Just over nine months ago, I wrote on OceanaGold (OTCPK:OCANF), noting that there was no way to justify chasing the stock above US$2.15 after its weak Q3 2022 results. This was because the stock had another high-cost year ahead before it finally started processing stope ore from Haile Underground, and it wasn’t cheap with it trading above 1.0x P/NAV. Since then, the stock is down by over 5% and has massively underperformed other mid-tier producers like Alamos Gold (AGI) and Eldorado Gold (EGO), and also significantly underperformed the price of gold. In this update, we’ll look at the company’s recent Q3 2023 results, its updated valuation from a relative standpoint, and whether the stock is still in a low-risk buy zone.

Oceana Gold Operations – Company Website

Q3 Production & Sales

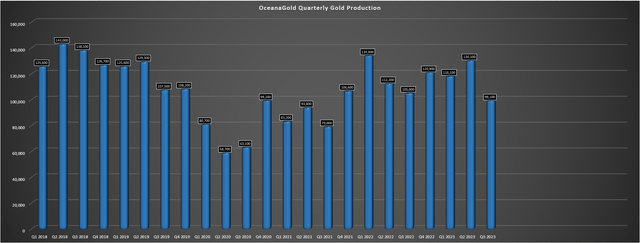

OceanaGold (“Oceana”) released its Q3 results last month, reporting quarterly production of ~99,600 ounces, a 6% decline from the year-ago period. The decline in production was attributed to a softer than expected quarter at the company’s Haile Mine in South Carolina, with lower grades, throughput, and recoveries, with just ~777,000 tonnes processed at 1.21 grams per tonne of gold at 76.6% recovery rates. Oceana noted that the lower grades were due to negative grade reconciliation from the lower benches of the Mill Zone Pit and the shift to waste stripping at the Ledbetter Pit, but the good news is that mining is now finished at the Mill Zone Pit. Unfortunately, this setback at its largest contributor has left year-to-date production at just ~347,000 ounces, tracking well behind its initial guidance midpoint of 485,000 ounces for FY2023, with Oceana cutting its guidance midpoint.

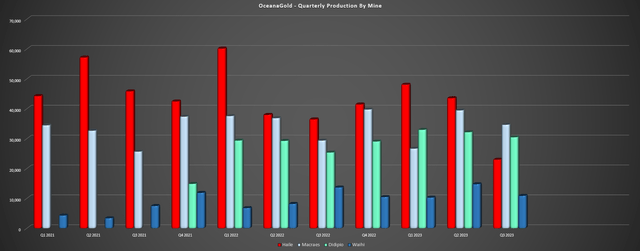

OceanaGold – Quarterly Gold Production – Company Filings, Author’s Chart OceanaGold Quarterly Production by Mine – Company Filings, Author’s Chart

Looking at the company’s other three mines, Macraes bounced back with ~34,700 ounces produced at $1,550/oz costs vs. ~29,400 ounces at $1,924/oz in the year-ago period, and the ball mill has been fully repaired with milling rates back to normal. Meanwhile, Didipio has had a solid year with ~30,500 ounces produced in Q3 and ~95,700 ounces year-to-date, and is tracking above initial guidance with some of the lower costs sector-wide after factoring in by-product credits (year-to-date all-in sustaining costs of $727/oz). That said, Waihi did rain on the parade with another very weak quarter, producing just ~10,900 ounces at industry-lagging costs of $2,196/oz. Like Haile, grades were below expectations, with challenging ground conditions in fresh stoping areas leading to reliance on lower grades from remnant stopes.

