NIO (NYSE:NIO) reported a 74% month-over-month increase in deliveries for June and reclaimed the important 10,000 delivery threshold as well. Further, data from the China Passenger Car Association (CPCA) shows that retail sales of new energy vehicles soared 10% month-over-month last month, indicating that Chinese electric vehicle start-ups could be entering the second half of the year with much stronger delivery and sales momentum than the first half.

As a result, NIO could be set for continual delivery gains, in part due to recovering new energy vehicle demand as well as new product launches, such as the ET5 Touring which expands the company’s sedan product portfolio. Since the company is experiencing new momentum after seemingly bottoming at $7 in June and NIO recently announced that it signed up a strategic investor for its EV mission as well, I believe the current rally has staying power!

NIO’s delivery accomplishments in June 2023 relative to rivals

NIO, Li Auto (LI) and XPeng (XPEV) all provided delivery updates for the month of June last weekend with Li Auto submitting by far the strongest delivery card. The EV company delivered a massive 32,575 electric vehicles in June, showing 150.1% Y/Y growth, and Li Auto delivered three times more EVs to its customers than NIO. XPeng fell further behind with deliveries of only 8,620 electric vehicles, showing a growth rate of -43% year over year.

NIO did very well in June, delivering 10,707 electric vehicles to its customers. June was the first month since March that the company delivered more than 10 thousand EVs and NIO achieved the second-highest monthly delivery total in FY 2023, only second to February’s 12,157 electric vehicle delivery volume. Month-over-month, NIO saw 74% growth which was also the fastest M/M growth rate the EV maker has seen this year as well.

|

Deliveries |

Apr-23 |

Apr Y/Y Growth |

May-23 |

May Y/Y Growth |

Jun-23 |

June Y/Y Growth |

|

NIO |

6,658 |

31.2% |

6,155 |

-12.4% |

10,707 |

-17.4% |

|

LI |

25,681 |

516.3% |

28,277 |

146.0% |

32,575 |

150.1% |

|

XPEV |

7,079 |

-21.4% |

7,506 |

-25.9% |

8,620 |

-43.0% |

(Source: Author)

NIO’s sedan deliveries totaled 4,324 units, showing 15% M/M growth. It was also the strongest M/M growth rate in FY 2023, a positive development as NIO is increasingly focused on its sedan line-up to generate delivery growth.

NIO also debuted yet another new EV, the ET5 Touring, which launched on June 15, 2023. The ET5 Touring is NIO’s first station wagon and slated to be introduced to Europe. NIO is not breaking down monthly delivery totals on a per-model basis, but given the strong ramp of the ET5 and ET7 last year, I estimate that the ET5 Touring could ramp to 2,000-3,000 monthly deliveries by the end of FY 2024.

|

NIO ET7/ET5 Metrics |

Jan-23 |

Feb-23 |

Mar-23 |

Apr-23 |

May-23 |

Jun-23 |

|

Total Deliveries |

8,506 |

12,157 |

10,378 |

6,658 |

6,155 |

10,707 |

|

NIO Sedan Deliveries |

6,316 |

7,120 |

7,175 |

4,945 |

3,759 |

4,324 |

|

M/M Growth |

-29.6% |

12.7% |

0.8% |

-31.1% |

-24.0% |

15.0% |

|

Sedan Delivery Share |

74.3% |

58.6% |

69.1% |

74.3% |

61.1% |

40.4% |

(Source: Author)

Indications of recovering demand for electric vehicles in China

The China Passenger Car Association releases information about the production and sales volumes of passenger cars in China each month.

According to CPCA’s preliminary data for the month of June, the industry has seen a total retail sales volume of 638,000 new energy vehicles in June, showing a 10% month-over-month increase. The CPCA’s NEV retail sales data now shows two consecutive months of strong growth (NEV sales were up 11% in May) which indicates that the Chinese EV market could enter the second half of FY 2023 with much stronger momentum than the first half: between January and June 2023, retail sales for passenger new energy vehicles increased a total 92%, indicating that the demand situation in the Chinese EV market is improving… from which NIO and its rivals in the EV industry are set to benefit.

Source: CPCA

NIO’s valuation relative to peers, why NIO may already have bottomed

NIO, in my opinion, has likely already bottomed at $7.00 in June and shares are up 46% since. The electric vehicle company is seeing improving demand (as is the broader industry) and NIO has seen a massive M/M increase in monthly deliveries in June. Combined with a recovery in industry retail sales, I believe the current rally has legs and investors are going to focus more on NIO’s positive business trends going forward.

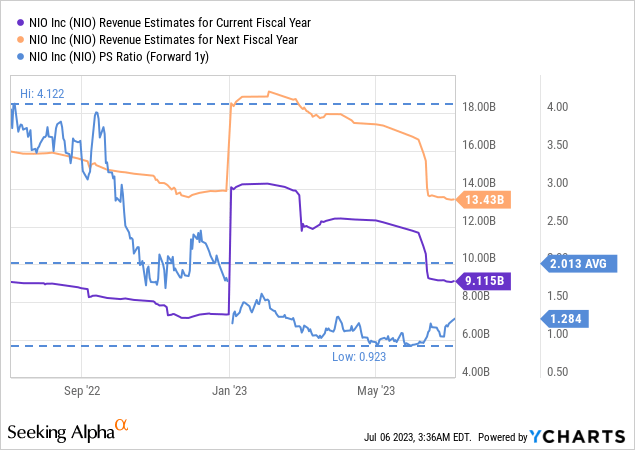

From a valuation perspective, NIO is still a good bargain as well, in my opinion: NIO is valued at 1.29X (FY 2024) revenues and I believe with delivery growth rates rebounding and industry growth recovering, there is a good chance that analysts are going to upgrade their revenue estimates… which in itself could be a positive catalyst for NIO’s shares. NIO’s 1-year average P/S ratio is 2.01X so if the EV company simply managed to return to its historical valuation, then shares of NIO could have 57% upside revaluation potential.

Risks with NIO

The biggest risk for NIO is that vehicle margins are deteriorating which poses a profitability challenge for the EV company as well as for the broader sector. Lower vehicle margins are a result of growing pricing pressure and stiffer competition in the market (with EV companies expanding their product portfolios, giving consumers greater choice). What would change my mind about NIO is if the company started to see negative vehicle margins, like XPeng did in the first-quarter.

Closing thoughts

NIO has seen some very positive share price momentum in the last couple of weeks and shares are now trading 46% above their June lows. I believe the positive new energy vehicle retail sales trend in China strongly indicates that the current share price rally for NIO can continue.

From an operational point of view, NIO also reported some very decent successes lately: NIO reclaimed the important 10 thousand EV delivery threshold in June for the first time since March and reported its second-highest monthly delivery volume of FY 2023 (only behind February). While NIO didn’t do as well as Li Auto, which cracked the 30 thousand EV delivery threshold for the first time ever, NIO did well in June nonetheless with a 74% M/M increase in deliveries as well as a rebound (15%) in sedan deliveries. The rebound in deliveries follows recent good news about a $740M strategic investment of Abu Dhabi!

Read the full article here