Following our initiation of coverage of On Holding AG (NYSE: NYSE:ONON), today we are back to comment on the company results based on the Nike Q2 2024 readout and the latest news on the Sporting Goods sector. In this update, there are at least three takes on the read across from Nike’s September-November results that we should take into consideration.

Nike Positive Implications

Firstly, Nike inventories were down by 14% on a year-on-year basis. This implied that inventory days are now aligned with pre-COVID-19 levels. Consequently, this provided a positive note to the sector and meant that inventory would likely normalize going forward (Point 1). Here at the Lab, given the supportive sales performance in the Winter period (with positive Black Friday results), we believe in a gross margin recovery for the sector which will set up into 2024. We are confident that Nike’s data point supports our view. Secondly, Nike EMEA sales were weaker than expected; however, looking at the segment’s results, this negative performance was due to the apparel division, which signed a minus 10%, while the footwear division was a positive outlier with a plus 1%. In North America, the company increased retail sales growth by a single digit, and again, we believe this could be a relatively positive indicator for On Holding (Point 2). Nevertheless, Nike’s performance in China and EMEA could be viewed as a negative sign, but we see a reason to be more constructive on the sector fundamentals. Our team believes that many sector pressures are already priced in, and beyond this, there are too many company-specific dynamics at play in the On Holding investment case. Nike’s beat on inventory and more robust trading and holiday events outline a positive view of our Swiss growth champion. As reported by BTIG, there might be additional supportive news for On Holding. In the Q&A analyst call, Nike reported running shoes as an area of interest with an ambitious plan to accelerate product innovation in the segment. Even if competitors were not mentioned, this positively confirmed On Holding’s successful product segment (Point 3).

Why are we supportive?

Aside from Nike’s positive readouts, several themes support a view change in On.

Product. At the Lab, On’s focus on innovation and maintaining a premium price are facts that cannot go unnoticed. We view the company as one of the world’s fastest-growing athletic wear brands that deserve multiple premiums. We believe that Wall Street sees the company as a running shoe player and doesn’t appreciate On’s potential to increase its market share penetration. The company focuses on deepening its roots in the running community and winning new athletes; however, On is also targeting new verticals like training and tennis. In addition, we see the company limiting product supply, increasing brand desirability, and selling at total price.

Promotions. In the Black Friday week, the company offered members a planned promotion of 30%. In the day, there was a 50% discount for Family and Friends, which was leaked. However, the company code was turned off, and minimal quantities were sold. Therefore, we expect no impact on the gross margin in Q4 2023.

Demand Trends. Looking back, I see last year’s demand was solid across all channels and regions. Indeed, the company had an exceptional Christmas season significantly above its internal plan. From what we understood, demand has remained strong in November, and wholesale partners like Foot Locker and Dick’s commented on a strong Black Friday. In addition, year-on-year growth remains supportive in the APAC region, the company’s smallest region.

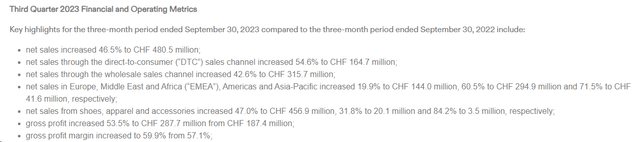

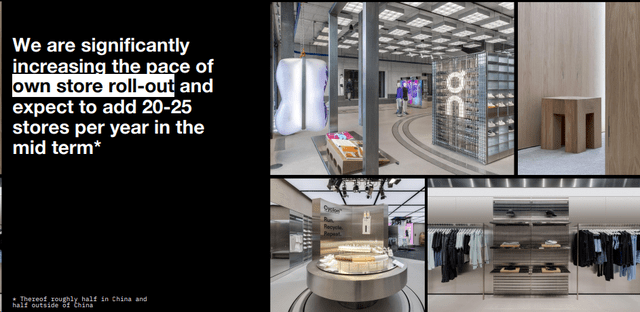

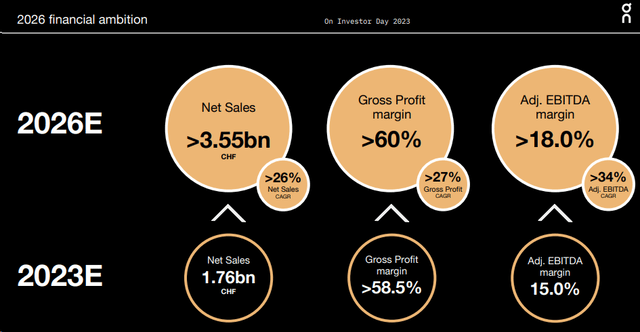

Financials. In our initiation of coverage, in our three-year visible period, we projected a 2023 EBITDA of CHF 280 million, with a 2025 estimate of CHF 460 million. During investor day in October, the company confirmed a gross margin target 60%+ with an EBITDA margin guidance of at least 18% in 2026. Looking at the recent Q3, On was close to its 60% gross margin guidance (Fig 1). Indeed, On delivered a gross margin of 59.9%. A few positive quarter factors include favorable currency development and lower freight costs. Despite that, looking ahead, we are more optimistic about On’s ability to deliver faster growth supported by new openings (Fig 2) and operating leverage. Leverage distribution is a central theme for 2025, when the company will have an automated warehouse. On the other costs, marketing is guided to remain flat at 11.5%-12.0% of top-line sales, and new hiring should grow at a slower pace than sales. Our team is forecasting 2023 sales to CHF 1.79 billion and a 30%+ growth in 2024, leading the company to achieve CHF 2.4 billion. In 2025, we derive top-line sales and EBITDA at CHF 3.2 billion and CHF 512 million, respectively. This equates to an unchanged EBITDA margin of 15.9%.

On Holding Q3 results – Gross Margin focus

Source: On Holding Q3 press release – Fig 1

On Holding new stores in China

Source: On Holding Investor Day presentation – Fig 2

On Holding 2026 target

Fig 3

Conclusion and Valuation

The company feels comfortable with its 2026 targets (Fig 3). Gross and EBITDA margins are set at 60%+ and 18%+. On expects progress each year supported by solid brand momentum. Looking beyond 2023, we are more optimistic about sales growth, a better gross margin evolution, and a higher SG&A leverage due to turnover expectations. Having increased our EBITDA estimates, we upgraded our valuation from $26 to $31 per share. Our buy rating is based on an EV/Sales multiple of 4x on our 2024 estimate. Here at the Lab, post Q3 results, we believe another strong quarter should quell Wall Street’s negative concerns and increase the share price. On is a unique story with a positive take on expanding its geographic area (China) and product portfolio assortments.

Read the full article here