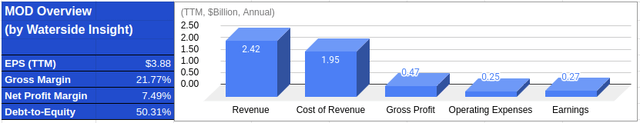

The company has a gross profit margin of almost 20% on a TTM basis. At its high in 2003, it was 25%. However, its cost of revenue is much lower back then. In a sense, should it be able to lower the costs, the gross profit margin can go up further.

Modine: Cost Of Revenue vs Gross Profit (Calculated and Charted by Waterside Insight)

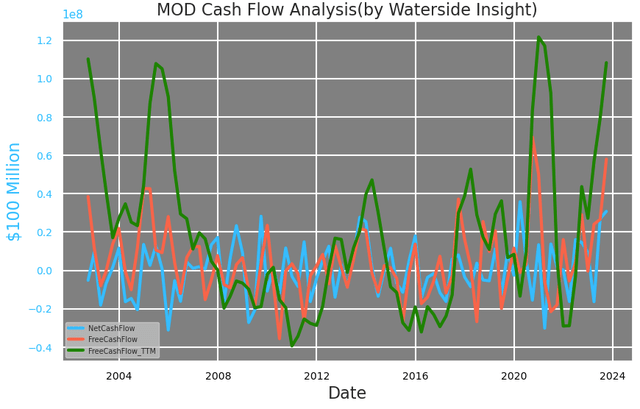

Its cash flow, both net and free cash flow, has reached where it was during 2003-2005.

Modine: Cash Flow Analysis (Calculated and Charted by Waterside Insight)

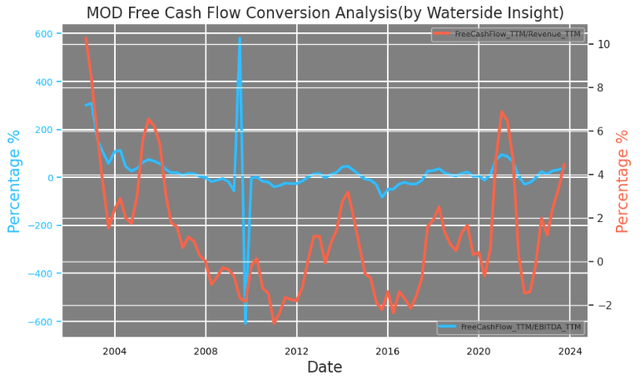

Modine has set a financial target of improving free cash flow to 5-7% of sales over the next five years (it reports net sales as net revenue). Looking back, it has not consistently achieved this level. Most of the time, its free cash flow was within the 2% range of its revenue. It has only reached these target levels a handful of times before. On the other hand, its free cash flow conversion from EBITDA fluctuated within the range of negative 25% to positive 30%, sometimes slipping to negative 75% such as in 2016. Stable free cash flow hasn’t been a strong suit for the company and it aims to change that.

Modine: Free Cash Flow Conversion (Calculated and Charted by Waterside Insight)

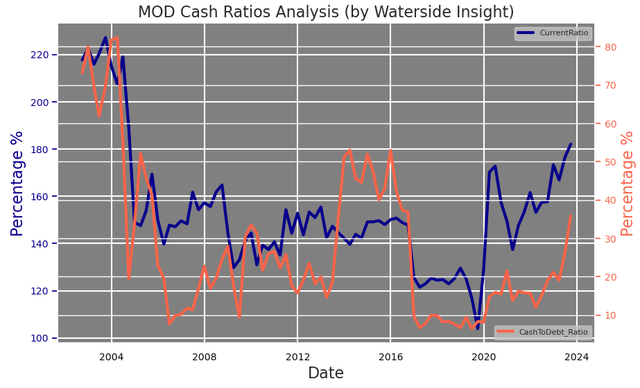

The company has brought down its short-term debt by almost $500 million since 2020, and it has now mostly long-term debt with about 51% debt-to-equity ratio. It has a 1.8x current ratio and a 35% cash-to-debt ratio. Since it’s mostly long-term debt, it is manageable with this ratio.

