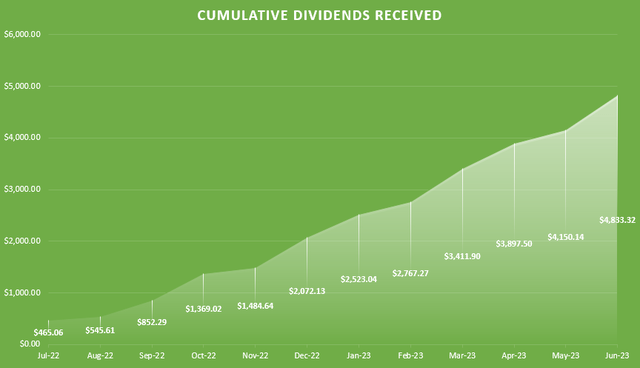

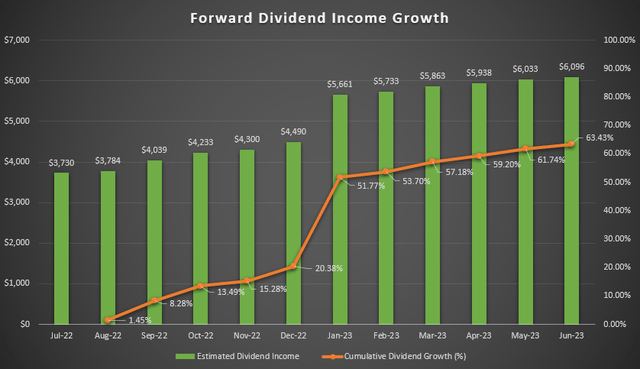

Once again, my dividend growth portfolio delivered an exciting achievement for the month. I set a personal high for dividends collected in a month at $683.18. This helped drive large growth in my cumulative dividends received, as well as strong growth in forward dividends via automatic dividend reinvestments.

Cumulative Dividends Received (Personal Spreadsheets) Dividend Income Growth (Personal Spreadsheets)

Background

The initiation of tracking my DGI income on Seeking Alpha can be found here. My dividend income is tracked across all of my portfolios (taxable accounts and IRAs, not 401ks). A large portion of the target $100,000 will be produced within retirement accounts and thus not easily accessible during early retirement; however, I will aim to maintain a 33% proportion of dividend income in my taxable account. With this level of dividend income and adhering to the 4% rule on the overall taxable account size, I will be able to reasonably consider a change in career into a more part-time role or pursue other methods of income until I am able to access retirement funds. Meanwhile, my retirement accounts will continue to build and grow until I’m ready to begin taking distributions to fund my retirement.

Forward Income Added

During the month of June, I added $62.70 in forward income, now making my total forward income $6,096. I received a record amount of dividends this month, $683.18. June is historically a strong month for me in terms of dividends received, and setting a new record is always welcome.

My breakdown of income added via new purchases, dividend reinvestments, and dividend rate increases does not include forward income added via re-allocation of funds that already existed within my portfolio (i.e., the money from the sale of one security invested into another). I will only be breaking down the effect of “new” capital entering the accounts in this section. Also, I would like to reiterate that increased income and tracking of funds from my recurring 401(k) contributions are not included in these articles, as the fund options available to me do not paint a clear picture on income and distributions.

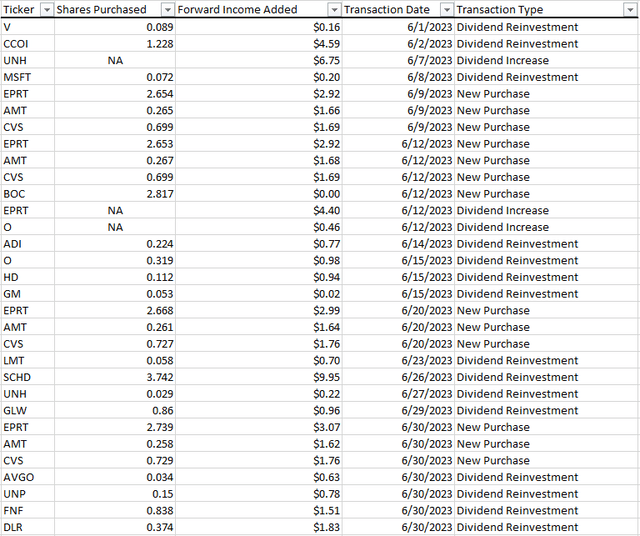

For my weekly $165 purchases I accumulated shares of CVS Health (CVS), American Tower Corp. (AMT), and Essential Properties Realty Trust (EPRT). Let’s first look at the forward dividends added via all new purchases:

