I already acknowledged my worst REIT investments so far in 2023 the other day. Truth be told, I don’t think any of my serious subscribers were surprised.

Take Safehold (SAFE) for starters, which invests in ground leases. A quick glance at it this year shows that its share price dropped off a cliff.

Yahoo Finance

Next up, I featured Innovative Industrial Properties (IIPR). It had a similar cliff moment before “steadying” into a less steep decline.

Yahoo Finance

Perhaps it’s in recovery mode since June. It’s impossible to tell if it’s hit rock bottom or not. But if it has officially changed course, gosh, it’s taking its sweet time.

(Q2-23 earnings were good: normalized FFO per share of $2.07, topping the average analyst estimate of $2.00, rose from $2.06 in Q1 and from $1.98 in Q2-22).

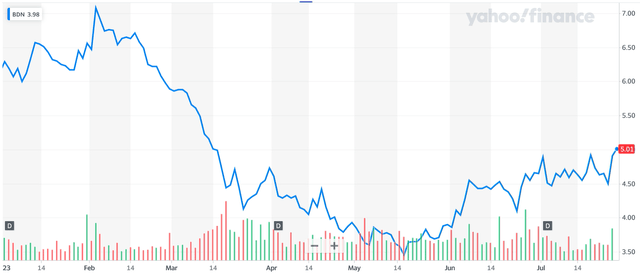

Finally, I listed Brandywine Realty Trust (BDN). Its “cliff” moment wasn’t a total nosedive. I guess that’s one positive thing we can say about it.

(Q2-23 FFO of $0.29 beats by $0.02).

However, fall it did, nonetheless.

Yahoo Finance

As I wrote in the previous article, “I’m very much about following the facts.” So here I am acknowledging that these three REIT picks look bad as July comes to a close.

Fortunately for me, there are more facts to follow than what merely meets the eye.

On How to Evaluate a “Losing” REIT

For the record, I’m still holding onto SAFE, IIPR, and BDN. Modest positions, mind you, but I own them all the same.

Moreover, I still believe they’re all headed higher. That’s where the facts are pointing me to.

And yes, you can say that I was following my facts back when I first recommended these positions. Yet look where they’ve taken me now.

I’ll accept that criticism, for what it’s worth. But it’s only worth so much in the long term.

I hope that doesn’t sound arrogant. By now, my followers should know that I’m willing to eat crow when crow needs to be eaten.

And sometimes, it definitely is. That’s why I publish a list of my biggest losers at the end of every year. (Or the beginning, depending on my schedule and market behavior.)

I’m fully aware that I’m not always right. However, unless you just started following me, you should be fully aware that I’m not in this for the short-term gains.

I’m in it for the long haul.

That’s why I analyze each pick repeatedly to see how to proceed week to week. Should I buy, sell, hold, double down… or even triple down?

The answer always depends on three follow-up questions:

- What are the company’s fundamentals?

- What is the stock’s current price point?

- What is the company’s likely future trajectory?

That’s why I got to end my previous piece by acknowledging that I’ve picked “far more winners than losers.” My fact-following journey has culminated in “annual returns averaging 12% since 2013.”

And that’s why I’m more than willing to admit my mistakes when they happen… and stick to my research when it says I didn’t make a mistake after all.

Which, I’ll admit, is sometimes much more easily determined than others.

More Moderation, Please!

The following picks fall into the “easier determined” category. Hands down.

Even in a lackluster REIT environment like the one we find ourselves in right now, there are always going to be standouts: Those companies that beat their indices or even many “regular” stocks by impressive amounts.

With that said… a note of caution, beginning with another few lines from “My Biggest Losers” writeup the other day:

The most important risk mitigator and the reason my portfolio has generated sustainable, low-double-digit returns for over a decade, is because of the power of diversification.”

There’s no reason to swing for the fences, no matter how strong the buy.”

In other words, don’t bet everything on a single stock. Don’t bet even most of what you got or half of what you got or a quarter of what you got. You need to invest in a number of assets across a variety of sectors.

