Nordson Corporation (NASDAQ:NDSN) manufactures dispensing products and offers its services to several industries, such as medical and packaging. NDSN recently announced strong Q4 FY23 and FY23 results. I think it can be a solid buy right now. I will discuss the reasons behind me saying it. I assign a buy rating on NDSN.

Financial Analysis

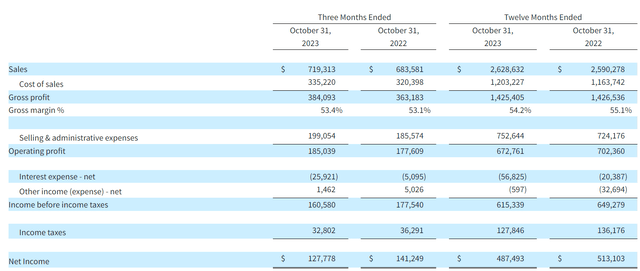

NDSN recently posted its Q4 FY23 and FY23 results. The sales for Q4 FY23 were $719 million, a rise of 5.2% compared to Q4 FY22. The major reason for the rise was a strong performance in its Industrial Precision Solutions segment. The Industrial Precision Solutions segment benefitted from the ARAG and CyberOptics acquisitions. The company also saw strong demand for its packaging and industrial coating product lines. Its gross margin for Q4 FY23 was 53.4%, which was 53.1% in Q4 FY22. The management attributed the increase to improved factory efficiency. Its EBITDA grew by 12% in Q4 FY23 compared to Q4 FY22.

NDSN’s Investor Relations

The annual results were also impressive. The sales for FY23 were $2.6 billion, a rise of 1.5% compared to FY22. The sales growth might seem low, but it was their best year in terms of sales. The EBITDA in FY23 was also a record. It reached $819 million. The company is performing well financially despite several headwinds, such as softness in the biopharma and electronic markets. It is sitting on its highest-ever sales, and the management is expecting its FY24 sales to be around 6.5% higher than FY23 sales. I think the target is achievable because its electronic market might recover in FY24. The semiconductor industry, which is now struggling, is expected to recover in the second half of 2024. So, if the semiconductor industry sees a recovery, then it will be beneficial for the electronic segment of the segment. In addition, the drop in interest rates and healthy supply chain are positive for them, and they are entering 2024 with a healthy backlog of $800 million. Hence, I think NDSN might do well in FY24.

Technical Analysis

Trading View

NDSN is trading at $261.3. NDSN is one of the most stable stocks, and we can see it in the price chart. The stock has moved up steadily, and talking about the current situation. I will just say that I am bullish on NDSN. Its current price action is quite bullish, and I believe it can skyrocket in the coming times. I am saying this because it has broken its all-time high range of $257. The stock was consolidating in the range of $200-$257 for about two years, and it tried around three times to break the range but failed. However, on the fourth attempt, it broke the range, and just to remind you that it was at its all-time high range. So, there are no barriers to stopping the price. Hence, the target for NDSN is open. In addition, the breakout happened after a long consolidation, so the chances of the breakout being successful are high.

Should One Invest In NDSN?

NDSN delivered solid results, and it looks like the market likes its results. We can see in its price chart that it has given a solid breakout. Now, looking at NDSN’s valuation. NDSN has a PEG [FWD] ratio of 0.93x compared to the sector median of 1.84x, and it is trading at a P/E [FWD] ratio of 26.84x, which is lower than its five-year average of 26.97x. So, the valuation looks good, and I believe it still has room for growth. After looking at all the factors, I think it is hard to resist NDSN at this point. Its results were solid, the outlook for FY24 is positive, the valuation looks reasonable, and most importantly, its stock price is very bullish. In addition, it has been one of the most stable stocks. Hence, I assign a buy rating on NDSN.

Risk

- Any time there is an increase in interest rates, it could be detrimental to their profitability. They owed $1,749,305 in total as of October 31, 2023, of which $553,020 had interest rates that fluctuated with the market. There would have been an extra $5,530 in interest costs in 2023 if the interest rate on the floating rate debt had increased by one percentage point. An increased amount of debt with a floating rate would expose more of it to interest rate fluctuations.

- They are vulnerable to changes in exchange rates for foreign currencies, especially those about the euro, yen, pound sterling, and Chinese yuan. Their ability to sell products competitively and control their cost structure could be impacted by any sizable shift in the value of the currencies of the nations in which they conduct business relative to the US dollar. This could materially negatively impact their operations, financial situation, and business.

Bottom Line

I think NDSN can be a great buy right now. The results were strong, and the outlook for FY24 is positive. The market seems to have liked the result because its stock price has given a solid breakout, and its stock price is looking for new all-time highs. In addition, its valuation looks reasonable. Hence, I assign a buy rating on NDSN.

Read the full article here