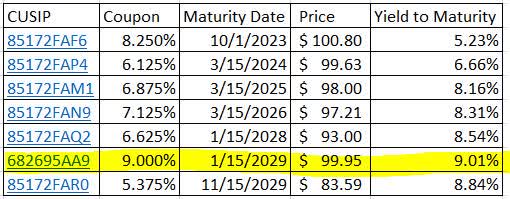

Consumer lending financial company OneMain Holdings (NYSE:OMF) announced last week that it would be offering a new publicly traded bond (prospectus). The bond offers a 9% coupon at $500 million in principal that would mature in January of 2029. I’ve featured OneMain’s debt as an alternative income investment to its dividend. With the new debt trading at slightly higher returns than the company’s other offerings, I believe the 9% notes provide a new opportunity for income investors to take a position in OneMain’s debt.

FINRA

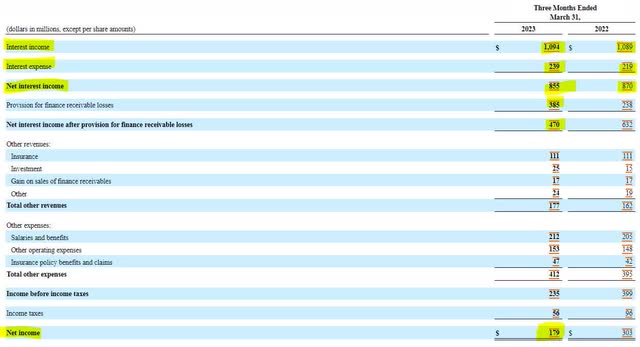

OneMain’s first quarter financial results demonstrated that the business is facing economic headwinds. Interest income rose marginally to just under $1.1 billion. Interest expense increased by about 10% to $239 million. These movements led to a slight decline in net interest income. Where the company took a hit is in its nearly $150 million increase in provision for credit losses. The increase in loan loss provision led to a drop in net income of about $125 million to $179 million.

SEC 10-Q

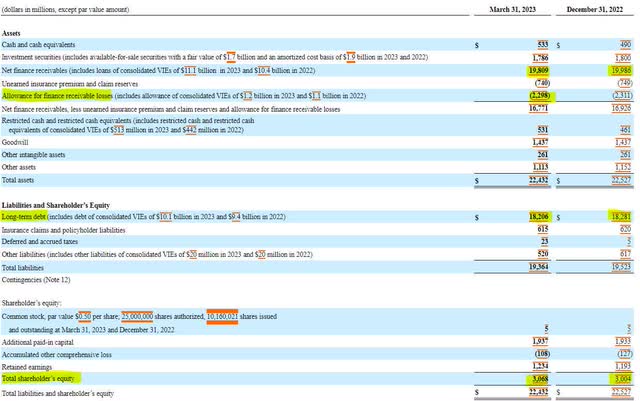

OneMain Holding’s balance sheet consists primarily of loans on the asset side and long-term debt on the liability side. The company does not rely on depositors, so uninsured deposit risk is not a factor here. The company’s loan balance declined slightly in the first quarter, as did its long-term debt. One important note related to earnings is that the increase in loss provision was necessary to maintain its existing allowance, meaning the level of earnings erosion seen in the first quarter will likely continue through the remainder of the year.

SEC 10-Q

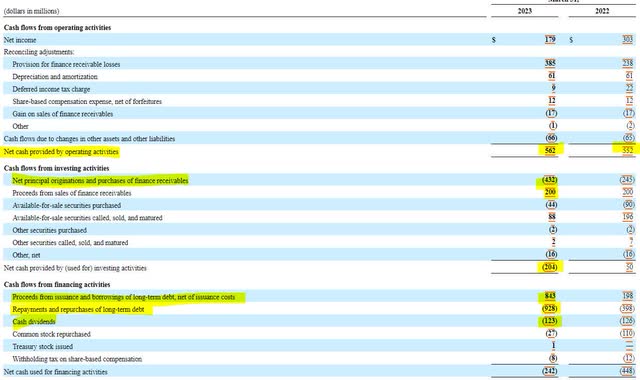

OneMain’s statement of cash flows provides more insight as to how the company treats cash within the organization. First quarter operating cash flows were actually slightly higher than the same quarter a year ago. OneMain used about half of its operating cash flows to conduct loan originations, which was partially offset by the sale of finance receivables. Out of the remaining $300 million, OneMain used $85 million for debt reduction, $123 million to pay dividends, and kept slightly over $100 million in cash. Based on this activity, I would determine that the dividend would be in danger if the company saw a $200 million drop in net interest income. Investing in the company’s long term debt does provide lower income (versus the current dividend), but shields investors from the dividend risks.

SEC 10-Q

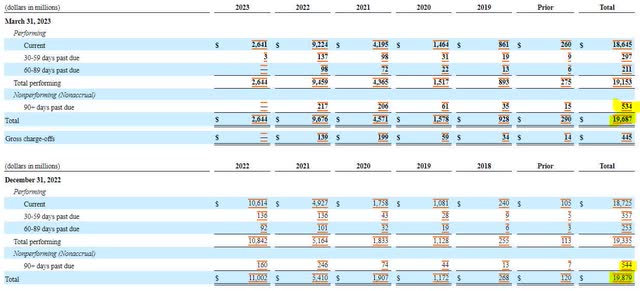

The biggest risk to OneMain Holdings comes in its loan performance. Should the economy downturn, and create higher unemployment, OneMain’s loan losses will likely accelerate and erode earnings further. Fortunately, OneMain’s past due loans as a percentage of total loans remained steady in the first quarter. Investors should take careful note to the loans underwritten in 2020 and 2021. These loans are resetting at higher interest rates, creating new income opportunities for OneMain, but also higher default risk.

SEC 10-Q

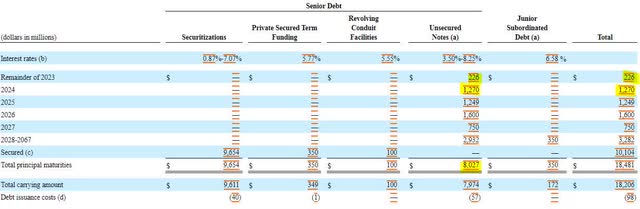

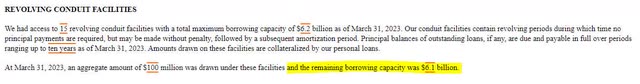

A deeper dive into OneMain’s debt shows that $1.5 billion in unsecured notes are coming due between now and the end of the next year. The company does have $2.2 billion in cash and short term equivalents to cover the upcoming maturities, not including the $500 million raised by the new notes offering. If the company’s current cash situation becomes insufficient, OneMain has $6.1 billion in additional liquidity under its revolving conduit facilities.

SEC 10-Q SEC 10-Q

OneMain has challenges ahead as a more difficult economy will increase defaults and lower earnings. The degree with which the company will be able to retain its dividend is largely unknown, but their ample liquidity position significantly lowers its risk of failure, making the 9% yielding debt more attractive.

CUSIP: 682695AA9

Price: $99.95

Coupon: 9%

Yield to Maturity: 9.01%

Maturity Date: 1/15/2029

Credit Rating (Moody’s/S&P): NR/BB

Read the full article here