I learned that lesson the hard way:

After losing practically everything back in 2008 (the Great Recession), I’ve clawed back with a much greater appreciation of capital preservation. In other words, I hate losing money and I will do everything in (my) power to protect my hard-earned principal at ALL costs.”

Again, that means being honest about when a stock is down and needs to be sold… when a stock is down and should be held or even bought further… when a stock is up and needs to be sold… or when a stock is up and needs to be held or even bought further.

So, without further ado, welcome to this year’s (so far) obvious winners category.

Ares Management (ARES)

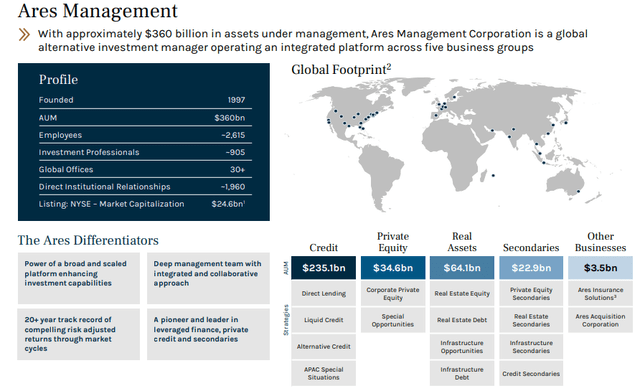

Ares Management was founded in 1997 and is a global alternative investment manager that offers investment solutions through its integrated platform of investment groups that includes credit, private equity, real assets, secondaries, and other businesses.

Its credit platform engages in direct lending and alternative credit, its private equity platform makes direct investments in non-publicly traded companies, its real assets platform invests in real estate equity, real estate debt, and infrastructure projects, its secondaries platform invests in private equity, credit, real estate and infrastructure through the secondaries market, and its other businesses platform consists of Ares Insurance Solutions and Ares Acquisition Corp, which is a special purpose acquisition company (“SPAC”).

Their largest investment group is its credit business which has $235.1 billion assets under management (“AUM”) followed by its real asset business which has 64.1 billion AUM.

As of June 30, 2023, ARES’ global platform had roughly $378 billion of assets under management and over 2,600 employees operating in North America, Asia Pacific, Europe, and the Middle East.

ARES – IR

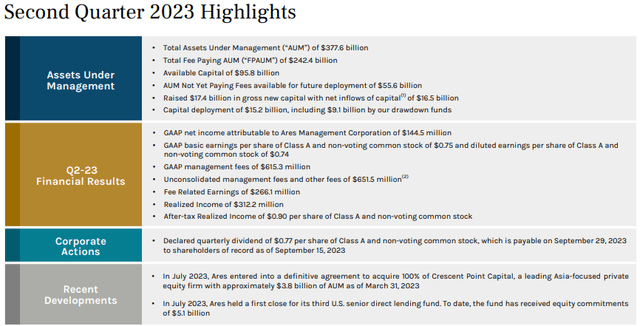

On August 1, ARES released 2023 second quarter results and reported GAAP net income of $144.5 million, or $0.74 per diluted share during the quarter compared to GAAP net income of $39.7 million, or $0.21 per diluted share in the second quarter of 2022.

After-tax realized income was reported at $292.2 million, or $0.90 per share during the quarter vs $233.3 million, or $0.74 per share for the same period in the previous year.

Additionally, ARES declared a quarterly dividend of $0.77 per share during the quarter which is payable on Sept. 29, 2023.

Michael Arougheti, the CEO and President of ARES, commented that the company demonstrated strong momentum during the second quarter with over $17 billion in new gross commitments and a strong pipeline of fund offerings.

He went on to say that they are well positioned to source attractive investment opportunities as private capital is taking a significant share of investing activity.

