Note:

Noble Corporation Plc (NYSE:NE) or “Noble” has been covered by me previously, so investors should view this as an update to my earlier articles on the company.

Last week, leading offshore driller Noble Corporation reported profitable second quarter results and maintained full-year expectations.

Company Presentation

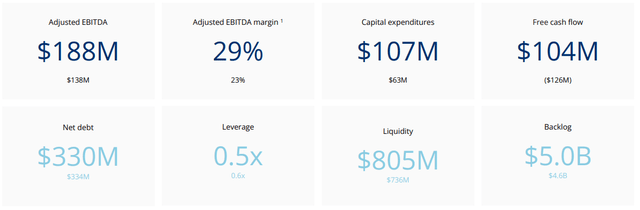

Adjusted EBITDA of $188 million increased by 36% sequentially, while Adjusted EBITDA margin of 29% reached a new multi-year high. Despite a sizeable uptick in capital expenditures, the company managed to generate $104 million in free cash flow for the quarter, which was partially utilized to repurchase 1.55 million common shares at an average price of $38.69.

In addition, the company declared a quarterly cash dividend of $0.30 per common share, thus becoming the first offshore driller to reinstate regular distributions.

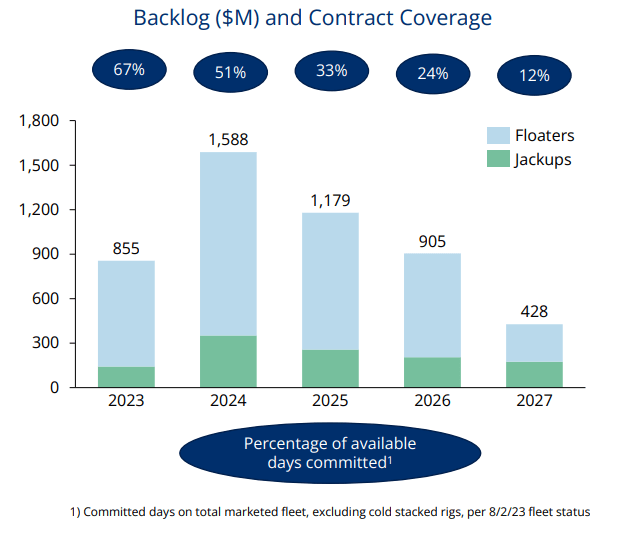

Total backlog increased by 9% sequentially to slightly above $5 billion, mostly due to the previously reported $500 million contract award for the drillship Noble Faye Kozack offshore Brazil.

Company Presentation

The company’s previously issued full-year outlook remains unchanged:

Company Presentation

On the conference call, management reiterated Noble’s commitment to return the significant majority of free cash flow to shareholders over time via dividends and share repurchases.

Management also echoed recent comments made by competitors Transocean (RIG) and Valaris (VAL) regarding the ongoing strength of the ultra-deepwater floater market and projected dayrates for high-specification assets to eclipse $500,000 fairly soon.

On the flip side, the company is still looking for a sufficient contract opportunity to reactivate the cold-stacked 7th generation drillship Pacific Meltem at an updated all-in cost of approximately $125 million (up from the previous $100 million estimate due to “persistent cost inflation“) with reactivation currently expected for next year.

Unfortunately, Noble’s North Sea jackup exposure continues to be a drag, as activity in the U.K. and Norway is likely to remain subdued until late 2024. That said, management expects the trough to be behind the company already:

(…) we believe that we have sufficient contract visibility now to call the first half of this year is the trough for our jackup fleet with tangible utilization improvement expected over the next 4 to 6 quarters.

This is supported by recent and pending contract start-ups for the Tom Prosser and Intrepid, which have both been idle throughout the first half of this year as well as a constructive outlook for the Regina Allen expected to be redeployed by mid-2024 upon completion of its repairs. The Regina Allen is currently in the shipyard in the Netherlands scheduled to finish the work on its leg and tracking system early next year and has good contract visibility for work outside the North Sea next year when the rig becomes available.

Beyond these discrete improvements, the longer-dated upside catalyst for our jackups would necessarily need to come from the Norway market. We’re obviously following the tightening dynamics within the Norway harsh floater segment with great interest and attention, since the competition zone of the Norwegian shelf could be impacted.

Management also updated investors on the expected revenue and earnings trajectory for the remainder of the year and going into 2024.

After a two-month contract start-up delay for the Noble Faye Kozack in the U.S. Gulf of Mexico, the drillship is now expected to work for almost the entire third quarter before entering the contract preparation and mobilization phase for the above-discussed long-term contract offshore Brazil which is scheduled to commence in March 2024.

We now anticipate a different quarterly sequential progression than before as the third quarter is now expected to be the highest quarter of the year in terms of adjusted EBITDA contribution, followed by a temporary sequential downtick in the fourth quarter. Accordingly, we now expect the second half of 2023 to account for slightly below 60% of the full year total, with Q4 landing somewhere between Q2 and Q3 levels.

(…)

We remain very excited about the financial prospects for 2024 and beyond, and we do expect a material step-up in adjusted EBITDA and free cash flow in 2024 versus 2023.

Assuming Adjusted EBITDA of 1.25 billion next year, Noble’s 2024 EV/Adjusted EBITDA ratio of 6x continues to be moderate.

Bottom Line:

Noble Corporation reported respectable second quarter results and reiterated full-year expectations, with results mostly driven by the ultra-deepwater floater fleet while the North Sea jackup markets are likely to remain a drag until at least late 2024. That said, management expects the trough to be behind the company already.

While I wouldn’t chase the stock after the most recent rally, I would strongly advise investors to use any major weakness to get long Noble Corporation Plc shares or add to existing positions, as the industry outlook remains exceptionally strong.

Read the full article here