Dear readers,

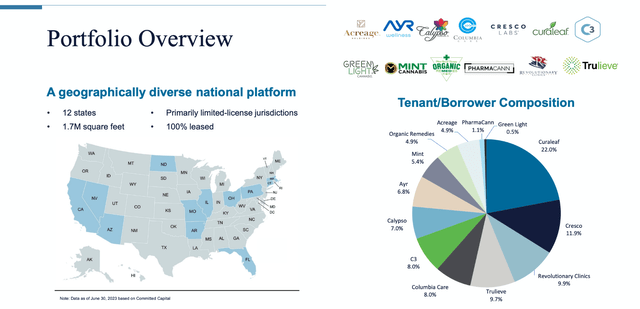

NewLake Capital Partners (OTCQX:NLCP) is a cannabis REIT that owns cultivation facilities and dispensaries with a heavy focus on limited-license states where licenses are generally tied to a property, therefore limiting competition and making it much easier to re-lease a property.

NLCP Presentation

I’ve written about NLCP a handful of times, most recently here.

My bullish thesis for the stock has been supported by:

- a nearly 12% dividend yield, which has been reasonably covered despite tenant delinquencies and rent collections of only 92%

- a large margin of safety implied by the valuation

- and several potential bullish catalysts that, in my mind, outweigh the headwinds that the industry is facing today.

The company has released its Q3 2023 earnings recently, there has been some progress on the legislation front and NewLake announced some key developments related to negotiations with the delinquent tenant Revolutionary Clinics.

Today I summarize these recent developments and publish my updated thesis for what I consider one of the safest double-digit dividend REITs.

Major recent developments

The cannabis industry has been facing significant headwinds over the past two years. And as a result of high interest rates and tighter-than-usual lending standards, many cannabis operators (NLCP’s tenants) have found it difficult to make ends meet.

Most notably, the REIT’s third largest tenant, Revolutionary Clinics, stopped paying rent in late 2022. Management has been actively working with the tenant to resolve the issue and recently closed a lease amendment and a forbearance agreement with Revolutionary Clinics.

Under the newly signed documentation, NewLake recovered $480,000 of previously unpaid rent and applied the remaining $315,000 of security deposit to rent. The REIT provided forbearance for the remaining $2 Million of owned rent, the lease term was extended by 5 years and Revolutionary Clinic’s monthly rent was reduced by about a third. In exchange, NewLake received 9.95% of Rev. Clinic’s equity in the form of warrants. All things considered, I think the deal makes sense when compared to the alternative which would be foreclosure and sale in an unfavourable transactional market. If the tenant recovers, NewLake will eventually recover all lost income. If the tenant fails to recover, foreclosure will always be an option, and hopefully by then the macro will be more favorable.

On a legislative level, there are currently three things worth paying attention to. Firstly, it seems likely that cannabis will be rescheduled to a Schedule 3 substance by Q2 2024. This would be a major positive as it would significantly lower taxes on the industry and consequently help ease pressure on tenant’s cash flow.

Secondly, Senate has passed a modified version of the SAFE Banking bill (now called SAFER) which would significantly relax banking standards for the cannabis industry and consequently make it much easier for operators to get bank financing. This would be great news in light of the recent tight credit market which has caused most of the pain in the sector. Unfortunately, it seems unlikely that the bill will be passed before the next election cycle.

Finally, recently a lawsuit has been filed by the cannabis industry against the government in at an attempt to challenge the government’s ability to regulate cannabis trade across states. While this lawsuit is likely to take a long time to get resolved, it’s yet another chance to close the state and federal legislation gap and would be a major positive for the sector.

All things considered, it seems as likely as ever that reasonable legislation will eventually get passed.

Recent Results

Third quarter results came in as expected with AFFO of $10.1 million or $0.47 per share. This was down 4.9% YoY entirely as a result of Revolutionary Clinic’s non-paid rent which resulted in a total rent collection of 92%.

Rent coverage has deteriorated slightly quarter-over-quarter to 4x for cultivation facilities and 9.8x for dispensaries, but remains in line with normal deviations over the past 6 quarters and importantly remains very high by any standard. For comparison, consider that high-quality net lease REITs such as Realty Income (O) or NNN REIT (NNN) normally record rent coverage of 3-4x. On this front, NewLake has more room for error, especially when you consider that it has no debt (more on this later).

