Introduction

In September, I wrote a bearish article on SA about China-focused multi-level marketing (MLM) company Natural Health Trends (NASDAQ:NHTC) in which I said that the fundamentals of the business looked bad due to falling sales and a shrinking number of active members. In my view, this is a good time to take another look at Natural Health Trends as the Q2 2023 financial results were released on August 2. In my view, it was an underwhelming quarter as revenues kept falling rapidly despite the first large in-person member event in three years and the number of active members was below 37,000 at the end of June. In addition, Natural Health Trends slipped into the red despite higher interest income on its more than $60 million in cash and cash equivalents. I’m downgrading my rating on the stock to a strong sell. Let’s review.

Overview of the Q2 2023 financial results

In case you’re not familiar with Natural Health Trends or my earlier coverage, here’s a short description of the business. This is a direct-selling and e-commerce company focused on wellness, lifestyle, and beauty products under the NHT Global brand. Natural Health Trends has subsidiaries across Asia, the Americas, and Europe and sales in over 40 countries worldwide. Yet, China usually accounts for over 80% of revenues. Looking at the sales composition, the top-selling products include noni fruit juice and several food supplements such as probiotics, protein powders, and Omega-3 fatty acids.

Natural Health Trends has a quarterly dividend of $0.20 per share whose size hasn’t changed since early 2020 and this translates into an annual dividend yield of 13.63% as of the time of writing. The next quarterly dividend will be paid on August 25, with the ex-dividend data being on August 14. Yet, I doubt that the company will be able to keep the quarterly dividend at these levels for more than a few more years as its revenues have been shrinking since 2016 and the operating income is in the red. Some of the weak performance of the business over the past years can be attributed to COVID-19 lockdowns as Natural Health Trends was unable to hold in-person meeting events and thus boost the recruiting of new members.

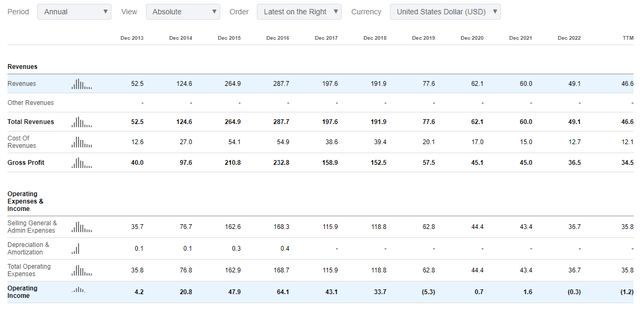

Seeking Alpha

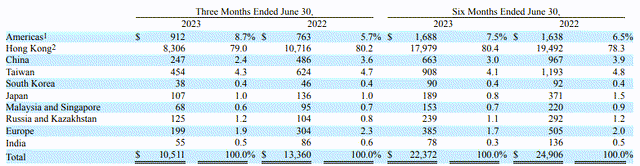

In early June 2023, the company organized its first large in-person member event in more than three years, and this resulted in a $1.2 million increase in deferred revenue in Q2 2023 (see page 20 here). However, the number of active members went down by 1,600 during the quarter to just 36.370 at the end of June (see page 16 here). In addition, revenues for Q2 2023 slumped by 21.3% year-on-year to $10.51 million due to weak consumer sentiment in China. Note that almost all revenues from Hong Kong are derived from the sale of products to members in China:

Natural Health Trends

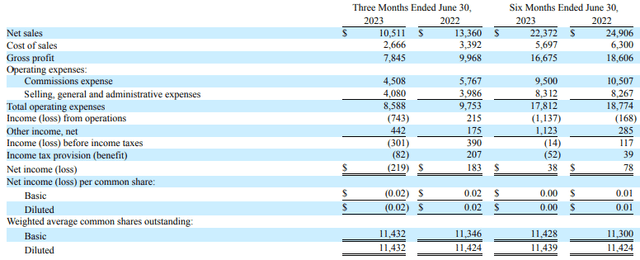

Turning our attention to the income statement, the gross profit margin inched up to 74.6% from 74.5% a year earlier while commissions declined to 42.9% of net sales from 43.2% in Q2 2023. However, Natural Health Trends booked a $0.74 million operating loss due to the lower size of the business as selling, general and administrative expenses remained almost unchanged. On a positive note, other income more than doubled to $0.44 million thanks to the higher interest earned on cash equivalents thanks to rising interest rates.

