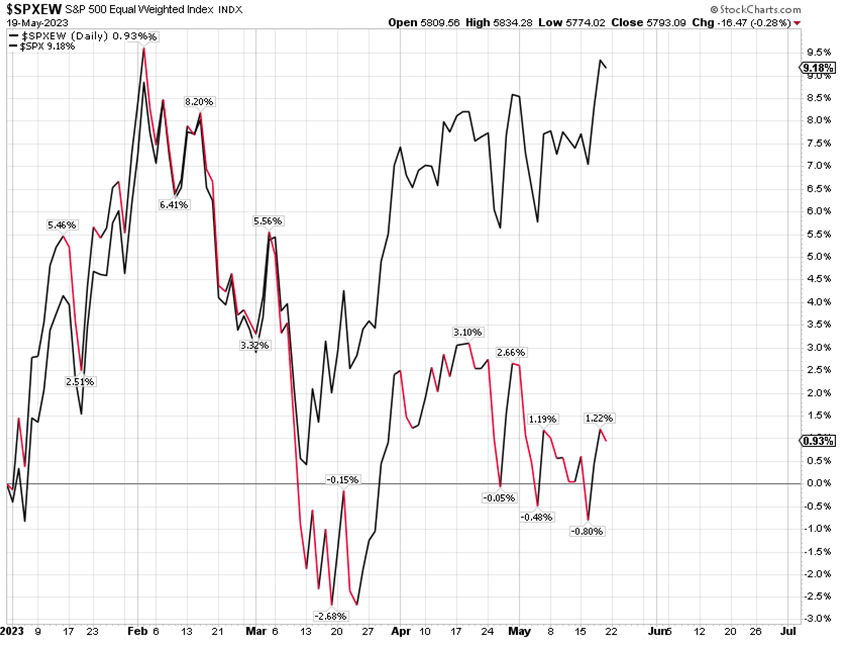

The S&P 500 Index (SPX) made a new high for 2023 last week while its cousin – the S&P 500 Equal Weighted Index (SPXEW), in which every stock in the index has equal weight irrespective of the market cap – was actually down for the year at the lows of last week. What gives?

As this chart shows, the gap started to widen when Silicon Valley Bank failed, and it has gotten progressively worse. For the stock market to remain on a firm footing, that must reverse. The equal-weighted index is now about 3.5% from its March lows, which is not that far. Those lows need to hold.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

With Republicans walking out of debt ceiling negotiations last Friday, and with political drama and the June 1 deadline fast approaching, we should see more volatility in both stocks and bonds this week.

I don’t believe that June 1 is a real deadline, and the U.S. Treasury department probably gave itself a little wiggle room when they came up with that date. The real date is probably a few weeks off that deadline. But the closer we get to June 1 without a resolution, the more volatile the stock market should get.

Stock market investors remember that a similar situation in 2011 caused a 19% draw-down in the S&P 500, although the eurozone debt crisis was in full swing with Greece about to default, so the comparison is not exactly kosher. Still, it would be better for both parties to come to terms and for the President not to invoke the 14th Amendment as a future Republican President in that scenario could surely do the same.

European Markets Perform Like Ukraine Never Happened

Having solved their horrific natural gas problems with the blow-up of Russian natural gas pipelines, the Europeans are looking to the future. This is big business for LNG exporters like the U.S., Qatar, and other LNG players, as it takes about 500 LNG tankers to supplement what the blown-up pipelines carried. Still, the Ukrainian situation has not been resolved and it continues to carry a lot of risks for global security.

Ukraine just lost the bloodiest battle of the war in Bakhmut as it readies its counteroffensive with lots of shiny Western weapons. If that counteroffensive does not live up to expectations, Ukrainians will be under a lot of pressure to make a deal with Moscow as support for the war has gotten very expensive.

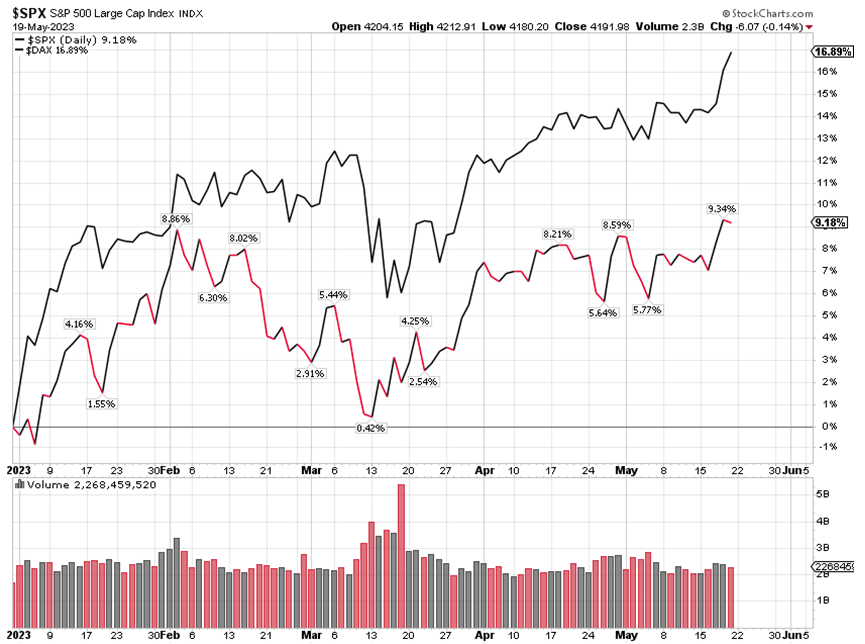

The German DAX index as well as CAC-40 in France and other European markets are close to all-time highs or have already made all-time highs this year. For comparison, the all-time high in the S&P 500 is over 600 points higher on the first trading day of 2022.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The trouble with this rally is that Ukraine is not over, and the ECB is not done with its tightening. Investors must think that Ukraine will be resolved soon, and that the ECB won’t break anything with its belated tightening cycle after years of negative interest rates, which are two very ambitious assumptions.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here