MSA Is On A Slow Growth Path

I have discussed MSA Safety Incorporated (NYSE:MSA) in the past, and you can read the latest article here. Over the years, it has expanded into new geographies and complementary technologies. After Q3, the company focuses on gas detection products and firefighter safety equipment. It has a book-to-bill ratio exceeding 1x, indicating sufficient future revenue visibility. It has recently grabbed a substantial contract from the U.S. Air Force to supply breathing apparatus and related kits. The company’s operating margin stability indicates its strategy to grow internationally.

On the other hand, the economic and industrial environment does not look conducive to rapid growth. MSA’s industrial PPE sales also went through a period of deceleration. Its cash flows have not improved sufficiently yet. However, a reduction in net debt in Q3 is right, given the economic uncertainty. The stock is relatively overvalued. Considering all the aspects, I reiterate my “hold” call.

Identifying Key Drivers

At the close of 2023-end, MSA will focus on its gas detection products. Recently, it has added the S5000 platform (S5000 operates over a wide temperature range using various gas sensing technologies) and a new lineup of portable gas detectors. It has also mitigated cyclicality following the acquisitions in the past years. Through business acquisitions, it has expanded into new geographies and complementary technologies.

The company’s sales have been resilient due to steady sales of firefighter safety equipment. This product category had the highest share of MSA’s revenues in Q3 2023. On top of that, fixed gas and flame detection and portable gas detection are used in highly regulated applications, such as critical infrastructure and for environmental safety. It also sells sensor technologies and software solutions in addition to the original product. Because these industries typically have high barriers to entry, MSA has a natural advantage.

Strategy And Industry Outlook

In my opinion, MSA’s near-to-medium-term outlook has to go through a few positive and adverse developments in the industry. For Q4 2023, its end markets remain healthy, evidenced by the book-to-bill ratio going up over 1x, indicating sufficient future visibility. The company’s management expects “mid-teens range” revenue growth in FY2023, assuming a typical seasonal reduction in backlog.

In 1H 2024, its backlog is expected to improve. It will likely face headwinds in the Industrial PPE market. On the pricing front, it saw a mild increase overall but lower than previously expected. The primary challenges, however, will emanate from high interest rates and inflation.

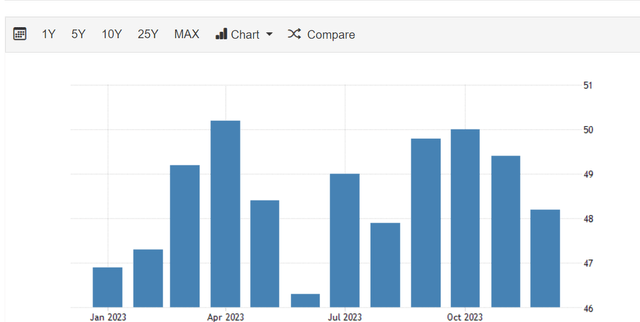

tradingeconomics.com

In December, the ISM Manufacturing PMI touched a four-month low at 48.2. This indicated contractions in output, new orders, employment, and purchase stocks. On the other hand, supplier delivery times improved over the past few months as material availability improved.

Many manufacturers have cut costs and continued working through stocks to fulfill new order requirements. MSA, for example, has reduced its backlog of fixed gas detection in firefighter protective apparel product lines. The PMI remaining below 50 can adversely affect MSA’s outlook, but as long as it stays close to that number, I do not see much to worry about.

Recent Project Awards

MSA bagged a $35 million contract with the U.S. Air Force in December to supply SCBA (Self-Contained Breathing Apparatus), chemical warfare components, and other respiratory kits. In Q3, it upgraded SCBA for the Pittsburgh Bureau of Fire in a $3.1 million contract award. It also received a $3.9 million contract to supply SCBA for Fresno.

It also looks to pursue sales of M1 SCBA in the international markets. In Q3, it received a $7 million contract to supply firefighters in the UK. As a result, its firefighter safety sales growth was 20% year-over-year in Q3 due to higher sales of breathing apparatus, firefighter helmets, and protective apparel.

The Key Drivers

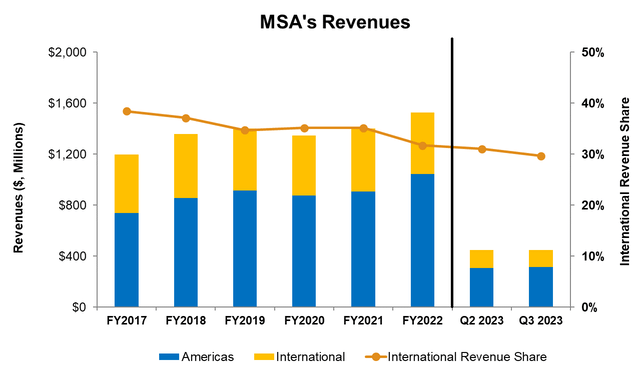

MSA’s filings

Geographically, year-over-year revenues in the Americas underperformed (14% rise) sales in international territories (25% up). In particular, fixed gas and flame detection sales were up 28%. The growth was driven by V-TEC io 1 self-retracting lifeline in warehouse applications. The International segment expanded its EBITDA margin by 940 basis points over a year ago. However, the shorter-cycle product line sales trend was relatively low in Q3. I think the company can see sales fall in industrial PPE in the near term.