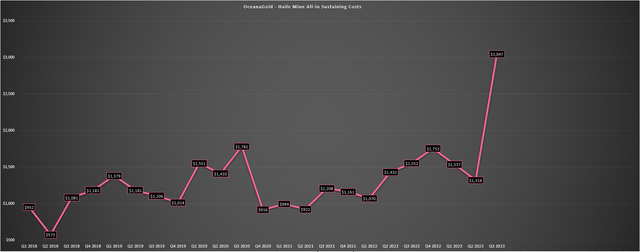

Given the poor performance at Waihi and a projected increase in operating costs from contract workers and additional water management costs has led to all-in sustaining costs [AISC] being well above the initial guidance midpoint of $1,450/oz. In fact, year-to-date AISC is sitting near $1,950/oz, with OceanaGold revising cost guidance at Waihi to $1,800/oz to $1,900/oz. Elsewhere, Haile’s costs spiked to their highest levels on record at $3,047/oz in Q3, affected by fewer ounces sold and higher pre-stripping and capitalized mining at Haile. On a positive note, the weak quarterly performance was an anomaly and Q4 and next year should be much better with the first stope ore heading to the mill this quarter which will lift overall grades in 2024 with full production levels at Horseshoe Underground expected by summer of next year.

Haile Mine AISC – Company Filings, Author’s Chart

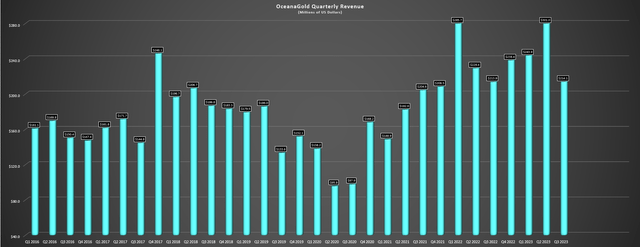

Not surprisingly, Oceana’s financial results suffered with revenue of $214.1 million (flat year-over-year), despite lapping easy comparisons given the much lower gold price in Q3 2022 of $1,699/oz. Meanwhile, operating cash flow came in at $62.5 million, well below my expectations, given the benefit of the higher gold price and free cash flow was negative, with an outflow of $29.6 million, though this was largely because of elevated capital expenditures in the period at Haile ($97.2 million on a consolidated basis vs. $56.4 million in Q3 2022). Finally, the company reported an adjusted net loss of $1.6 million, paling compared to the $24.6 million in earnings from Karora (OTCQX:KRRGF) and $6.6 million from Orla Mining (ORLA) on much smaller production profiles.

OceanaGold Quarterly Revenue – Company Filings, Author’s Chart

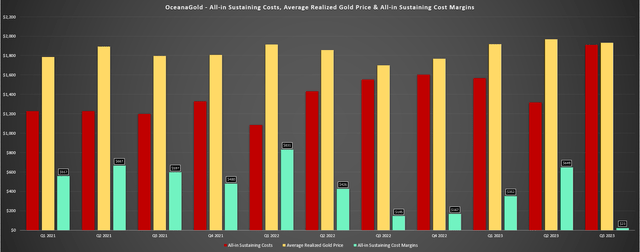

Costs & Margins

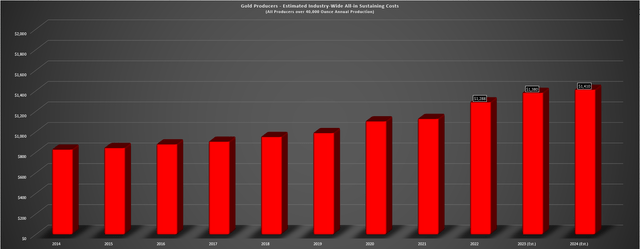

Moving over to costs and margins, there wasn’t anything to write home about here either, with all-in sustaining costs soaring to $1,911/oz, resulting in significant margin compression despite higher gold and copper prices and easy comparisons from Q3 2022. In fact, AISC margins plunged to $23/oz from $145/oz in the year-ago period and full-year AISC is now expected to come in just shy of $1,600/oz vs. prior estimates of $1,475/oz at the midpoint. This is certainly disappointing as these costs are yet again well above the industry average (FY2023 industry average estimates: ~$1,380/oz), though the company is in decent financial shape despite the cash outflows with ~$175 million in liquidity, $60+ million in cash, and a much better year ahead from a free cash flow standpoint once higher grade starts hitting the mill at Haile.