ARES – IR

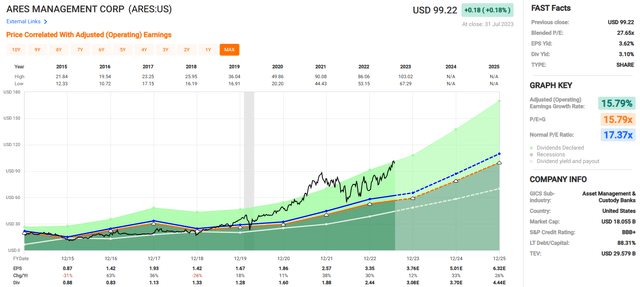

Year-to-date ARES stock is up 49.66% making it one of my biggest winners in 2023. Since 2015 the company has had an average adjusted operating earnings growth rate of 15.79% and a compound dividend growth rate of 24.60%.

They pay a 3.10% dividend yield that is well covered with an operating earnings payout ratio of 72.84% and currently trade at a P/E ratio of 27.65x which is stretched when compared to its normal P/E ratio of 17.37x.

Analysts expect high earnings growth over the next several years with adjusted operating earnings projected to increase by 33% and 26% in the years 2024 and 2025 respectively. While the future looks optimistic and ARES has been one of my best performers of 2023, we advise investors to wait for a pull back in price before initiating a position.

We rate ARES a Sell.

FAST Graphs

Toll Brothers Inc. (TOL)

Toll Brothers is a home builder that was founded in 1967 and went public in 1986. They design, build, and arrange financing for a variety of luxury homes including single-family residential homes, attached homes, master-planned and golf course communities, and low, mid, and high-rise communities.

TOL specializes in luxury homes and caters to first-time buyers, buyers looking to “move-up,” and active-adult and empty-nester buyers. TOL also caters to urban and suburban renters under their brands: Toll Brothers Apartment Living & Toll Brothers Campus Living, as well as design and build luxury condominiums through their joint venture: Toll Brothers City Living.

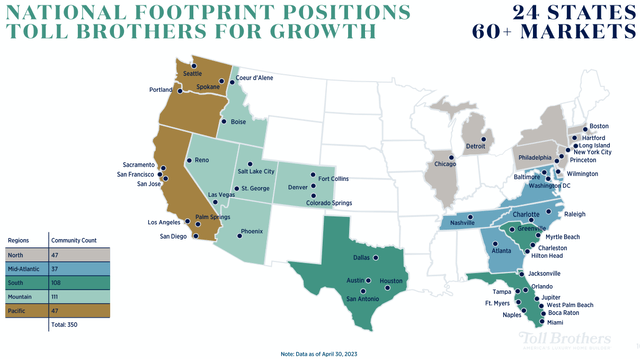

TOL is able to manage each phase of the homebuilding process as its operates its own engineering, architectural, mortgage and title, insurance, and land development and has a national footprint with a presence in more than 60 markets across 24 states.

TOL – IR

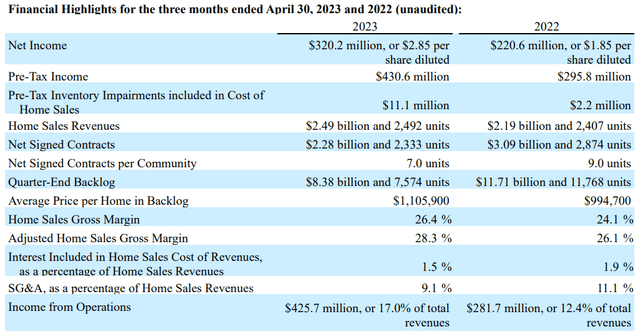

Toll Brothers released second quarter operating results on May 23, and reported home sales revenues at $2.5 billion, which were up 14% compared to the second quarter of 2022.

Net income and earnings per share (“EPS”) came in at $320.2 million and $2.85, respectively, which was a significant increase from their net income of $220.6 million and EPS of $1.85 reported during the second quarter of 2022.

