Introduction

NovaGold Resources Inc. (NYSE:NG) owns 50% of a gold project in Western Alaska called the Donlin Gold Project. The joint venture is shared with Barrick Gold Corporation (GOLD). Here is an excerpt of the last 10-Q filing.

The Donlin Gold project is owned and operated by Donlin Gold LLC (“Donlin Gold”), a limited liability company that is owned equally by wholly-owned subsidiaries of NOVAGOLD and Barrick Gold Corporation (“Barrick”).

NovaGold Resources released its second quarter of 2023 results on June 28, 2023.

This article updates my article published on October 5, 2022.

Note: The Company released its third-quarter results on October 4, 2022, ending 08/31/2022. I have followed NovaGold Resources since 2019.

1 – Presentation and 2Q23 Results Snapshot

Reminder: NovaGold Resources and Barrick Gold USA – a subsidiary of Barrick Gold Corporation – are developing the Donlin Creek open-pit gold project in Alaska under a 50-50 joint-venture (“JV”) partnership called Donlin Gold (2007).

The Company filed its 10-Q for the second quarter of 2023 on August 4, 2022.

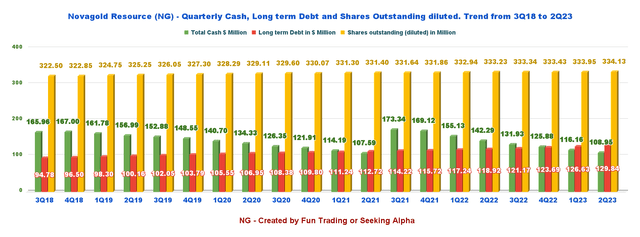

NovaGold Resources posted a loss of $14.65 million, with total cash of $108.95 million, down from $142.29 million in 2Q22.

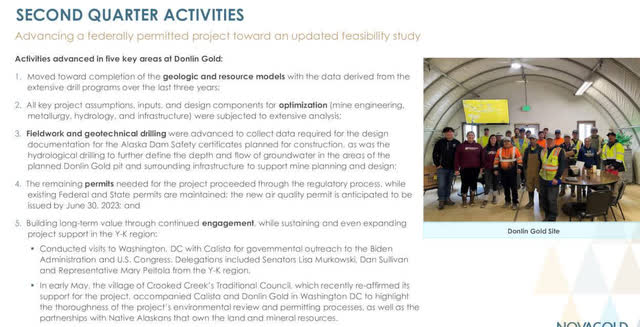

NG 2Q23 Activities Highlights (NG June Presentation)

The only issue is the cost necessary to bring this project to production. Inflationary pressures are here to stay, and will considerably inflate an already ballooning CapEx, which threatens the project’s feasibility, one of the world’s biggest.

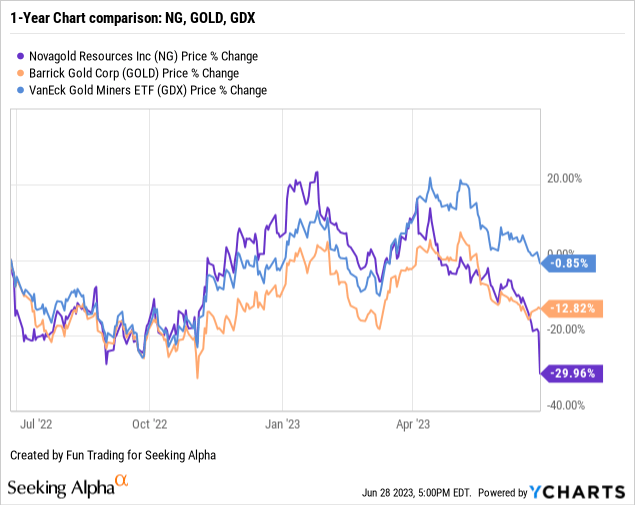

2 – Stock Performance and commentary

NG has dropped 30% on a one-year basis. If we compare NG to GOLD, we can see that NG was tightly following GOLD on a one-year basis up until today.

3 – Investment Thesis

I see Donlin Project as a fair opportunity to invest long term. The recent drop in NovaGold Resources Inc. stock price should be considered a good opportunity for a very patient investor. However, we must be cautious and prudent with large gold projects and understand the issue’s complexity.

On second thought, I seriously wonder about the entire “feasibility” of the project and the possible insufficiency of commitment from Barrick Gold at this advanced stage.

I see Barrick Gold committing an initial CapEx of over $7 billion to complete the Reko Diq copper and gold mine in Pakistan (50% owned by Barrick). Still, it seems hesitant to move decisively with the Donlin Gold Project, which requires the same initial CapEx.

Reko Diq is expected to have a life of at least 40 years as a truck-and-shovel open pit operation with processing facilities producing a high-quality copper-gold concentrate. Construction is expected in two phases with a combined process capacity of 80 million tonnes per annum.

By the way, Barrick Gold targets 2028 for the first production from Reko Diq.

It has been over 15 years of studies, and all we are reading in this new report is that the company intends to update the feasibility study while the project has received nearly all the necessary green lights. The company said the remaining permits needed for the project to proceed through the regulatory process while existing Federal and State permits are maintained will be received in June 2023.

NG Permitting (NG Presentation)

After today’s NovaGold Resources Inc. selloff, it is obvious that investors are exhausted from waiting for some concrete decision. Time is of the essence.

Therefore, as I regularly recommend to my subscribers in my marketplace, “The Gold and Oil Corner,” trade short-term LIFO by using about 80% of your NG position. I also recommend building a core long-term investment that you keep and grow until the project’s final investment decision using only the short-term gains accumulated.

