Even though the past couple of years have resulted in some major wins on my part in terms of the investments that I have made, I always regret missing out on a company that I felt was attractive but ultimately ended up not buying shares which went on to see tremendous upside. A great example of this can be seen by looking at Oil-Dri Corporation of America (NYSE:ODC), a company that produces and sells sorbent products, including those that are used for agriculture and horticulture, as well as some that are used for the production of cat litter. In the past, shares of the company were attractively priced and financial performance was rather robust. Fast forward to today, and shares aren’t all that cheap. However, the company continues to grow at a strong pace.

The last article that I wrote about the business was published in early May of this year. In it, I was reviewing my prior ‘buy’ rating on the stock. From the time of my first bullish thesis on the company in August of 2022 until my May 2023 article, shares had skyrocketed 55.2% at a time when the S&P 500 was up 2.8%. Despite that, I kept Oil-Dri Corporation of America rated a ‘buy’ because of how much upside it seemed to offer. So far, returns have continued to impress, with shares up another 66.1% while the S&P 500 is up 13.7%. That places the total return since my first article on the company at 157.2%. That’s almost 10 times the 16.8% seen by the broader market. Even with that tremendous upside, the company continues to post attractive financial results. I do truly believe that most of the easy money has been made and that further upside from this point on is certainly limited. But it’s not limited enough to downgrade the business from a ‘buy’ just yet.

A firm that keeps on delivering

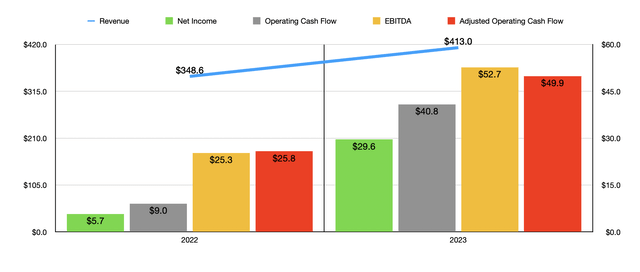

Author – SEC EDGAR Data

To understand just how robust the financial performance of Oil-Dri Corporation of America continues to be, we should touch on how the business fared in 2023. During the 2023 fiscal year, revenue came in at $413 million. That’s 18.5% above the $348.6 million generated one year earlier. For a couple of years, because of supply chain constraints and strong demand, the business suffered from a good problem, which was an incredibly high backlog. To address this and bring it down, the company increased the number of personnel that it employed. It expanded production shifts, worked on equipment optimization, and engaged in other initiatives, all resulting in a 45% decrease in backlog from July of 2022 through the end of the 2023 fiscal year.

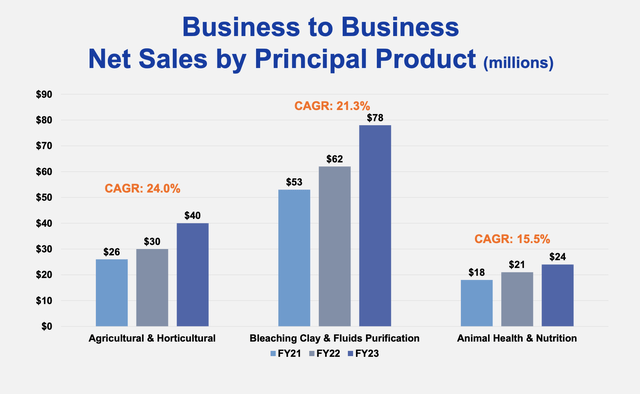

Oil-Dri Corporation of America

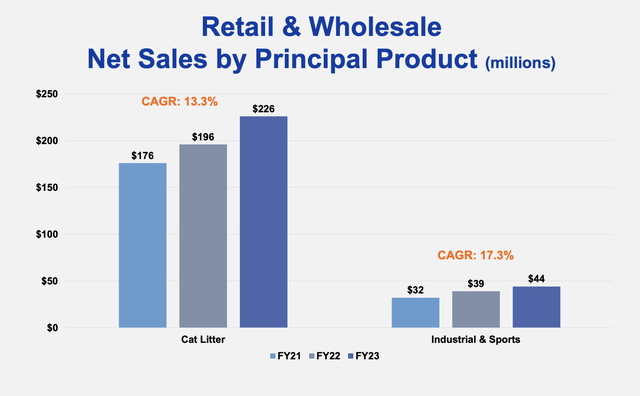

There are two different parts of the company. The first one is the Business to Business Products Group, which, as the name suggests, sells directly to businesses. In 2023, sales for that unit were up 26%, totaling $29 million, from what we’ve seen in 2022. Management reported increased demand across all product categories such as agriculture and horticulture products, animal health products, and fluids purification products. Although higher demand for its offerings, as measured by volume, contributed to this increase, the biggest benefit for the firm was its ability to increase pricing. Next, we have the Retail and Wholesale Products Group, which reported a 15% rise in revenue thanks in large part to higher demand for the company’s cat litter, industrial, and sports products. Higher pricing was largely responsible for these improvements, though organic volume growth of both its branded and private label lightweight scoop, as well as its private label coarse litter, also helped.

