Investment thesis

Nike (NYSE:NKE) has been demonstrating strong financial performance over the long term thanks to high customer loyalty and a strong brand. Being a discretionary company, the company faces headwinds given the current harsh macro environment. Nike has strong pricing power and weathered many past storms, so I expect the company to pass the current turmoil successfully. Though, margins are under pressure because of elevated inventory levels. The stock is slightly overvalued, so I believe there will be better points to start a position in NKE stock.

Company information

Nike develops and markets athletic apparel. The company’s products are sold through a mix of independent distributors, licensees, and subsidiaries. Apart from the NIKE brand, the company owns such well-known brands as “Jordan” and “Converse”.

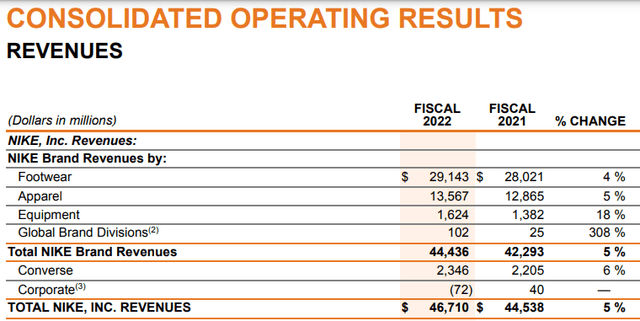

Nike’s fiscal year ends May 31. Revenue generated by footwear sales comprises about two-thirds of total sales. More than 40% of total sales are generated within North America.

Nike’s latest 10-K report

Financials

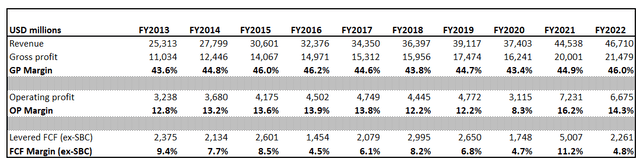

Nike has utilized its strong brand and customer loyalty exceptionally over the last decade. The company has been increasing its top line by 7% per year, meaning sales almost doubled during the past decade. The management was decisive in dealing with growth which I can see from both gross and operating margins expanding through the decade.

Author’s calculations

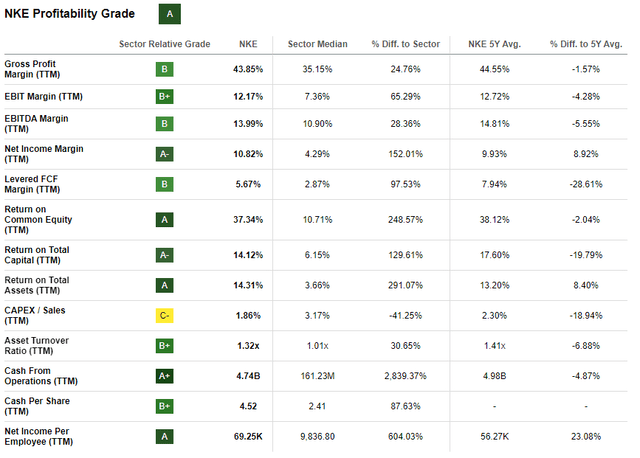

The company’s profitability is robust compared to median sector levels, according to Seeking Alpha Quant profitability metrics, though I would like to underline that current margins are lower than 5-year averages. It is due to the current harsh environment.

Seeking Alpha

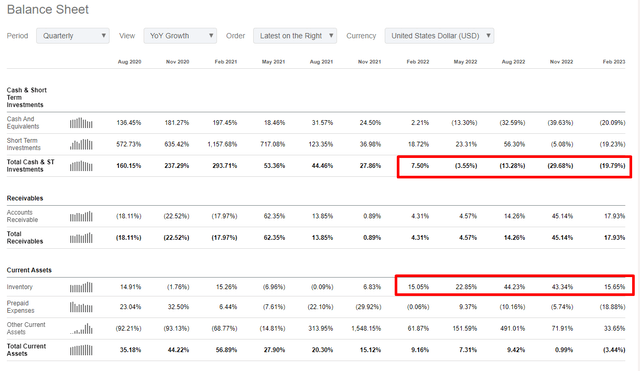

The company is experiencing downward pressure on margins due to the softening macro environment caused by the potential recession and a looming credit crunch. As we can see, there is a warning trend for inventory levels which has been growing consistently over the last quarters. The cash balance decline has been primarily in line with increasing inventory, meaning the company is freezing money in warehouses.

Seeking Alpha

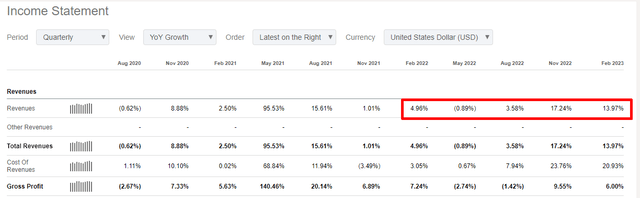

It is apparent that growing inventory alone cannot be a red flag since the company’s revenues are increasing as well. So, let me add context here and underline that the revenue YoY growth pace has been lagging behind the inventory growth.

Seeking Alpha

Growing inventory means the company has no options other than cutting prices to manage rapidly increasing inventory levels. This will continue driving profitability down because costs are rising, and selling prices have little option but to go down. Therefore, I believe that several next quarters will be challenging for the company due to the necessity to clear the company’s warehouses and stores’ shelves.

