Introduction

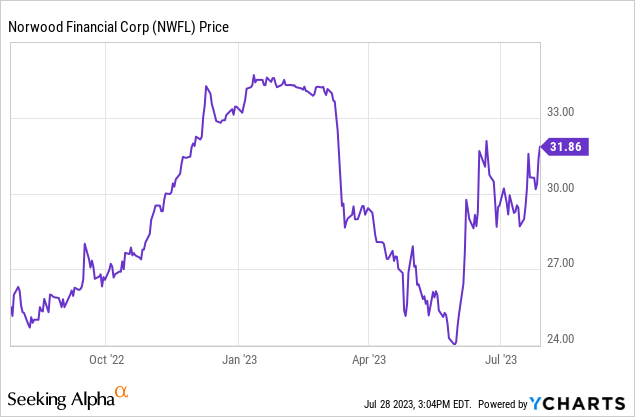

All eyes in the banking sector are obviously on the net interest income performance of the smaller banks. And while generally a lower net interest margin and net interest income is expected across the board, it always is interesting to see who was able to keep the damage limited.

I have been keeping an eye on Norwood Financial (NASDAQ:NWFL), a relatively small regional bank with just over $2B in assets focusing on Pennsylvania where it’s doing business as the Wayne Bank.

A stronger than expected result

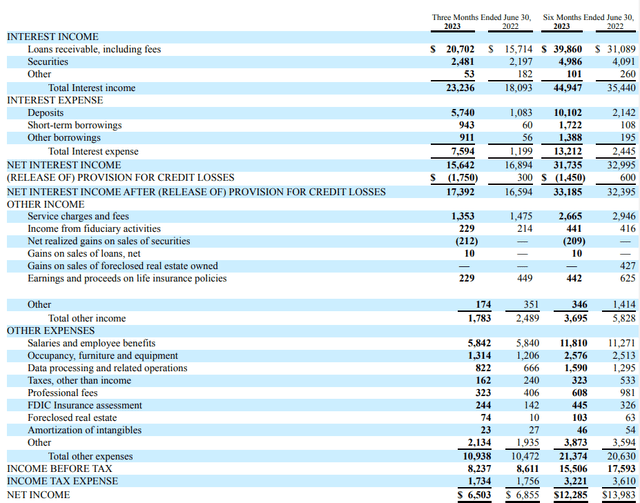

Norwood Financial was actually able to keep the net interest income relatively stable. Its interest income increased by almost $5.3M to $23.2M compared to the second quarter of last year. And of course, the total interest expenses also increased, by in excess of 500% to $7.6M, resulting in a net interest income of $15.6M. While that’s lower than in the second quarter of last year, the decrease of just $1.25M is actually very decent as it shows the bank has been able to keep the pressure on its net interest income limited. Additionally, the net interest income decreased by just 3% from the $16.1M in the first quarter of this year.

NWFL Investor Relations

The main drag for Norwood was the net non-interest expenses. The bank reported a $0.7M decrease in non-interest expenses but this was combined with a $0.45M increase in non-interest expenses which ultimately resulted in a net increase of the net non-interest expenses by in excess of $1.1M. The only reason why the pre-tax income was still very decent at $8.2M was due to the $1.75M release of provisions for credit losses.

The total tax bill was $1.7M resulting in a net income of $6.5M or $0.81 per share. That’s a good result, but again, this includes a substantial $1.75M boost from the release of credit loss provisions. Excluding that release, the EPS would likely have been just around $0.64-0.65 although this does include a net realized loss of $0.2M on the sale of securities as well, which had a net impact of about $0.02/share. The quarterly dividend of $0.29 per share obviously remains well-covered, resulting in a current yield of around 3.7%.

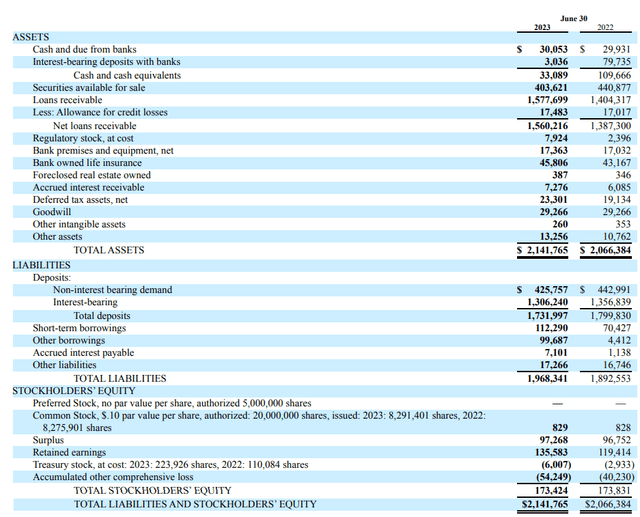

Looking at the balance sheet, Norwood still has a very liquid balance sheet. The bank has about $1.73B in deposits on the liabilities side of the balance sheet and it’s holding about $437M in cash and securities available for sale. There are no securities held to maturity on the balance sheet. This means about 25% of the total deposits are held in cash and securities available for sale.

It’s also interesting to see the total size of the loan boo increased by in excess of 10% compared to one year ago, while the allowance for credit losses has barely moved (an increase of just around 2.5% to $17.5M).

NWFL Investor Relations

While the total provision for loan losses appears to be low at 1.11% of the total amount of loans, let’s not forget that only 0.20% of the loans are currently classified as non-performing. We’ll have to wait for the company to publish its detailed quarterly report to see which part of the loan book is under increasing pressure. While the total amount of non-performing loans vs. the total loan book has quintupled in the past 12 months, let’s not forget this still represents just $3.2M in non-performing loans.

As of the end of the second quarter, the total book value of Norwood Financial was $173.4M. Divided over 8.07M shares outstanding, the book value per share was $21.49. After deducting the $29.5M in goodwill and other intangible assets, the tangible book value is just under $18. Which means the stock is currently trading at about 1.8 times the tangible book value per share, which is pretty high. The book value is somewhat stabilizing though as Norwood only lost about $1.5 per share in tangible book value compared to one year ago.

Investment thesis

Back in January I had a “hold” rating on the stock, and I think I’d still have to keep it at “hold.” While the stock appears reasonably priced based on the earnings profile with an EPS of $1.52 in the first semester, but this includes the benefit from a $1.45M release from loan loss provisions in that semester, which had a positive impact of about $0.14 per share. This means I don’t really expect the full-year EPS to come in above $3/share (and if it does, it may be marginally higher) as I don’t expect the bank to be able to record additional provision releases while the net interest income will remain under pressure.

While it’s important to retain a longer-term look at the results of Norwood Financial as the net interest margin appears to be bottoming out, that’s not a bank-specific element as the NIM pressure should ease across the sector. And that’s why I’m not a buyer of a stock trading at 10-10.5 times its earnings and at a 80% premium to the tangible book value. I’m for now sticking with my position in Flushing Financial (FFIC) which I discussed here. While Flushing’s P/E ratio will be substantially worse this year, it’s trading at a discount of in excess of 30% on its tangible book value, providing an additional margin of safety.

Read the full article here