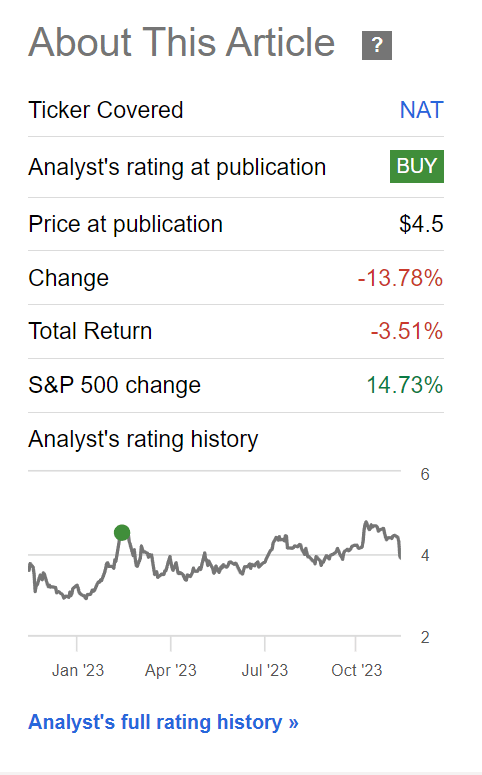

It has been a few months since I last wrote about Nordic American Tankers (NYSE:NAT). Back in March, I was constructive on NAT shares, as I believed Russian oil disruptions have caused tanker rates to stay elevated while full shipyards mean higher tanker rates can stay extended for a long time. However, since my article, NAT’s shares have actually languished, delivering -3.5% total return since early March (Figure 1).

Figure 1 – NAT’s shares have languished (Seeking Alpha)

What was the cause of NAT’s weakness and what is my outlook heading into 2024?

Brief Company Overview

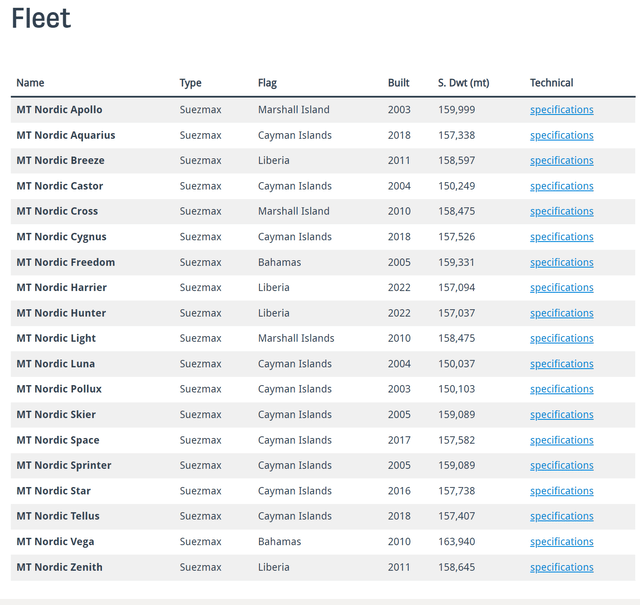

Nordic American Tankers own a fleet of 19 fairly interchangeable Suezmax oil tankers that are mostly operated in the spot market (Figure 2).

Figure 2 – NAT fleet overview (nat.bm)

NAT’s fleet has an average age of ~10 years, with several vessels getting close to 20 years in age. Oil tankers tend to have an operating lifespan of 25-30 years, so there could be an impetus for Nordic to renew its fleet in the coming years. For example, Nordic acquired two newbuilds in 2022 and recently added the 2016-built ‘Nordic Hawk’ to its fleet in December 2023.

As I have explained in the past, NAT’s business model is very simple: it tries to keep operating costs low, with current operating costs of ~$9k / day, such that when tanker markets tighten, NAT can earn large windfall profits.

Tanker Rates Eased In 2023 On OPEC Production Cuts

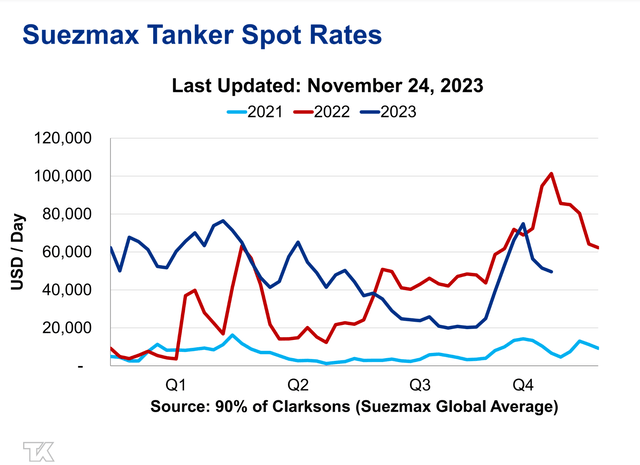

Since my last article in March, tanker rates have gradually eased, from a peak of $60-80k time charter equivalent (“TCE”) in the first quarter to a low of $20-40k in the third quarter, before a recent run-up (Figure 3).