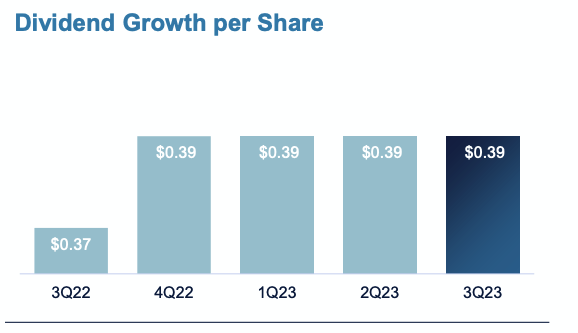

Despite lower collections, the REIT has declared and paid a $0.39 per share dividend which remained covered with a payout ratio of 83%, in the bottom half of the targeted range of 80% to 90%. I don’t expect dividend growth for a while, but with decent rent coverage, I think it’s quite likely that the dividend will remain covered going forward.

NLCP Presentation

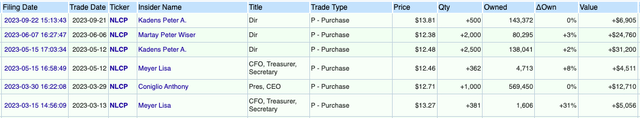

Year to date, NewLake has also bought back $9.3 million of their own stock at an average price of $12.96, which has resulted in 3%+ AFFO per share accretion for shareholders. Going forward, there’s a further $10.7 Million authorized for share repurchases and I fully expect management to take advantage of these low prices. Moreover, management has also made significant additions to their private positions at these prices.

Openinsider

Why NewLake?

I like NewLake for a number of reasons.

Beyond the already discussed potential tailwinds from regulation, the REIT will obviously also benefit from any decline in yields, whenever it comes.

Additionally, I want to point out the stock still trades OTC and a listing on any major exchange would be a major catalyst. I don’t expect this one to play out over the short term and management didn’t mention it on their earnings call, but when macro improves and cannabis is in favor again, this could indeed provide further upside.

Management has been doing a good job, has dealt with the Revolutionary Clinics’ delinquency in a reasonable fashion, and acts in a shareholder-friendly way by buying back shares at accretive levels and paying a high and quite sustainable dividend. Meanwhile, they have been increasing their private positions at these prices.

Before, diving into valuation, there’s one key thing to mention. This is one of the very few REITs that has no debt. That’s obviously very beneficial today and significantly increases the margin of safety here, especially when compared to an average net lease REIT which has a net debt /EBITDA of about 5x and therefore is likely to see its interest expense grow in today’s environment.

The REIT trades at a market cap of $270 Million which, according to my calculations, corresponds to an implied cap rate of roughly 11%. That’s a huge 6.5% spread to 10-year treasuries.

For my base case, I assume:

- a 12% dividend yield

- significant upside when sentiment turns as a result of either a decline in yields or progress in legislation. The timing of upside is hard to forecast, but it could be significant. For instance, at a 4% spread to treasuries, which seems reasonable, we’re talking upside of 30%+

- somewhat limited downside as the current valuation essentially prices in a 50% write-off on the whole portfolio of properties. NewLake’s properties are quite unique and selling them wouldn’t be easy, but I take some comfort in buying them at 50% of book value. Especially with book values of $389/sft for dispensaries and $252/sft for cultivation facilities, both of which are below replacement costs. Moreover, the REIT has recently (somewhat) demonstrated that book values aren’t inflated by selling one of their Massachusetts properties for $2 Million on a book value of $1.95 Million.

NLCP is more speculative than a traditional net lease REIT such as O. But to me, higher uncertainty is very well compensated by a much higher dividend yield and a low valuation which comes with a higher margin of safety. Would I buy NewLake if it had the same level of debt as net lease peers? Of course not! But with no debt on its balance sheet, the REIT has a lot of flexibility to ride things out, which is why I reiterate my BUY rating here at $13 per share.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here