- 2.854 shares of CVS, adding $6.91 in forward income.

- 1.051 shares of AMT adding $6.60 in forward income.

- 10.714 shares of EPRT adding $11.89 in forward income.

The massive month for received dividends brought healthy growth in my forward dividend income through the reinvestment of dividends. In total, I reinvested dividends in 15 different positions throughout the month:

- 0.089 shares of Visa (V) reinvested, adding $0.16 in forward income.

- 1.228 shares of Cogent Communications (CCOI) reinvested, adding $4.59 in forward income.

- 0.072 shares of Microsoft (MSFT) reinvested, adding $0.20 in forward income.

- 0.224 shares of Analog Devices, Inc. (ADI) reinvested, adding $0.77 in forward income.

- 0.319 shares of Realty Income Corp. (O) reinvested, adding $0.98 in forward income.

- 0.112 shares of Home Depot (HD) reinvested, adding $0.94 in forward income.

- 0.053 shares of General Motors (GM) reinvested, adding $0.02 in forward income.

- 0.058 shares of Lockheed Martin (LMT) reinvested, adding $0.70 in forward income.

- 0.029 shares of UnitedHealthcare (UNH) reinvested, adding $0.22 in forward income.

- 0.860 shares of Corning Inc. (GLW) reinvested, adding $0.96 in forward income.

- 0.034 shares of Broadcom Inc. (AVGO) reinvested, adding $0.63 in forward income.

- 3.742 shares of Schwab U.S. Dividend Equity ETF (SCHD) reinvested, adding $9.95 in forward income.

- 0.150 shares of Union Pacific Corp. (UNP) reinvested, adding $0.78 in forward income.

- 0.838 shares of Fidelity National Financial (FNF) reinvested, adding $1.51 in forward income.

- 0.374 shares of Digital Realty Trust (DLR) reinvested, adding $1.83 in forward income.

To round out my forward dividend income growth for the month, three companies announced dividend increases in June:

- UNH announced a 13.9% increase to the dividend, adding $6.75 in forward income. United Health continues to dish out strong dividend growth year after year, exactly what I was hoping to see.

- EPRT announced a 1.8% increase to the dividend, adding $4.40 in forward income. Essential Properties Trust has historically increased the dividend twice per year, making the smaller increase announced this month more digestible.

- O announced a 0.2% increase to the dividend, adding $0.46 in forward income. Realty income announces multiple dividend increases per year, so the small percentage increases throughout the year add up to an acceptable increase to the dividend annually for my goals.

Below you will find a transaction log of all transactions throughout the month. One item to note is that I did make a small purchase to accumulate more shares in one of my non-dividend paying positions. This company is Boston Omaha Corporation, a company I believe has a bright future and was trading at bargain prices.

As always, I take a look at the forward dividend income growth attributed to each of my defined transaction types. I love to see the strong growth from dividend increases and dividend reinvestments in June, as this represents the organic growth of my dividends. Even better, it looks like I have almost a perfect 50/50 split in dividend growth contributed by organic (div. reinvestments + div. increases) and inorganic (new purchases) growth at the halfway point through the year.