NovaGold Resources 2Q23 – The Raw Numbers:

Note: The Company is not generating revenues and is in development.

| NovaGold Resources | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 | 2Q23 |

| Net Income in $ Million | -10.00 | -14.97 | -16.12 | -12.26 | -10.66 | -14.65 |

| EBITDA $ Million | -8.48 | -13.29 | -13.93 | -9.72 | -7.64 | -11.44 |

| EPS diluted in $/share | -0.03 | -0.04 | -0.05 | -0.04 | -0.03 | -0.04 |

| Operating Cash Flow in $ Million | -6,00 | -2.32 | -1.64 | -2.40 | -4.49 | -0.17 |

| Total Cash $ Million | 155.13 | 142.29 | 131.93 | 125.88 | 116.16 | 108.95 |

| Long-term Debt in $ Million | 117.24 | 118.92 | 121.17 | 123.69 | 126.63 | 129.84 |

| Shares outstanding (diluted) in Million | 332.94 | 333.23 | 333.34 | 333.43 | 333.95 | 334.13* |

Source: NovaGold Resources 10-Q.

* In the 10-Q: As of June 20, 2023, the Company had 334,132,703 Common Shares, no par value, outstanding.

As shown in the table above, the outstanding shares diluted and the long-term Debt are maintained nearly at the same level, and the total cash dropped to $108.95 million at the end of 2Q23.

An additional payment from Newmont Corporation (NEM) of $25 million comes due in July 2023 related to the sale of NovaGold’s 50% interest in the Galore Creek project in 2018. Also, NG owns a note receivable for $75 million contingent upon the owner’s approval of a Galore Creek project construction plan.

NG Balance Sheet 2Q23 (Fun Trading)

The solid financial position supports the 2023 CapEx estimated at $31 million. Furthermore, on an optimistic note, the Company reaffirmed that the cash position is sufficient to cover the expected funding of the Donlin Gold Project.

We anticipate spending approximately $31 million in 2023, which includes $17 million to fund the Donlin Gold project, $13 million for corporate general and administrative costs, and $1 million for working capital and other items

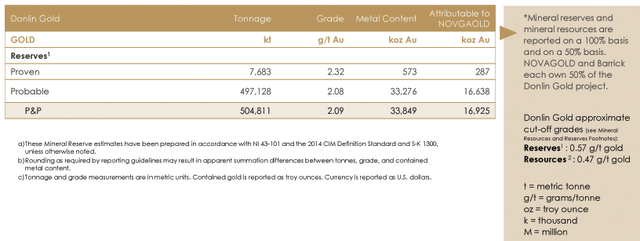

Mineral reserves are indicated in the table below. They are unchanged from the preceding quarter.

NovaGold Resources’ share of the mineral reserve proven and probable is 16.925 Moz, with an additional 2.997 Moz in M&I and inferred. The basics have not changed since the preceding article.

Donlin Project reserves (NG Presentation)

- The mineral reserves, P1 and P2, are 33,849K Au Oz with a cut-off grade of 0.57g/t gold related to reserves, and the total grade is 2.09 g/t with a LOM of 27+ years. The Company expects to produce 1.5 M Au Oz annually in the first five years.

- The initial CapEx for Donlin Gold is $7,402 million. Because of the location, barging will be used as the main transport for goods.

- 2023 proposed overall CapEx is expected to be $31 million, equally shared with Barrick.

- Long-term debt represents a promissory note payable to Barrick Gold of $129.84 million.

CEO Greg Lang said in the conference call:

It is our belief that Donlin Gold is among the rarest of gold development assets. A Tier 1 asset in a Tier 1 jurisdiction. To touch on Donlin’s attributes, as currently envisioned with approximately 39 million ounces, it hosts one of the largest and highest grade undeveloped gold endowments in the world that would average over a million ounces per year of gold production for 27 years.

Technical Analysis and Commentary

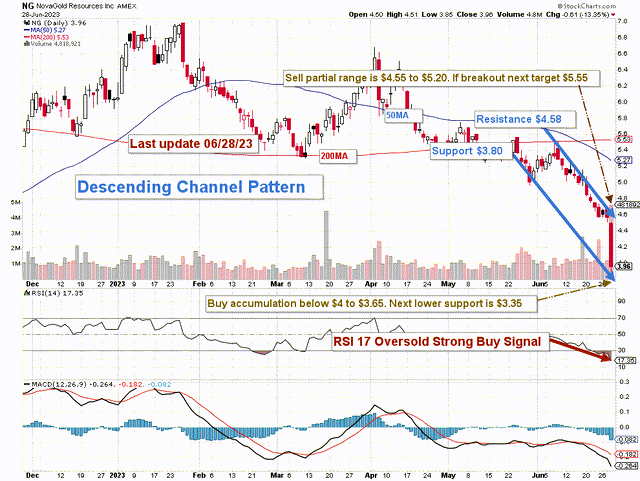

NG TA Chart Short-Term (Fun Trading StockCharts)

NG forms a steep descending channel pattern with resistance at $4.58 and support at $3.80. RSI is now very oversold at 17, a strong buy signal.

Descending channel patterns are short-term bearish in that a stock moves lower within a descending channel, but they often form within longer-term uptrends as continuation patterns. Higher prices usually follow The descending channel pattern but only after an upside penetration of the upper trend line.

As I have recommended in my preceding article, the trading strategy I suggest is selling LIFO 50% between $4.55 and $5.20 with possible higher resistance at $5.55 and waiting for a retracement to buy back between $4 and $3.65 with potential lower support at $3.35.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Read the full article here