OceanaGold AISC, Average Realized Price & AISC Margins – Company Filings, Author’s Chart

So, what’s the good news?

While 2023 has been another year to forget for investors and we saw some setbacks, we should see annual production increase to ~550,000 ounces in FY2024 at costs closer to $1,400/oz. Meanwhile, capital expenditures will cool down with OceanaGold set up to generate over $180 million in free cash flow at a $2,000/oz gold price assumption. Not only will this help the company move closer to a net cash position, but it will also improve its margin profile and likely sentiment for the stock. Hence, although OceanaGold is down and has underperformed, it’s certainly not out and has a much stronger back half of the decade ahead with ~4.0 gram per tonne grades (over twice the open-pit grade) from Haile Underground.

Recent Developments

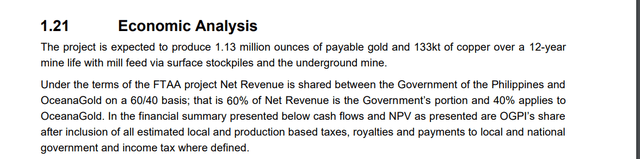

Moving over to recent developments, there was one in the quarter aside from the operational setbacks. This was the fact that OceanaGold has now crossed the threshold where it has to start sharing net revenue with the Philippines Government on a 60/40 basis under the FTAA, with this certainly affecting contribution from its highest margin operation. In fact, the government’s share was $13.9 million in Q3 alone. Obviously, this isn’t an enormous deal as Haile is ramping up to higher production levels at lower costs and this is just one of its assets, but it’s certainly a negative development relative to previous contribution levels from this asset. It’s also worth noting that the company is looking at a study to push throughput ~15% higher to “at least 2.0 million tonnes per annum” which could lift production at this asset post-2025 as a minor offset.

“This quarter we accrued $13.9 million for the additional government share per the terms of the FTAA with the Philippines government. This is the first accrual and the final amount due for 2023 will be finalized at year end, payable in Q2 of 2024. In broad terms, the Philippines government is entitled to a 60% share of net revenue once the company has effectively recovered its capital investment in Didipio and we effectively crossed this threshold in Q3 and expect to pay the additional government share moving forward.”

– OceanaGold, Q3 2023 Conference Call

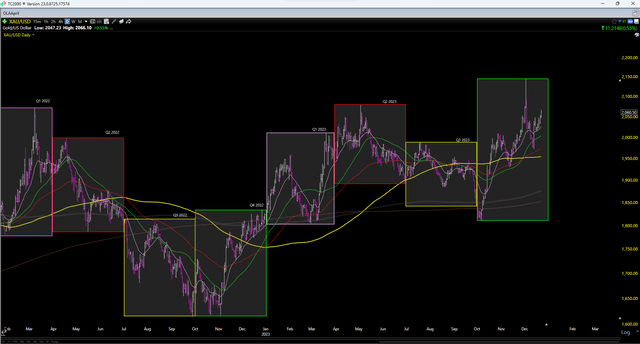

Didipio Profit Sharing – 2021 TR

On a positive note, the gold price has averaged ~$1,970/oz quarter-to-date, and should come in at the highest level on record for the Gold Miners Index (GDX). This is because past rallies above the $2,000/oz level have been fleeting vs. a record of five consecutive closes above $2,000/oz this week. Obviously, this is a significant tailwind from a margin standpoint and it certainly doesn’t hurt that oil prices have softened materially, providing one of the best setups for miners in years (persistently high gold prices with relatively low oil prices), and suggesting a very strong Q4 report on deck for the sector and certainly a much better quarter sequentially for OceanaGold. Finally, drill results at Haile haven’t been too shabby, with an impressive 73.8 meters at 16.17 grams per tonne of gold (Horseshoe) and 73.2 meters at 4.92 grams per tonne of gold (Palomino) reported after quarter-end (not true widths).

