OmniAb (NASDAQ:OABI) is a favorite of mine which I have followed since its 11/2022 spinoff from its former parent, Ligand Pharmaceuticals (LGND). My most recent OmniAb article is 09/2023’s “OmniAb: Hold For Growth” evaluating it following its Q2, 2023 earnings call.

At the time I had a positive viewpoint on the company. I rated it a “hold”, downgrading it from a buy as established in 05/2023’s “OmniAb: 6 Months In And Going Strong”.

This article updates my thinking on OmniAb after its Q3, 2023 special earnings call and virtual event (the “Event”) and Event presentation (the “Presentation”). The company continues to be attractive. However, no new developments merit a return to a “buy” rating, particularly with its current (12/11/2023) elevated market cap.

The Event was a combination technology review/conference call providing in-depth insights into OmniAb.

General

The Event was unusual in my experience. It was a combination of a normal earnings conference call with an added dollop of technology update and review. The accompanying Presentation was more detailed and helpful than its typical quarterly slideshows.

The Event provides an excellent jumping-off point for those interested in understanding OmniAb’s uniquely attractive take on biotech innovation.

OmniAb’s Mission

CEO Foehr opened the Event by describing OmniAb’s mission. He characterized it as a critical factor in guiding the company and keeping it focused. Per his description the company’s mission is simple and straightforward; it is to:

…enable the rapid development of innovative therapeutics by pushing the frontiers of drug discovery technologies.

This is not an unusual mission for a biotech company. What sets OmniAb apart from its peers and makes it such an important component of a biotech investors’ portfolio is its approach to achieving this mission.

Business

OmniAb’s Presentation slide 7 describes its business as leveraging its proprietary discovery technology platform worldwide. The slide consists of panels that help to understand its potential scope and scale as it pursues its mission.

It characterizes antibody discovery as one of the largest greenfields in the pharmaceutical industry with a $279 billion total addressable market for antibodies by 2025. OmniAb’s business relies on securing partners who develop programs using its antibody discovery technology.

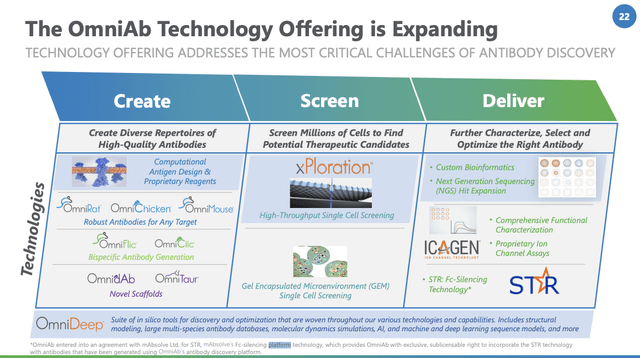

Over the years it has acquired its various transgenic animals, beginning in 2012 with Ligand’s acquisition of the OmniRat platform. Its slide 22 lists its dynamic technology which is very much in an ongoing growth phase:

seekingalpha.com

It is now operating with dozens of antibodies in clinical development with a diverse group of partners as shown by Presentation slide 16. It already has three approved programs partnered respectively by Gilead (GILD), Pfizer (PFE), and Johnson & Johnson (JNJ) subsidiary Janssen.

Financials

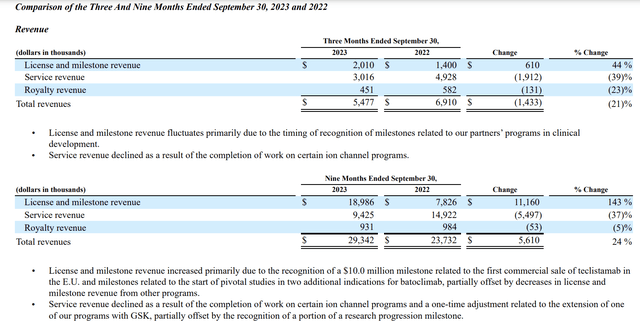

No matter how much I like OmniAb’s business, I can’t disregard the challenge it faces in terms of generating sufficient revenue to meet its expenses. As set out in its Q3, 2023 10-Q (p.12) it generates four types of revenues:

- license revenue — upfront or annual payments for technology access;

- service revenue — payments for the performance of research services;

- milestone revenue — downstream payments in the form of preclinical, intellectual property, clinical, regulatory, and commercial milestones; and

- royalty revenue — royalties on net sales from partners’ product sales.