Delivered homes was reported at 2,492 during the second quarter, which was up 4% from the same period in the previous year. At the end of the second quarter TOL’s backlog value was $8.4 billion, which is down 28% compared to the second quarter a year ago and 7,574 homes were in backlog which was down 36% compared to 2Q22.

Additionally, the company disclosed that during the quarter they retired $400 million of debt and extended their revolving credit facilities out five years and repurchased approximately 1.4 million shares at an average price of $58.14.

TOL – IR

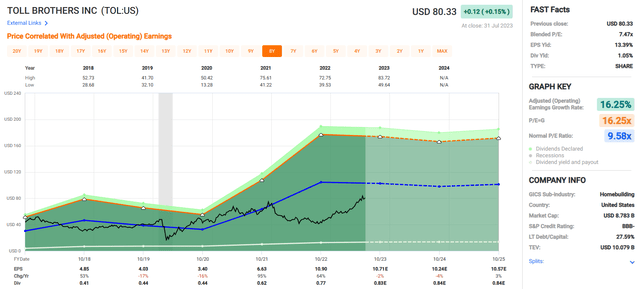

Year-to-date Toll Brothers’ stock is up 58.58%, making it one of my biggest winners in 2023. Since 2018 the company has had an average adjusted operating earnings growth rate of 16.25% and a compound dividend growth rate of 26.26%.

They pay a 1.05% dividend yield that’s very secure with an operating earnings payout ratio of only 7.06% and currently trades at a P/E ratio of 7.47x, which compares favorably to their normal P/E ratio of 9.58x.

Analyst expect earnings to fall by -2% in the current year and fall by -4% in 2024 before returning to growth with earnings expected to increase by 3% in 2025.

We rate Toll Brothers a Hold.

FAST Graphs

Arbor Realty Trust (ABR)

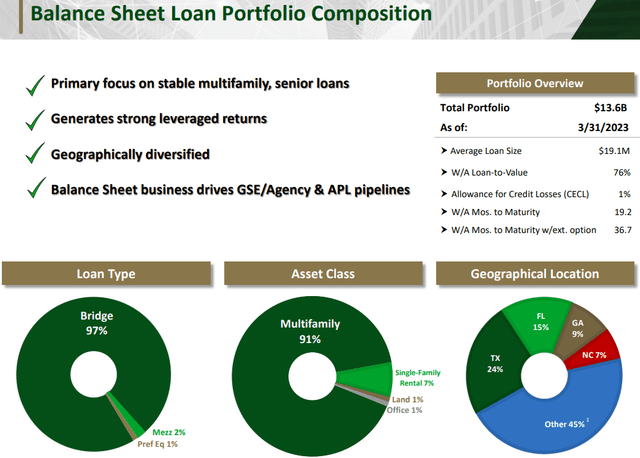

Arbor Realty Trust is an internally managed mortgage real estate investment trust (“mREIT”) that specializes in originating and servicing loans. ABR has two primary business segments, their Structured Business and their Agency Business.

Through their Structured Business they primarily originate bridge loans for multifamily properties but also issue mezzanine loans and preferred equity.

While the majority of ABR’s balance sheet loan originations are for multifamily properties, they also issue loans for single-family rental, land, and office properties through their Structured Business.

As of March 31, 2023, they had a 13.64 billion Structured Business loan portfolio with an average loan size $19.1 million and a weighted average loan-to-value (“LTV”) of 76%.

ABR – IR

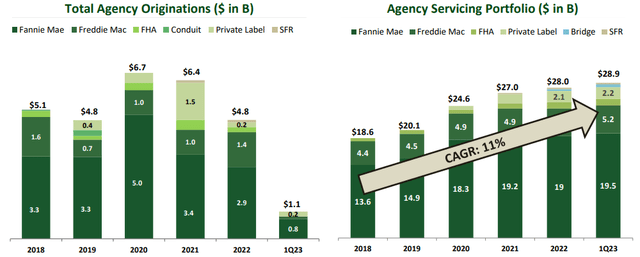

Arbor’s Agency Business specializes in originating, selling, and servicing loans issued for multifamily real estate through government-sponsored enterprises (“GSEs”) such as Freddie Mac and Fannie Mae.