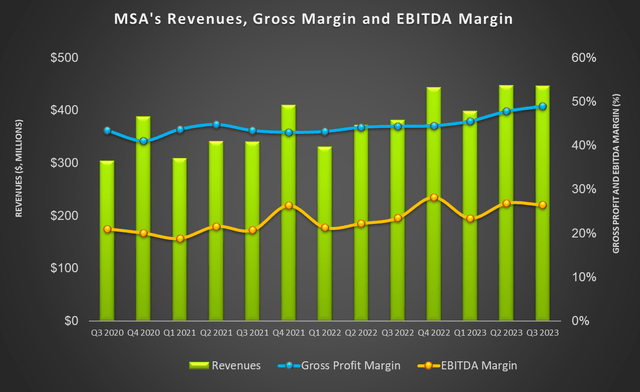

Seeking Alpha

MSA’s gross profit margin inflated by 460 basis points in Q3 compared to a year ago. The adjusted operating margin expanded, too. A rise in sales volume, an increased share of higher-margin products, and the benefits of the MSA Business System led to margin growth in Q3. I expect the operating margin to grow in the Americas and international territories in Q4.

Cash Flows And Debt Level

In 9M 2023, MSA’s cash flow from operations (or CFO) turned steeply negative from a healthy CFO a year ago. Although revenues increased, the divestiture of MSA LLC affected cash flows adversely. Free cash flow (or FCF) also turned negative and amounted to negative $97 million in 9M 2023.

MSA has a higher debt-to-equity ratio (1.0x) than some competitors (GRC, BRC, TNC). Its liquidity totaled $580 million as of September 30, 2023. Its net debt was reduced by $90 million in Q3 from Q2. Despite negative cash flows, lower net debt can allay investors’ concerns to some extent.

Relative Valuation

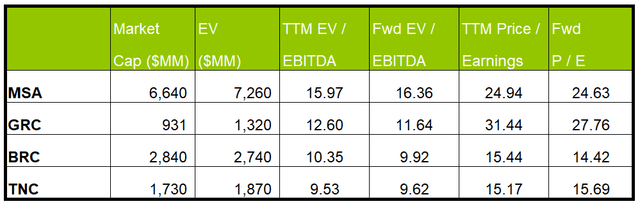

Author Created and Seeking Alpha

MSA’s forward EV/EBITDA multiple expansion versus the current EV/EBITDA contrasts its peers, which typically reflects in a lower EV/EBITDA multiple than peers. However, its EV/EBITDA multiple (16x) is higher than its peers’ (GRC, BRC, and TNC) average of 11.9x. So, the stock is relatively overvalued. However, it is trading at a discount to its past five-year average.

Considering every aspect, I think the stock can slip marginally from the current level. With strengthened strategic positioning, I believe it can recover and yield positive returns in the medium term.

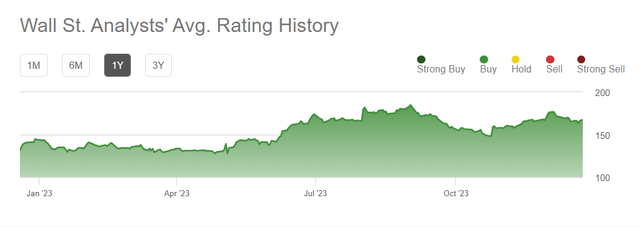

Wall Street Rating

Seeking Alpha

Two sell-side analysts have rated MSA a “buy” (including “Strong buy.”) One analyst rated it a “hold,” while none rated it a “sell.” The consensus target price is $188, suggesting a 13% upside at the current price.

Why Do I Keep My Rating Unchanged?

In my previous article, I found MSA on a firm footing as its book-to-bill ratio stabilized. The outlook for many of its product lines brightened, while its cost management strategy was key in steadying margins. However, its industrial PPE business faced headwinds, especially in non-residential construction. I wrote:

Improved labor and material availability have enhanced the outlook for firefighter and protective apparel businesses. The Bacharach acquisition continues to strengthen its HVAC and refrigeration product lines. The company’s recent foray into the restaurant sector and another large order from the U.S. Navy will propel it forward over the medium term.

After Q3, the company keenly focuses on fixed gas and flame detection and portable gas detection product sales. It received several awards for selling SCBA products in Q3. However, the industrial PPE sales might underperform in Q4. It churned negative cash flows in 9M 2023. So, I continue to rate it a “hold.”

What’s The Take On MSA?

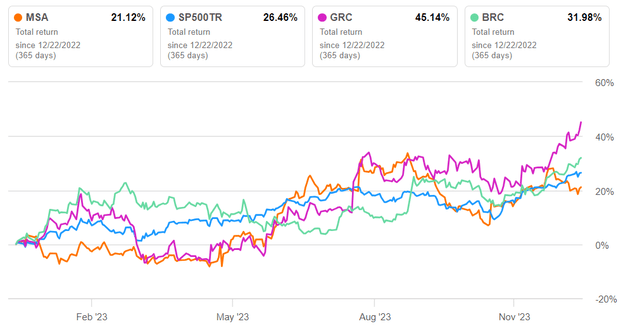

Seeking Alpha

The US economy and manufacturing industry environment are going through an uncertain period after the rise in interest rates. Despite that, MSA’s topline has been resilient due to steady sales of firefighter safety equipment. The recent project award from the defense force to supply respiratory protective equipment should push its revenues higher in 2024. Sales and operating margin in its international operations increased impressively in Q3 from over a year ago.

On the other hand, the sales deceleration in the industrial PPE business looks to continue in the near term. Its short-cycle product lines will likely trend lower. I think the company’s steps to reduce net debt will alleviate some concerns related to its negative cash flow. So, the stock underperformed the SPDR S&P 500 ETF (SPY) in the past year. Plus, the company has robust liquidity. Although relative valuation appears to be stretched, I think the stock deserves a “hold” call.

Read the full article here