Natural Health Trends

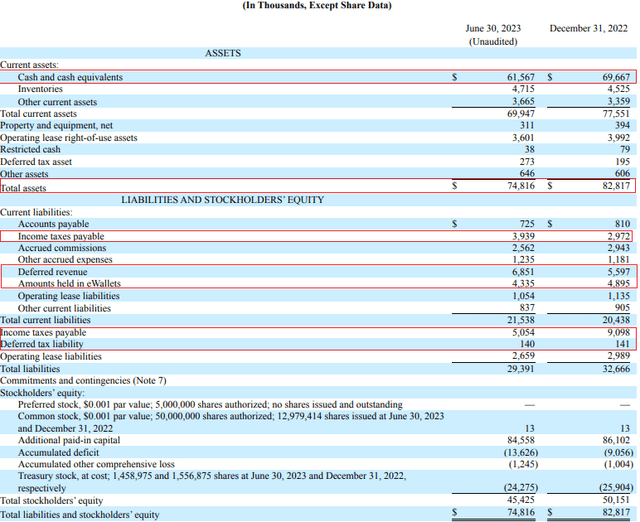

Looking at the balance sheet, cash and cash equivalents decreased by $5.04 million quarter on quarter as Natural Health Trends distributed a $2.3 million dividend while net cash used in operating activities came in at $2.64 million. As you can see from the table below, this is an asset-light business model, with cash and cash equivalents accounting for over 80% of total assets as of June. Yet, it’s worth noting that members of the business held $4.34 million in electronic wallets and that deferred revenue was $6.85 million as of June. In addition, Natural Health Trends owed just over $9 million in income taxes and the shareholders’ equity was $45.43 million, which puts the book value per share at just $3.94.

Natural Health Trends

Overall, I think the Q2 2023 financial results of Natural Health Trends were disappointing as revenues and the number of active members continued to decline rapidly despite an in-person member event held in early June and I don’t expect Q4 to look better. In my view, this is a business in a secular decline and the double-digit percentage dividend yield looks unsustainable in the long term. I think that the business of Natural Health Trends isn’t worth much and that the stock seems overvalued above levels of 1.0x book value.

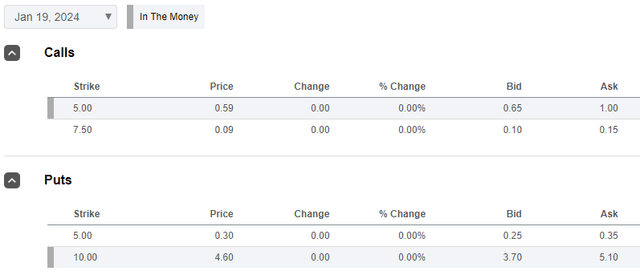

So, how do you play this? Well, short-selling seems like a viable idea as data from Fintel shows that the short borrow fee rate is 5.63% as of the time of writing. In addition, the short interest is just 0.36% of the float, and it takes less than a day to cover, which means the short squeeze risk should be low. Call options to protect the downside also look relatively cheap.

Seeking Alpha

That being said, it could be best for risk-averse investors to avoid this stock as the share prices of microcaps can soar without any news or catalysts, which can lead to significant losses for short sellers. Looking at other major upside risks, Natural Health Trends has $21.9 million remaining under its $70 million share repurchase program (see page 13 here) and I think that buybacks here can boost the share price significantly considering that the daily trading volume rarely exceeds 10,000 shares. In addition, it’s possible that revenues and operating margins improve over the coming quarters if the company holds more in-person member events or if the consumer sentiment in China improves in the near future.

Investor takeaway

The financial results of Natural Health Trends continued to deteriorate in Q2 2023, despite the first large in-person member event in more than three years. The company is in the red and the number of active members is shrinking fast, and I think that the stock looks significantly overvalued above book value. While short-selling seems viable as the short borrow fee rate is below 6%, I think that it could be best for risk-averse investors to avoid this stock as there could be significant share price volatility in the future.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here