Dear readers,

NNN REIT (NYSE:NNN), formerly known by many of you as National Retail Properties, is a major net lease REIT, with a well-performing portfolio of small (<$5 Million) assets leased to a variety of net lease tenants from casual restaurants to car washes.

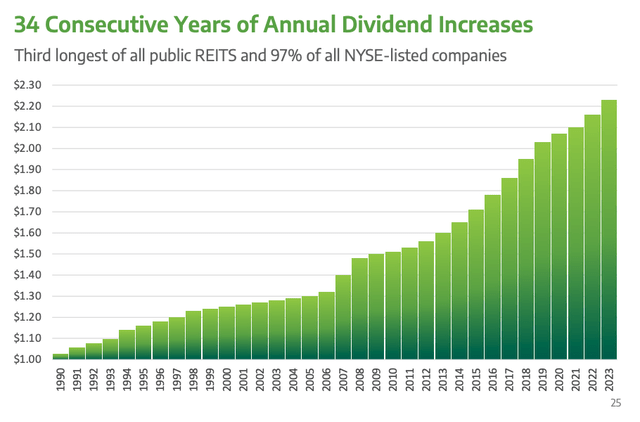

Notably, the company is also one of only a few REIT dividend aristocrats with a 34-year history of increasing its dividend. As such, NNN REIT is arguably amongst the safest companies in the sector, alongside Realty Income (O).

NNN Presentation

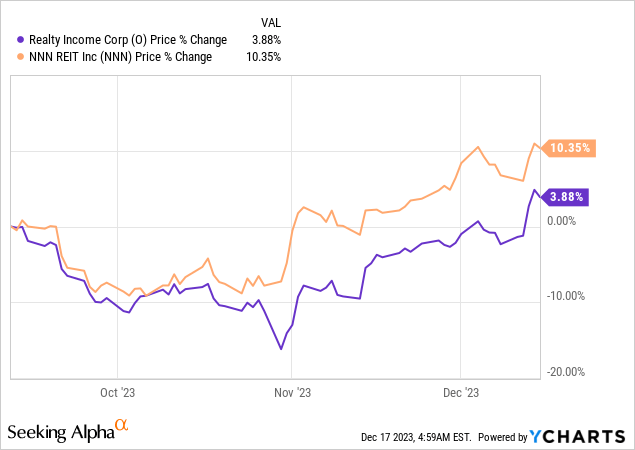

I’ve covered the REIT before, most recently in September here, where I called NNN REIT a worthy alternative to Realty Income and issued a BUY rating at $38 per share with the potential for 15%+ total annual returns. Since then, the stock has done well with a 13% RoR vs 5% RoR of the S&P 500 (SPX) and 4% RoR of Realty Income.

Stable low growth portfolio

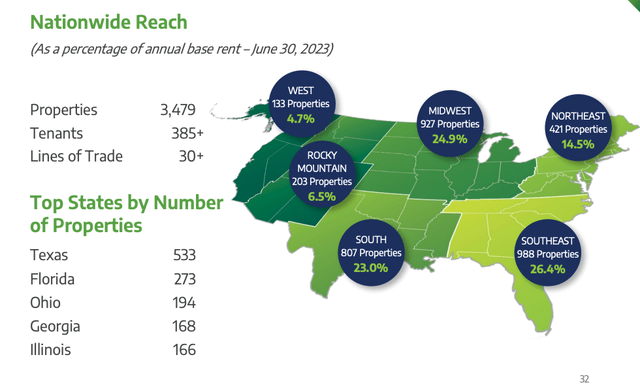

NNN holds a portfolio of just over 3,500 properties located across the country with a near-perfect 99.2% occupancy and only 27 vacant properties. The portfolio which is focused on casual dining restaurants (18%), convenience stores (16.5%), and automotive services (13.7%) has been very resilient with occupancy never falling below 94.6%.

Lease terms are long at 10+ years, tenant’s rent coverage is solid at over 3x, and near-term lease expirations are low at 3.3% next year. The result is very predictable cash flow. The downside is low internal revenue growth which comes almost entirely from average 1.5% rent escalators and limits the REIT’s ability to increase rents in an inflationary environment. Because of the nature of the net lease business, NNN was forced to grow its portfolio primarily through external acquisitions, averaging $600 Million in acquisition volume per year over the past 15 years.

