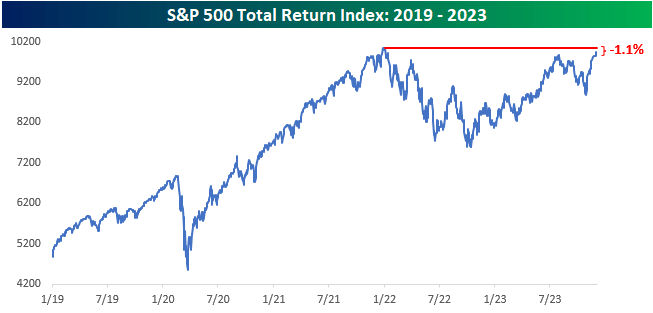

The equity market (and most other parts of the financial universe) has been in rally mode for about five weeks now, and while it would be greedy to think that the S&P 500 could rally the 4% needed between now and year-end to get back to its prior highs from the start of 2022, on a total return basis, the market is knocking on the door of new all-time highs.

As shown in the chart below, the total return index is within 1.1% of its prior all-time high from 1/3/22. In addition to nearing its prior highs, the pattern of the S&P 500 looks a lot like a cup and handle, which technicians consider to be a bullish formation.

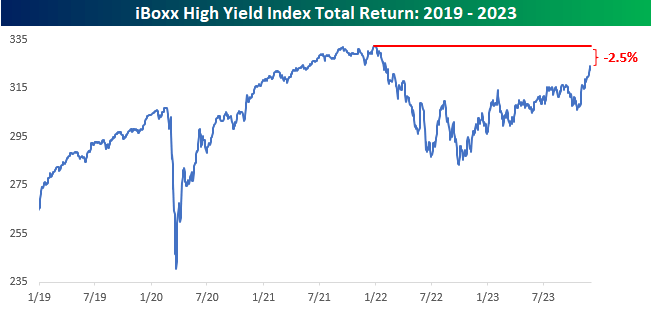

For all the weakness that we’ve seen in the US Treasury market over the last couple of years, high-yield bonds have fared much better.

As shown in the chart below, the iBoxx High Yield Total Return Index, which is the underlying index of the popular ETF (HYG), came into the week just 2.5% below its prior all-time high from 12/28/21.

That’s impressive in its own right, but even more noteworthy when you consider the fact that long-term Treasuries (20+ year maturities), long considered the ‘safest’ area of the fixed income sector, or all financial assets for that matter, are still down over 40% on a total return basis from their Summer 2020 peak.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here