Oil-Dri Corporation of America

With revenue rising, profits shot through the roof. This makes sense when you consider that higher pricing is essentially 100% margin, after accounting for increased operating costs and taxes. Net profits, as a result, grew from $5.7 million in 2022 to $29.6 million in 2023. Operating cash flow expanded from $9 million to $40.8 million. If we adjust for changes in working capital, we get a slightly smaller increase from $25.8 million to $49.9 million. And finally, EBITDA for the company expanded from $25.2 million to $52.7 million.

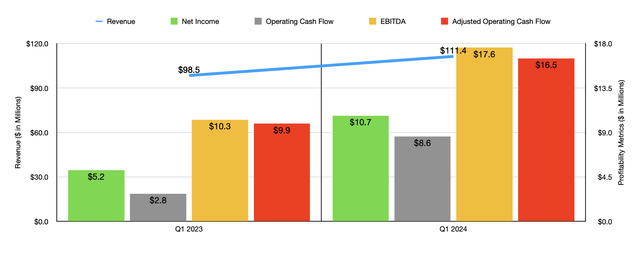

Author – SEC EDGAR Data

Financial performance for the company continued to improve into the 2024 fiscal year. During the first quarter, revenue totaled $111.4 million. That’s 13.1% above the $98.5 million reported one year earlier. The Business to Business Products Group of the company reported a 16% sales increase, with all three of the company’s primary product lines benefiting from multiple factors. In particular, management said that new customers in the renewable diesel business in North America were primary drivers of its expansion. Strong demand continued to be the base case when it came to products used in the filtration of edible oil and the firm also benefited from higher pricing on some of its products. Although still a very small part of the company, net sales for the animal health and nutrition products part of the business managed to grow by about 18%. But that amounted to an increase of only $1 million. The Retail and Wholesale Products Group, meanwhile, reported a roughly 11% sales increase thanks in large part to higher revenue associated with some of the company’s cat litter products. And that, according to management, was largely due to higher pricing.

Oil-Dri Corporation of America

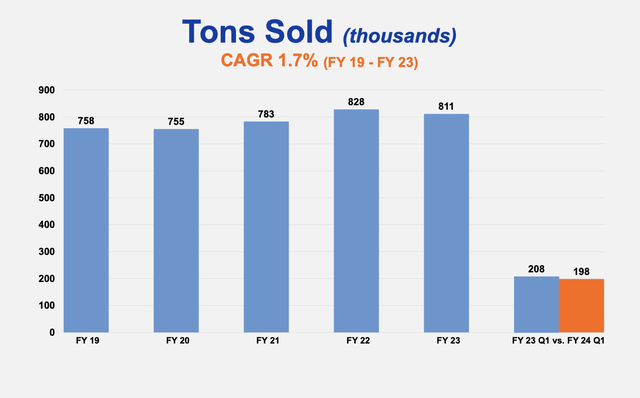

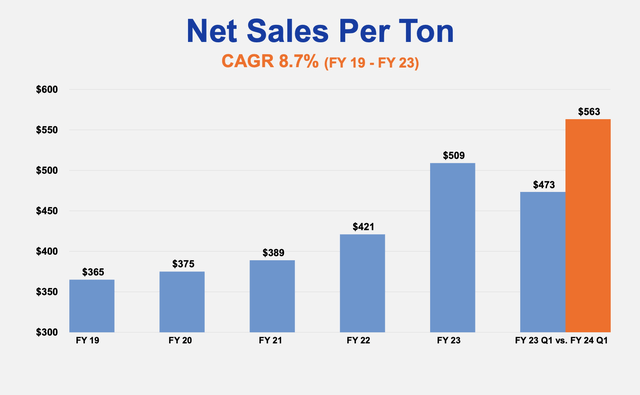

It is worth noting that, so far this year, the company has seen some weakness when it comes to the total tons of products sold. In the most recent quarter, Oil-Dri Corporation of America sold 198,000 tons, which was down from the 208,000 reported in the same quarter of last year. However, the net sales per ton have shot up from $473 last year to $563 this year. This shows the company’s pricing power and it should not be a surprise that profits would climb in response.

Oil-Dri Corporation of America

On the bottom line, profits continued to fare well. Net income more than doubled from $5.2 million to $10.7 million. Operating cash flow more than tripled from $2.8 million to $8.6 million, while the adjusted figure for it managed to rise from $9.9 million to $16.5 million. And lastly, we have EBITDA. In the first quarter of 2023, it totaled $10.3 million. For the same time of the 2024 fiscal year, it came in rather strong at 17.6%.