On page 34, its 10-Q lists the amounts of these revenues as follows:

seekingalpha.com

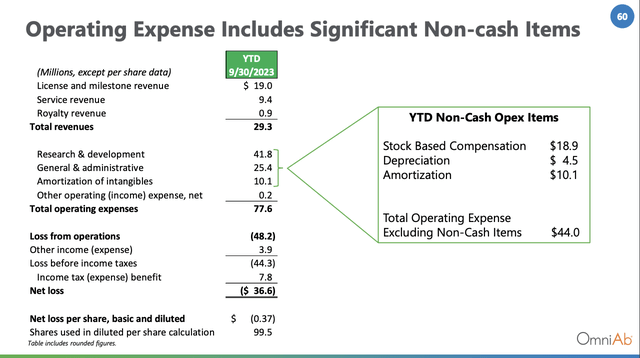

During the Event CFO Gustafson reviews OmniAb’s cash situation with a particular focus on its noncash expenses. In this regard he points to Presentation slide 60:

seekingalpha.com

He emphasizes that OmniAb’s net income is not a good proxy for its cash burn based on all these noncash items. He takes a quite optimistic view on OmniAb’s longer-term cash runway noting:

Earlier in the year, we saw some attrition in clinical programs for the very first time. And later in the year, we’re starting to see some delays in some of our partner programs. And as a result, we now expect to end the year with slightly less cash than the balance that we had as of 12/31/2022. That being said, we still continue to expect that our cash will provide sufficient runway to fund our operations for the foreseeable future….

Of course “foreseeable future” is an uncertain term. As I understand the term, I would regard it as good news indeed if OmniAb’s end of Q3, 2023 cash and investments of $96.6 million lasts for the foreseeable future.

Partners

The key component of OmniAb’s business which differentiates it from most other biotech companies is its symbiotic relationship with its biotech partners. Its presentation slide 21 lists its three categories of partners as:

- discovery technology access partners — partners granted access to the platform for current or new/potential programs as well as rights to develop and commercialize OmniAb-derived antibodies;

- commercial partners — partners who have geographic or therapy area rights to a commercial or development-stage OmniAb-derived antibody;

- academic partner licenses — partners granted licenses designed for revenue sharing, with discovery technology platform access and an understanding that programs can be spun out into development or commercial entities.

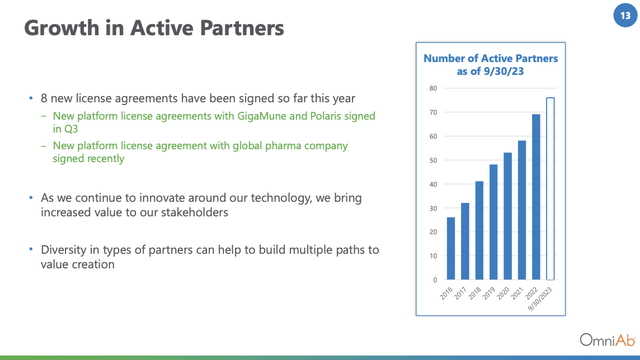

OmniAb has been steadily developing its partnership base as shown by its Presentation slide 13 below:

seelingalpha.com

OmnidAb

The term “OmnidAb” is hardly a felicitous name for an OmniAb product offering. It looks far too much like a careless typo for OmniAb. Somehow the powers at OmniAb are unconcerned.

In fact, OmniAb’s newest product offering launched during the Event is indeed “OmnidAb” with its lower case “d” stuck immediately in front of its second syllable “Ab”. Such obfuscatory titular minutia aside, during the Event, CEO Foehr described OmnidAb as an exciting new technology.

He characterized it as a heavy-chain OmniChicken. He then went on to wax eloquent about potential growth in OmniAb’s technology offerings:

…our innovation engine for either producing new transgenic animals or new elements of our technology is becoming more and more efficient. We’re able to do it faster. We’re able to do it more cost effectively. And that’s something that I think will feed well — to feed the business well into the future. We will launch other novel technologies next year as well, and we also expect to roll out other new partner experience enhancements as we call them, in 2024 and beyond.

OmniAb faces significant competition in the antibody discovery business.

General

OmniAb’s 2023 10-K (p. 15) lists the significant competition it faces from a diverse group of competitors. These include companies using a variety of business models including:

- the development of internal pipelines of therapeutics;

- financial investment in partner programs, technology licensing, and the sale of instruments and devices;

- use of internal resources and technologies for discovery capabilities, as well as integrated contract research organizations that use traditional hybridoma, phage, and yeast display technologies in discovery.

AbCellera

OmniAb’s most directly comparable competitor is AbCellera (ABCL). It has a business model that is quite similar to OmniAb’s as described in “OmniAb: Legitimate Competition To AbCellera In Antibody Discovery (“Discovery”)”.

Accordingly, as an OmniAb bull and investor, I was interested in a recent Seeking Alpha article. The article “AbCellera: Difficult 2023 Suggests Business Model Should Pivot In 2024” questions whether discovering drugs for partners is a sustainable business model.

Interestingly AbCellera with its outsized COVID antiviral bamlanivimab has suffered a major falloff in market cap similar to Ligand’s Captisol falloff now that the pandemic has cooled. Unlike its former parent, OmniAb’s business has no such faltering blockbuster disrupting it.

Conclusion

OmniAb is a biotech with a strongly positive differentiator in its business model. Nonetheless, it is losing money and seems likely to continue to do so for the foreseeable future. I expect that it will have a tough time holding on to its current market cap of ~$567 million and will likely experience periods of weakness before it marches higher.

Accordingly, I rate it as a hold that deserves to be accumulated on weakness.

Read the full article here