Modine: Cash Ratios (Calculated and Charted by Waterside Insight)

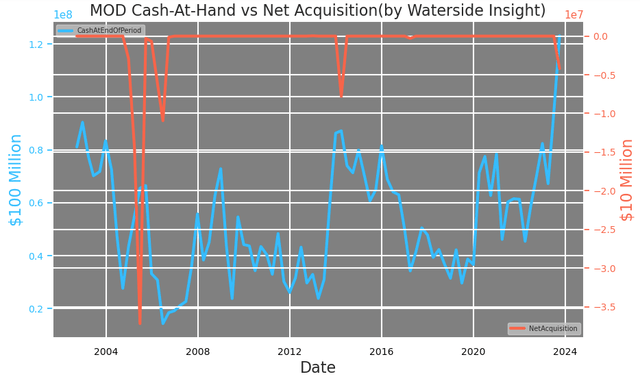

To speculate, we look at Modine’s cash and net acquisition in the coming years. The size of their previous acquisition is in the $10’s of millions, while their cash-at-hand currently has exceeded $100 million.

Modine: Cash-At-Hand (Calculated and Charted by Waterside Insight)

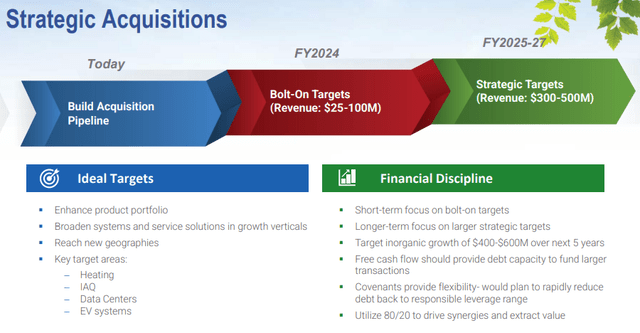

Certainly, return to shareholders could be a way as it hasn’t paid dividends since 2008. Still, we think with its price at a new high, it is more likely to make an acquisition or two within the previous purchase price tag range, should an appropriate opportunity arise. On July 1 this year, the company acquired all net operating assets of Napps Technology Corporation totaling $5.8 million, and paid $4.8 million during the Q2 of FY24. Napps’s business is mostly air- and water-cooled chillers, condensing units, and heat pumps. It aims to use the acquisition to boost its CS segment. Previously, its acquisitions were made when its cash-to-debt ratio was up to about 80% and 2.2x current ratio. It spent over $60 million in FY 2007 to acquire and build up Modine Brazil and Modine Taiwan, which have given rise to its current revenue composition of over 50% coming from outside of the US. Its current ratio in comparison is still a bit weaker than those periods, but if it can continue its current growth momentum, acquiring complementary business could potentially boost its margin and productivity. While the previous acquisitions mostly related to geographical expansion, we expect this coming round will focus more on horizontal integration in specific industries that can consolidate its in-house strength, and vertical acquisitions of some downstream growth gaining more access to customers. In fact, it has identified the ideal targets for its potential acquisitions in Heating, IAQ, Data Centers, and EV Systems. Its Heating and IAQ units although in the lower range of 15-20% 3-year CAGR, they have certain government funding and regulatory support for medium growth visibility. EV systems in the Advanced Solutions unit have a higher 35-40% 3-year CAGR with a wide range of market applications in bus & truck, specialty vehicle & off-highway, and last-mile delivery. Its fast 29% YoY growth helps to compensate for the slower of less than 5% YoY growth in air-and liquid-cooled applications units, which together are over 50% of total revenue. Another smaller unit, the Data Centers, grew almost double YoY and is also an important target. In reality, its cooling technology has no problem finding faster growth downstream applications in the Data Centers than in commercial vehicles and automotive industries.