Figure 3 – Tanker rates have moderated in 2023 (teekay.com)

Spot rates softened in Q2 mostly due to OPEC’s surprise production cut announced in April that saw the cartel reduce output by more than 1 million barrels/day. Tanker rates further weakened during the summer months as Russian crude oil exports were diverted to domestic refineries to meet summer demand, and OPEC product cuts were extended into year-end on weak global demand.

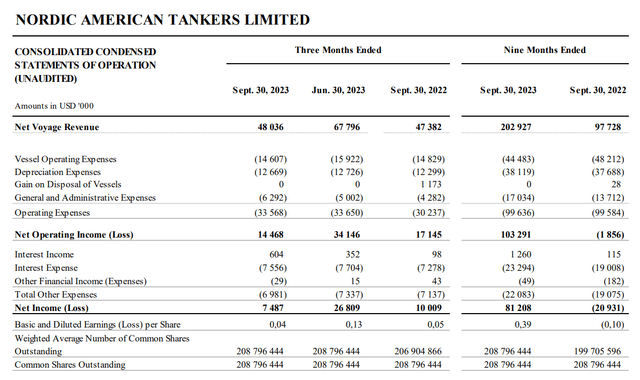

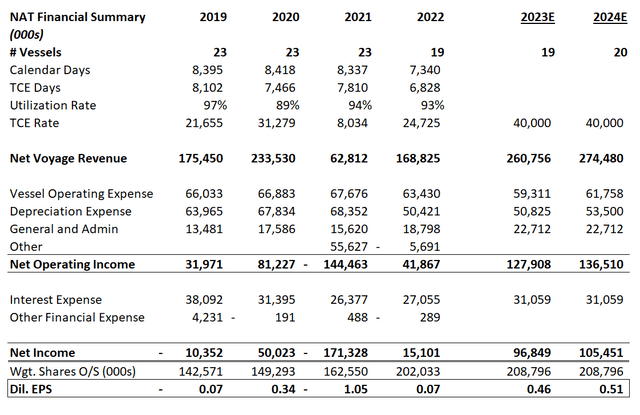

Although softening tanker rates was an unwelcome development, this year’s tanker rates are still far above Nordic’s operating costs, allowing NAT to report strong YTD revenues of $203 million, more than double 2022’s revenues at the same point in time (Figure 4). Earnings-wise, NAT was able to deliver $0.39 / share in dil. EPS for the first 9 months of 2023, a stark improvement compared to a $0.10 / share loss in 2022.

Figure 4 – NAT financial summary (NAT Q3/2023 report)

However, Q3 results were a little disappointing with revenues of only $48 million (+1.2% YoY) and dil. EPS of $0.04 compared to $0.05 in the prior year’s third quarter.

Looking forward, Q4 results do look brighter, as 73% of NAT’s spot voyage days have been booked at an average TCE of $43,160, significantly higher than the $32,832 TCE NAT booked for its spot vessels in Q3.

Is Higher For Longer Tanker Rates Still Valid?

Rather than look at a quarter-to-quarter basis, the key question investors and I are asking is how long will this lull in tanker rates last? Is the ‘higher for longer’ tanker rates thesis still valid?

On the one hand, Russian crudes continue to be sanctioned by the EU and must be shipped to faraway destinations like China and India, which adds to days-on-sea demand and supports tanker rates. Essentially, the seaborne crude oil market is replacing short-haul voyages between Russia and Europe with long-haul voyages between Russia to India or Houston to Europe (for a more detailed explanation, please refer to my older articles that laid out the thesis).

On the other, the global economy continues to be weak, as higher interest rates put a damper on economic activity. OPEC recently had to deepen and extend its production cuts even further to support the oil price. From now until March 2024, OPEC+ has agreed to voluntarily cut 2.2 million barrels/day of production. Extended production cuts would curtail seaborne oil demand, which should cap tanker rates.

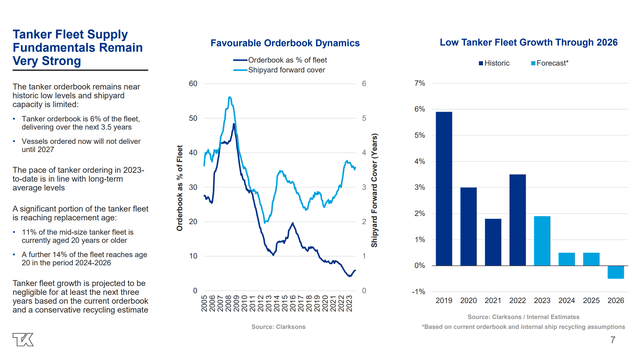

Given tanker fleet growth remains subdued as shipyards are full, any tanker rate declines should be limited unless the global economy falls into a recession (Figure 5).