Quarterly Gold Price – Worden.com

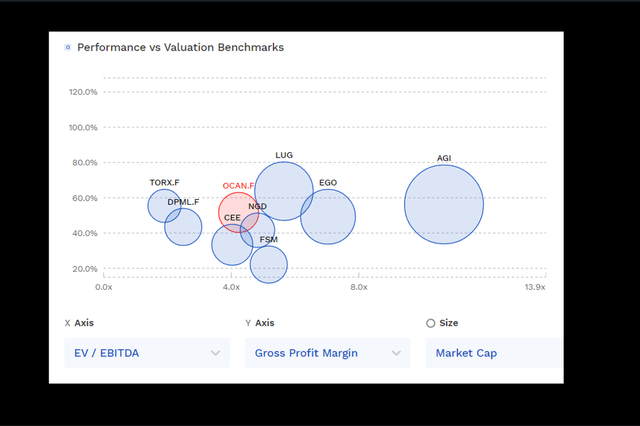

Valuation

Based on ~725 million fully diluted shares and a share price of US$2.09, OceanaGold trades at a market cap of $1.51 billion and an enterprise value of ~$1.68 billion. This leaves OceanaGold as one of the lower capitalization mid-tier producers, and well behind Eldorado Gold after its year of outperformance. And while this certainly looks justified after a disappointing Q3 showing with industry-lagging AISC margins of ~$20/oz, it’s worth noting that Oceana’s margin profile will improve materially next year even if we assume more conservative cost estimates of ~$1,400/oz. In fact, even using a lower average realized gold price of $1,950/oz to be conservative, OceanaGold’s AISC margins will improve from ~$400/oz (2023) to ~$550/oz, and back in line with the estimated industry average.

OceanaGold vs. Peers – EV/EBITDA Multiple, Margins & Market Cap – FinBox Gold Producers – Estimated Industry Wide AISC – Company Filings, Author’s Chart

Using what I believe to be a fair multiple of 1.0x P/NAV and 7.0x FY2024 cash flow per share estimates and a 65/35 weighting (P/NAV 65%, P/CF 35%), I see an updated fair value for the stock of US$3.22. This points to a 54% upside from current levels, making OceanaGold one of the more undervalued names in the sector among peers with the bulk of their production from Tier-1 ranked jurisdictions. That being said, I am looking for a minimum 40% discount to fair value to ensure an adequate margin of safety, translating to a low-risk buy zone for OceanaGold of US$1.92 or lower. In summary, while this rally in the stock could certainly continue as the stock can play catch-up from a valuation standpoint, I don’t see enough of a margin of safety following the recent rally.

Summary

OceanaGold had a tough Q3 and certainly underperformed its peers, with it being one of the top-5 highest-cost producers in the sector next to Iamgold (IAG). Meanwhile, free cash flow generation has significantly lagged similar-sized producers like Alamos Gold (AGI) and Lundin Gold (OTCQX:LUGDF), and Didipio’s contribution will be significantly affected from now on. That said, OceanaGold trades at just over 8x FY2024 free cash flow estimates, will look like an entirely different company if Horseshoe Underground delivers as planned, and although Waihi has disappointed, WKP is certainly an exciting opportunity longer-term with phenomenal results like ~5 meters at 77 grams per tonne of gold.

In summary, if I were looking for Tier-1 gold exposure at a reasonable price, I would view any pullbacks below US$1.92 on OCANF as a buying opportunity. However, if I was looking to put capital to work today, I continue to see a better reward/risk setup in a name like Argonaut Gold (OTCPK:ARNGF) that is also a Tier-1 jurisdiction producer (plans to divest Mexican assets), and currently trades at just ~3x FY2024 free cash flow estimates.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here