Author – SEC EDGAR Data

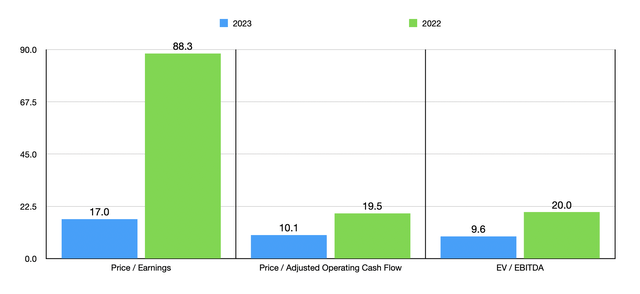

As much as I would like to forecast financial results for the rest of the 2024 fiscal year, management has not provided any real guidance on that front and it is still quite early in the year to expect to get anything remotely realistic. Instead, I decided to value the company using results from 2022 and 2023. In the chart above, you can see the pricing for the business using three different approaches. Although the stock is a bit lofty on a price-to-earnings basis for 2023, it looks quite affordable when it comes to the other two profitability metrics. As part of my analysis, I also compared the business to five similar firms. These can be seen in the table below. On both a price-to-earnings basis and price-to-operating cash flow basis, two of the five companies were cheaper than Oil-Dri Corporation of America. But when it comes to the EV to EBITDA approach, it ended up being the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Oil-Dri Corporation of America | 17.0 | 10.1 | 9.6 |

| Energizer (ENR) | 16.6 | 5.9 | 11.6 |

| Central Garden & Pet Company (CENT) | 20.1 | 6.6 | 10.7 |

| Spectrum Brands (SPB) | 1.8 | 16.9 | 163.8 |

| WD-40 Company (WDFC) | 49.4 | 32.9 | 33.0 |

| Reynolds Consumer Products (REYN) | 20.6 | 10.5 | 12.5 |

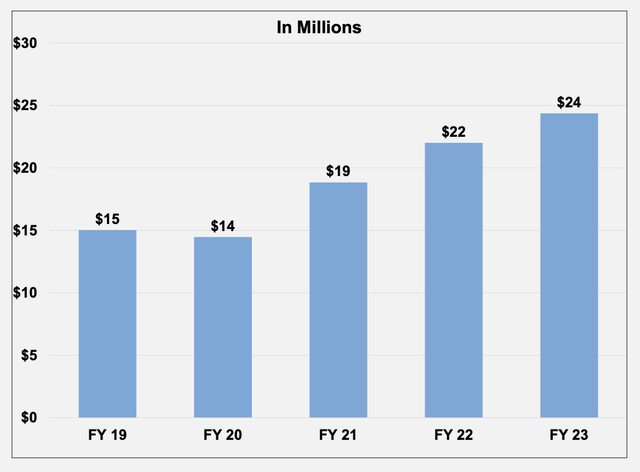

Outside of the topic of valuation, it is worth noting that I believe that financial growth will continue for the company for the foreseeable future. Management has been investing heavily in expanding its opportunities. Last year, for instance, the company spent $24 million on capital expenditures, marking the most ever spent in any given year. That’s up from $22 million in 2022 and $19 million in 2021. Over the past three years, the firm has been investing heavily in alternative energy initiatives.

Oil-Dri Corporation of America

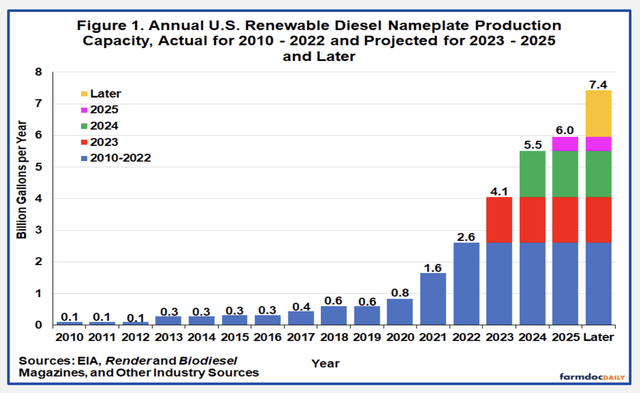

This includes investments in LED lighting and power monitoring using mostly solar panels and natural gas-powered turbine generators. Some of the spending has also been allocated toward increasing production capacity, such as being able to add volume for its traditional angular Absorb products that help to support crop protection. The companies also focused on the renewable diesel market here at home. This is because they see attractive growth in that market. According to forecasts, renewable diesel capacity is expected to grow from 4.1 billion gallons this year to 6 billion gallons by 2025. In the long run, we are looking at about 7.4 billion gallons annually.

Oil-Dri Corporation of America

Takeaway

From all that I can tell, Oil-Dri Corporation of America continues to do very well for itself. The company continues to grow while increasing its bottom line. Shares aren’t exactly as cheap as they used to be, but they do still look fairly attractive. Management is making big investments in growth initiatives and I see no reason why those won’t turn out well. Even though the easy money has certainly been made, I would argue that the stock still deserves a bit of upside from here. Because of that, I am keeping it rated a ‘buy’ at this time.

Read the full article here