Modine: Strategic Acquisitions (Company Presentation Nov 23)

Getting back to its 80/20 rule and turning our attention to the 80% of the activities that only generate 20% of results, we struggle to understand the saying that there is always 20% producing 80% results as fundamental as its DNA. In a way, these two ways of saying it are basically the same thing. A logical question to ask is, if there is, shouldn’t Modine be doing something about that inefficient 80%? Will there be a reduction in the inefficient part of the business?

Modine: 80/20 Core of DNA (Company Presentation Nov 23)

Perhaps a divestiture is in order? If so, the cash generated from the sale could also be used to make acquisitions as well. Our understanding is this 80/20 process is a transitional phase as the business directs more of its inefficient 80% resources to the high-performing 20%, it will gradually become more balanced. Although this transitional phase could last for a few years. During this process, both acquisition and divestiture are likely to happen in the medium term, in our opinion. So at the end of the day, this strategy should be taken by its core meaning, increasing efficiency and resource utilization. But this should be happening no matter what, even if it’s 50/50.

Ultimately, Modine wants to improve margin and cash flow by transforming into a company that is more versatile towards customers’ needs. the company’s latest product release called “AirWall ONE” is aiming in this direction. It is a product developed “from the ground-up with considerable input from data center end-users, consultants and contractors alike”. It has a parametric design that allows customers to configure the units to their site and cooling design more intricately and intelligently. Such an efficiency improvement will go a long way in handling the changing landscape of clients’ demands stemming from climate change conditions both in urban and rural areas. Also by working more closely with its clients, the company can form more enduring business relationships.

Financial Overview & Valuation

Modine: Financial Overview (Calculated and Charted by Waterside Insight with data from company)

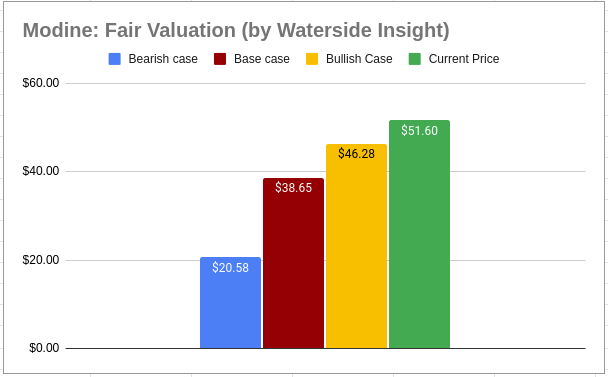

Based on the analysis above, we use our proprietary models to assess the fair value of Modine by projecting the growth ten years forward. We use a cost of equity of 9.88% and a WACC of 10.26%. In the base case, the company has greatly improved its free cash flow without experiencing any negative year in the next ten years, but volatility remains due to both the acquisitions and restructuring to sustain more stable growth; it was priced at $38.65. In the bullish case, its growth is not only stable but also experiences a certain spur to explode with further upside in the next 3-5 years; it was priced at $46.28. In the bearish case, it had only one year of downside growth within the next five years due to restructuring and acquisition integration; it was priced at $20.58. The market price currently has embedded a rich premium that has exceeded our bullish valuation for the stock.

Modine: Fair Value (Calculated and Charted by Waterside Insight with data from company)

Conclusion

Modine’s past two years of improving efficiency and refocusing its resources have brought on strong growth both on the top line and the bottom line. The company is poised to enter a new era in its growth pattern and trajectory. However, the goal the company set out for its free cash flow is something it has never consistently achieved in the past. It is not out of reach but the path to such stable growth may not be as smooth as it requires more restructuring and perhaps both acquisitions and divestitures. We are by no means bearish on the company, but the current market price is too lofty for the company to realize even in the most bullish scenario. We recommend a sell at this rich price.

Read the full article here