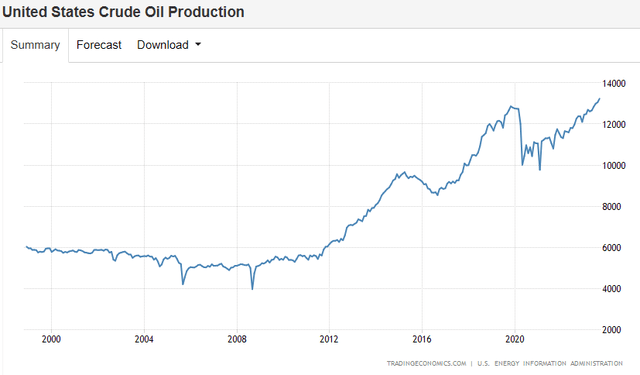

MPLX LP (NYSE:MPLX) continues to reward its unitholders by growing its distribution. Most investors look toward energy infrastructure companies to generate income rather than investing in a big tech company for capital appreciation. I have been bullish on master limited partnerships [MLP] focused on pipelines for years as I have believed this asset class was significantly undervalued and a strong investment for income generation. Investors should be aware that MLPs generate a K-1 tax package. For those who are interested in MPLX, I would recommend going to their taxation page (click here) and reading through the documentation, then discussing how investing in an MLP that generates a K-1 tax package will impact you with your tax professional. Units of MPLX continue to climb as they have appreciated by 10.53% YTD while generating $3.18 in distributions per share. I think shares of MPLX will continue to increase in 2024, and investors will continue to benefit from a growing distribution. The global energy demand continues to grow, and America’s oil production has never been higher, which is a winning combination for MPLX.

Seeking Alpha

Following up on my previous article about MPLX

On October 5th, I wrote an article about MPLX (can be read here), and I discussed how MPLX was still appreciating compared to other high-yield investments and why I felt MPLX would continue higher into the end of 2023. I am following up on this article as oil production continues to increase in 2023, MPLX increases its distribution, and the energy landscape is setting up for another strong year in the energy infrastructure space. I am very bullish on MPLX and feel it will continue appreciating in 2024 while generating high single-digit yields.

MLPs are synonymous with income generation, and MPLX continues to deliver larger amounts of cash to its shareholders through its growing distribution

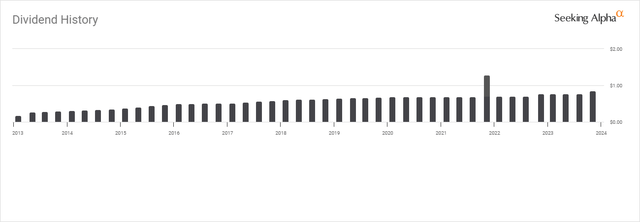

In Q4, MPLX delivered its 10th year of consecutive dividend increases as MPLX raised its quarterly distributions by 9.68% from $0.775 to $0.85. Unitholders continue to be rewarded for investing their capital in MPLX as shares continue to increase and more income is generated through the distributions. Rather than locking up capital in treasuries or CDs to generate a risk-free rate of return of around 5% in 2023, investors could have purchased units of MPLX at $32.58 at the beginning of January and generated $3.18 from its distributions. This would have been a 9.75% yield on invested capital if the income had been taken as cash, and if the distributions had been reinvested, this income stream would have grown on a quarterly basis. This is on top of the underlying asset of MPLX units appreciating by 10.53% YTD, so it outperformed risk-free assets on yield generated and by appreciating in value.

Seeking Alpha

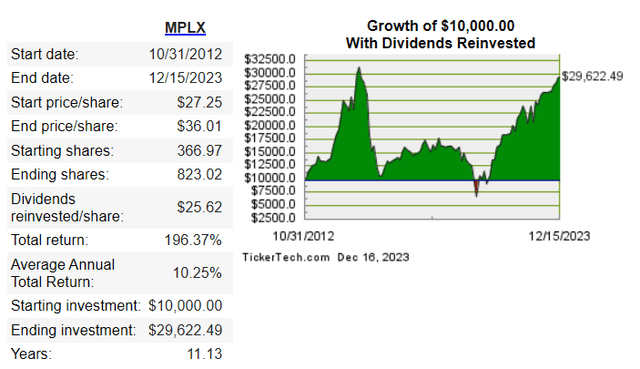

MPLX is a perfect example of why I love income investing. Units of MPLX have appreciated by 35.53% as units increased from $26.57 on October 29th, 2012, to $36.01 since inception. While a 35.53% return may not be enticing to some, MPLX has generated 96.39% of its initial unit price in distributed income, returning $25.62 to unitholders. Long-term investors hold an asset that has appreciated in value, generated its initial investment value in distributed income, and is still producing a forward yield of 9.44%. When you put the pieces together, MPLX has been a solid investment, and if you had reinvested all of the distributions since the end of October 2012, the amount of forward distribution income generated on an investment of $10,000 would have increased by 977.63% or $2,538.60. The combination of reinvesting the distributions and 10 years of MPLX increasing the distribution would have been a winning combination for income investors.