Figure 5 – Global fleet growth remains subdued (teekay.com)

Considering the risks and rewards, I believe the most likely scenario is a range-bound tanker rate market where Suezmax rates range between $30,000 to $60,000, essentially the rates we have seen in the past year. This should lead to decent, but not spectacular earnings for Nordic American.

Rolling Out Estimates For 2024

With this article, I am also updating my forecasts for Nordic’s operating performance for 2023 and 2024. At an estimated $40,000 TCE equivalent tanker rate for the full year 2023, I expect Nordic to be able to deliver $0.46/share in dil. EPS, slightly better than in 2020 but not as strong as the windfall performance in 2021 (Figure 6).

Figure 6 – NAT financial model (Author created)

Similarly, with the addition of 1 extra vessel for 2024, I expect Nordic should be able to generate $274 million in revenues and $0.51 / share in dil. EPS, assuming tanker rates average ~$40,000 for the full year.

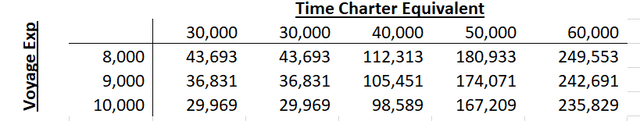

Figure 7 shows a sensitivity analysis on Nordic’s estimated 2024 net income with respect to tanker rates and operating expenses.

Figure 7 – NAT 2024 earning estimate sensitivity (Author created)

By my estimates, to achieve earnings similar to 2021’s bonanza year, tanker rates will have to surpass $50,000 TCE.

Tanker Stocks Still Viewed As Highly Cyclical

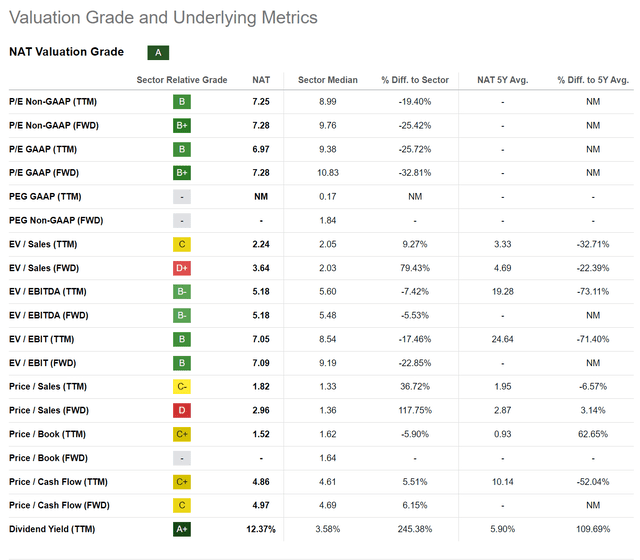

Given the volatile and cyclical nature of tanker rates, investors historically do not give too much credit to tanker stocks for their trailing earnings. Unfortunately, tanker rate volatility in the past year has not helped to dispel this view. NAT’s shares continue to trade at a discounted 7.0x trailing P/E and 7.3x Fwd P/E (Figure 8).

Figure 8 – NAT valuation (Seeking Alpha)

However, tanker stocks can deliver very strong earnings and dividends during good years. So far in 2023, Nordic has paid $0.49 / share in dividends, or a 12% trailing yield (Figure 9).

Figure 12 – NAT has paid a 12% trailing yield (Seeking Alpha)

However, investors are cautioned against counting their chickens before they hatch, as future dividends depend on tanker rates. For example, NAT’s dividend was $0.13 last quarter but was cut to just $0.06 this quarter due to the lowered profitability.

Insiders Continue To Buy

Nordic’s insiders continue to eat their own cooking, with board member Alexander Hansson continuing to buy shares every quarter. On November 30th, NAT reported that Mr. Hansson bought 100,000 shares at $3.93 / share, bringing his total stake to 2.25 million shares.

The Hansson family remains the largest private shareholder group in the company.

Lowering Rating Based On Balanced Risks

While ‘higher for longer’ tanker rates remain my base case, my bullish view is tempered by the weak global economy and the need by OPEC+ to keep more than 2 million barrels of oil production off the market. Simply put, OPEC production cuts limit the upside for tanker rates and hence tanker stocks.

However, downside to tanker rates should also be limited, as global tanker fleet growth remains muted and Russian crude continues to be shipped to the Far East.

With the risks and rewards more balanced, I am lowering my rating on NAT to hold.

Read the full article here