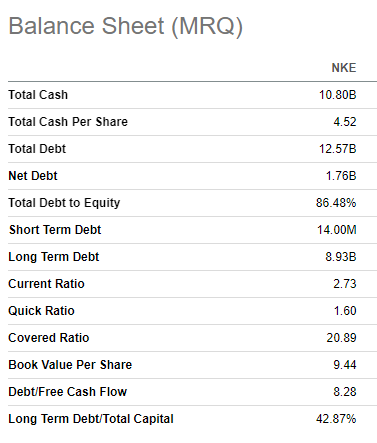

Though, these challenges are temporary. The company has vast experience in facing different kinds of macro storms, and I have a firm conviction that the company will pass the probable recession. A fortress balance sheet also backs the company’s strong brand. Liquidity is solid even if we deduct elevated inventory. The company is in a net debt position, though I consider credit risk as low given a rather moderate debt-to-equity ratio.

Seeking Alpha

The company released its latest quarterly earnings on March 21, delivering solid top and bottom lines beat against consensus estimates. Revenue increased about 14% YoY, proving my thesis regarding the company’s strong pricing power, though the EPS declined from $0.87 last year to $0.79 in fiscal quarter-3 2023. Softening profitability reflects higher transportation and logistics costs, an increase in markdowns, and foreign exchange headwinds, offset in part by higher selling prices.

Valuation

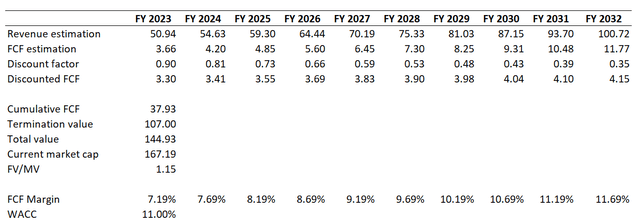

First, I will start with the DCF approach. For future FCF, I have earnings consensus estimates available up to FY 2032, i.e., the next decade. Revenue is expected to grow at 7% CAGR, which is precisely in line with the past decade’s top line growth pace. For the FCF margin, I use 7.2%, which coincided to be both the median and average for the past decade on the ex-SBC basis.

Author’s calculations

Incorporating all assumptions together into the DCF model gives me about 15% overvaluation for the stock.

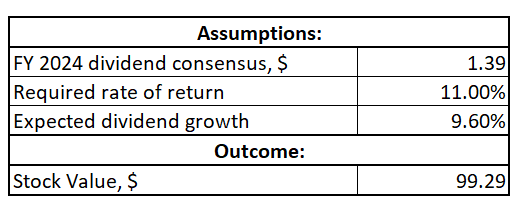

Now, let me cross-check with the DDM. I use FY 2024 consensus estimate for the dividend, which is at $1.39 per share. The dividend growth I use is Nike’s dividend per share forward growth rate 5-year average, which is at 9.6%.

Author’s calculations

With all the above assumptions, the DDM formula returns me a fair stock price at about a hundred bucks, which is approximately 8% lower than the current market price.

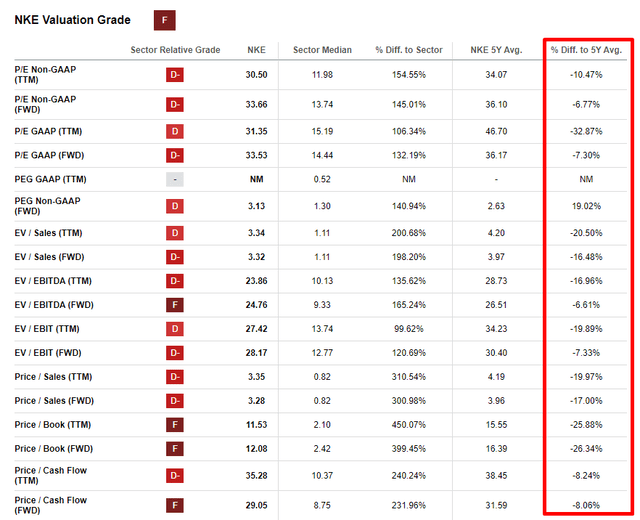

On the other hand, if we look at valuation multiples provided by Seeking Alpha Quant, NKE is currently trading double digits below its historical 5-year multiples. This usually indicates undervaluation, unless the company is at the declining stage of the business life cycle. Nike is not declining, so from a valuation ratios perspective, the stock looks undervalued.

Seeking Alpha

Overall, the outcomes of different valuation approaches are mixed, as you can see. I think that the upside potential is insignificant, especially in the current tough environment.

Risks to consider

Slowing global economy is the most apparent risk for a consumer discretionary company like Nike. The company has a powerful brand and is well-positioned to weather storms in the macro environment. Though it still will experience headwinds and downward pressure on margins to keep inventory levels reasonable. This might last over several quarters, leading to low pressure on the stock price.

Also, Nike’s apparel is sold globally, and this geographic diversification generally benefits the company. But along with its expansive international presence comes a significant foreign exchange risk. Unfavorable foreign exchange fluctuations can directly influence Nike’s financial performance and profitability.

Nike is also vulnerable to high inflation and rising salaries since the business is labor-intensive and highly depends on raw material prices. Managing these cost pressures becomes crucial for Nike to maintain profitability and sustain its competitive position in the market. I also see the current macro environment as unfavorable for Nike, though they are temporary and not secular.

Bottom line

Overall, the company currently faces tough headwinds, which I consider temporary. Though, margins are expected to soften in the nearest quarters since the management is forced to cut prices to control inventory levels amid broad environment weakness. The valuation does not look attractive at the moment, so I give the stock a neutral rating.

Read the full article here