ABR retains the servicing rights on almost all of the loans they originate and sell under the GSE programs and generates income with their Agency Business through servicing revenues. As of the end of the first quarter, ABR’s Agency Business had a $28.91 billion servicing portfolio.

ABR – IR

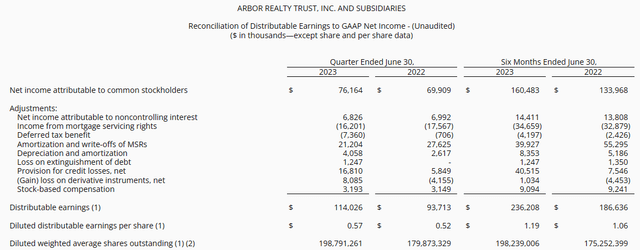

On July 28 Arbor released its second quarter results and reported net interest income of $108.5 million in the second quarter of 2023 vs $94.3 million in the second quarter of 2022.

Net income during the second quarter was reported at $76.2 million, or $0.41 per share compared to net income of $69.9 million, or $0.41 per share for the same period in the previous year.

Distributable earnings for the quarter came in at $114.0 million, or $0.57 per share vs $93.7 million, or $0.52 per share for the second quarter in 2022.

Additionally, ABR increased their quarterly dividend by 2%, to $0.43 per share, which represents an annualized dividend of $1.72 per share. Based on distributable earnings, Arbor’s dividend was well covered with a second quarter payout ratio of 75.4%.

ABR – IR

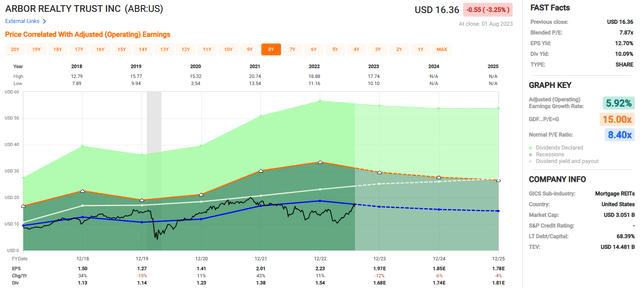

Year-to-date ABR’s stock has gained 19.70% making it one of my biggest winners in 2023. The stock took a significant hit in mid-April after a short report came out, but since that time it has recovered with a gain of approximately 50%.

Since 2018 Arbor has had an average adjusted operating earnings growth rate of 5.92% and an average dividend growth rate of 18.34%.

They pay a 10.09% dividend yield that is well covered with a distributable earnings payout ratio of 75% and the stock currently trades at a P/E ratio of 7.87x which is a discount to their normal P/E ratio of 8.40x.

We rate Arbor Realty a Buy and assign it a tier 1 rating.

FAST Graphs

In Closing

Over the years that I’ve been writing here I’ve been able to generate some exceptional gains.

Of course, in order to achieve the wins, you must often go “against the herd” and that means being criticized for making bad calls.

Today my investment portfolio is highly diversified, which means that I’m able to spread risk across various asset classes and sectors.

The key to the success is rooted in the concept of identifying companies with competitive advantages (or moats) with an emphasis on

- Quality

- Pricing Power

- Cost of Capital

- Economies of Scale

- Management

The common thread is here that these companies deliver the highest returns because they generate sustainable ROIC. Our “moat methodology” is proven and it’s the bedrock of our investment practices.

In other words, we’re not looking for the so-called “one-hit wonders.”

(Although I do own a modest position in Tesla (TSLA)).

That’s not our objective at all.

Instead, we’re identifying stocks that we can own for generations and that will deliver real economic value by investing capital at returns that exceed their cost of capital.

Stay tuned for my next article titled:

Don’t Get To Cute!

Thanks for reading and happy SWAN investing!

Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Read the full article here