Dividend Channel

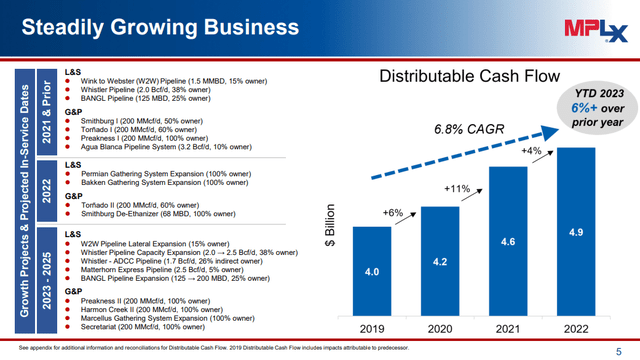

MPLX’s distribution has a 5-year average growth rate of 4.98%. In the first 9 months of 2023 MPLX has generated $3.96 billion of distributable cash flow [DCF] and has paid a total of $2.42 billion in distributions. MPLX has a 1.64x distribution coverage ratio for the first 9 months of 2023 as it’s paid 61.15% of its DCF to unitholders in distributions and retained $1.54 billion of its DCF. There is more than enough room in the retained DCF for MPLX to continue providing distribution increases on an annual basis while allocating billions toward new growth projects. Over the next 5 years, we could see MPLX increase its annual distribution to $4.34 per unit if it keeps up its current annualized growth trend. Based on the amount of oil being produced in America and the current distribution coverage ratio MPLX is operating at, I think they are in a position to keep increasing the distribution going forward.

U.S oil production is at all-time highs, and this sets up well for MPLX

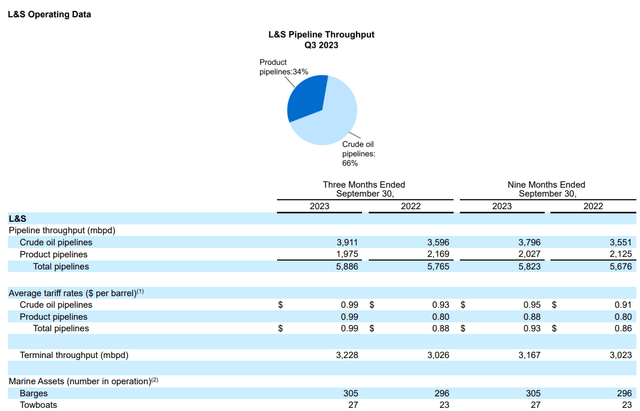

In Q3 of 2023, MPLX generated record amounts of Adjusted EBITDA at $1.6 billion and DCF at $1.37 billion while returning $799 million back to unitholders through distributions. In the first 9-months of 2023, MPLX has grown its DCF by over 6% YoY as more growth projects have come online. Its logistics and storage segment set a new record for crude pipeline throughput while its gathering and processing segment continued to support customers in key basins across the U.S. MPLX continues to progress through its 2023 capital allocation program, which remains on target for allocating $800 million of growth capital and $150 million of maintenance capital. In the logistics and storage segment, MPLX’s joint venture natural gas, crude, and NGL pipeline projects in the Permian are progressing, while the 2.5 billion bcf per day Whistler expansion project was completed at the end of Q3. MPLX is expected to place the Agua Dulce Corpus Christi Pipeline lateral into service in Q3 of 2024, and volumes are expected to ramp up on their Wink to Webster crude pipeline over the next 2 years.

MPLX LP

MPLX has roughly 16,000 miles of pipeline transporting crude and refined products. In the first 9 months of 2023, MPLX has transported 3,796 mbpd of crude and 2,027 mbpd of refined products. Despite what seemed like a war on oil and gas during the early days of this administration, U.S. oil production has increased to all-time highs while oil exports are also growing. As U.S. oil production grows to meet the domestic and global energy demands, more takeaway capacity will be needed, and energy infrastructure companies such as MPLX are an integral part of society. MPLX has 9 projects coming online over the next 2 years to help support the growth in oil production. As more fuel moves through their system, MPLX should continue generating record levels of Adjusted EBITDA and DCF, which will correlate to increased distributions.

MPLX LP Trading Economics

Risks associated with investing in MPLX

While the sentiment toward oil and gas seems to have retraced a bit, this is still an industry that some people want to see disappear. While oil and gas are embedded throughout our way of life, there are political risks and a changing energy landscape to consider. As solar energy becomes more affordable and electric vehicles become a more viable option, it could cut into the amount of fossil fuels needed. Oil and gas will be needed for decades to come, but the projections continue to change depending on who the elected officials are, and the rate of change can either increase or decrease. There are also regulation risks and seasonality risks; supply and demand continuously change.

Conclusion

MPLX continues to grow its footprint, deliver record levels of profitability, and distribute cash to its unitholders. Over the years, MPLX has been a strong income investment as the distribution has grown for 10 consecutive years. Investors who allocated capital to MPLX at the beginning of 2023 rather than going down the T-bill and chill path have done significantly better as MPLX has delivered more yield than risk-free assets in addition to capital appreciation. Today, units of MPLX yield close to 9.44%, and crude production in the U.S. is on the rise. I am bullish on MPLX because the demand for energy continues to increase, and it has correlated to growth for MPLX. I think capital is going to flow into the markets as the Fed starts cutting rates in 2024, and MPLX will benefit as investors look to recreate a high-yield environment for their capital. I am bullish on MPLX as a hybrid investment for investors looking to generate income while having prospects for capital appreciation.

Read the full article here