June 2023 Transaction Log (Personal Spreadsheets)

| Forward Income Added | Total Income Added in 2023 | Percentage of Total Income Added | |

| New Purchases | $25.40 | $225.30 | 50.41% |

| Dividend Reinvestments | $24.22 | $137.08 | 30.67% |

| Dividend Increases | $11.60 | $84.57 | 18.92% |

| Total | $61.22 | $446.96 | 100.00% |

Dollar cost averaging effects continue to get captured after an active month long in the transaction log. Halfway through 2023, my portfolio has taken advantage of dollar cost averaging via 175 transactions on 74 different trading days.

| Number of Transactions | |||

| New Purchases – This Month | 13 | New Purchases -2023 | 100 |

| Dividend Increases – This Month | 3 | Dividend Increases – 2023 | 14 |

| Dividend Reinvestments – This Month | 15 | Dividend Reinvestments – 2023 | 61 |

| Total | 31 | Total | 175 |

| Number of Days w/ Transactions – Jun. | 14 | Number of Days w/ Transactions – 2023 | 74 |

Change In Portfolio Holdings

I made one change to my portfolio through the sale of one company and the full re-allocation of cash into one new company. This was a major transaction, as the position that was replaced was one of my larger dividend producers. The stock that I sold during the month was Franchise Group (FRG), a sad day as I had high long-term hopes for the company. However, the board-approved deal to go private forced me to sell. It proved to be difficult to find a suitable replacement for this interesting company, but ultimately, I found an attractive candidate in Altria (MO). Their long history of healthy dividend growth and current starting yield made it an easy choice, even better the roll-over of cash from the FRG sale into MO came out to nearly a perfectly equal amount in forward dividends.

Portfolio

No large shake-ups in my portfolio this month, other than the 1-for-1 exchange of Franchise Group for Altria. I am continuing to see the strong representation I was hoping for in my Visa, Microsoft, and Analog Devices positions. Microsoft in particular is really starting to flex its muscles, a development I was hoping to see.

| Symbol | Percent Of Account | Est. Annual Income |

| SCHD | 17.52% | $1,280.42 |

| MSFT | 7.24% | $96.70 |

| V | 6.22% | $78.78 |

| ADI | 5.67% | $167.36 |

| AMT | 4.37% | $236.37 |

| VICI | 3.43% | $284.95 |

| CCOI | 3.33% | $309.83 |

| AVGO | 3.30% | $116.98 |

| EPRT | 3.17% | $252.34 |

| HD | 3.02% | $136.05 |

| MPW | 2.88% | $603.88 |

| UNP | 2.87% | $122.02 |

| WSO | 2.80% | $120.48 |

| O | 2.75% | $235.67 |

| CMCSA | 2.67% | $124.86 |

| MO | 2.55% | $353.92 |

| LMT | 2.47% | $107.67 |

| ALLY | 2.41% | $179.42 |

| MPLX | 2.39% | $364.36 |

| DLR | 2.31% | $165.26 |

| GLW | 2.24% | $119.83 |

| AMZN | 2.19% | — |

| UNH | 2.12% | $55.36 |

| CVS | 2.04% | $119.56 |

| EPD | 1.98% | $245.94 |

| SBUX | 1.74% | $62.44 |

| FNF | 1.44% | $120.45 |

| BOC | 1.29% | — |

| CARR | 1.08% | $26.89 |

| GM | 0.51% | $7.91 |

Looking Forward

In July, I will allocate my weekly recurring $165 purchases into companies with healthy, strong cash flows that I find are at attractive valuations. As it turns out, that results in just one change in my recurring purchases from last month. Swapping out CVS with Enterprise Products Partners, I will be purchasing new shares every week of AMT, EPD, and EPRT.

As we are at the midway point for the calendar year, I plan to release a separate article this month that dives into my portfolio with greater detail.

The conclusion of July 2023 will represent one full year since I began documenting my dividend growth journey. I plan to take an in-depth look at the past year and reflect on how 12 months of dividend growth investing has impacted my portfolio and my life. I couldn’t be happier with my decision to start this series, and I want to thank you all for your support and suggestions.

Summary

Halfway through the year and I’ve already achieved several milestones and personal records, hard to complain. Healthy contributions from several factors helped propel my forward dividend income by $62.70, a 1.04% increase month-over-month. My estimated forward dividend income now stands at $6,096, a number I can’t wait to continue to grow for the rest of the year. Every day is a day closer to the ultimate goal!

Read the full article here