NNN Presentation

Since my last article, NNN has issued Q3 2023 results which (1) reveal that the firm has been able to go shopping in this distressed environment and purchase good volume of properties at solid discounts, and (2) confirm that the portfolio continues to do extremely well from an operational standpoint.

Over the first nine months of the year, NNN has invested $550 Million into 125 properties at an average cap rate of 7.2%, which according to management is 100 bps above last year’s average. Of this, $212 Million was executed in the third quarter alone at an even higher 7.4% average cap rate.

For the next several quarters, management expect cap rates to expand further and they fully intend to take advantage as they have raised the midpoint of their full year acquisition target from $650 Million to $750 Million and have secured funding by issuing $500 Million of 10-year notes with a 5.9% yield to maturity.

I really like that the REIT is doubling down on acquisitions now, that cap rates have expanded and are comfortably above their cost of capital. The cherry on top is that year-to-date, NNN has sold 26 of their properties at an average cap rate of 5.8%, resulting in accretive capital recycling.

The company is now well on track to hit the $750 Million acquisition target, which would increase their $8 Billion portfolio by nearly 10% and should increase per share FFO by around 1.5% if cap rates stay where they are today.

My expectations for this and next year’s FFO per share growth, assuming that NNN will continue with their aggressive acquisition strategy, is as follows:

- 1.5% external growth from $600-750 Million in acquisition volume at cap rates at least 1.5% above cost of capital (7.4% vs 5.9% most recently)

- 1.5% build-in rent escalators

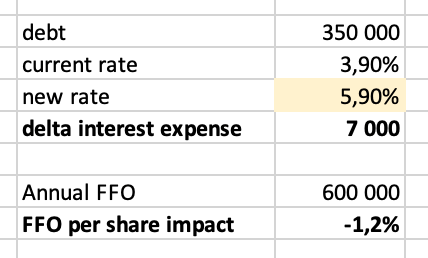

- -1.2% from refinancing the $350 Million debt maturity next year at a rate of 5.9% (now 3.9%)

Author’s calculations

- Combined I expect FFO per share to grow by 2% per year.

Valuation

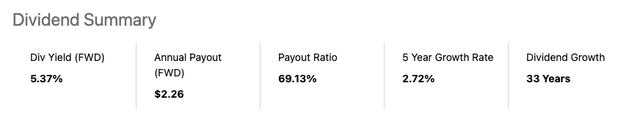

A large part of the investment case is NNN’s $2.26 per share dividend which yields 5.4% and is very well covered with a payout ratio of 68%.

In short, I see the dividend is very dependable and likely to grow going forward at around 2% per year.

Seeking Alpha

Beyond the dividend, I continue to believe that there is further upside here.

Currently the stock trades at 13x FFO and an implied cap rate of 6.1%, which is a fair 200 bps above 10-year treasury yields. For comparison, Realty Income trades at an implied cap rate of 5.6%. The premium is likely justified given its A- rating (vs BBB+ of NNN).

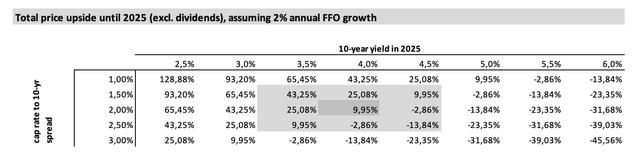

I don’t expect the 2% spread to narrow by much, but if long-term yields fall further below 4%, NNN will return substantial upside. Using 3.5% long-term yields by 2025 gives upside potential of 25%.

Author’s calculations

Bottom Line

NNN REIT is clearly not as attractive as it was in September.

But if you’re looking for reliable dividend income and expect long-term yields to drop further in the following years, then the stock can make a solid addition to a REIT portfolio.

I rate the stock a HOLD here at $42 per share, based on:

- a highly reliable high 5.4% dividend

- a resilient well-performing portfolio with a very visible cash flow

- an aggressive acquisition strategy that adds value

- and a reasonable valuation of 200 bps above long-term yields

Risks

Admittedly, the biggest risk to NNN is high inflation. Because of the REIT’s inability to increase rents on their properties beyond the 1.5% rent escalators, a prolonged period of high inflation, which would very likely lead to high interest rates, would be tough for the company as cash flows would most likely contract under the burden of higher interest payments.

Read the full article here